Spreadex is a spread betting and foreign exchange broker that is based out of Hertfordshire, United Kingdom and is both registered and regulated by the Finance Conduct Authority (FCA). The financial trading side of the business was launched in 2006 and has since been awarded various accolades and been featured in many of the UK’s top lists. We will be using this review to look into the services on offer and to see exactly how they compare to the competition, it should also provide you with the information to decide whether they are the right broker for your trading needs.

Account Types

It seems that there is just one account type available to use, so as we go through this review, all information provided will be relevant to this singular account type, as a brief overview, the account does not have a minimum deposit requirement. It comes with leverage up to 1:200 and variable spreads starting from 0.6 pips. We will go over these features in a little more detail as we go through this review.

Platforms

Spreadex has created its own proprietary trading platform. The platform can be used as applications on your devices including Tablets, iOS phones, and Android phones. There are a host of features mentioned by Spreadex as to why their platform is worth using:

- Trade spread bets and CFDs from one account

- A fully customizable screen to organize your trading

- Advanced Charting tools with Pattern Recognition and Pro Trend lines

- Fast and fair, award-winning execution

- Advanced Orders including Force Opens

- Price Alerts by text, push, or email

There are also some additional features:

- Trade via Charts

- Automated Pro Trend lines and Pattern Recognition

- A wide range of advanced technical indicators

- Macro-data directly available on our charts

- Sophisticated drawing tools

- Extensive price history of over 10 years

- Templates that you can create, save and edit

- Go long and short on the same market (Force Open)

- Guaranteed stops

- One-click dealing, for instant access to the markets

- Price Tolerance Threshold, so you can get your trades filled in times of extreme market volatility

Leverage

Leverage limits on the opening of a position by a retail client range from 30:1 to 2:1, which vary according to the volatility of the underlying:

- 30:1 for major currency pairs;

- 20:1 for non-major currency pairs, gold, and major indices;

- 10:1 for commodities other than gold and non-major equity indices;

- 5:1 for individual equities and other reference values;

- 2:1 for cryptocurrencies

You are able to get leverage up to 1:200 if you are classed as a professional trader.

Trade Sizes

Trade sizes start from 0.01 lots and they then go up in increments of 0.01 lots, so the next trade would be 0.02 lots and then 0.03 lots. We do not know what the maximum trade size is or how many open trades you are able to have at any one time.

Trading Costs

There does not seem to be any added commissions added to the trading accounts as they mainly use a spread-based system that we will look at later in this review. There will most likely be swap charges though, these are fees that will be charged or received depending on the interest rates when holding trades overnight, they can often be viewed within the trading platform itself.

Assets

The assets have been broken down into various categories, we have outlined the categories below along with a number of different instruments within those groups.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURCZK, EURDKK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, EURSGD, EURUSD, EURZAR, GBPAUD, GBPCAD, GBPCHF, GBPDKK, GBPEUR, GBPJPY, GBPNOK, GBPNZD, GBPSEK, GBPUSD, GBPZAR, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDCZK, USDDKK, USDHUF, USDINR, USDJPY, USDMXN, USDNOK, USDPLN, USDRUB, USDSEK, USDSGD, USDTRY, USDZAR.

Commodities: Brent Crude, Cocoa, Coffee, Copper, Corn, Cotton, Feeder Cattle, Gold, Lean Hogs, Light Crude, Gas Oil, Lumber, Natural Gas, Gasoline, Oats, Orange Juice, Palladium, Platinum, Rough Rice, Silver, Soybean, Sugar #11, and Wheat.

Indices: Germany 30, SPX 500, UK 100, Wall Street, Australia 200, China A50, Euro stocks 50, France 40, Hong Kong 50, India 50, Japan 225, and US Tech 100 are a few of the available indices.

Shares: There are hundreds of stocks available including the likes of Amazon, Facebook, Tesco, Citigroup, Tesla, Netflix, and many more.

Spreads

The spreads are kept quite low which is great to see, spreads for some instruments such as EURUSD are constantly under 1 pip and can be seen around 0.6 pips. The spreads are variable, so they will move about and be influenced by the markets, different instruments and assets will also have different available spreads and they won’t all be as low as 0.6 pips.

Minimum Deposit

There is no minimum amount required to open up an account, this means the accounts are accessible to all sorts of traders, big and small. We would, however, recommend depositing at least $500 as this allows for better profit potential and the ability to run proper risk management.

Deposit Methods & Costs

The only methods that seem to be available are Bank Wire Transfers and Credit/Debit Cards. This could potentially limit those that prefer to use other methods. We are not sure if there are any added fees or commissions when depositing, we would always suggest contacting your own bank or card issuer to find out if they will add any outgoing transfer fees of their own. The following statement is present though:

“Spreadex reserves the right to charge £1 on debit card deposits under £50.”

