If you’ve heard the word hedging or hedging mentioned and you’re not sure exactly what this is about when trading, this article can help. As is normal in my posts, an example to bring it down to earth. Imagine you have bought a car or a house. When we buy an asset of this type we usually want to protect our investment from possible accidents or situations that may occur against us.

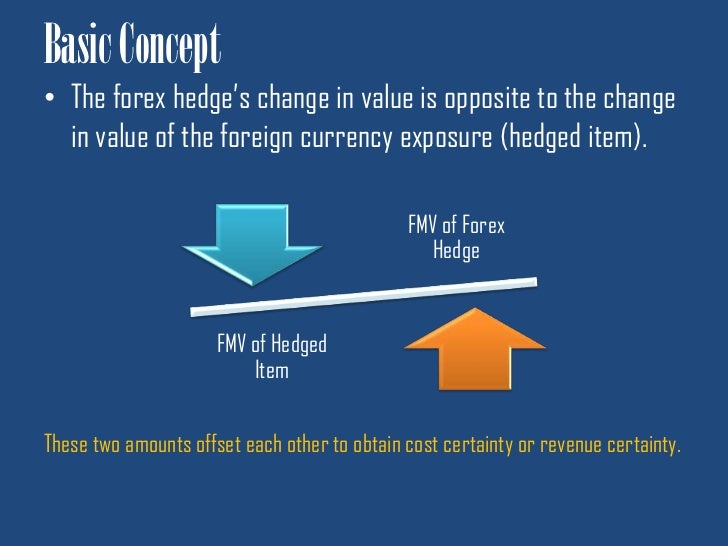

One of the simplest ways to protect these assets is to take out an insurance policy that allows us to reduce the possible losses we might have if some unexpected situation occurs that we sometimes cannot avoid. In trading, hedging works similarly. It is simply an investment to compensate or protect our funds, reducing the risk of price movements against us. In this way and simply put, investors or traders use hedging to reduce and control their risk exposure.

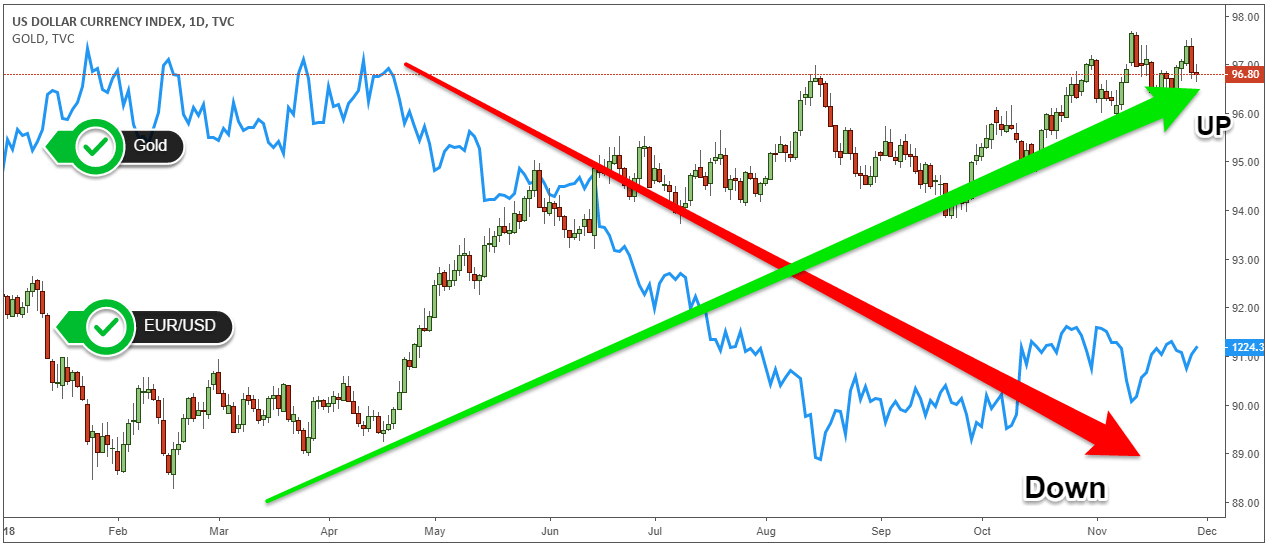

A very important aspect when using a hedging strategy is the fact that as you reduce the potential risk you also reduce potential earnings. This is because, as an insurance policy, coverage is not free. Hedging can also be achieved by opening a position in another financial asset that has a negative correlation to the vulnerable asset, that is, the initial investment we want to protect. In the case of Forex, we say that two currency pairs have a high negative correlation if the correlation is negative and above 80 generally, in this case, the pairs move in opposite directions.

For example, in the foreign exchange market, the pairs with a high negative correlation are usually the EUR/USD pair and the USD/CHF pair. Anyway, I leave you a complete article that I wrote about forex correlation and how you can consult it at any time (you don’t have to do the calculation manually). It’s an important concept.

Before you continue, it’s important to know that hedging is not allowed in the United States. This is because brokers operating in that country must comply with the “no-coverage” rule known as FIFO (First in, First out. First in, first out) of the NFA (National Futures Association).

