Stock STP is a foreign exchange broker based in Cyprus, it is registered and regulated by the Cyprus Securities and Exchange Commission (CySEC). They state that their main advantages are that they are licensed and regulated, offer advanced technology, have excellent trading conditions, offer seamless execution, have fast deposits and withdrawals, offer news and analysis, and provide trading education. We will be looking into the services offered to see if they truly are offered and live up to and so you can see if they are a broker that you would want to trade with.

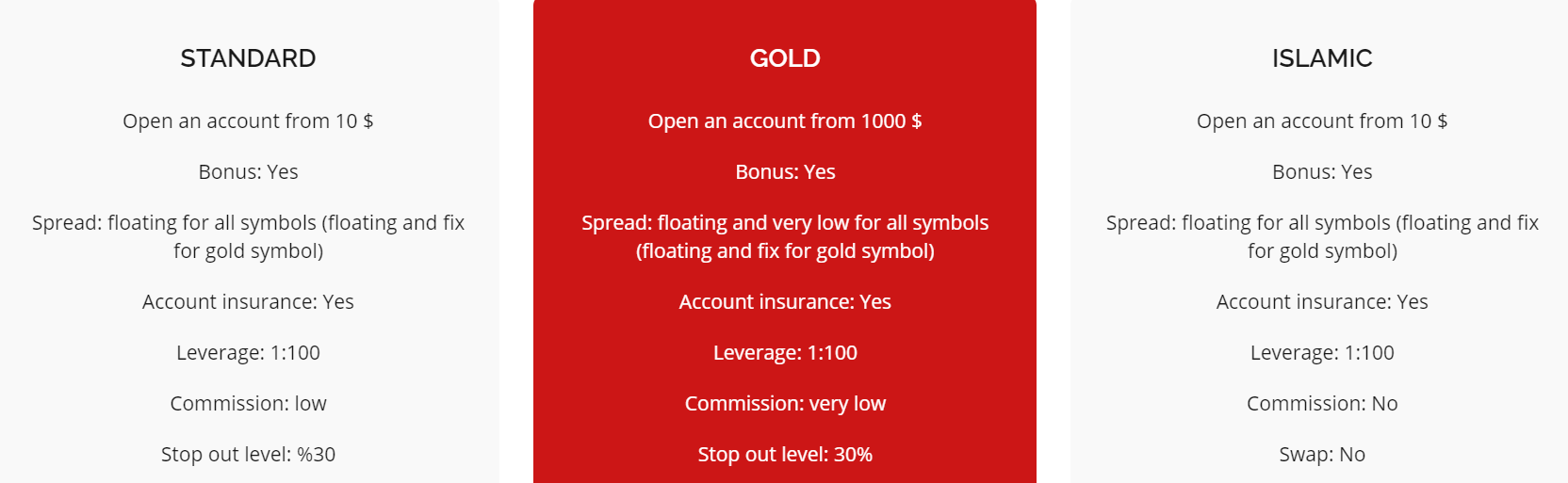

Account Types

There are two categories of accounts and within each is three different account types, we have outlined the main features of the accounts below.

STP Pro Accounts

Mini Account: This account requires a minimum deposit of at least $250, it comes with a variable spread starting from 2.4 pips and there is a commission as low as $0. It uses market execution and has access to a junior account manager. The account also has access to news and analysis, a limited amount of social trading, video tutorials, and the account has a margin level of 150% and a stop out level of 50%.

Premium Account: This account requires a minimum deposit of at least $3,000, it comes with a variable spread starting from 2.1 pips and there is a commission as low as $0. It uses market execution and has access to a junior account manager. The account also has access to news and analysis, social trading, video tutorials, webinars, a free VPS, and the account has a margin level of 150% and a stop-out level of 50%.

VIP Account: This account requires a minimum deposit of at least $50,000, it comes with a variable spread starting from 1.8 pips and there are no added commissions. It uses market execution and has access to a senior account manager. The account also has access to news and analysis, social trading, video tutorials, webinars, 1 to 1 training, a free VPS, and the account has a margin level of 150% and a stop-out level of 50%.

