Introduction

Scalping is a type of trading that involves placing many trades in a single day to profit from minor price changes in the Forex market. Traders who use this strategy are known as scalpers. It is crucial to have a robust exit strategy for scalpers to earn large gains from small market moves.

Scalping strategies are mostly applied to the intraday markets, and the trade holding duration can vary from a few seconds to minutes. For novice Forex traders, this type of trading is not recommended as scalping involves a fast-paced activity that requires precision in timing and execution.

We must always use a smaller timeframe such as a 5-min or 1-min for scalping the Forex market. We can use various reliable indicators for scalping, but in this article, we’ll learn how to scalp the 5-minute timeframe using Bollinger Bands.

Why Bollinger Bands?

Bollinger Bands is a technical analysis tool that was developed by John Bollinger. This indicator is composed of three lines as follows – A Simple Moving Average, which is the Middle band, the Upper Band & the Lower Band. The usage of Bollinger Bands indicator goes like this – the closer the price action moves to the upper band, the more overbought the market. Likewise, the closer the price moves to the lower band, the more oversold the market. The bands in this indicator widen and contract based on the market volatility. They expand when the market activity is increased and contract in choppy or less volatile markets. Let’s use this indicator in the 5-min timeframe to identify potential trading opportunities.

Scalp Trading With Bollinger Bands

We must go long when the price hits the lower band and look out for short-selling opportunities when prices hit the upper band. This is the traditional way of trading the market using Bollinger bands which is still being used by scalp traders across the world. The reason why this strategy is famous is because of its ease of usage and its ability to milk quick buck from the market.