This “no cover” rule only allows for an open position on the same symbol. If, for example, we open a purchase position on an instrument and then open a short on the same instrument with the same volume, the initial position is closed because one order cancels the other. Because of this limitation, typically brokers that are regulated by NFA have international subsidiaries for their customers outside the United States.

Advantages and Disadvantages of Hedging

Like any strategy, hedging has its advantages and disadvantages. Depending on your trading system it may or may not make sense to apply it (I don’t use it, I’ll tell you later). One of the main advantages we find in having to negotiate with hedges is that they limit your losses, but as I was saying, it also erases a portion of our profits. Although it is a fairly conservative trading strategy (a priori), it allows us to have a high hit rate, although the profit/risk ratio decreases.

Hedging increases liquidity in the market because it involves the opening of new clearing operations. However, this represents a disadvantage as a trader because you will pay more commissions. Although we can do it on almost any platform, some brokers do not allow you to do it, bear in mind before applying it. A clear disadvantage that we must always bear in mind is that not all risks can be covered.

Types of Hedging Strategies in Forex

The types of hedging strategies are varied and although they all seek to reduce risks and limit losses, each of these strategies can achieve its goal in different ways. Let’s look at the most common trading strategies used:

Total Coverage: As its name indicates, when we make a total coverage we keep open the same volume in long and short operations. Full-coverage allows you to block your exposure in the market, that is, raise or lower the asset in question will not affect your account. Be careful because a trade with a fixed profit and loss level could reach its stop or take profit and close (and you can keep the contrary trade open with a negative float and no coverage).

Partial Coverage: With a partial coverage strategy you have open long and short positions, but with different volumes. Here already if there is risk (the difference between the volume of one and another position of the same asset that you have opened.

Correlated Coverage: The correlated hedging strategy is one of the best known in trading. Although I mentioned this strategy at the beginning of the post, let’s go a little deeper. It consists of covering an open operation with another operation in a correlated currency pair. The correlation between both currency pairs or assets can be positive or negative.

In Forex, an alternative is to trade “strong” currencies against “weak” currencies and thus maintain less exposure with strong ups or downs. Suppose for example you decide to go short on the pair EUR/USD. Currency pairs such as AUD/USD and GBP/USD have a high positive correlation with EUR/USD, so their price is likely to fall as well.

If you open another short in AUD/USD or GBP/USD, you are more exposed in the market because of the EUR/USD short position you already have. In the case of currency pairs with a high negative correlation as the case of EUR/USD and USD/CHF, if we open a short in EUR/USD and go long in USD/CHF we would also be incurring a higher risk.

Here, we can perform a correlated coverage. What must be vital to us is always to maintain in mind the following: if the correlation is positive, to make the coverage you must trade in opposite directions (sale – purchase or purchase – sale) and if the correlation is negative you must trade in the same direction (purchase – purchase or sale – sale).

Direct Coverage: It consists of opening positions in the same currency pair. It may seem a bit confusing or pointless, I explain it better with an example (like not):

Suppose you are long in the pair EUR/USD, the position is green but still does not reach your take profit. You’re coming up with a high-impact story (for example, NFP or GDP) and you want to partially protect your earnings without closing the position. One way to protect yourself from movements due to the high volatility this news may generate is to open a short position in the same pair and when volatility decreases close the hedging position. Minimizing in this way the potential risks of the news.

Direct coverage is also often used to leverage corrective movements in a trend. Anticipating a possible price correction in an uptrend, we can cover a long position by opening a short position. If the correction does occur, we gain in the short position while maintaining the long position.

Coverage with Futures: Hedging operations with foreign exchange futures are one of the hedging more used by the big market operators. Suppose an investment fund, based in the United States, invested in a Japanese company and generated 1 million yen in unrealized profits. Since the investment fund needs dollars instead of yen, it can buy USD/JPY futures contracts on the stock exchange for the total amount of yen it expects to receive (total coverage) or for a percentage of the total to receive (partial coverage). In this way the fund secures a fixed rate for its yen, protecting itself from the risk associated with USD/JPY torque fluctuations.

Hedging: Yes or No?

From my experience, I consider that every trader should know and know how to apply the different strategies around hedging, especially in a market as volatile as the Forex market. What we want to achieve with coverage is to minimize risks of movements against us when making an investment and at no time seeks to maximize potential profits, so we can consider it a purely defensive strategy.

It allows us to manage our positions in a calmer way, reducing the stress of the psychological factor when trading. There are many hedging strategies depending on the financial instrument you are operating.

Robots Using Hedging

We find a lot of systems on the Internet that may seem very attractive but that constantly make coverage by delaying losses and adding more and more positions. You can imagine how this ends. Run away from these kinds of robots. And you’ll wonder, how do you detect them? Easy, don’t buy a forex robot that you don’t know how it’s created, how it works, and you’ve spent time testing. That’s for not telling you straight away not to buy a robot to trade.

My Opinion

As you know, I do algorithmic trading and none of my systems apply hedging. They could tell you that psychologically this technique makes you not close with losses and… I ask you, why not take the loss and delay it by taking more commissions?

Doesn’t make any statistical sense in that case. Applying currency trading systems individually does not. Hedging can make sense in correlation strategies as we have seen between assets or in our stock portfolio to protect us from currency risk. If for example we buy shares in dollars but our account is in euros. I certainly think today it is an excellent tool, not for trading systems.