A stop loss is an order placed by a trader on any underlying asset, the order remains until the price action reaches that specific point, then it automatically executes a buy or sell order in the market. Trading the markets without a stop loss is dangerous. However, by placing the stop loss, traders can easily eliminate the emotions from their trading decisions. In your trading carrier, you will often hear about the traders who never use the stop-loss orders, and they continually make money in the market. They rely on the no-stop loss forex trading strategy, and some of the traders succeed, and some don’t. The traders who win consistently in the markets are emotionally intelligent; also, they spent an endless amount of hours on demo trading to master the strategy well. Another most critical skill they learn is Accurate Thinking, and they don’t see things the way they are, they see things the way things are.

Not Using The Stop Loss Have Some Advantages In The Market

In dead markets hours when none of the trading sessions is active, at that time, most of the forex brokers wider their spreads so that they can avoid the scalpers to move the market. In that time, if your strategy gives you the trading opportunity, a widening spread can easily trigger your stop loss. During the opening hours or the high political news events, markets are quite volatile, which sometimes prints unexpected spikes in the market that ends up closing your positions and markets happily moving in the directions you predicted.

No Stop-Loss Trading Strategy

Keep in mind that trading without the stop loss is only applicable for intraday trading only, and it is advisable that use this strategy only on the lower timeframes because markets are random and it’s risky to let your positions to run overnight in the market. Like a gambler, you need to keep watching your trades until your trades hit the take profit. If you are beginner traders, then we don’t recommend you to use this strategy to trade in the live market, first of all, spend two to three months on the demo account to master this strategy and then give it a try on live markets.

Trading The Markets With The Moving Average

From beginners to advanced to chartists to market movers, everyone uses the moving average once in their lifetime. Even chartists and professional traders use this indicator in their everyday market analysis. Moving average defines the current market trend, spot trend reversals; also, it indicates the buy and sell signals. When the indicator is above the price action, it means that the trend is down, and then the indicator goes below the price action, which shows that the trend is up. Many traders and chartists use some other form of technical analysis in conjunction with the moving average to identify the trading signals. You can pair it with other indicators; also, you can use the higher period average with the lower period average to find the best entries. This strategy only works in the trending market, and we suggest you avoid using it in the dead, volatile, and consolidation phases.

Buying Rules

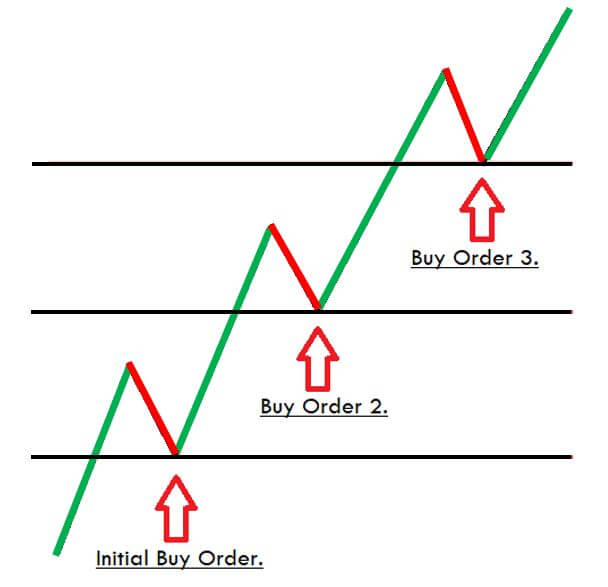

- In an uptrend, go long when the 7 MA crosses the 14 MA to the upside.

- Exit your position when the red candle closes below the 14period MA.

- No need to place the stop loss.

