TTS Markets is a broker that offers trading with more than 60 financial instruments, including Forex, commodities, and indices, on two trading platforms: Metatrader 4 and Metatrader 5. According to the information on the broker’s website, the company behind the trademark TTS Markets is Tamil Trading Services Ltd. This company is based in Belize and is in the process of obtaining a license from the Belize International Financial Services Commission (IFSC).

However, when we tested your MT4 demo platform, which is provided by another forex broker (Richly Active Limited), we found only twenty pairs of forex and precious metals available for trading. What we like least is that TTS Markets is not regulated.

As we have said in other reviews, trading with an off-shore broker has some risks. Regulation in Belize is better than having nothing. Unlike the UK FCA and other financial institutions, IFSC has rather light control over foreign exchange brokers. But regulation in Belize is undoubtedly better than most offshore destinations. IFSC sets a minimum capital requirement for derivatives brokers, and commodities brokers of USD 500,000, which is to demonstrate the financial solvency of the company. Also, it charges an annual leave fee of $25,000. Also, IFSC requires licensed companies to have client funds in segregated accounts.

Let’s see all we can find out about this broker:

ACCOUNT TYPES

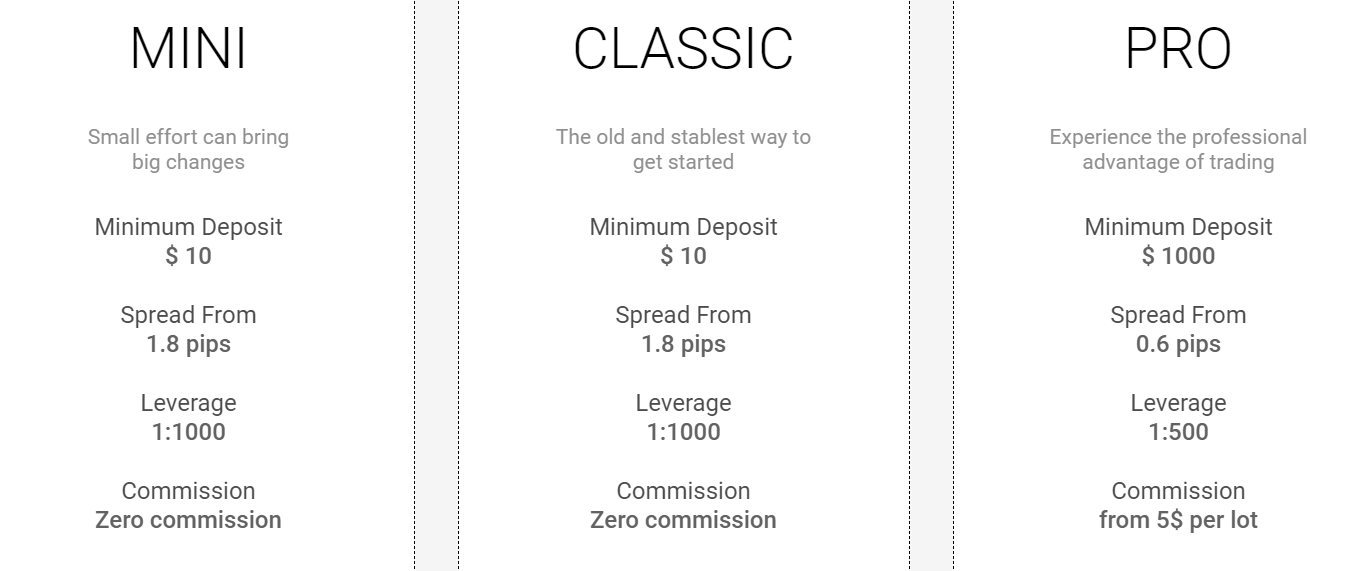

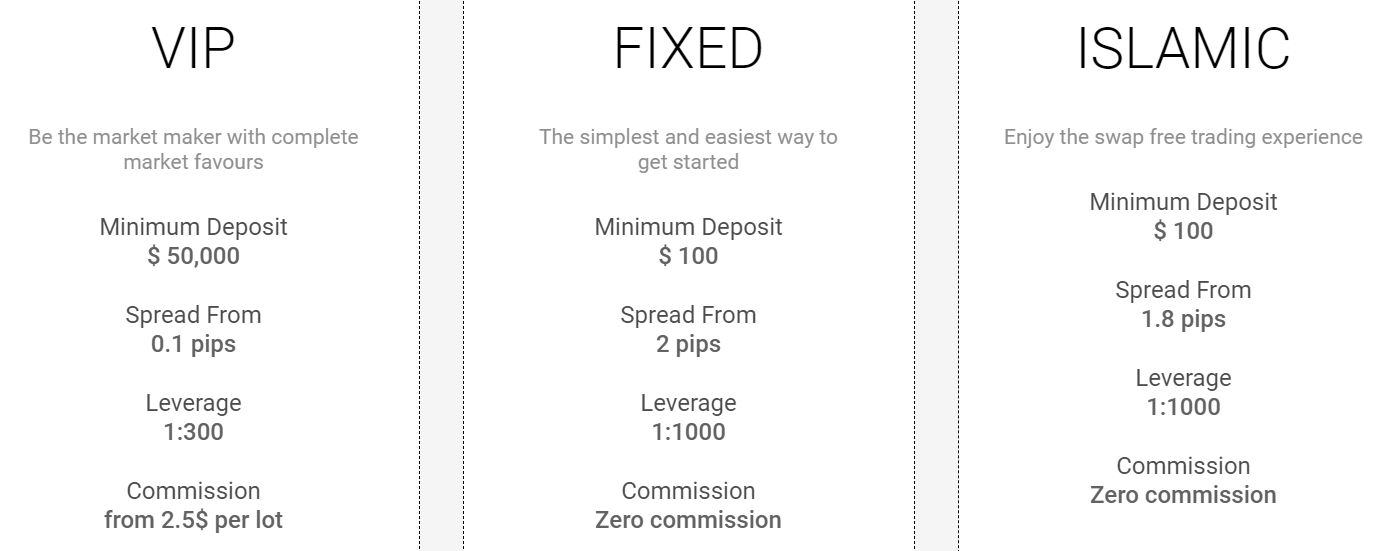

