You have most likely seen the warnings, every site to do with trading will have a little warning that tells you that trading is risky and that the majority of people that trade it lose money. This is a legal requirement for any service offering Forex or CFDs to show, this is for the simple fact that people look at trading as an easy way to make money, without actually understanding the risks. So why do so many people lose when trading? We are going to look at some of the more obvious reasons as to why they may make some losses.

Being Friends with the Market

When you have made a few good trades in a row, or things are starting to go your way, it is easy to get quite comfortable with the markets, you begin to believe that you have the perfect strategy or that you are able to read the markets. People in this situation often forget that the markets can be quite fragile, anything in the real world could cause it to tumble or jump up in price. Thinking that you and the markets are now friends and moving in the right direction will only cause you to lose once the markets decide to turn, and they certainly will turn at some point.

Too Much Risk

Many traders, especially the newer ones like to take too many risks, this can be in the form of a larger trade size or just an increase in the number of trades that you are going to make. Whichever of these two things you do, it is increasing your risk and is actually negating any risk management plans that you may have put in place. People often do this when they are either on a winning or losing streak, trying to make a bit extra or to win back some of the lost money from previous losses. Increasing the risk on your account is a sure-fire way to lose it, so it is important that once you have a working risk management plan, stick with it and do not change things up, even for the one extra trade.

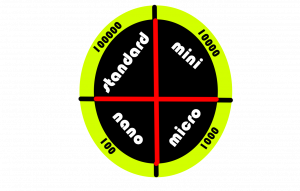

Not Enough Capital

Starting with a balance that is too long can make it hard to implement some proper risk management into your trading plans. It is great that some brokers are now letting you start trading with low amounts, even $10 with some brokers, but what are you going to do with this? Even a currency trade at 0.01 lots can easily decrease to -$10 which would then blow the account. You are not able to apply risk or money management to such small amounts. It knows you want to learn and start earning, but you will need to invest a slightly more amount if you want to be successful at it.

Starting with a balance that is too long can make it hard to implement some proper risk management into your trading plans. It is great that some brokers are now letting you start trading with low amounts, even $10 with some brokers, but what are you going to do with this? Even a currency trade at 0.01 lots can easily decrease to -$10 which would then blow the account. You are not able to apply risk or money management to such small amounts. It knows you want to learn and start earning, but you will need to invest a slightly more amount if you want to be successful at it.

Greed, Greed, and Greed

This kind of goes along the same lines as taking too much risk, but greed can get the better of anyone, you see trades going well so you want more, or something made a loss so you want to earn that money back. Both of these wants can lead to disaster as it can cause you to increase the amount of risk that you are putting on your account. You need to remember that you are trading with a plan, stick to it or things will only go downhill.

Too Much Guessing

Never guess which way the markets will go, what makes you think that you know what is going to happen but the person next to you doesn’t. The markets can be very unpredictable. In fact, there have been times where all fundamental and technical analysis would indicate that something should go down, but it continues to rise, these things can actually be quite common, so if proper analysis cannot fully predict the movements, there is no reason why you should be able to instead. Stick to a tried and true strategy instead of going on what you think.