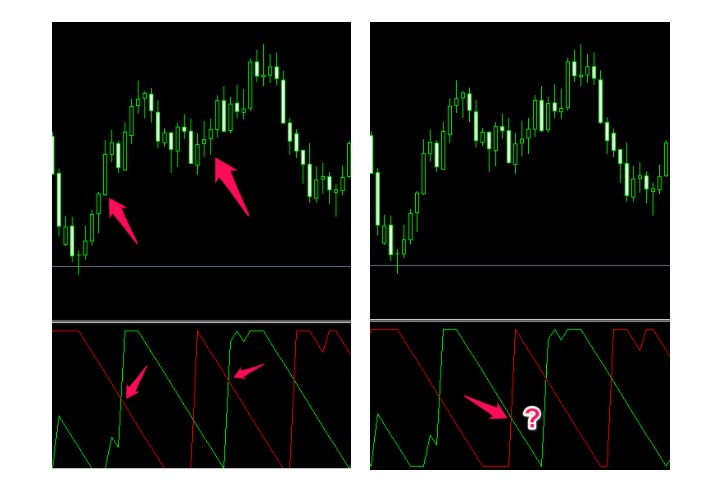

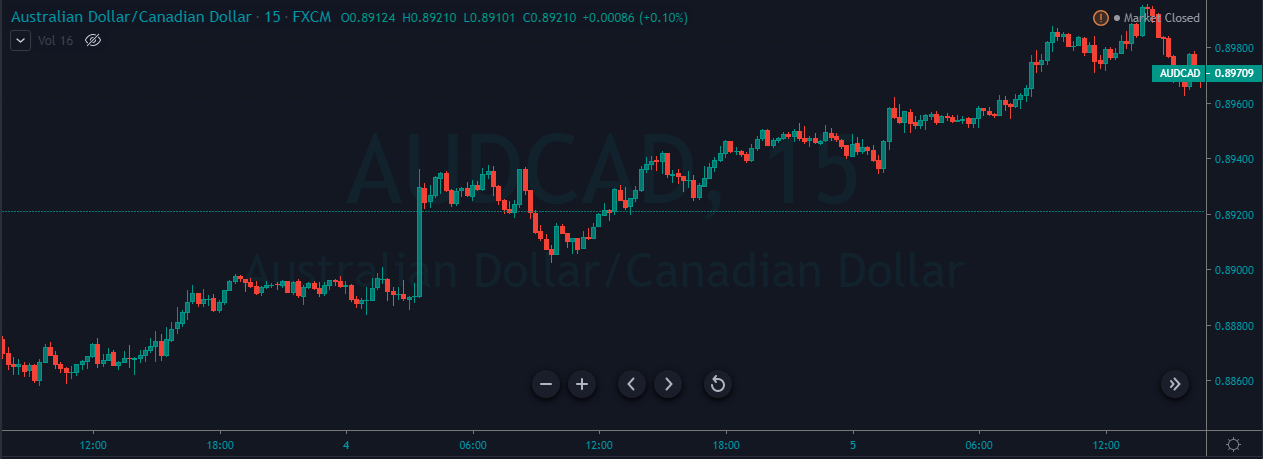

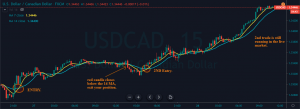

As you can see in the below image of the USDCAD 15 minute forex chart, the markets were overall in an uptrend. Our strategy gives the first trading opportunity around the 27th of February, and exits were also the same day. Our early trade gives us 30+ pips profit. After our position exiting the market provides us with a trading opportunity in the US session, we took this example from the recent market conditions, so our second trade in still running. By now, our second trade is up by 100+ pips. By following the flow of the market, you can easily make money, without placing the stop loss. You can see in the below image that the market is not even dead and volatile; the markets were moving in a relaxed and calm manner, find these kinds of markets to spotlighting the outstanding trading opportunities.

Selling Rules

- In a downtrend, go short when the 7 MA crosses the 14 MA to the downside.

- Exit your position when the green candle closes above the 14period MA.

- No need to place the stop loss.

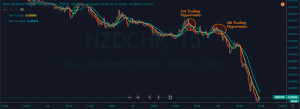

The below NZDCHF forex pair indicates the selling opportunities by using the Doube moving average. The markets were in a strong downtrend, and it gives us the first trading opportunity on the 25th of February around the London session. After our entry price action dropped immediately and printed the brand new lower low. The very next day market gives the second selling opportunity in the London session. On the same day, the opening of the New York session indicates us to close both buying positions when a green candle closes above the 24 periods MA. Both trades help us to milk 80+ pips in just two working trading days.

The below image represents the 3rd and 4th trading opportunities in the NZDCHF forex pair. We activate the 3rd trade in the New York session on the 27th of February, and the last trade was taken in the Asian session on the 28th of February. Both of these trades are running successfully, and we are in profits of nearly 200 pips. Now, all we need is to wait for the green candle to close above the 14 periods MA so that we can book profits. You can use this way to exit your position, or you can use the significant support resistance areas to book the profits. The MA lines also act as a dynamic support resistance to the price action, and the more, the higher the period we choose, the stronger the S/R will be. So when the price action crosses the 14 periods MA, it indicates our trading party loses its power, { buyers in buying side, sellers in selling side } so it’s the best time to close our position.

Conclusion

We believe that by now, you can understand that it is possible to trade the market without using the stop loss. All you need to do is to put in the extra work required to find one of the best trading opportunities to make some consistent money. In short, Activate your trades only in active trading hours, no trade in dead or volatile market conditions also avoid choppy or ranging market conditions. Find out the super smooth trend in any instrument and wait for the price action to meet the rules of strategy to take trades.

Keep Milking The Markets, Peace.