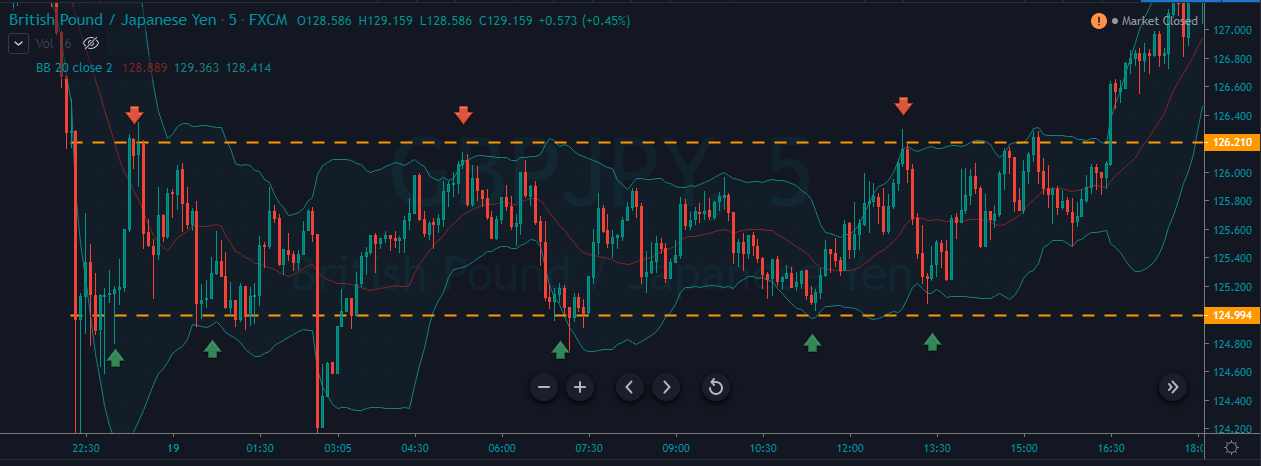

Scalping Ranges – Example 1

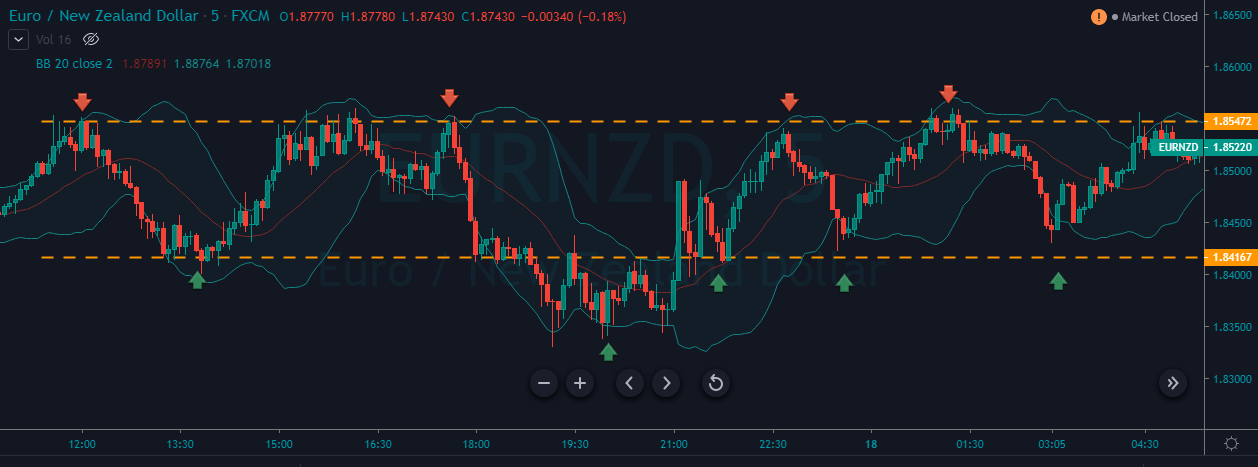

In the below price chart, you can see that we have taken five buying and four selling trades in the EUR/NZD Forex pair. In this example, we have applied this strategy in a ranging market. When the price approached the support line, and when it also hit the upper Bollinger band, it is an indication for us to go long. Similarly, when the price goes near the resistance line in a range, it is an indication for us to close our long positions and look for selling opportunities.

By doing this, we have been continuously engaged in the market and made some consistent profits overall.

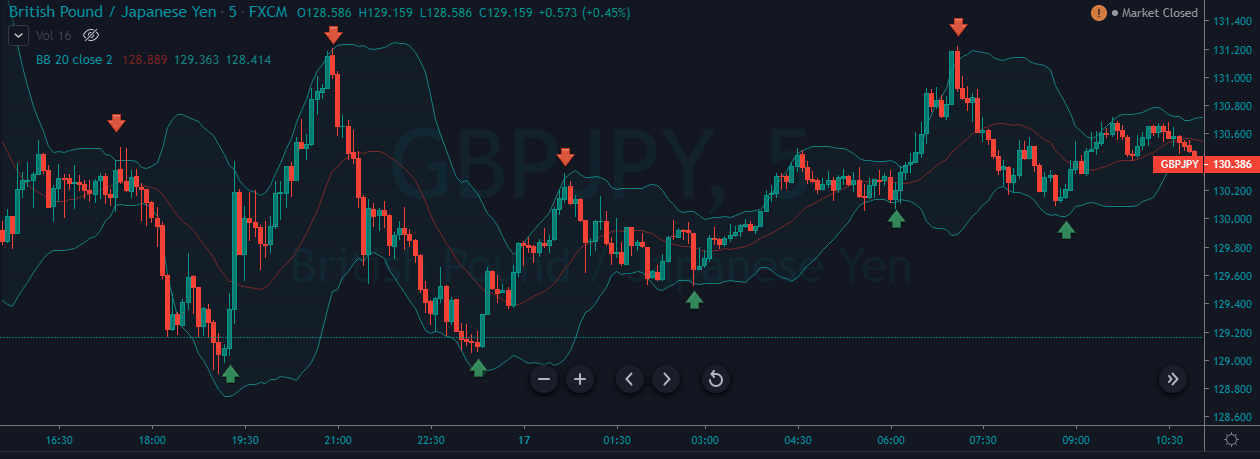

Example 2

Below is another example of scalp trading the Forex market when it is in the consolidation phase. Typically in a range, both the parties have equal strength. Also, it is a known fact that it is comparatively hard to trade the consolidation markets than the ranging markets. However, using this strategy, we have managed to take five buying and three selling trades in the GBPJPY Forex pair.

Scalpers typically go long or short when the price approaches the upper or lower range lines. This is the right approach, but by pairing that strategy with an indicator like Bollinger band can drastically increase the probability of those trades. The USP of the Bollinger band indicator is that it works well in all the types of market situations. It really doesn’t matter whether you scalp the ranges, channels, or even trends; this strategy will always provide reliable trading opportunities.

Example 3

In the below price chart, the price was dragging towards the upside, indicating a buying momentum, but it ended up forming a channel. In a channel, both parties hold equal power and us being scalpers; it is easy to make money from both sides. Below we can notice that if we go either long or short, we can make an equal amount of money if we are right. This is the major benefit of using Bollinger bands in channel conditions.

