Number One Capital Markets (N1CM) is a fully licensed and regulated forex and CFD broker. N1CM aims to combine technological ingenuity and attentive personal service to become a leading provider of forex trading. Catering for both novice and professional traders we will be looking into the services being offered to see if they are the right broker for you.

Account Types

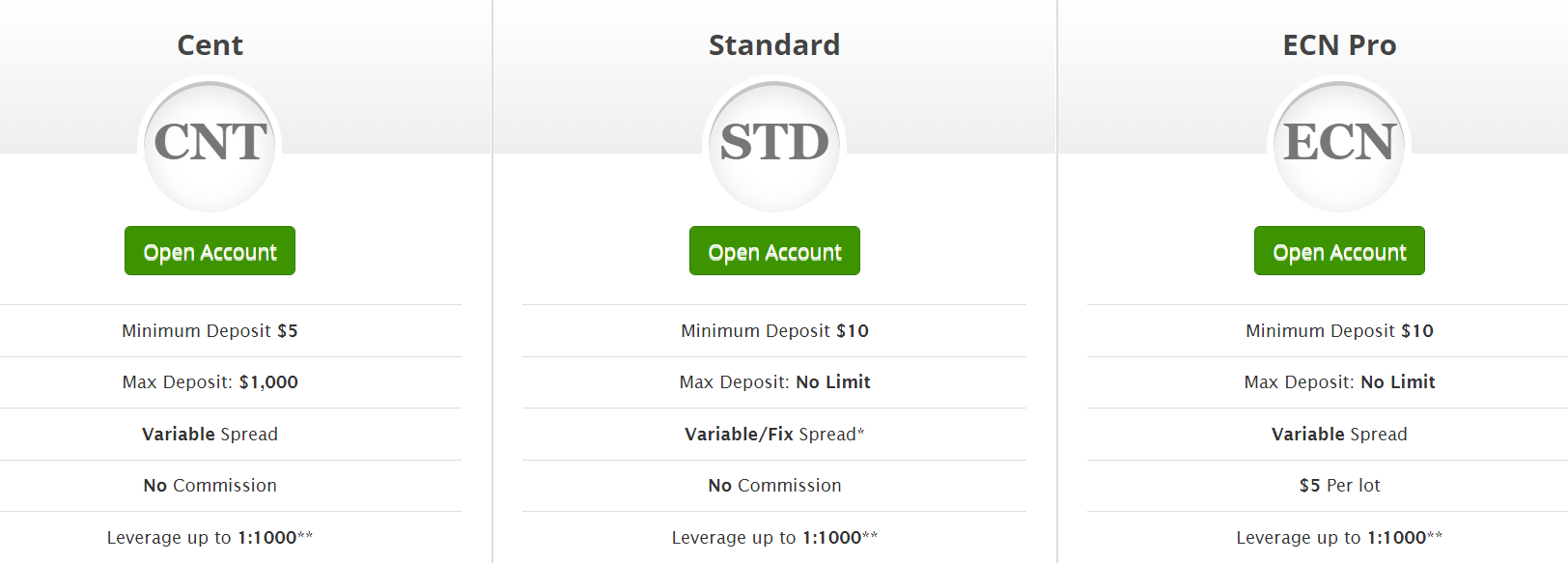

There are three different accounts on offer with differing requirements and trading conditions, let’s have a look at what they are.

Cent Account: This account requires a minimum deposit of $5 with a maximum deposit of $1,000. The account comes with variable spreads and leverages up to 1:1000. The minimum trade size is 0.01 lots and the account can have up to 50 positions open at one time. 1 lot is equal to 1,000 units on this account and the max trade size is 5 units. It uses instant execution and has a margin level of 100% and stop-out level of 30%. It can only trade forex pairs (major and minor), the account currency must be in USD and it uses the MetaTrader 4 trading platform.

