Elite FX is a Forex broker, which has various types of accounts for its clients. Differences in trading conditions are not well defined. They also offer Islamic accounts (no swap). This broker has a daily service of forex signals that are published every day at 10:00 pm. The company behind Elite FX is not exactly named or mentioned anywhere on the website, except in the ownership of the recipient of the bank account used for the deposits. The company is called Elite Index Limited and has a bank account at a bank based in Dubai, United Arab Emirates.

Elite FX looks like a broker aimed at Arab clients, as even the English version of the website is written in Arabic. We don’t know if they operate outside the United Arab Emirates. They do not report any regulatory oversight, which is already a reason to consider opening an account with this broker. The Elite FX website is very simple and does not inspire confidence, there is a lack of information in general, especially in such important areas as commercial conditions.

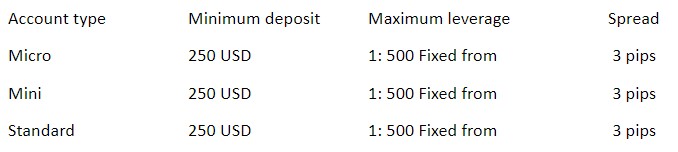

ACCOUNT TYPES

Below we detail 3 types of accounts offered by this broker, without being clear the difference of conditions between them.

PLATFORMS

Elite FX offers its customers, trading, technology available on the Metatrader4 platform (MT4). This is the platform most used by most Forex and CFDs traders. Some brokers develop their own customized platforms, as an alternative to Metatrader platforms. But certainly, MT4 has many advantages: experienced traders are used to it, the immense number of users of the platform, along with the programming language, very easy to learn, has determined the development of many custom tools. Some of these tools are paid and others are free.

The two most interesting tools are technical indicators and automated trading systems, also called Expert Advisors. MT4 also has mobile apps, available on iOS and Android. Mobile tools may not be able to provide you with the same potential as your desktop, but they will offer you most of their functionality in summary form. Also, there is a web version, which allows you to log into your trading account from any mobile device, provided you have an internet connection. We recommend having your mobile app installed on your smartphone.

LEVERAGE

Elite FX offers maximum leverage of 1:500. This leverage is certainly greater than necessary if you want to negotiate in a reasonable way. Certainly, and given the growth rate of the Forex industry, Elite FX is not the only one to offer such high leverage, as many brokers offer it.

Obviously, having leverage that high doesn’t mean I have to use it. What this level of leverage does is block a very small part of your trading account as a margin requirement, provided you open a new position. What you should do is leave most of your account unused. Make sure you understand how Forex and CFD trade works well before you risk your money, as you can earn a lot, but also lose a lot.

TRADE SIZES

The Elite FX website does not report trade sizes. However, knowing that they accept accounts with a minimum deposit of 250 USD, it is very likely that the minimum size to trade is 0.01 lot (micro lot).

TRADING COSTS

Elite FX trading costs are included in fixed spreads. Spreads start from 3 pips in EUR / USD. This margin is well above the proposals you can find in other brokers that use a fixed spread. There are no commissions per operation.

However, like any broker, traders will pay a swap for transactions that remain open overnight. Swaps are interests based on the economic conditions and policies of the central bank of the country of origin of the currency.

ASSETS

Elite Fx reports that it has more than 70 financial instruments to trade. Unfortunately, it does not specify what they are. We understand that they may be currency pairs and CFDs on indices and commodities, but this is not verified.

SPREADS

As far as we have been able to report, Elite FX offers a fixed spread on all their accounts starting from the 3 pips in EUR/USD.

MINIMUM DEPOSIT

The minimum deposit to open an account and start trading with Elite FX is 250 USD.

DEPOSIT METHODS & COSTS

Elite FX only provides one payment method for its customers, Bank Transfer. International bank transfers can take several days to reach your destination, so more and more brokers offer instant payment systems like Skrill, Neteller, or simply a credit or debit card. The cost of the bank transfer is set by your bank, an approximate cost would be 0.5% of the total amount to be deposited.

WITHDRAWAL METHODS & COSTS

Knowing that the only deposit method is bank transfer, surely the only withdrawal method will also by bank transfer. The broker has an online form for withdrawal requests from his clients. We have not been able to inform ourselves of the costs applied by Elite FX in the withdrawals.

WITHDRAWAL PROCESSING & WAIT TIME

Once we have completed the online questionnaire to request a withdrawal, we have no information about how long the process will take, or how long the bank transfer they issue may take.

BONUSES & PROMOTIONS

Elite FX currently has no bonuses or promotions. The broker offers an IB system (Introducing Broker), in fact, on the website, there is access for them where they can access their private area using a username and password. The IB is partners that attract clients for the broker in exchange for a commission for their operations. Obviously, the particular conditions have to be dealt with the bróker directly.

EDUCATIONAL & TRADING TOOLS

Elite FX has at its disposal a section of [ resources where it makes available to its clients a glossary of terms related to trading. We consider this contribution to be insufficient. We always recommend that a broker have at least one news section and an economic calendar showing the most important key events of the day.

CUSTOMER SERVICE

To contact the customer service we only have two alternatives, an email and a contact form. We are missing a phone or a live chat, which are the 2 most direct contact methods and can meet our requirements in less time.

E-mail: [email protected]

The website reports multilingual support in 13 languages: English, Greek, Arabic, Farsi, French, Italian, German, Romanian, Serbian, Polish, Russian, and Chinese. They also claim to have a 24/7 live chat but we have not seen that service available anywhere on the website.

DEMO ACCOUNT

The broker offers a Demo account on his website, which we consider good news, as a Demo account helps the novice trader learn how to use the platform without risking his own capital. The broker does not report whether this demo account is free, nor how much time the customer has available for its use.

COUNTRIES ACCEPTED

Apparently, this broker is targeting the Arab world. Elite FX does not provide information about citizenship or jurisdictions that cannot open an account with them.

CONCLUSION

Many countries in the world have agencies that set standards and enforce them and are dedicated rules for companies in the financial services sector. In the United Arab Emirates, it is the Central Bank that assumes this role, so Elite FX does not need any specific regulation.

Let’s look at other situations: in the UK, the financial regulator is called the Financial Conduct Authority (FCA). This regulator has many rules, one of the most important is the segregation of accounts, own and those of customers. This means that a broker regulated by the FCA must have separate accounts for customer deposits, with the aim of not merging them with the company’s operational accounts. This rule was designed to prevent the broker from being able to spend his clients’ money.

Another important aspect, from the point of view of the Forex trader, is the mandatory inclusion in the Financial Services Clearing System (FSCS). This system works in a similar way to insurance companies: each broker gives a part of its profits to a collective fund, which has the purpose of acting as a guarantee in case any broker goes bankrupt. This is how a broker works when it is formally regulated, so the lack of regulation has to be taken very much into account by traders before choosing a broker to trade.