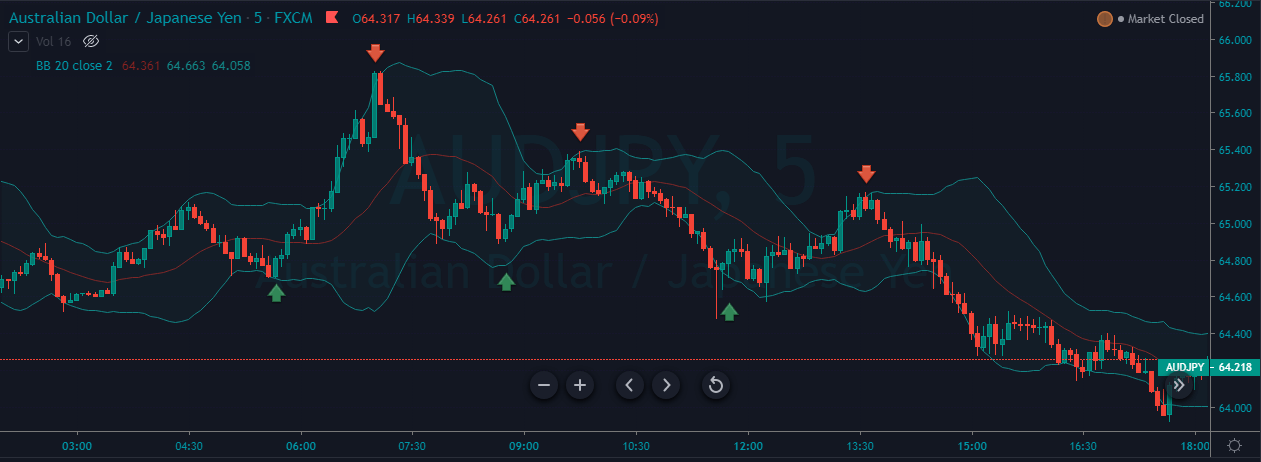

Scalping Trends – Example 1

Below is the price chart of the AUD/JPY currency pair in an uptrend. As you can see, during the pullback phase, the market gave us the first buy trade. When the price action approached the upper Bollinger band, the price immediately moved in the opposite direction. As a scalper, prepare your mind for these kinds of quick moves. Follow the rules of the strategy to the point, and if any trade goes three to four pips against you, immediately exit and wait for the next opportunity.

Our third buy trade also performed, but it didn’t go for bigger targets. Instead, the price action immediately reversed, which end up generating a sell signal. The next buy trade was also ended u with minor profits. For scalpers, even a profit of 8 to 10 pips can be considered good in a single trade.

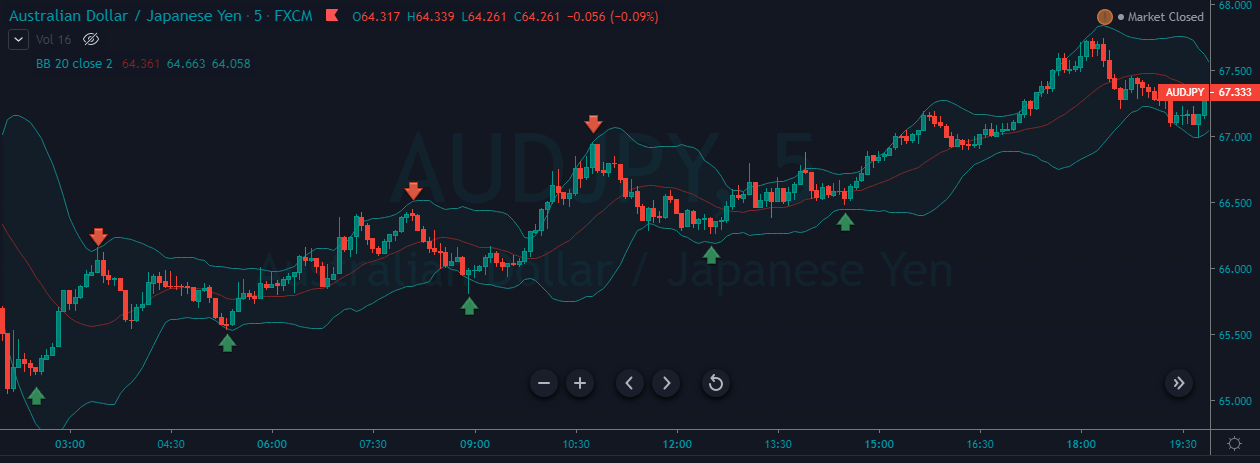

Example 2

Below is an example of buying and selling trades in an uptrend in the AUD/JPY pair. We are saying this pair is an uptrend after analyzing its higher time frame. In the lower timeframe, the market may seem to be ranging, but since we know that this pair is up-trending overall, we must consider buying opportunities over sell signals.

The markets gave us five buying and three selling trades in this pair. Even though we have identifies many sell signals, we recommend not to enter those unless you have confirmation. Always remember that trend is your friend and trade according to the trend. This is the essence of scalp trading the trending markets. Therefore, when scalping trends, always go for bigger targets by following the trend. Also, expect less accuracy on counter-trend trades.

Conclusion

It requires a lot of practice to master scalping. Since the time frame is small, you must be quick in everything you do while scalping. Also, talking additional confirmations is not possible in this form of trading because of its swift nature. Please practice these strategies on a demo account before you apply them on the live markets. All the best. Cheers!