STP Account: The account requires a minimum deposit of $10 and there is no maximum deposit. It has a choice of variable or fixed spreads and has no added commission. Leverage can be up to 1:1000, the trade sizes start at 0.01 lots and there is no maximum number of trades. 1 lot is equal to 100,000 units and the maximum trade size is 50 lots. It uses market execution and has a margin call level of 100% and a stop-out level of 30%. It has Forex, Metals, Indices, Energies, and CFDs available to trade on the MetaTrader 4 platform, the account currency must be in USD.

ECN Account: The account requires a minimum deposit of $10 and there is no maximum deposit. It has a variable spread and has an added commission of $5 per lot traded. Leverage can be up to 1:1000, the trade sizes start at 0.01 lots and there is no maximum number of trades. 1 lot is equal to 100,000 units and the maximum trade size is 50 lots. It uses market execution and has a margin call level of 100% and a stop-out level of 30%. It has Forex, Metals, Indices, Energies, and CFDs available to trade on the MetaTrader 4 platform, the account currency must be in USD.

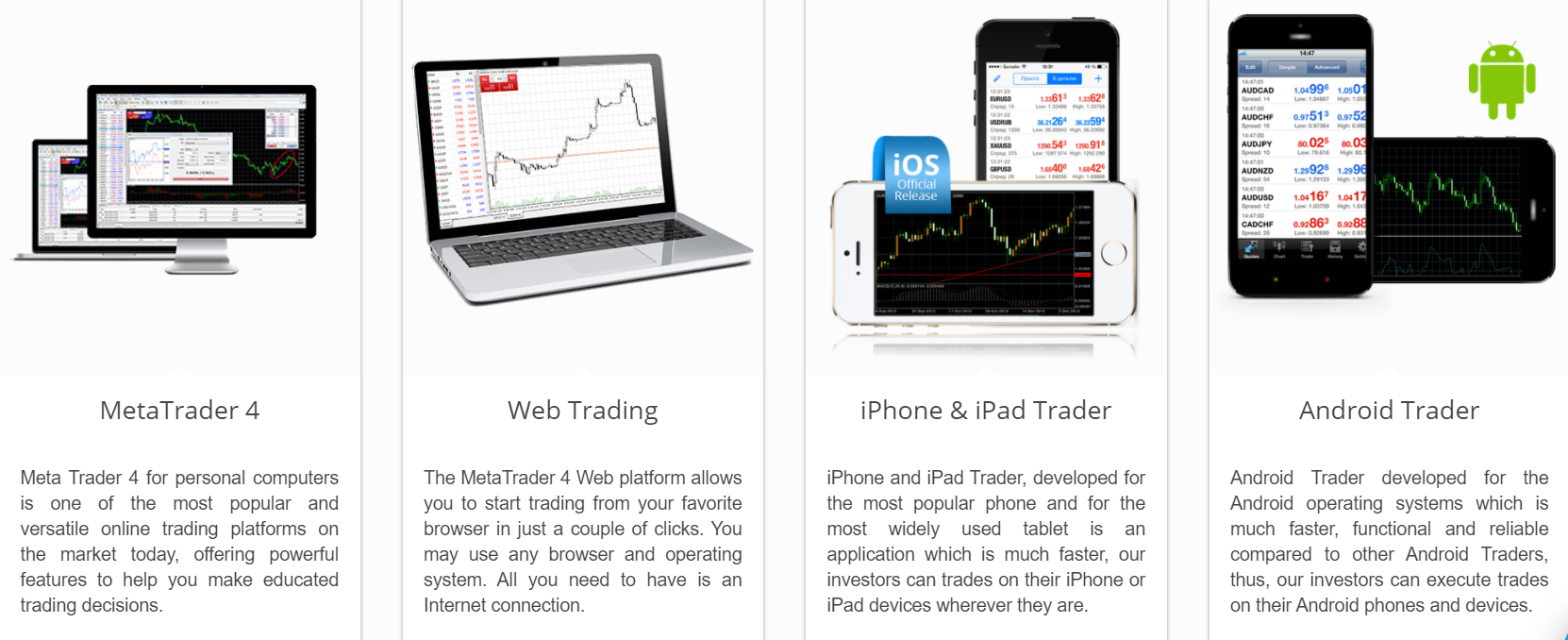

Platforms

There is just a single trading platform on offer from Number One Capital Markets, this is the popular MetaTrader 4 platform. MetaTrader 4 (MT4) is second to none, available as a desktop download, an app for Android and iOS devices, and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Leverage

Leverage can be selected from between 1:25 all the way up to 1:1000, we would suggest going no higher than 1:500 though as the risks grow exponentially above this. Leverage can be selected when opening up an account and should you wish to change it on an already opened account then you can do so by getting in touch with the customer service team with your request.

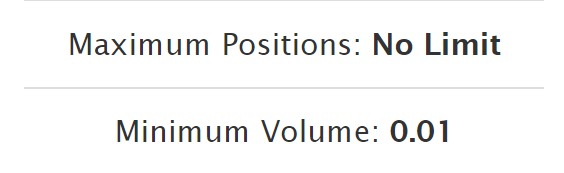

Trade Sizes

