IKOFX is a foreign exchange broker based in Vanuatu. IKOFX aims to never stop improving in order to meet the growing expectations of its global client base and to continue to build on relationships with its clients and partners. Providing services like news, tools, trading platforms and competitive trading conditions are their aims. We will be looking through the site to see if they achieve this and how they compare to the competition.

Account Types

There are three different accounts available from IKOFX and when signing up you will need to select one of them, so let’s look at their features.

Mini Account: This account requires a deposit of $1, it must be in USD and can have leveraged up to 1:1000. Trade sizes on this account start from 0.01 lots which equate to 1 cent per pip due to the contract size on this account being 10,000. There are swap-free aversions of this account and it has access to 26 currency pairs as well as Gold and Silver.

Standard Account: This account requires a deposit of $2,000, it must be in USD and can have leveraged up to 1:500. Trade sizes on this account start from 1 lot which equates to $1 cent per pip due to the contract size on this account being 10,000. There are swap-free aversions of this account and it has access to 26 currency pairs as well as Gold and Silver.

ECN Account: This account requires a deposit of $1,000, it must be in USD and can have leveraged up to 1:200. Trade sizes on this account start from 0.01 lot and the contract size on this account is 100,000. Swap-free versions of this account are not available and it has access to 26 currency pairs as well as Gold and Silver.

Platforms

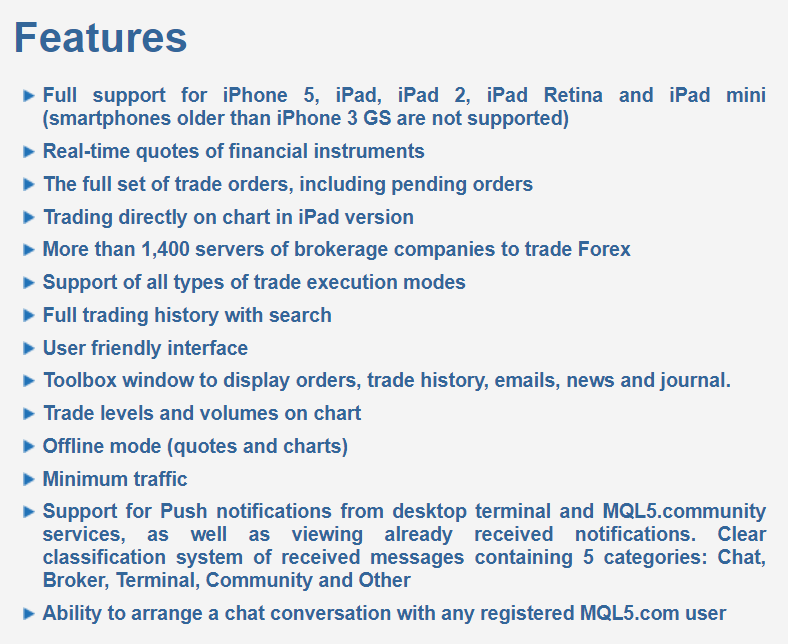

IKOFX offers MetaTrader 5 as its sole trading platform, MT5 is the younger brother of MetaTrader 4 (MT4)m developed by MetaQuotes Software and released in 2010, MT5 is used by millions and for good reason. Offering plenty of trading and analysis features to aid in your trading. Additional services expand the functionality of the platform making its capabilities almost limitless.

Leverage

The leverage that you get depends on the account type that you are using, we have outlined them for you below.

- Mini Account: Up to 1:1000

- Standard Account: Up to 1:500

- ECN Account: Up to 1:200

Leverage can be selected when opening up an account and can be changed by sending a request to the customer service team.

Trade Sizes

The Mini and Standard accounts have contract sizes of 10,000 units, the Mini account has trades starting from 0.01 lots and the Standard account starts at 1 lot. The ENC account has a contract size of 100,000 units and has a minimum trade size of 0.01 lots. We do not know what the maximum trade size is or what the maximum number of open trades you can have at any one time is.

Trading Costs

We did not see any information surrounding commissions, however as there is an ECN account there could be on that account, but again we do not know either way. There are however swap fees for holding trades overnight and these can be viewed either on the site or in the trading platform you are using. Swap-free accounts are available for the Mini and Standard account types.

