Risk is something that is present in pretty much everything that we do when it comes to trading forex, each trade that we put on is a risk, each time we increase our lot sizes or trade a new currency pair, it is a risk, risks are everywhere. While risks are present, and there are ways to monitor and reduce the risks, there is one thing that we are not able to change, and that is our own tolerance or appetite for risks.

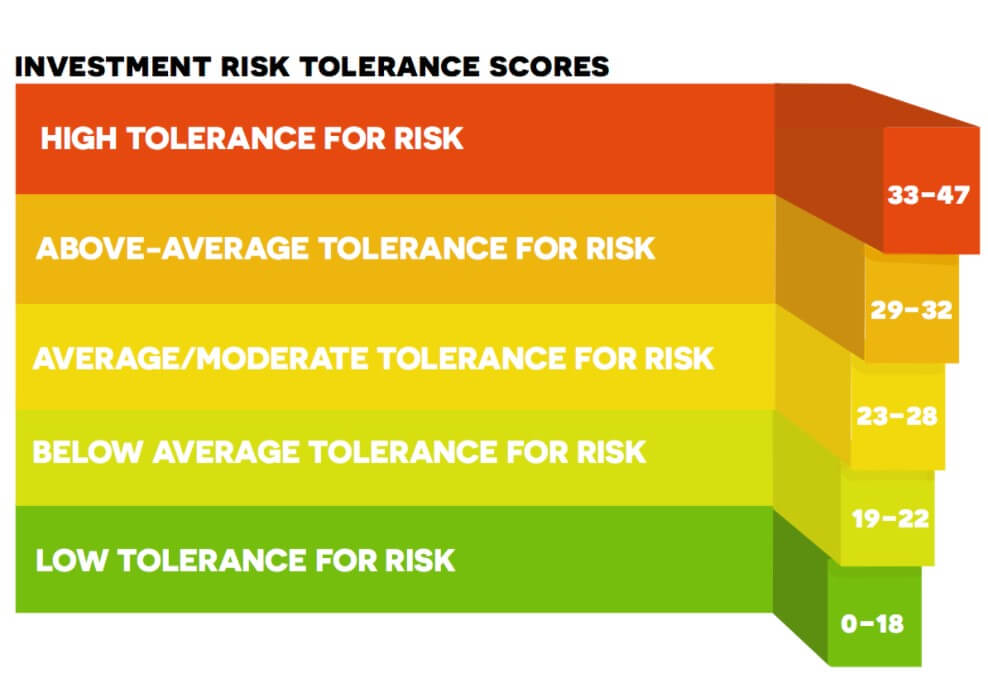

Risk tolerance is basically your ability to deal with risks, it is an emotional state where you are either tolerant of the risk, able to deal with it with a clear mind and an objective view, intolerance is where you are not able to handle it quite as well, it will cause you to stress, it will cause you anxiety and it can even cause you to place trades that you otherwise would not have.

Your risk appetite is about how much risk you actually want, for many wanting risks would seem like a strange thing to want, but for others, it is something that they get their buzz and thrill out of it. In fact, this lust for risk can cause people to trade too much, to trade too large and to trade at a level that puts their accounts at risk. For others with very little risk appetite, they may not want to trade at all once they have experienced the risks that are involved.

With that being said, how do you know whether your own appetite for risk is appropriate and reasonable? Firstly, if you are getting severe anxiety or stress from trading, you don’t really want to press that trade button due to worry that you may lose something then your risk tolerance and appetite is on the low side, if it is really bad, then this can be a sign that trading is simply not for you, there will be risks and to trade is to accept those risks. For some it is possible to work through it and to develop a better tolerance to the trades, for others it is simply not possible and so trading will simply be a stressful situation for you.

With that being said, how do you know whether your own appetite for risk is appropriate and reasonable? Firstly, if you are getting severe anxiety or stress from trading, you don’t really want to press that trade button due to worry that you may lose something then your risk tolerance and appetite is on the low side, if it is really bad, then this can be a sign that trading is simply not for you, there will be risks and to trade is to accept those risks. For some it is possible to work through it and to develop a better tolerance to the trades, for others it is simply not possible and so trading will simply be a stressful situation for you.

On the other end of the spectrum are those that like a little too much risk, they want to place huge trades, they want to be trading at all times regardless of their strategy or how the markets are. The more volatile the markets the more they will want to trade as the risk and rewards are both far higher. This can be a dangerous situation to be in as very little risk management will be put in place, these sorts of thrill-seekers will either become rich very quickly or lose everything in a matter of days, sometimes both, getting some wins, getting the confidence and then losing it due to risking too much.

Those are the two extremes when it comes to risk tolerance and appetite, what we need to remember is that there are in fact things that we can do to help maintain a safer trading environment. If of course, you are right in the middle of the tolerance and appetite levels, then you are in a great place when it comes to trading as you are able to tolerate the risks and are also not afraid to take a few.

So let’s assume that you are either high or low on the appetite level, what can we do to help? The first thing is to create a trading plan, within this plan you will have set out some rules, these rules are there for one important thing. They are there to ensure that you are in line with your plan and that your risks are limited. These rules will help someone with a low appetite for risk to understand that they are still in charge and that trading along these rules gives them the essence of safety, a way of controlling the risks that they are being put under.

So let’s assume that you are either high or low on the appetite level, what can we do to help? The first thing is to create a trading plan, within this plan you will have set out some rules, these rules are there for one important thing. They are there to ensure that you are in line with your plan and that your risks are limited. These rules will help someone with a low appetite for risk to understand that they are still in charge and that trading along these rules gives them the essence of safety, a way of controlling the risks that they are being put under.

For those that are on the high end, it will enable them to reign in the risks that they are taking. Trading to the rules will basically ensure that you are not putting on any additional trades that you shouldn’t be and that you are not placing trades that are simply too large for your account. Of course, it is up to the person whether they continue to follow it, but some discipline will enable you to manage your risks a little better.

Your risk management plan must also be in place. This plan sets out all of the risks that you will be putting yourself under, it will give you a good understanding of what risks there are and also how you will be reducing them. Ensure that you understand where your stop losses will be, what your risk to reward ratio is along other aspects of your trading. Much like mentioned above will enable you to maintain your risks and to help you stay at the right level. When we trade to the plan, we are making good trades, regardless of win or a loss, and with taking good trades we will ultimately profit at the end of the day. The issue of course is sticking to that plan, which is often easier said than done.

So what level of risk appetite is reasonable? There isn’t really one. There are some people who are in the middle which is perfect for them, but for many others, you are in a situation where you either like the risk or you hate it, but wherever you are on the line, you need to ensure that you have everything that you can in place in order to manage and reduce the risks that you are putting your account under. Stick to those plans and you will be in a great situation.