Olympus Markets is a Vanuatu-based foreign exchange broker. Claiming to have over 372,500 clients Olympus Markets aims to offer low spreads, high leverage, fast execution, a personal mentor, custom-made offers, and winning trading strategies. We will be using this review as an opportunity to look into the services being offered to see how they compare to the competition.

Account Types

There are a massive 7 different accounts on offer when signing up. We have outlined some of the basic features below.

Jade: The account can be leveraged up to 1:500, it comes with standard spreads as well as 24/6 customer support, daily market overviews, access to the education centre, live trading webinars, daily analysis videos, and price alerts.

Ruby: The account can be leveraged up to 1:500, it comes with standard spreads as well as 24/6 customer support, daily market overviews, access to the education centre, live trading webinars, daily analysis videos, and price alerts. This account also comes with a junior account manager.

Emerald: The account can be leveraged up to 1:500, it comes with silver (reduced) spreads as well as 24/6 customer support, daily market overviews, access to the education centre, live trading webinars, daily analysis videos, and price alerts. This account also comes with a senior account manager.

Sapphire: The account can be leveraged up to 1:500, it comes with gold (further reduced) spreads as well as 24/6 customer support, daily market overviews, access to the education centre, live trading webinars, daily analysis videos, and price alerts. This account also comes with a VIP account manager and a personalised trading strategy.

Diamond: The account can be leveraged up to 1:500, it comes with platinum (even further reduced) spreads as well as 24/6 customer support, daily market overviews, access to the education centre, live trading webinars, daily analysis videos, and price alerts. This account also comes with a VIP account manager, a personalised trading strategy, and one on one training.

Islamic Sapphire: The account can be leveraged up to 1:500, it comes with gold (reduced) spreads as well as 24/6 customer support, daily market overviews, access to the education centre, live trading webinars, daily analysis videos, and price alerts. This account also comes with a senior account manager, the account does not have swap charges.

Islamic Diamond: The account can be leveraged up to 1:500, it comes with platinum (reduced) spreads as well as 24/6 customer support, daily market overviews, access to the education centre, live trading webinars, daily analysis videos, and price alerts. This account also comes with a VIP account manager, the account does not have swap charges.

