Introduction

EUR/PLN is the abbreviation for the Euro Area’s euro against the Polish Zloty. This European currency is classified as an exotic-cross currency pair. In this pair, the EUR is the base currency, and the PLN is the quote currency.

Understanding EUR/PLN

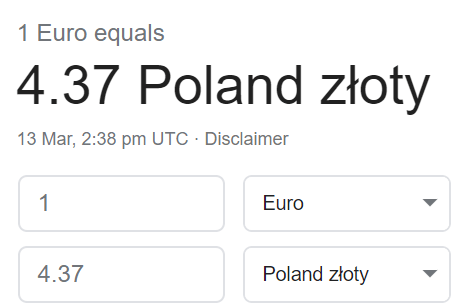

The value of this pair simply represents the value of PLN equivalent to one Euro. It is quoted as 1 EUR per X PLN. An example of the same is shown below.

Spread

The spread is a popular terminology used in the forex industry, which is defined as the difference between bid and ask prices in the market. This is not the same on all brokers but varies based on the execution model they use.

ECN: 30 pips | STP: 34 pips

Fees

A Fee is similar to the commission that is paid to the brokers. Fee on ECN accounts is between 5-10 pips, while it is nil for STP accounts.

Slippage

Slippage is the difference between the price wanted by the client and the price they actually received from the broker. There is this difference due to two reasons:

- Broker’s execution speed

- Market volatility

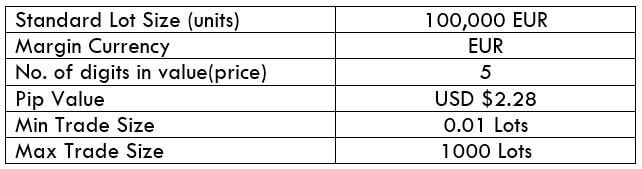

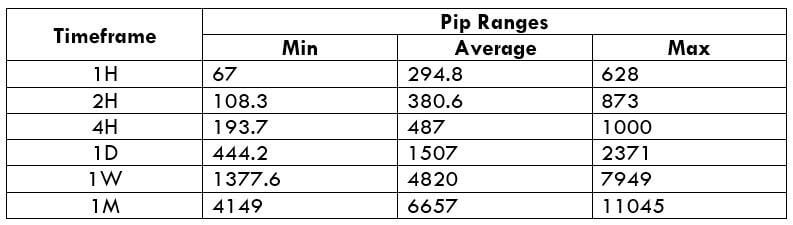

Trading Range in EUR/PLN

A trading range is a table that represents the minimum, average, and maximum volatility of the market for various timeframes. With these pip movements from the past, we can determine the profit/loss that can be made from a trade.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

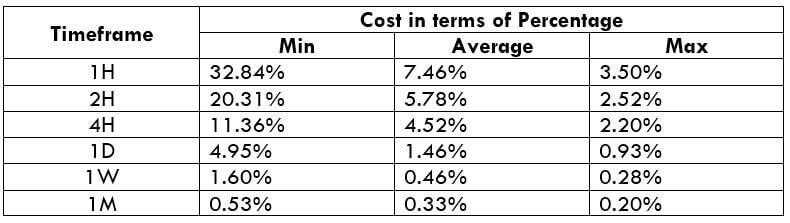

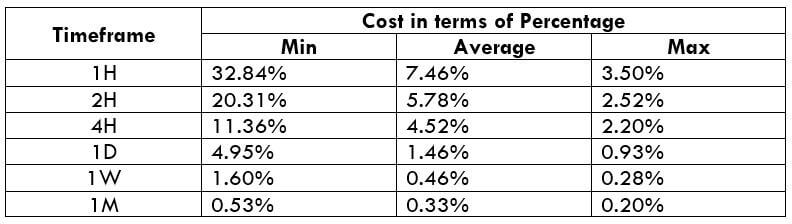

EUR/PLN Cost as a Percent of the Trading Range

In calculating the total costs, spread and slippage are variables. These values change as the volatility of the market changes. And below, we have represented the variation of the costs by applying the values from the trading range table.

ECN Model Account

Spread = 30 | Slippage = 3 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 3 + 30 + 3 = 36

STP Model Account

Spread = 34 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 34 + 0 = 37

Trading the EUR/PLN

Trading the EURPLN is not a hurdle. Though this pair is a major/minor currency pair, its characteristics are similar to that of majors/minors.

Firstly, the spread is around 30 pips, which are lower compared to other exotic-cross currencies involving EUR as the base currency. Secondly, the volatility of this pair is pretty decent. It is neither too high nor too low.

Coming to the above two tables, we can see that the percentage values are large in the min column and gets smaller as we move towards the max column. Since the values in the min column are significant, it is not advisable to trade this pair during low volatility. To have enough volatility with inexpensive costs, one may trade when the volatility is around the average values.

Placing orders through ‘limit’ and ‘stop’ would further decrease the costs. In doing so, the slippage on the trade will be nullified, and this will, in turn, bring down the total costs.