The minimum trade size is 0.01 lots (known as a micro lot) on all accounts, the trades then go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. The maximum trade size on the cent account is 5 lots, while the STD and ECN accounts have a maximum trade size of 50 lots which is great as we would not suggest trading over 50 lots in a single trade anyway. There is no limit to the number of open trades allowed at any one time.

Trading Costs

The Cent and STP accounts do not have any additional commissions and instead use a spread-based system that we will look at later in this review. The ECN account has an added commission of $5 per lot which is just under the industry average of $6 per lot traded. Swap charges are also a factor, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice.

Assets

Number One Capital Markets have broken down their assets into a number of different categories but do not give a lot of information about them away, they simply state that they have 52 currency pairs to trade, but no examples of which ones. For commodities, they simply state Gold, Silver, Oil, and more. Stocks are available for the world’s biggest companies and there are 120 different indices to trade. It would have been nice to see a full breakdown because often potential clients will be looking for specific instruments to trade, not having them visible can put them off.

Spreads

The actual spreads are not specified on the site so we do not know what they are starting from. The Cent and ECN accounts have variable spreads (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. The STD account can have either variable or fixed spreads, fixed spreads do not move no matter what the markets are doing but they are normally higher than variable spreads start. It is also worth noting that different instruments and assets have different starting spreads so they will not all be the same.

Minimum Deposit

The minimum deposit required to open a Cent account is $5, in order to open an STD or ECN account you will need to deposit $10. Once an account is open any subsequent top-up deposits have a minimum value of $1.

