One of the aspects of being a professional trader for which many are unprepared is the depressing periods of drawdowns in forex. Losing streaks can shake you and wreak havoc on your emotions, levels of confidence, and feelings of self-esteem. If you’ve been operating for a while, you’ll know what we mean. Consecutive losses place you in a state of “panic,” which severely degrades your decision-making process.

So what can we do? How can you recover from a losing streak or even avoid it in the future? Forgive our frankness, but the reality is that you cannot completely avoid this kind of accumulation of lost trades, they are simply a fact in trading. That is why it is very important that you learn to prepare, anticipate, and deal with this inconvenience, so when the time comes, the mental and emotional impact will be reduced.

Don’t be one of those traders who thinks “this won’t happen to me” because the reality is that someday it will happen to you. Even the best trading system that can exist is not free from the occasional losing streak. Trading is a profession that focuses on statistics and probabilities, so it is very unhealthy to believe that you will never lose money. You should wait for the losses.

In the “heat” of a drawdowns period, your future as a forex trader will be determined by the way you handle yourself in that moment of hopelessness. Will you collapse under pressure and let your account disintegrate along with your emotions? Or will you remain strong, disciplined, and logical while maintaining a rational mindset and maximizing your chances of surviving the storm?

In today’s guide, we will share some tips to help you through those difficult times on your way to trading.

Drawdowns in Forex: Don’t Let Your Mind Fool You

Placing an operation is quite easy, perhaps excessively easy. It’s just a click on a button and in a matter of milliseconds, your operation is running. The ease of placing a transaction can make a trader act on impulse without really thinking about what he has done. This is especially true when you feel emotional, such as having had some consecutive losses.

When you plant an operation, you do it because you think the odds are in your favor, and you’re exploiting your advantage in the market. When you are suffering the effects of your emotional side due to a drawdown, it is easy to despair and have a sense of urgency to take another operation in an attempt to recover the recent losses. This happens even if there is no good operation to take. It is called revenge trading.

When you operate in despair, you make bad decisions, and the market uses those feelings against you. You will begin to convince yourself that there are good setups in front of you, like a person stranded in the desert who sees mirages in the distance. It’s just your mind playing tricks on you.

It is important that you maintain discipline, taking only high probability operations and not starting to operate setups of the 2nd or 3rd category just because you are eager to get your money back. Consistency is the key to success and will be a vital component in recovering from a losing streak.

Use a Trading Journal to Highlight Potential Problems

You must keep a diary designed not only to record your operations data but also contain the psychological components of your operations. This way you can track your “feeling” and “mental state” during the different phases of your trading.

Such psychological data can be used during losing streaks. Go back to your recent operations in your journal and compare all those that make up the drawdowns period. There’s a good chance you can do it to see a common problem or weakness in the way you felt at the time.

It’s very likely that all this escaped your attention in the heat of the moment when you pulled the trigger. Surely the only thing on your mind was the desperate thoughts of getting everything back with a big winning operation. The problem is that many traders will do almost anything to recover their losses in the market, but they are willing to do very little when it comes to improving their emotional and mental performance.

Before taking any surgery, you should check your diary and remind yourself what happens when you operate on impulse and without discipline.