Assets

There are only two categories of instruments, forex, and metals, we have outlined them below.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZF, GBPUSD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY

Metals: Gold and Silver

Spreads

Unfortunately, only one set of spreads is available so we cannot see a difference between the three account types. The information that we do have has the spreads starting from around 2 pips for the EURUSD pair, while other pairs are starting higher, for example, AUDJPY is starting at 5 pips. The spreads are variable which means they move with the markets and any added volatility on the markets will make them move slightly higher.

Minimum Deposit

The minimum amount required to open up the Mini account is $1, in order to open up a standard account you will need to deposit at least $2,000 and $1,000 for the ECN account.

Deposit Methods & Costs

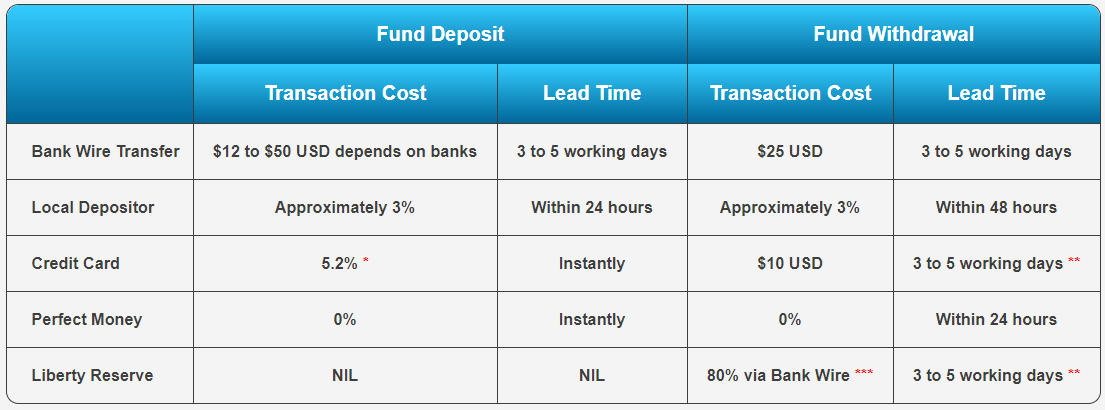

There are a few different ways to deposit into IKOFX, we have outlined them below along with any fees that are applicable.

- Bank Wire Transfer – $12 to $50 USD fee

- Local Deposit – Approximated a 3% fee

- Credit Card – 5.2% fee

- Perfect Money – No fee

- Liberty Reserve – No fee

You should also check with your own bank or processor to see if there are any added fees from them.

Withdrawal Methods & Costs

The same methods are available to withdraw with, we have outlined them again with any added fees that are applicable to them.

- Bank Wire Transfer – $25 fee

- Local Deposit – Approximated a 3% fee

- Credit Card – $10 free

- Perfect Money – No fee

- Liberty Reserve – 80% fee via bank wire

As usual, you should also check with your bank or processor to see if they will charge for incoming transactions or processing.

Withdrawal Processing & Wait Time

The amount of time it takes for the withdrawals to fully process once again depends on the method used, we have outlined the times below.

- Bank Wire Transfer – 3 to 5 working days

- Local Deposit – Within 48 hours

- Credit Card – 3 to 5 working days

- Perfect Money – Within 24 hours

- Liberty Reserve – 3 to 5 working days

Bonuses & Promotions

There is currently one promotion active on the site, this is a deposit bonus where you are able to receive a deposit bonus of up to 40%. The maximum credit per account is $3,000 and there is a maximum of $15,000 per client. Looking through the terms, it does not seem like these funds can be converted into real funds and so they will always remain as credit for trading only.

There have been plenty of other promotions in the past so it looks like they are constantly changing, so the bonuses available to you may be different from the one we have mentioned above. IKOFX for some reason also has their leverage being at 1:1000 as a promotion, but we don’t really think it is.

