S2 Trade is a forex broker that was founded and managed by industry professionals. Their main values are to impress their traders through their dedication, to show integrity and fairness, to be dependable and communicate effectively, and to take complete responsibility for their actions. They pride themselves on the customer service department and also their education center. We will be using this review to look into the services offered to see how they compare to the competition and so you can decide if they are the right broker to use.

Account Types

S2 Trade offers three different accounts to their clients. They each have slightly different features and requirements, so let’s look at what they are.

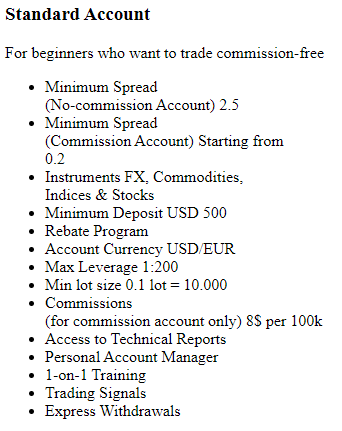

Standard Account: This account requires a minimum deposit of $500 and must be in either USD or EUR, it has a minimum spread of 2.5 pips on a non-commission account or 0.2 pips on a commission-based account. The commission account has an added commission of $8 per lot traded. You are able to trade forex, commodities, indices, and stocks. The account can be leveraged up to 1:200, minimum trade sizes start from 0.1 lots, the account also has access to a personal account manager and access to technical support.

Standard Account: This account requires a minimum deposit of $500 and must be in either USD or EUR, it has a minimum spread of 2.5 pips on a non-commission account or 0.2 pips on a commission-based account. The commission account has an added commission of $8 per lot traded. You are able to trade forex, commodities, indices, and stocks. The account can be leveraged up to 1:200, minimum trade sizes start from 0.1 lots, the account also has access to a personal account manager and access to technical support.

Premium Account: This account requires a minimum deposit of $5,000 and must be in either USD or EUR, it has a minimum spread of 2.1 pips on a non-commission account or 0.1 pips on a commission-based account. The commission account has an added commission of $3.5 per lot traded. You are able to trade forex, commodities, indices, and stocks. The account can be leveraged up to 1:200, minimum trade sizes start from 0.1 lots, the account also has access to a personal account manager and access to technical support. The account also has access to one on one training, trading signals, and a rebate program.

VIP Account: This account requires a minimum deposit of $50,000 and must be in either USD or EUR, it has a minimum spread of 1.5 pips on a non-commission account or 0.1 pips on a commission-based account. The commission account has an added commission of $2 per lot traded. You are able to trade forex, commodities, indices, and stocks. The account can be leveraged up to 1:200, minimum trade sizes start from 0.1 lots, the account also has access to a personal account manager and access to technical support. The account also has access to one on one training, trading signals, and a rebate program. You also get express withdrawals when using this account.

Platforms

There are two platforms available to use, including the well-known MT4 and MobileTrade. There isn’t much left to say about MetaTrader 4, as it is an extremely popular trading platform used by millions of Forex traders all over the world. As for MobileTrade, it is a mobile-only trading platform that offers advanced Trading Options, trade Forex pairs including EURUSD, trade top stocks with 10 to 20 times leverage.

There are two platforms available to use, including the well-known MT4 and MobileTrade. There isn’t much left to say about MetaTrader 4, as it is an extremely popular trading platform used by millions of Forex traders all over the world. As for MobileTrade, it is a mobile-only trading platform that offers advanced Trading Options, trade Forex pairs including EURUSD, trade top stocks with 10 to 20 times leverage.

Leverage

All accounts at S2 Trade can be leveraged up to 1:200, this is an acceptable level and offers decent levels of risk and reward, many brokers are now looking to offer 1:500 leverage. Clients can select the leverage that they want when opening up a new account. Should you need to change it on an account that you are already open, you can send a request to change it to the customer service team.

Different instruments also have different available leverages, we have listed them for you below.

- 1:200 – Forex Majors, Forex Crosses, Metals.

- 1:100 – Commodities, Energy Futures.

- 1:50 – Indices.

- 1:20 – USA Shares, Europe Shares.

- 1:5 – Cryptos

Trade Sizes

The Trade sizes on all three accounts start from 0.1 lots which are also known as mini-lots and equate to 10,000 base currency units. Sadly, we do not know what the maximum trade size is or how many trades you can have open at any one time.

Trading Costs

Each account type has an option of different payment structures, they can either use a spread-based system (we will look at this later in the review) or a commission-based system. When using commissions, the Standard account has an added commission of $8 per lot traded, the Premium account has a commission of $3.5 per lot traded and the VIP account has an added commission of $2 per lot traded, considering the industry average is around $6 per lot traded, the Premium and VIP account c can be considered quite cheap.

There are also swap charges, these are fees that are either charged or received for holding trades overnight or the weekend, they can be viewed within the trading platform that you are using.

Assets

There are plenty of assets available and they have been broken down into a number of different categories, we have outlined them below along with the instruments found within them.

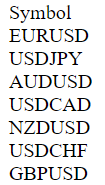

Forex Majors: EURUSD, USDJPY, AUDUSD, USDCAD, NZDUSD, USDCHF, GBPUSD.

Forex Majors: EURUSD, USDJPY, AUDUSD, USDCAD, NZDUSD, USDCHF, GBPUSD.