ECN Accounts

Classic Account: This account requires a minimum deposit of at least $250, it comes with a variable spread starting from 0.8 pips and there is an added commission on the account. It uses market execution and has access to a junior account manager. The account has access to a free VPS service, can be used as an Islamic swap-free account, has access to news and analysis, video tutorials, and webinars. The account also comes with a margin call level of 150% and a stop-out level of 50%.

Advanced Account: This account requires a minimum deposit of at least $5,000, it comes with a variable spread starting from 0.6 pips and there is an added commission on the account. It uses market execution and has access to a senior account manager. The account has access to a free VPS service, can be used as an Islamic swap-free account, has access to news and analysis, video tutorials, webinars, and 1 on 1 training. The account also comes with a margin call level of 150% and a stop-out level of 50%.

Retirement Account: This account requires a minimum deposit of at least $50,000, it comes with a variable spread starting from 0 pips and there is an added commission on the account. It uses market execution and has access to a senior account manager. The account has access to a free VPS service, can be used as an Islamic swap-free account, has access to news and analysis, video tutorials, webinars, and 1 on 1 training. The account also comes with a margin call level of 150% and a stop-out level of 50%.

Platforms

There are two main platforms available, including Sirix Station (WebTrader) and Metatrader. Sirix Station seamlessly connects traders with a variety of currencies and markets. It’s compatible with both Mac OS and Windows. MetaTrader is one of the most used and most trusted trading platforms. Some of its features include instant execution, request execution, complete technical analysis package, inbuilt indicators and charting tools, the ability to create various custom indicators, different time periods (from minutes to months), and much more.

Leverage

Stock STP follows the recommendations of the ESMA which are below. Leverage limits on the opening of a position by a retail client from 30:1 to 2:1, which vary according to the volatility of the underlying:

- 30:1 for major currency pairs;

- 20:1 for non-major currency pairs, gold, and major indices;

- 10:1 for commodities other than gold and non-major equity indices;

- 5:1 for individual equities and other reference values;

- 2:1 for cryptocurrencies

Trade Sizes

Trade sizes start from 0.01 lots which then go up in increments of 0.01 lots until they reach the maximum which varies by currency or asset but can go as high as 100 lots. We would recommend not trading over 50 lots at a single time though, we also do not know how many open trades or orders you can have at any one time.

Trading Costs

The ECN accounts all have commissions added to the account, there isn’t a fixed amount as they get a certain amount of spread charged as a commission, if we take AUDCAD, the Classic ECN account has an added spread commission of 5.6 pips, the Advanced account has an added spread commission of 4.3 pips. The other accounts all use a spread-based system that we will look at later in the review.

There are also swap charges which are a fee that is charged when you hold a trade overnight or over the weekend., They can be both positive or negative and can be viewed within the trading platform you are using.

Assets

There are plenty of assets available, there is a product specification available which goes over a lot of the accounts, there are too many for us to go through as different accounts shave different assets available, we have outlined the ones that we can below.

Forex: AUDCADM AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURDKK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDCNH, USDCZK, USDDKK, USDHKD, USDHUF, USDILS, USDJPY, USDMXN, USDNOK, USDPLN, USDRON, USDRUB, USDSEK, USDSGD, USDTRY, USDZAR.

Metals: Gold and Silver are available to trade.

Indices: We cannot see all of them but some include FTSE 100, S&P 500, Dow Jones, DAX, and US 30.

Commodities: Again, we do not know them all as they are scattered about. A few include Natural Gas, Brent Crude Oil, and WTI Crude Oil.

Shares: Plenty of shares available including Alibaba, Apple, Tesco, GMW, and Metro.

Spreads

The spreads that you get depends on the platform and account that you are using. When looking at MT4, the mini account has spreads starting from 2.4 pips the premium account from 2.1 pips and the VIP account starts at around 1.8 pips. For the ECN accounts, the Classic account has spread starting from 0.8 pips, the Advanced account starts from 0.6 pips and the Retirement account has spreads starting from 0 pips.

The spreads are variable which means they move with the markets, the less liquidity or more volatility in the markets the higher the spreads will be. Different instruments will also have a different starting spread so be sure to check each individual asset spread.