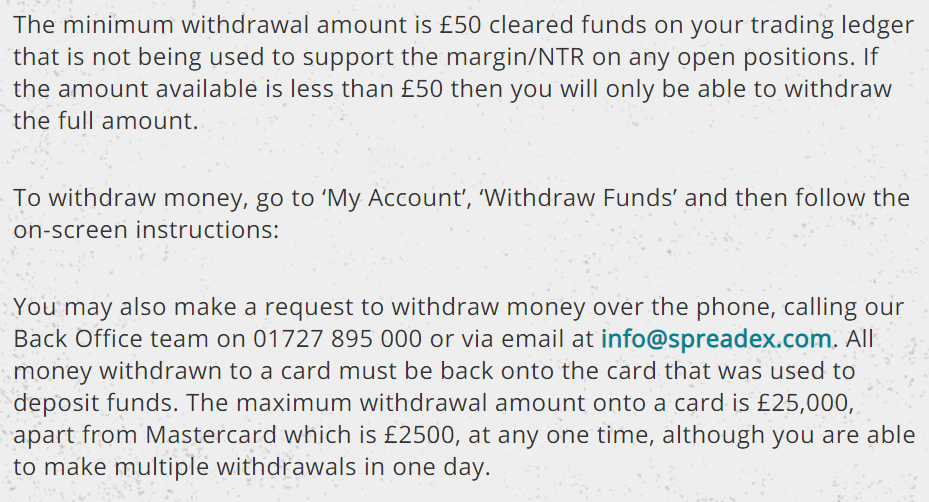

Withdrawal Methods & Costs

The same two methods are available to withdraw with, again these are Bank Wire Transfers and Credit/Debit Cards. You can probably imagine that there isn’t any information on potential fees, so hopefully, this means that there won’t be any, but we cannot say this for sure. You should check with your own card issuer or bank to see if they will add any incoming processing fees of their own.

Withdrawal Processing & Wait Time

Spreadex should process your request within 24 hours but it could take as long as 48 hours depending on when the request is made. It will then take an additional 1 to 5 working days for the request to fully process, this time will depend on the processing time of your card issuer or bank.

Bonuses & Promotions

Looking through the site, we did not come across anything that looked like a bonus or promotion, if you are after a promotion, you could always contact the customer service team to see if there are any coming up that you could take part in.

Educational & Trading Tools

There seems to be quite a lot when it comes to education and tools, the help section of the site has a video trading center, thus has a number of different videos teaching you how to place trades and how to use the Spreadex platform. There is also an FAQ for Charts, Trading, and Technical trading, finally, there is also a glossary of trading-related terms to refer back to if you come across something you do not understand the meaning of.

There is also an Analysis part of the site, this section has a number of different tools available, the first is an economic calendar that details different news events that are coming up and also how those events may affect the markets. There are also some pages that teach you about chart analysis, chart patterns, and how to analyze them. There are also a number of blogs and update pages that can give you some idea about news and possible market movements.

Customer Service

The customer service team is available 7 days a week between 8 am and 5:30 pm GMT. Spreadex has provided a postal address, phone number, and email address to use, so you have a choice of your preferred method to use.

Address: Freepost RRRS-GTBG-HGZB, Spreadex Ltd., Churchill House, Upper Marlborough Road, St Albans. Hertfordshire, AL1 3UU

Address: Freepost RRRS-GTBG-HGZB, Spreadex Ltd., Churchill House, Upper Marlborough Road, St Albans. Hertfordshire, AL1 3UU

Email: [email protected]

Phone: 01727 895 000

Demo Account

Sadly, there doesn’t appear to be a demo account available when using Spreadex, this is a shame as demo accounts allow potential and existing clients to test out the platforms, conditions, and new strategies without having to risk any of their own strategies. So if they are in fact not available, it is something that Spraedex should look at adding to their list of services.

Countries Accepted

The following statement can be found at the bottom of the website:

“The information on this website is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any law or regulatory requirement.”

This does not provide a lot of information, so if you are thinking of signing up, we would recommend contacting the customer service team to check whether you are eligible for an account or not.

Conclusion

The Spreadex website is very well laid out and professional-looking, providing most of the information we needed. They have been around for a long time and their trading conditions seem to be quite competitive with leverage at 1:200, no commissions, and spread starting under 1 pip. There are also plenty of assets available, the one bit that we feel falls short is the lack of deposit and withdrawal methods, just Card and Bank Transfers are available which could limit some clients.

The way the website is shown, makes us believe that they are aiming more towards the UK client base due to them also offering spread betting, so if you are from the UK, they could be a decent broker to sue, from outside the UK, we would suggest possibly looking somewhere else, however, there is nothing to say that you can not join up with Spreadex.