Educational & Trading Tools

There are a few different sections when it comes to education and tools, the first is an economic calendar which details upcoming news events and also what markets they may have and affect on there is also a news section but the page was constantly loading for us so we could not view the content. The interest rate page has not been updated since 2012. There are also forex calculators for pip value, profit, swap charges, and margins. Finally, there is a live TV section but this hasn’t been updated since 2017.

There are a few different sections when it comes to education and tools, the first is an economic calendar which details upcoming news events and also what markets they may have and affect on there is also a news section but the page was constantly loading for us so we could not view the content. The interest rate page has not been updated since 2012. There are also forex calculators for pip value, profit, swap charges, and margins. Finally, there is a live TV section but this hasn’t been updated since 2017.

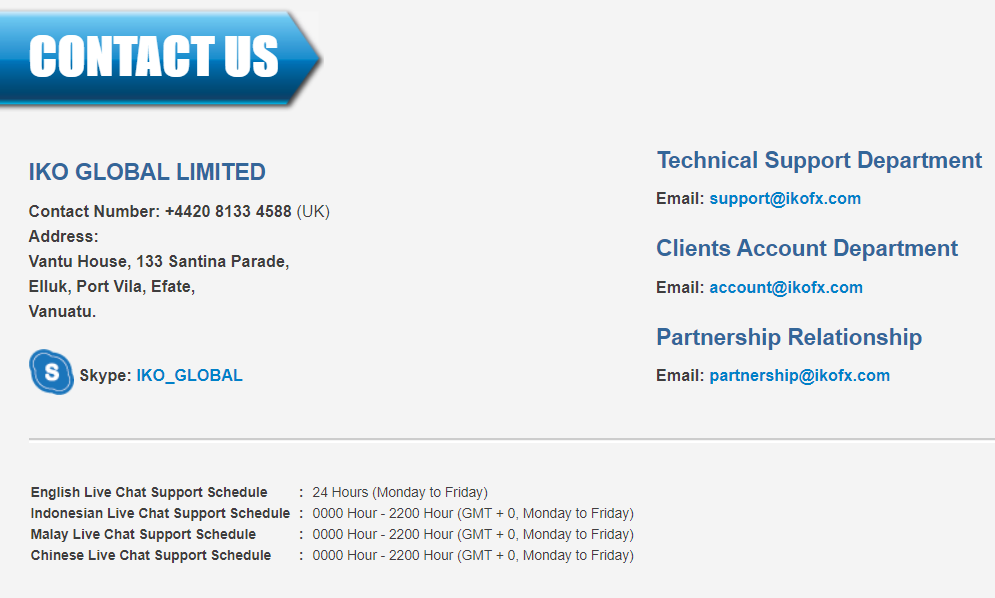

Customer Service

The customer service team is available to contact 24 hours a day 5 days a week as they close over the weekends. You can use a few methods to get in touch, you can use email to contact the support team, clients account team, or the partnership team. There is also a phone number, postal address, and Skype username. There is also a live chat feature in English, Indonesian, Malay, and Chinese.

- Address: Vantu House, 133 Santina Parade, Elluk, Port Vila, Efate, Vanuatu

- Email: [email protected]

- Phone: +4420 8133 4588

- Skype: IKO_GLOBAL

Demo Account

Demo accounts allow you to test out new strategies or the servers without any real risk and so it is good to see that they are available with IKOFX. You can choose to use the demo account as a Mini or Standard account and can select leverage between 1:1 and 1:500 and capital between 1,000 and 500,000. We do not know what the expiration time on the accounts is.

Countries Accepted

This information is not present on the site, so if you are thinking of joining we would recommend contacting the customer service team to find out your eligibility prior to opening an account.

Conclusion

There are three different accounts each with its own features and trading conditions giving you a choice to use the one that suits you. Unfortunately, when it comes to trading costs we do not know the difference between them as we only have one set of spreads and no information on any commissions. When it comes to assets there is a limited number of them meaning there could be a lot of downtime with nothing to trade. The deposit and withdrawal methods are also lacking with fees for both deposit and withdrawing and one fee as high as 80% is a little crazy. IKOFX could be an expensive place to trade with very few assets so our recommendation at this point in time is to look for a more suitable broker elsewhere.