While there are many possible pieces of the puzzle that you can put together to earn money, certainly the most important general area is money management. The most important thing for money management is to understand its role regarding risk tolerance in Forex trading.

What is Risk Tolerance in Trading?

So, before we continue, we need to understand what risk tolerance is when we talk about transactions. It simply means the amount of risk you can tolerate per trade. It is a little different from money management, as money management focuses on your ability to survive a continuous series of losses. However, risk tolerance is more in line with the psychological ability to take a loss.

What is intended to make understand with this is that various traders are very comfortable risking 3in a trade, while others will risk 0.5% in the same setting. In general, it is a personal problem, as each individual person and trader will, of course, be different. However, knowing your risk tolerance will ultimately be crucial to your success, as if you are not comfortable in a position, you may be leaving too soon. What will be even worse is that many times when you are in that position, your startup analysis can be successful and you are jumping off the market based on fear, and not on anything substantial. There are some worse things to see a position go your way after you’ve been a little scared.

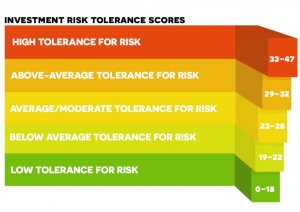

How to Know Your Risk Tolerance Level

Knowing your risk tolerance is a lot less than complicated than you realize. As a start, you should know that understanding money management is critical, so we’ll use two examples that are realistic:

Suppose you take a setting and risk 1% of your total account at the loss limit. If you feel very comfortable with this position, then you know that it is within your risk tolerance. A very simple exercise could be to get up and get away from the computer. Continue with your day and see if you are too concerned about how the position is working. If you can go to the park, work, or spend time with your friends or family without checking your position often, you are most likely within your risk tolerance.

In another trade, maybe you risk 2%. In this scenario, you are more concerned about trade and analyze how it works quite often. If it causes stress, it is above your risk tolerance. It is really so simple. I can’t tell you how many times I’ve found myself above my own risk tolerance, I had a bargaining chip against me, and then I turned in my direction just to get out of the balance point just to get rid of the uncomfortable feeling. Of course, trade continues to work in my favor and I would have cleaned it up. Psychological stress can have a big influence on how trade works.

An Exercise to Measure Your Risk Tolerance

I leave you with a simple exercise. Place an operation with a total risk of 0.5% in the stop loss. Watch how it feels when you walk away from the computer and let the market do what it wants. The next transaction should be 0.75%, with the same parameters and the same observations. From there, it simply rises by 0.25% every time you make an exchange until you find it too difficult to leave the market alone.

Some people will feel comfortable risking insane amounts of money, like 20%. That’s a completely different conversation as you approach money management. Money management dictates that you shouldn’t risk that kind of financial impact, but at the end of the day, working at a reasonable range to find where you can leave the trade just to decide which way it’s going, will be one of the main steps forward to become a much more professional trader. For what it’s worth, I’ve found that in many traders the risk tolerance is about 1%. Their tolerance may be different, but in the long run, these types of operations can be converted into good returns.