Deposit Methods & Costs

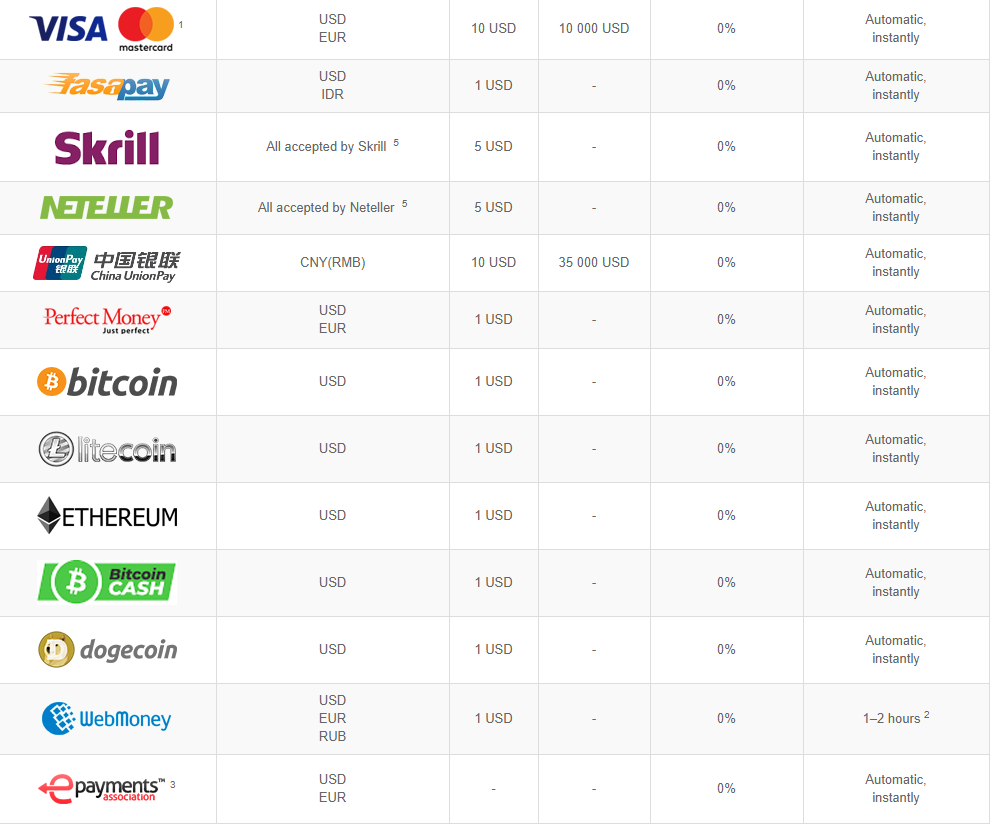

There are plenty of ways to deposit your funds into Number One Capital Markets, we have listed them all for you below.

Visa Debit/Credit, MasterCard Debit/Credit, Fasapay, Skrill, Neteller, China UnionPay, Perfect Money, Bitcoin, Litecoin, Ethereum, Bitcoin Cash, Dogecoin, WebMoney, ePayments, China Bank Wire, Indonesian Bank Wire, Malaysia Bank Wire, Vietnam Bank Wire, QIWI Wallet, Wire Transfer, OKPay, and the Number 1 Capital Markets Prepaid Card.

There are no added fees apart from OK Pay which has a 1% or minimum 5 USD charge, also check with your bank when using bank transfers to see if they add any fees of their own.

Withdrawal Methods & Costs

The same methods are available for withdrawal, we have classed them into different sections based on their withdrawal fees.

- 0.5% Fee: Fasapay, Perfect Money, QIWI Wallet

- 0.8% Fee: WebMoney

- 1% Fee: Skrill, China UnionPay (min 6 CPY)

- 2% Fee: OK Pay

- 2.5% Fee: Visa and Mastercard (+7.5 USD / 6 EUR)

- 50 EUR Fee: Bank Wire Transfer

- 0% Fee: Neteller, Bitcoin, Litecoin, Ethereum, Bitcoin Cash, Dogecoin, ePayments, China Bank Wire, Indonesian Bank Wire, Malaysia Bank Wire, Vietnam Bank Wire, Number One Capital Markets Prepaid Card.

Along with the withdrawal fee, be sure to check with your bank in case they add any fees of their own.

Withdrawal Processing & Wait Time

A withdrawal request will be processed within 2 working days however on occasion they can take up to 5 days. You will then receive your money from between 1 hour to 5 additional days based on the processor and bank processing times.