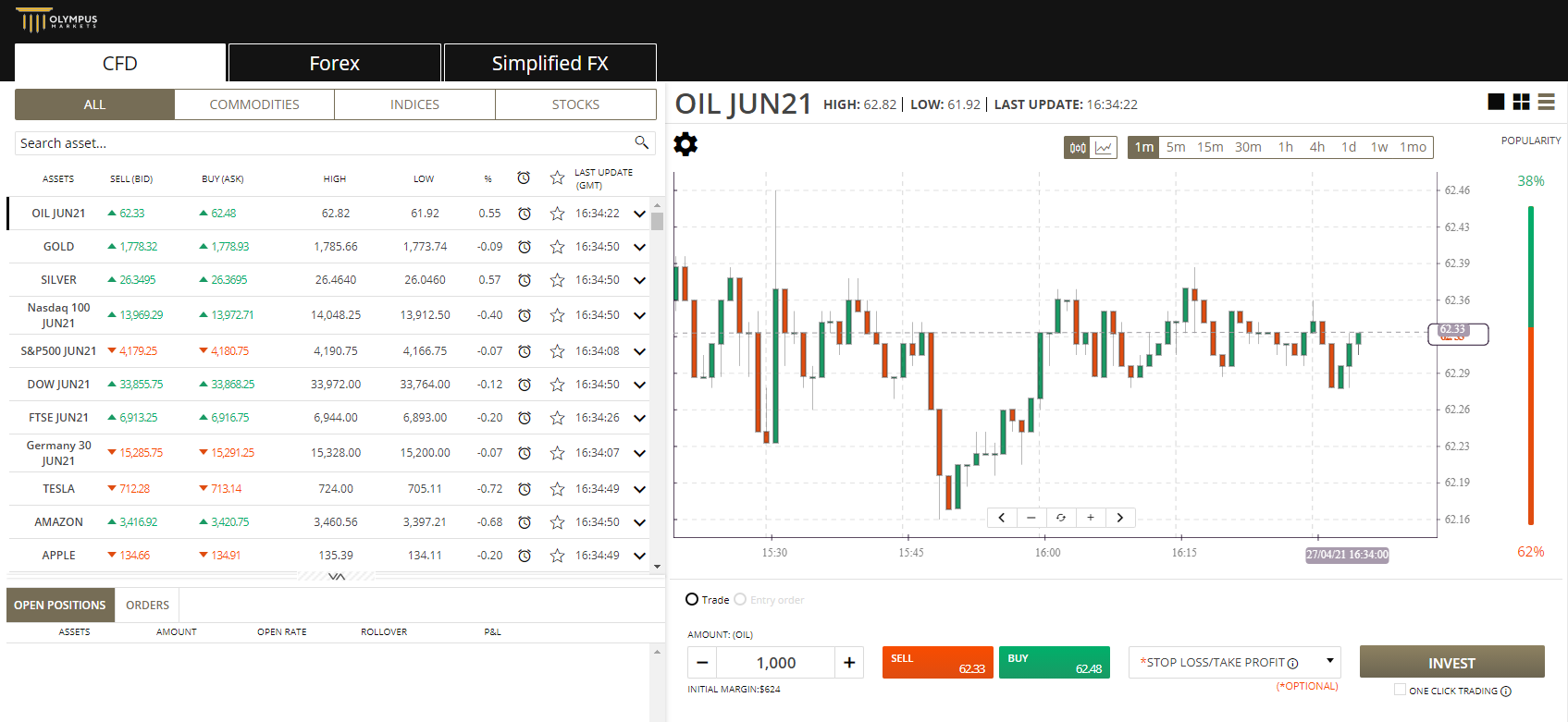

Platforms

Olympus Markets use their own platform for trading rather than using one of the more well-known platforms. The platform is called the Olympus Markets Trader, it offers a few features including one-click trading, forex simplified tab, stop loss and take profit limits, can be connected to robots, has interactive charts and 9 timeframes, free technical indicators, downloading on windows, ios, and android and there are 3 execution methods, 2 market orders and, 4 pending order. The main concern we have seen is the performance, many traders compare platforms to Metatrader 4 or 5, and sadly it seems that the Olympus Markets Trader does not live up to the competition.

Leverage

The maximum leverage available is 1:500, this is correct for all account types.

Trade Sizes

Trade sizes are unknown but we believe that they start at 0.01 lots. The maximum trade size is unknown but we would recommend not trading over 50 lots in a single trade, it is also not known how many open trades you can have at any one time.

Trading Costs

There are no additional commissions when trading on any of the accounts as they use a spread-based system instead. There are however swap charges, these are fees that are charged for holding trades overnight, they can often be viewed within the trading platform you are using, the Islamic accounts on offer do not have these fees.

Assets

Unfortunately, there is not a breakdown of available assets, this is always a shame to see as a lot of potential clients will look for specific instruments that they like trading, so not knowing what is available can really put them off.

Spreads

The spreads are also not stated, they simply have different names, silver spreads, gold spreads and platinum spreads indicate a difference, most likely lower spread, however, they are not present on the site with examples so it is impossible to know what the true costs of trading care. The other thing we do know about spreads is that they are all variable, which means they move with the market and will be constantly changing.

Minimum Deposit

The minimum deposit is 250 SUD, GBP, or EUR, this will allow you to use the lower tier accounts, you will need to deposit more for the higher-tier accounts.

Deposit Methods & Costs

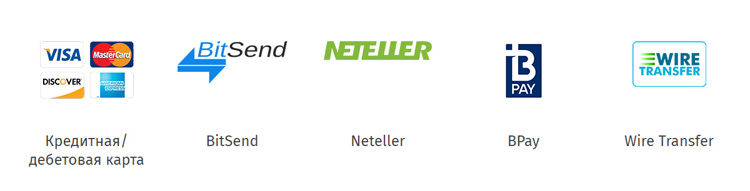

There are a few different methods available for depositing funds into Olympus Markets, they are Credit/Debit card, Bank Wire Transfer, Entropay, Neteller, BPay, and Bitsend (for Bitcoin). It is unknown if there are any additional fees, however, be sure to check with your own bank or card issuer to see if they have any added fees of their own.

Withdrawal Methods & Costs

According to the FAQ, the only methods for withdrawal are Credit/Debit card if you deposited via that method, otherwise, you are required to use Bank Wire Transfer. We do not know if there are any added fees from Olympus Markets, your bank or card issuer may add transfer fees of their own so be sure to check with them prior to making deposits or withdrawals.

Withdrawal Processing & Wait Time

Once your withdrawal request has been submitted it could take up to 3 business days for it to be approved, once it has been approved depending on your bank or card issuer it will take a further 1 to 5 business days to fully process.

Bonuses & Promotions

We did not see any mentions of bonuses or promotions, however, this does not mean there won’t ever be any if you are interested in bonuses, the customer service team will know if there are any upcoming so you could get in contact with them to find out.

Educational & Trading Tools

The accounts page mentions a number of tools and education however there isn’t any information about them on the site, the things mentioned include a daily market overview, access to an education centre, live trading webinars, daily analysis videos, price alerts, personalised trading strategies and one on one training. This all sounds great but with no information about them, we cannot see how effective or worthwhile they really are.

Customer Service

The support team is available to help 24 hours a day 6 days a week. That is great but there are very limited ways to actually contact them, the headquarters part of the page is blank which doesn’t really help. You can use the online form to fill in your query and then get a reply via email, or there are two separate phone numbers, one for Malaysia and one for Russia.

- Malaysia: +60392121729

- Russia: +74992131726

Demo Account

Demo accounts are available for testing and practice, you can get an account with a balance of $10,000. The trading conditions are unknown as it does not state which account they will mimic, there is also no indication of an expiration time so it seems like they will last indefinitely.

Countries Accepted

The following statement is on the website:

“Olympus Markets doesn’t offer all available services to residents of certain jurisdictions including but not limited to the United States of America.”

If you are not sure of your eligibility we would recommend contacting the customer service team.

Conclusion

There are a lot of accounts to choose from when joining Olympus Markets, unfortunately, we don’t really know the difference between them when it comes to trading conditions, they do not have commissions which means they all use a spread based system, unfortunately, the spreads are not shown on the site so we have no idea what the cost of trading really is. There is also a lot of information missing such as tradable assets or a lot of information related to deposits and withdrawals. All of this is vital for new traders to know what they are getting themselves into and without it, it is hard for us to recommend them as a broker to use.