USD/CHF Exogenous Analysis

The exogenous analysis covers fundamental indicators that can compare the performance of the US and Swiss economies. Note that this comparison between the two economies is what drives the exchange rate of USD/CHF. They are:

- US and Swiss interest rate differential

- The difference in the GDP growth in the US and Switzerland

- Balance of trade differential

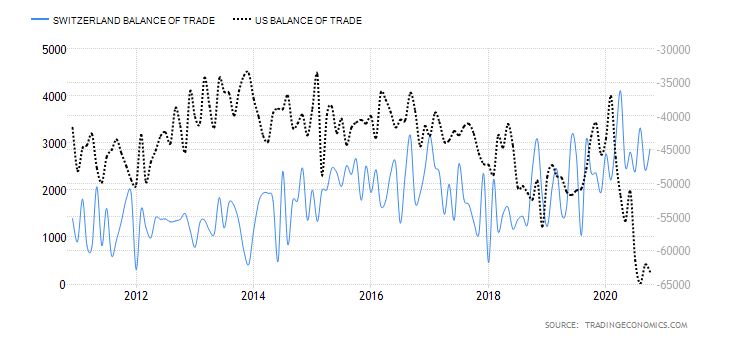

Balance of trade differential

For each country, the balance of trade shows the demand for the domestic currency in the international market. When a country has a surplus of the balance of trade, it means that its currency is in high demand in international trade. The rationale behind this is that when a country exports more than it imports, other countries will need more of that country’s currency to participate in international trade.

The balance of trade differential measures the difference between the balance of trade in Switzerland and the US. If the Swiss balance of trade is higher than that of the US, the USD/CHF pair will be bearish.

In October 2020, Switzerland had a trade surplus of CHF 2.9 billion while the US a deficit of $63.1 billion. Throughout 2020, the US trade deficit has been widening from $37 billion in January, while the Swiss trade surplus has increased from CHF 2.8 billion.

Based on the correlation with the USD/CHF pair, we assign the balance of trade differential a score of -5.

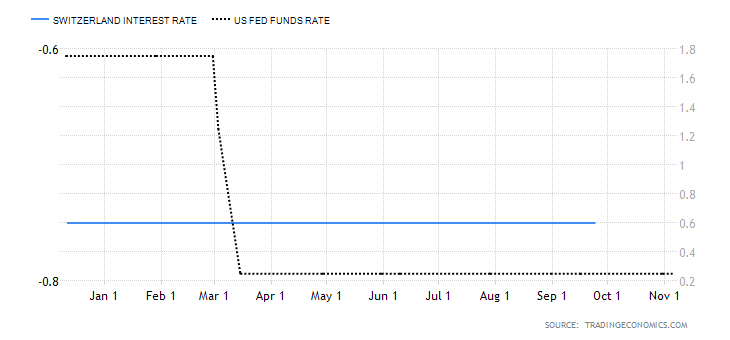

US and Switzerland interest rate differential

Typically, the country with a higher interest rate attracts more foreign capital seeking superior returns. A higher interest rate increases the domestic currency demand, which makes it appreciate in the forex market. More so, forex traders tend to be bullish on the currency with the higher interest rate.

The interest rate by The Swiss National Bank is -0.75% since January 2015. In the US, the federal funds rate is 0.25%. That makes the interest rate differential 1% for the USD/CHF pair.

Based on the correlation analysis with the USD/CHF pair, we assign the interest rate differential a score of 3.

The difference in the GDP growth in the US and Switzerland

A country’s GDP is primarily driven by domestic consumption. Although the GDP size differs in absolute terms, we can compare the US and Swiss GDP in terms of growth rate. An expanding economy is accompanied by appreciating currency. Therefore, if the US growth rate is higher than Switzerland’s, we can expect a bullish trend for the USD/CHF pair.