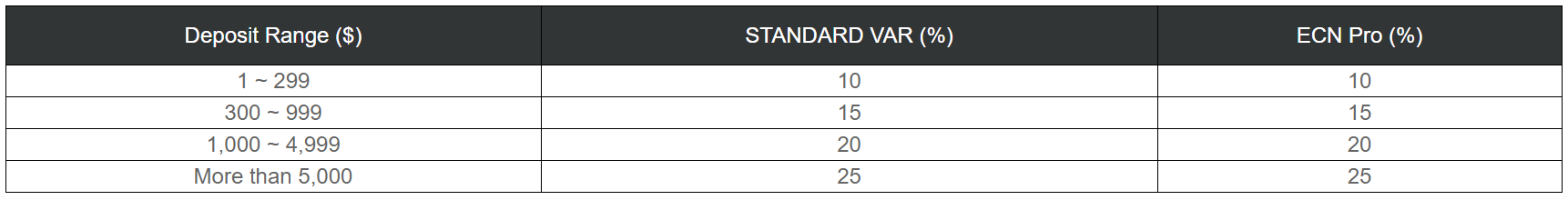

Bonuses & Promotions

There are three promotions currently advertised on the site however one of them, the welcome bonus has expired as it ended January 1st, 2020, so we will disregard that promotion.

Protection Bonus: You can receive a bonus of up to 65% for each deposit. The more you deposit the bigger the bonus will be. The maximum bonus is $5,000. For each lot closed $1 of bonus funds will be converted into real funds.

Free Gift: You can receive a free iPhone, in order to get this you will need to deposit a certain amount and then trade a certain amount of volumes, we have detailed them as:

- iPhone 8 (64 GB) – $5,000 min deposit – 400 lots traded

- iPhone 8 Plus (64 GB) – $5,000 min deposit – 500 lots traded

- iPhone XR (64 GB) – $10,000 min deposit – 500 lots traded

- iPhone XS (64 GB) – $10,000 min deposit – 600 lots traded

Educational & Trading Tools

There does not seem to be any educational tools available which is a shame as a lot of brokers these days are looking to help their clients develop as traders by providing some training so it would be good to see Number One Capital Markets do a similar thing.

*UPDATE* A series of training videos have been added to the site, which is excellent. An economic calendar and market news have also been added.

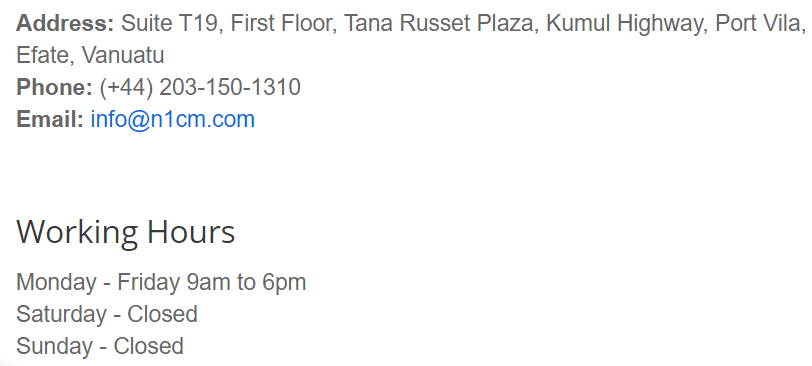

Customer Service

If you want to get in contact with the customer service tame you can do so by using the online submissions form, simply fill in your query and you should receive a reply via email. There is also an email and phone number should you wish to contact them directly. The customer service team is open Monday to Friday between 9 am and 6 pm, it is closed over the weekend and on bank holidays, the same time as the markets are closed.

Demo Account

Demo accounts are available but there is no information about what features the account has, such as the trading conditions or if the accounts expire after a certain period of time.

Countries Accepted

The information about which countries are accepted and which are not is not present on the website, so if you are interested in joining, be sure to get in contact with the customer service team to check if you are eligible for an account or not.

Conclusion

Number One Capital Markets offer some nice trading environments in terms of leverages and number of assets available to trade, however, there is a lack of information on what the assets are or more importantly what the spreads are, we just know that they are variable or fixed, not what they actually are. Plenty of ways to deposit and withdraw, some with no fees others unfortunately with them, and there are plenty of ways to get in touch with the customer service team.