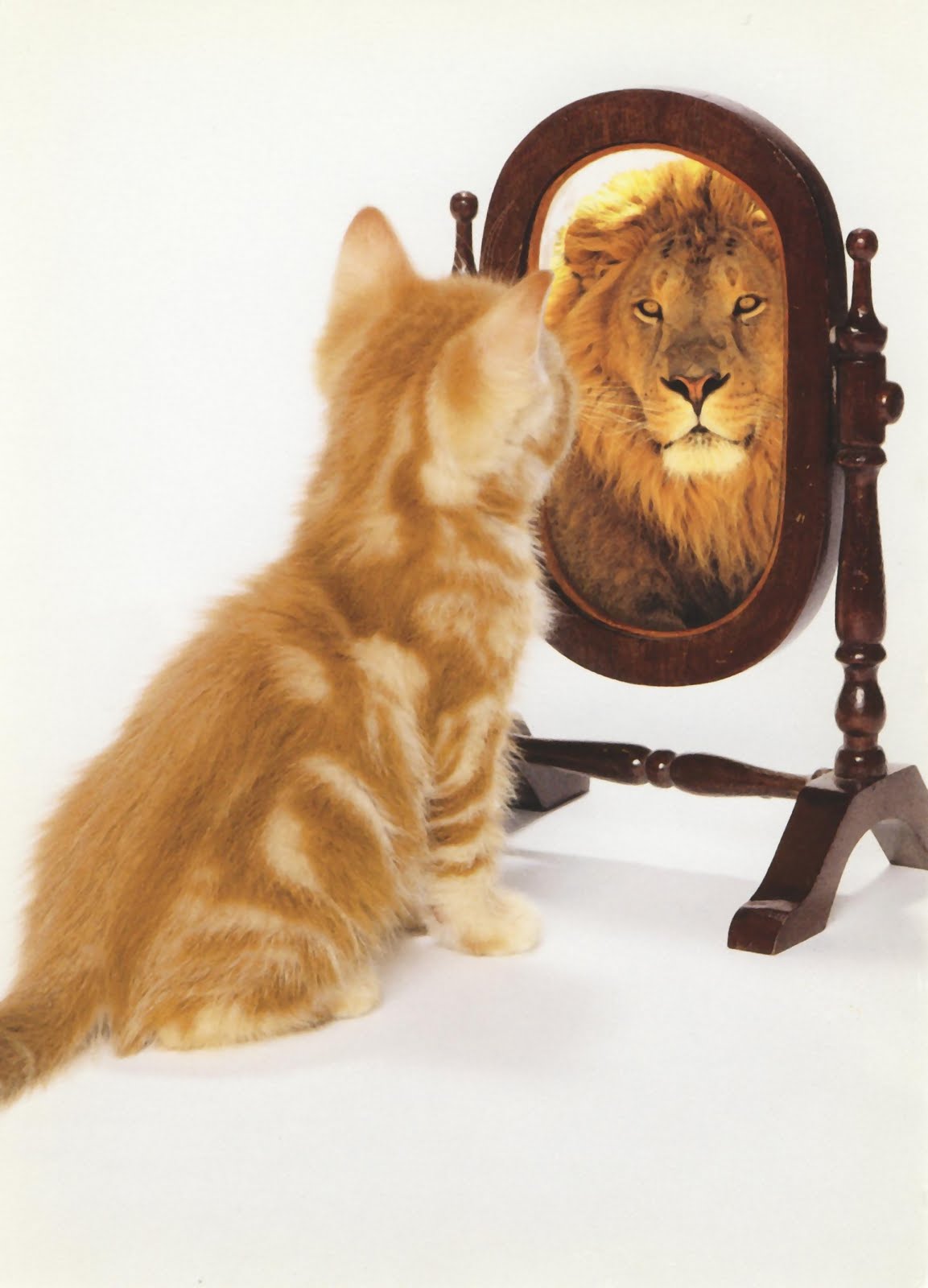

Overconfidence

Overconfidence

When you go on a winning run, it can build up your confidence, and confidence is great until it grows a little too large. Once you have grown in confidence and get into the overconfident stage, things can quickly start to turn south. What do you often do when you have a little too much confidence? You often start to increase your trade sizes or start taking guesses at the movement of the markets, you have been right before so you can definitely be right again. Stop and think about it, you were right because of your strategy and not your own guess. As soon as you step away from that strategy you will only begin to make some unwanted losses.

Using Sub-Par Signals or Trading Systems

Sometimes you just don’t want the hassle of working out a strategy or spending the time to learn yet another aspect of trading, so instead, you decide to purchase an EA or trading signal. Bad idea, not only do you have no control over this signal, there are so many scam ones out there which are only after your money. When a trade comes through, why is that trade there? You have no idea as you do not understand the reasons behind out of how the strategy is working. Not having that knowledge means you have no idea if it is a good or bad trade. It is much better to learn and trade yourself than to rely on others, especially people who you do not know and that have no interest in knowing you.

Those are just some of the ways that you can lose when trading and common reasons why so many do. It is important to learn and to create a trading plan that you can tick to, as soon as you deviate from it disaster will only be one trade away.