Like most foreign exchange brokers, TTS Markets offers its customers the option of up to 7 different account types, depending on the initial investment. All accounts are free of quotations, except one, and offer variable spreads, as well as the option to trade in micro lots, in order to have a good risk management strategy.

TTS Markets offers 7 different account types, called, Cent account, Mini account, Classic account, Pro account, Vip account, Fixed spread account, and Islamic account, here are the features of each of them:

Cent Account:

- Spread floating, from 1.8 points

- Commission None

- Execution type Instant Execution

- Execution speed 1.63 seconds

- Platform MT5

- Leverage 1:1000 – 1:1

- Account base currency USD

- Minimum deposit $1

- Maximum deposit $1,000

- Minimum lot 0.01

- Maximum lot 500

- Minimum step 0.01

- Max. number of orders Unlimited

- Margin Call Level 100%

- Stop Out Level 20%

- Forex contract size 1 lot = 100000

- Limit & stop levels From one spread

Mini Account:

- Spread floating, from 1.8 points

- Commission None

- Execution type Instant Execution

- Execution speed 1.13 seconds

- Platform MT5

- Leverage 1:1000 – 1:1

- Account base currency USD

- Minimum deposit $10

- Maximum deposit No limit

- Minimum lot 0.01

- Maximum lot 500

- Minimum step 0.01

- Max. number of orders Unlimited

- Margin Call Level 100%

- Stop Out Level 20%

- Forex contract size 1 lot = 100000

- Limit & stop levels From one spread

Classic Account:

