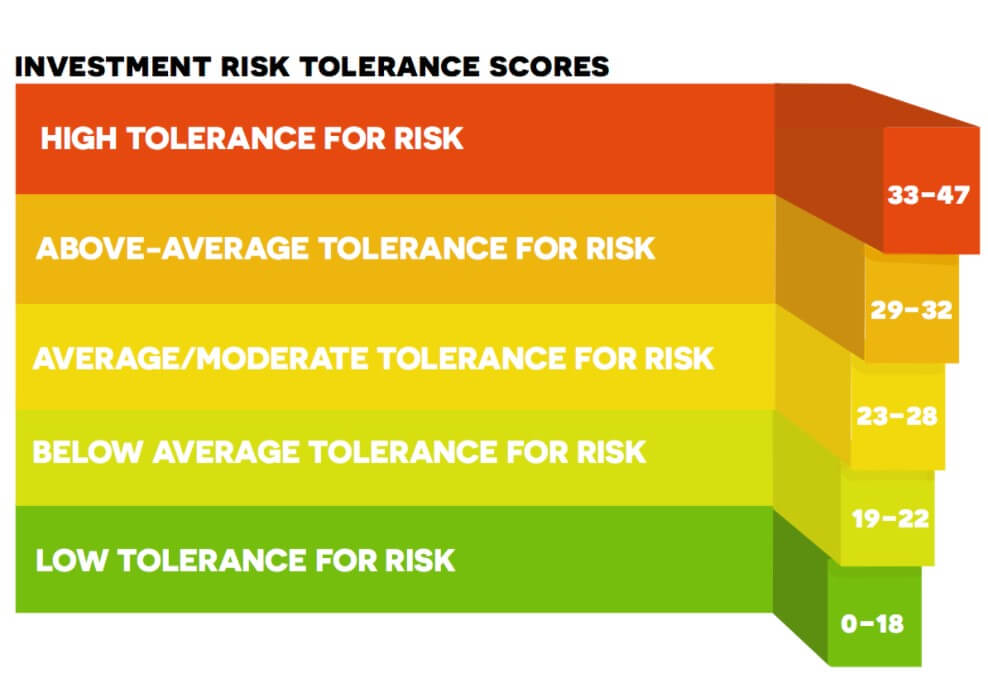

In Forex, your risk tolerance refers to how much money you are willing to risk on each trade. In order to limit their losses, traders base the position sizes they take on the amount of money that they are willing to risk. Many beginners make the mistake of taking larger trades than they should, which can really result in a big blow to the account if they incur a loss. If you risk 15% on one trade, 20% on another, and so on, it isn’t hard to run out of money. Of course, the more you risk, the more you stand to gain. So how much should you really risk on each trade?

The answer is different for everyone. In the end, you should only risk an amount that won’t evoke an emotional response from you in the event that you lose. This amount will look different for different kinds of traders, as a billionaire is not likely to blink at the loss of $100, while a newbie/working-class trader would probably feel the sting from such a loss. Here are some tips that might help you decide how much you want to risk:

- Experts recommend only risking 1-2% of your total account balance on a single trade, for example, you’d only risk a dollar or two on a trade if you had $100 sitting in your trading account. This helps to ensure that your losses remain small.

- Some professionals say that you shouldn’t go with the 1-2% rule because one-size doesn’t fit all. Instead, they recommend that you determine how much you’re willing to risk to each trade individually. The idea is that you might be willing to risk more on a trade that you feel more confident about, while a smaller risk amount is more suitable for a trade you’re on the fence about. It’s still a good idea to think of smaller percentages here – no more than 5% of your account balance.

Whichever approach you choose, you should be sure that you’ll be able to accept the money loss should the market move against you. Otherwise, you might fall victim to certain trading emotions or find yourself revenge trading, which typically leads traders to lose even more money as they try to regain their losses. If you’ve already started trading, you should consider how much you’re currently risking and how you feel when you lose. If you haven’t started yet, remember that you might have an idea of how much you’re willing to risk, but you could find that it does upset you once you get started. You can always go back and adjust the amount you risk once you get a better idea of how those losses feel.

Although risking too much might make us think of greed, it’s important to note that some traders do this because they tie their feelings to their self-worth. Winning big makes these traders feel better about themselves, so they are less cautious when setting position sizes. The best way to deal with this problem is to acknowledge it, as those feel-good hormones won’t last long if you lose big. Some traders might have the opposite problem and find themselves extremely worried about risking money to the point that they barely take chances at all. It’s important to find a middle-ground here if you’re on either of the strong ends of the spectrum.

In the end, each trader has to assess their own risk tolerance and decide how they’d like to apply that. Some might risk 1% on each trade, for example, while others might compute the amount for each individual trade. If you find yourself feeling upset after taking a loss, this is a good sign that you might need to reduce the amount you’re risking, as disciplined forex traders shouldn’t feel emotional about losses. If you can define the right risk-tolerance for yourself, you’ll have completed one of several steps that leads to future success as a forex trader.