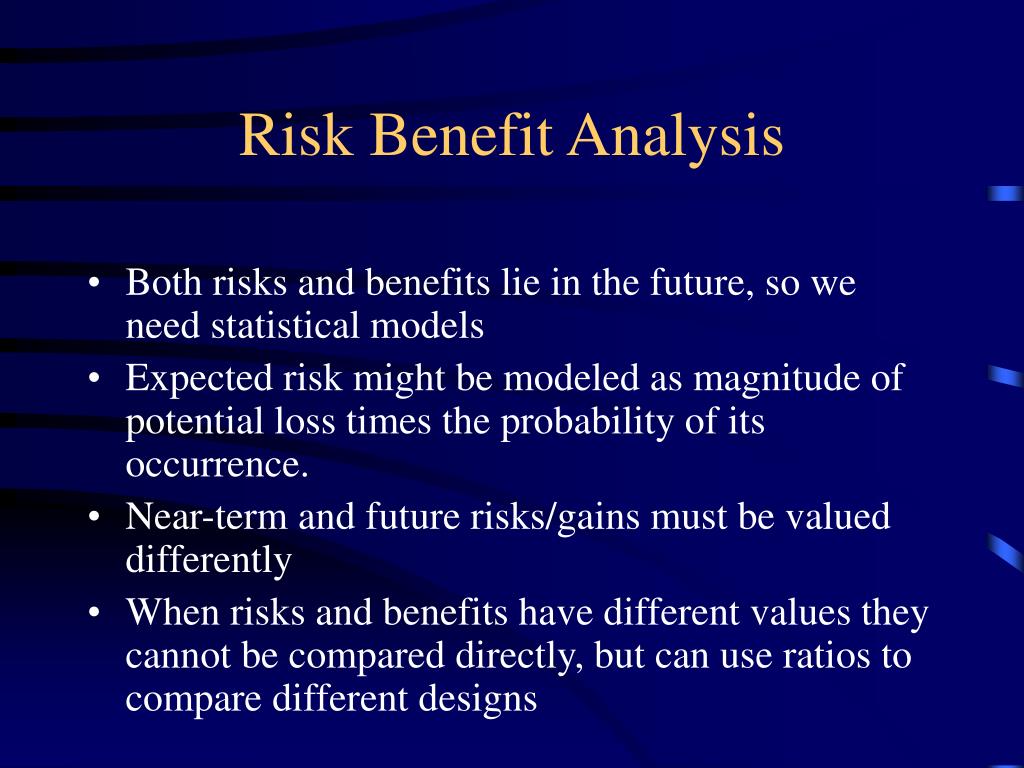

Maintain Positive Risk-Benefit Ratios

Remember, forex is a business, and businesses need a return on investment. Every time you place an operation you are risking some of your capital with the intention of getting a return on the investment. You only risk that capital when your trading system tells you that the chances of getting a good return on your risk are in your favor.

Positive benefit-risk ratios are a mathematical concept that ensures you aim for a return greater than your risk in each of the positions. When you do the accounts you discover that the positive ratios allow you to have more operations with stops executed than those whose objective was reached and still maintain the ability to grow your account.

If you remain disciplined and focused, you will eventually begin to see your operations achieve their objectives. It is not uncommon for a properly planned operation to eliminate all losses from a slump. Maintaining strict money management is vital during difficult times, and positive risk-benefit ratios should be at the core of any sound money management system. If your money management strategy allows your losses to be greater than your profit goals, then discard them before they destroy your account.

Have Faith in Your Trading System

Losing streaks come and go. Operating with a system you can trust and put your faith in will be very important. Just as with a diet, if you don’t think it’s helping you, you won’t get attached to it and therefore never reverse your unhealthy habits. A trader needs confidence in his trading system to be able to stay in good mental and emotional condition. Trading is useless if you do not believe in the trading methodology you are practicing.

We know losing streaks will make you question your trading strategy and even tempt you to make those “in-flight adjustments” to your plan. Remember that the market is dynamic and goes through different phases. One or two of these phases may not work very well with your system. If you start changing your rules, you could turn your trading system into something useless during market conditions in which you would have experienced good profits.

Don’t try to fix something that isn’t broken: no strategy has a 100% success rate. One aspect that we find critical is that you understand the reasons why you take the operations that your system generates. Many traders blindly follow the alerts that come out of some “magic indicator” they have bought. The trader has no idea why he’s pulling the trigger, he only does it because the gauge tells him to.

How can you trust the system if you don’t even know where those operations come from? The focus should be on how the trading system sends the signals. It should be based on a logic that you can understand. This is one of the innumerable reasons why like price action trading. Operating with price action signals allows you to understand market movements and safely identify high probability situations in which you can pull the trigger without hesitation.

Refresh

No matter how long you’ve been trading forex, every day you face a major new psychological challenge. If a forex trader tells you he can operate without emotion, he’s lying. As a trader, you will always be struggling with your emotions, making sure they stay away from your trading decisions.

The periods of drawdowns caused by losing streaks will blow up your emotions and there is a good chance that they will start to bring out the worst in you. Most people take their trading performance personally, and these losing streaks become a reflection of how they see themselves as people, resulting in low self-esteem and periods of depression.

Whether you like it or not, you will experience emotional upheavals from time to time. The way you handle yourself in these situations will be what will strongly impact your chances of success. Sometimes a trader could bring to the trading screen the stress of his outer life, coming from a bad day at work or a family discussion.

The best thing you can do when you’re emotional is to get away from the graphics. This is so simple, but it can do wonders for you. Sitting in front of your trading screen in a negative state of mind is unhealthy.

Get up and go do something that takes your mind off trading. Go to the gym, it’s important to stay healthy; watch a movie, or organize something with your friends. Socializing with other people will be a refreshing experience of the solitude of your trading table. You will notice that once you have participated in some activity that you enjoy, you will return to the markets with a fresh and positive attitude.

Operates on Favourable Terms

One of the big problems of novice traders is that they tend to look at a single market and sometimes become obsessed with it. They tend to confuse bad price action signs with good ones, due to the lack of consideration of market conditions surrounding the signal. Trends are the place where you can make a lot of money, and consolidation periods are just “black holes” that work as traps for your money. Operating when the market is going nowhere is like whipping a dead horse and expecting it to do something.

Often traders are taken to stop loss on the first operation and then start “revenge operations” on the same market to try to recover the lost. It might be helpful to create a rule for yourself that you will stop operating for 24 or 48 hours if you have more than 2 missed operations on the same day. Market conditions should be the first check when you look at the charts; if there’s no movement, do yourself a favor and stay away from that market.

Don’t Give Up on Me!

Remember, losing streaks are not uncommon in trading. Each operation individually is completely independent of the previous one and the next one. Just because you’ve had eight losing operations doesn’t mean the next eight can’t be winners.

Don’t despair or get anxious, if you do this your money will flow into the pockets of traders who have confidence and discipline. Always keep money management positive-oriented, so your winning operations will outperform your losers, making drawdowns periods somewhat less likely.

Do not be prey to revenge trading or panic trading. You need to maintain confidence in your trading system, remain patient, disciplined, and always have realistic expectations of the forex market. If you are looking for a system that is logical and in which you can understand why you are placing each operation, then price action is our recommendation for you.