- Spread floating, from 1.8 points

- Commission None

- Execution type Market Execution

- Execution speed 1.13 seconds

- Platform MT5

- Leverage 1:1000 – 1:1

- Account base currency USD

- Minimum deposit $10

- Maximum deposit No limit

- Minimum lot 0.01

- Maximum lot 500

- Minimum step 0.01

- Max. number of orders Unlimited

- Margin Call Level 100%

- Stop Out Level 20%

- Forex contract size 1 lot = 100000

- Limit & stop levels From one spread

Pro Account:

- Spread floating, from 0.6 points

- Commission From 5$ per lot

- Execution type Market Execution

- Execution speed 0.95 seconds

- Platform MT5

- Leverage 1:500 – 1:1

- Account base currency USD

- Minimum deposit $1,000

- Maximum deposit No limit

- Minimum lot 0.01

- Maximum lot 500

- Minimum step 0.01

- Max. number of orders Unlimited

- Margin Call Level 100%

- Stop Out Level 20%

- Forex contract size 1 lot = 100000

- Limit & stop levels From one spread

VIP Account:

- Spread floating, from 0.1 points

- Commission From 2.5$ per lot

- Execution type Market Execution

- Execution speed 0.37 seconds

- Platform MT5

- Leverage 1:300 – 1:1

- Account base currency USD

- Minimum deposit $50,000

- Maximum deposit No limit

- Minimum lot 0.01

- Maximum lot 500

- Minimum step 0.01

- Max. number of orders Unlimited

- Margin Call Level 100%

- Stop Out Level 20%

- Forex contract size 1 lot = 100000

- Limit & stop levels No limit

Fixed Spread Account:

- Spread floating, from 2 points

- Commission None

- Execution type Instant Execution

- Execution speed 1.13 seconds

- Platform MT5

- Leverage 1:1000 – 1:1

- Account base currency USD

- Minimum deposit $10

- Maximum deposit No limit

- Minimum lot 0.01

- Maximum lot 500

- Minimum step 0.01

- Max. number of orders Unlimited

- Margin Call Level 100%

- Stop Out Level 20%

- Forex contract size 1 lot = 100000

- Limit & stop levels From one spread

Islamic Account:

- Spread floating, from 1.8 points

- Commission None

- Execution type Market Execution

- Execution speed 1.13 seconds

- Platform MT5

- Leverage 1:1000 – 1:1

- Account base currency USD

- Minimum deposit $10

- Maximum deposit No limit

- Minimum lot 0.01

- Maximum lot 500

- Minimum step 0.01

- Max. number of orders Unlimited

- Margin Call Level 100%

- Stop Out Level 20%

- Forex contract size 1 lot = 100000

- Limit & stop levels From one spread

Looking at all the accounts, we see that there are differences in spreads, leverages, and minimum deposits. It calls our attention that there are differences in execution speed and that the account called Fixed Spread, has a variable spread (unless it is a typographical error of the website)

PLATFORMS

TTS Markets offers its customers two of the most popular currency trading platforms, MetaTrader 4 (MT4) and Metatrader 5 (MT5). Both platforms, MT4 and MT5, are available in a mobile version for use on smartphones and tablets, whether iOS or Android. Besides, TTS Markets offers its clients the VPS hosting service. It is a remote server that guarantees stability, reliability, and high-quality technical conditions, beneficial for those who work with Expert Advisors and automated strategies.

LEVERAGE

The biggest leverage with this broker (1:1000), is available on all your accounts except the Pro account and the Vip account, where you have a leverage of 1:500 and 1:300, respectively. Traders can start with a minimum no deposit account and leverage of 1:1000. While this may seem like a reasonable offer, we do not recommend using the leverage of 1:1000 with this or any other broker. Because if the market moves against you, even a minimal move, chances are you’ll lose the whole account.

The biggest leverage with this broker (1:1000), is available on all your accounts except the Pro account and the Vip account, where you have a leverage of 1:500 and 1:300, respectively. Traders can start with a minimum no deposit account and leverage of 1:1000. While this may seem like a reasonable offer, we do not recommend using the leverage of 1:1000 with this or any other broker. Because if the market moves against you, even a minimal move, chances are you’ll lose the whole account.