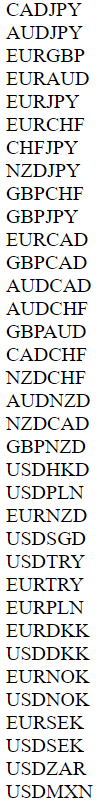

Forex Crosses: CADJPY, AUDJPY, EURGBP, EURAUD, EURJPY, EURCHF, CHFJPY, NZDJPY, GBPCHF, GBPJPY, EURCAD, GBPCAD, EURCAD, AUDCAD, AUDCHF, GBPAUD, CADCHF, NZDCHF, AUDNZD, GBPNZD, USDHKD, USDPLN, EURNZD, USDSGD, USDTRY, EURTRY, EURPLN, EURDKK, USDDKK, EURNOK, USDNOK, EURSEK, USDSEK, USDZAR, USDMXN.

Indices: Nasdaq, Dow Jones, S&P 500, CAC 40, IBEX 35, Nikkei, SMI,  Dax 30, FTSE 100.

Dax 30, FTSE 100.

Metals: XAGUSD, XAUUSD (Silver and Gold)

Shares: There are plenty of shares available from the USA and Europe, some of them include Cisco, Google, Coca-Cola, BMW, and FIAT.

Commodities: Cocoa, Corn, Soybean, Wheat, Coffee, and Sugar

Energy Futures: Crude Oil, Natural Gas, and Brent Crude Oil

Cryptos: ETHUSD (Ethereum), BTCUSD (Bitcoin), XRPUSD (Ripple), and LTCUSD (Litecoin)

Spreads

The accounts can use either a spread-based system or a commission-based one when using the commission-based system that we looked at earlier, the Standard account has spreads starting from 0.2 pips while the Premium and VIP accounts have spreads starting from around 0.1 pips. When using the spread-based system the Standard account has spreads starting from 2.5 pips, the PRemium account from 2.1 pips, and the VIP account has spreads starting from 1.5 pips.

The spreads are variable which means they will move with the markets, the more volatility, the higher the spreads will be. Different instruments will also have different average spreads when looking at the Standard account, the average spread for USDJPY is 1.6 pips while the spread for GBPUSD is 4 pips.

Minimum Deposit

The minimum deposit required to open up an account is $500 which gets you to access the Standard account, if you want the Premium account you will need to deposit at least $5,00 and $50,m000 for the VIP account. Once an account has been opened the minimum deposit amount reduces down to $250 for future top-up deposits.

Deposit Methods & Costs

Deposit Methods & Costs

There are five different methods available to deposit with, these are Visa/MasterCard, Bank Wire Transfer, Skrill, Neteller, and WebMoney. There are no added fees from S2 Trade, however, if using a Credit/Debit card you should ensure that you deposit using the same currency or you will need to pay an exchange fee, you should also check with your bank or processor for any outgoing transfer fees charged by them.

Withdrawal Methods & Costs

We believe that the same five methods are available to withdraw with, once again these are Visa/MasterCard, Bank Wire Transfer, Skrill, Neteller, and WebMoney. There is no mention of any fees on the withdrawals information page, however, you should always check with your bank or card issuer to see if they will add any incoming processing fees of their own.

Withdrawal Processing & Wait Time

The website states that any withdrawal requests from S2 Trade will be processed between 3 to 5 business days; this is the total time for the withdrawal to be fully processed. The time can vary based on your own bank’s processing times.

Bonuses & Promotions

There are three different cashback programs available, they are based on the deposit value that you make and offer different amounts of rebate. If you deposit between $1,000 and $5,000 then there will be a rebate of $1 per lot traded for 2 months. Deposit between $5,000 and $25,000 and you will relieve a $5 rebate per lot traded for 3 months and if you deposit over $35,000 you will receive $10 per lot traded for 6 months. There doesn’t appear to be any actual bonuses in bonus funds available, but you could always check with the customer service team to see if there is anything extra available.

Educational & Trading Tools

The educational side of the site contains three different aspects. The first is an economic calendar, this details upcoming news events and also shows which markets and currencies the news event could have an effect on. There are also video tutorials however they are currently not working so we can’t see what topics they cover or what sort of quality they offer. Finally, there is some daily market analysis but this has not taken place since July 2019 so it does not look like it is happening anymore.

Customer Service

While the main support team is available 24 hours a day, 5 days a week, their main phone line is available between 08:00 and 22:00 GMT+2 from Sunday to Friday. You can get in touch by sending a message through the online submission form and you should get a reply by email. You can also use the available postal address, email address, and phone number.

- Email: [email protected]

- Phone: +3726347396

Demo Account

The demo account isn’t clearly advertised on the site but we believe that once you have signed up you will be able to open one up. The demo account allows you to test the markets and strategies without risk, however, we do not know the conditions of the account or if there is an expiration time on them.

Countries Accepted

This is not stated on the site so if you are thinking of joining S2 Trade, then get in contact with the customer service team to see if you are eligible for an account or not.

Conclusion

You get a lot of choices with S2 Trade, while it may only look like there are three account types there are actually six on offer. Each account can be used as a spread-based account or as a commission-based account. The trading costs seem reasonable however on the lower tier Standard account it can be a little expensive, it becomes a lot cheaper the higher your account tier. There are plenty of assets to trade that can be leveraged up to 1:200 which is a reasonable amount. Plenty of ways to contact the customer service team is also good and you should easily find a deposit or withdrawal method that suits you. The only real downside is that some of the educational material is not being updated, so either they got bored of doing it or the quality was bringing in enough clients.