In Q3 of 2020, the Swiss economy expanded by 7.2% and the US by 33.1%. It means that the US economy is recovering faster than that of Switzerland. We, therefore, assign a score of 2. This implies that the GDP growth rate differential between the US and Switzerland has led to a bullish USD/CHF.

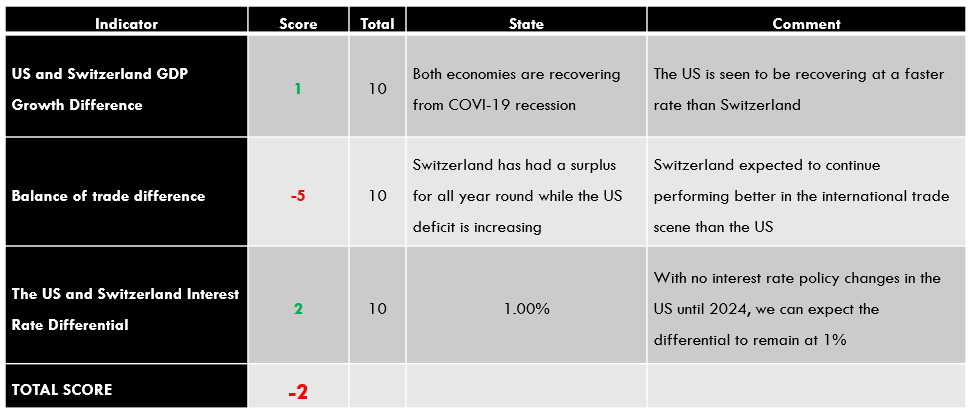

Conclusion

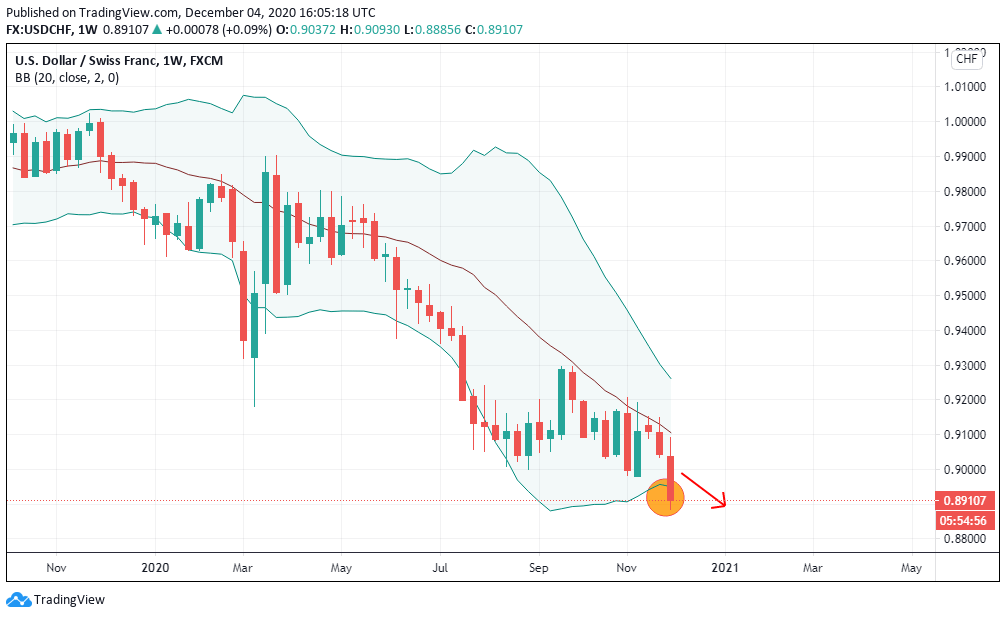

The USD/CHF pair has an exogenous score of -2. This implies that we can expect the pair to continue with its current bearish trend in the near future.

Note that the USD/CHF pair has breached the lower Bollinger band. Therefore, we can expect the downtrend to continue for a while, which supports our fundamental analysis. All the best.