TRADE SIZES

In all accounts offered by TTS Markets, the minimum trade size is 0.01 lot (micro lot), and the maximum trade size is 500 lots.

TRADING COSTS

Regardless of the Spreads, TTS Markets accounts generally do not have commissions for traded lots. Only the Pro account costs 5 USD per lot, and the Vip Account costs 2.5 USD per lot. Another cost to add will be the Swap, which is any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

ASSETS

ASSETS

The assets available to trade are 40 currency pairs (Forex), and CFDs on metals, indices, and commodities.

SPREADS

As for TTS Markets spreads, they are not very competitive: more than 2 pips in EUR / USD. We tested the broker’s MT4 demo platform, and the spreads for this pair of currencies were fluctuating around 1.6 pips (probably the Classic account price feed), a cost that is also above the market average.

MINIMUM DEPOSIT

The minimum deposit required by TTS Markets varies according to the account chosen. For example, for the Cent account, they only ask for 1 USD, for the Mini or Classic accounts, they are 10 USD. Pro and VIP accounts already require higher initial capital, USD 1,000, and USD 50,000, respectively.

The minimum deposit required by TTS Markets varies according to the account chosen. For example, for the Cent account, they only ask for 1 USD, for the Mini or Classic accounts, they are 10 USD. Pro and VIP accounts already require higher initial capital, USD 1,000, and USD 50,000, respectively.

DEPOSIT METHODS & COSTS

Customers of TTS Markets, have available the following payment methods: credit or debit cards (Visa or Mastercard), bank transfers, and the following e-wallet, Skrill and Neteller. Additionally, it is also possible to deposit in Bitcoins. The Broker announces no deposit fees.

WITHDRAWAL METHODS & COSTS

The methods of withdrawal must be the same as those by which the deposit was made. The broker announces that he does not charge commissions for withdrawals, and if there is any expense, he assumes it. This is good news and a plus.

WITHDRAWAL PROCESSING & WAIT TIME

TTS Markets announces that it processes withdrawals within 24 hours. Also, the time taken for the various withdrawal methods should be added, which are usually instantaneous in the case of e-wallets and bank cards, and 2 to 5 working days in the case of bank transfers.

TTS Markets announces that it processes withdrawals within 24 hours. Also, the time taken for the various withdrawal methods should be added, which are usually instantaneous in the case of e-wallets and bank cards, and 2 to 5 working days in the case of bank transfers.

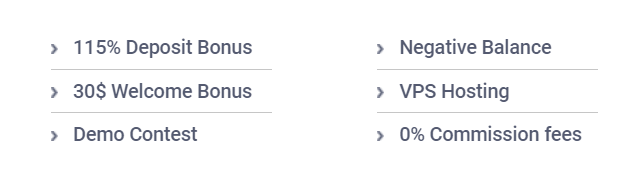

BONUSES & PROMOTIONS

There are currently several bonuses available with this broker:

-A bonus of 115% for your first deposit, the condition to be able to withdraw that 115% is to trade 500 lots. Condition quite difficult to get.

-Welcome bonus of 30 USD. The Bonus is not removable, but you can withdraw the winnings generated by it.

-There is negative balance protection; in this case, if your balance sheet turns negative as a reason for a losing trade, the broker will restore the balance to 0 USD. In short, you can never lose more than you’ve deposited.

-They also have in the promotion to rent VPS s from 15 USD, depending on the characteristics of the VPS that can cost up to 30 or 45 USD.

-Another of their promotions, called 0% commissions, is that the broker will reimburse you any expenses you may have when making your deposit so that it is free for the customer.

The broker offers an Introducing Broker program. An Introducing Broker is an agent that introduces customers to a broker. The IB’s receive compensation, in the form of a commission, for the clients they add, but do not collect from the clients. In the case of TTS Markets, it is offered, 10 USD per lot on customers with Classic account, and 2 USD per lot on the PRO account.

EDUCATIONAL & TRADING TOOLS

As tools, we have an economic Calendar, which we like very much to appear on the website, as it is a tool of interest since it seems the most important events of the day, and that may affect different financial assets that the trader may be trading. We also found a blog, very educational, with many interesting articles, all of them related to trading, worth reading. And finally, we also have a Screener and a Forex Heat Map to see the current status of the assets and their real-time quotes.

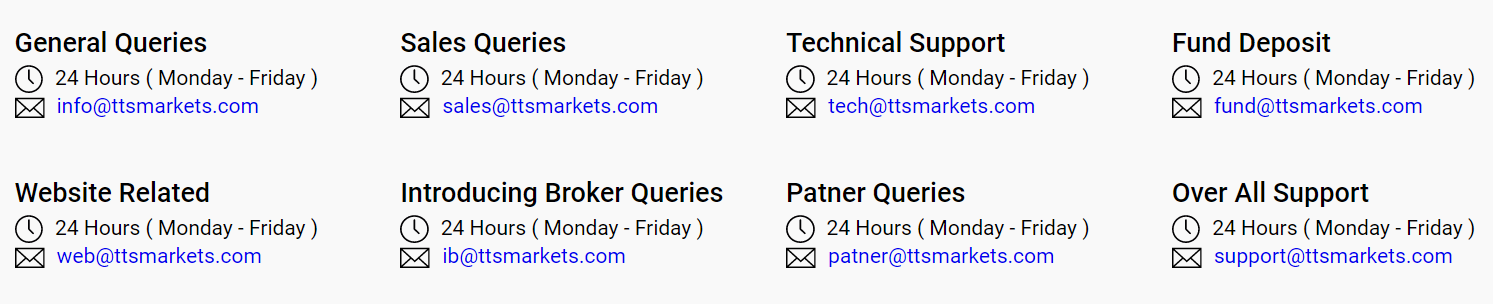

CUSTOMER SERVICE

To get in touch with TTS Market’s customer service, we have 4 main routes, Telephone, email, a contact form that appears on the web, and a live chat. The data we have collected are as follows:

- Email: [email protected]

- London Contact : +44 12239 69922, +27 11 083 5399

- Dubai Contact : +971 5813 98086

- Hong Kong Contact: +852-8192 9984

- General Queries. 24 hours ( Monday – Friday ). [email protected]

- Sales Queries. 24 hours ( Monday – Friday ). [email protected]

- Technical Support. 24 hours ( Monday – Friday ). [email protected]

- Fund Deposit. 24 hours ( Monday – Friday ). [email protected]

- Website Related. 24 hours ( Monday – Friday ). [email protected]

- Introducing Broker Queries. 24 hours ( Monday – Friday ). [email protected]

- Partner Queries. 24 hours ( Monday – Friday ). [email protected]

- Over All Support. 24 hours ( Monday – Friday ). [email protected]

DEMO ACCOUNT

Fortunately, TTS Markets provides a demo account that you can install in a few seconds. There is a download section on the website where you can choose the version you want, MT4 or MT5. Notify that the platform is provided by a company that is not TTS Markets. (liquiditysoftsolutions).

COUNTRIES ACCEPTED

The broker does not mention anywhere on his website about citizens or jurisdictions that may have restricted the fact of opening an account with TTS Markets. We advise all traders interested in opening an account with this broker to contact customer service to find out if you can open an account or not.

CONCLUSION

TTS Markets is a Belize-based foreign exchange broker with MT4 and MT5 trading platforms. The broker claims to be in the process of obtaining a license from the Belize IFSC. But it is currently operating without a currency broker license, and this is a disadvantage. Moreover, their spreads are above the market average. Another broker provides the MT4 platform, and its asset portfolio is quite limited.

To sum up, we discuss the advantages and disadvantages:

Advantages:

- MT4 and MT5 platforms available

- A low initial deposit is required

- VPS available at a very reasonable cost

- Very high levels of leverage are offered

Disadvantages:

- Broker not regulated

- Spreads are relatively high

- MT4 provided by another company

- No CFDs on indices and raw materials