Minimum Deposit

The minimum amount required to open up an account is $250, this will allow you to get access to the STP Mini account or the ECN Classic account.

Deposit Methods & Costs

You can deposit using Bank Wire Transfer, or Credit/Debit cards. At the bottom of the website, there is an image of Skrill, but there is no mention of it on the withdrawal information page, so we do not know if it is a usable payment processor. Stock STP does not add any fees to the deposits however you are responsible for any fees added by your own bank or card issuer.

Withdrawal Methods & Costs

The same two methods are mentioned for withdrawals which are Bank Wire Transfer and Credit/Debit card, the same notice of no additional fees is present for the withdrawals too. Once again, check with your bank or card issuer for any potential incoming processing fees added by them.

Withdrawal Processing & Wait Time

The expected timescale of the withdrawals is not mentioned on the site. We would be expecting any withdrawal requests to be fully processed between 3 to 5 days from the date of the request being made. This can depend on the processing time from Stock STP and also the processing time of your bank or card issuer.

Bonuses & Promotions

Bonuses & Promotions

There is a free VPS on offer as stated on the account page and also on the promotions page, however when you go into the promotion to get more information it simply states that it is coming soon, so we do not know what you need to do to get the free VPS or if the promotion is actually running. If you are after bonuses, you could always contact the customer service team to find out if there are any available for you to use.

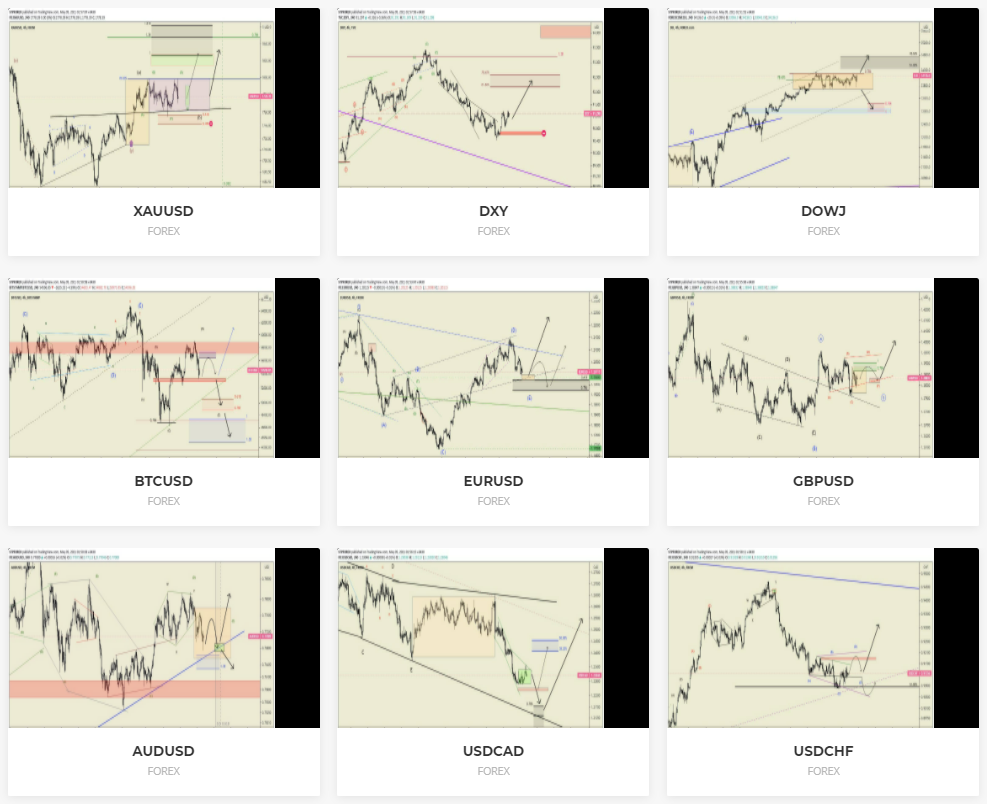

Educational & Trading Tools

Educational & Trading Tools

The educational side of the site offers a page detailing what forex is and why people trade it. There is also a guide to investing PDF which is just a straightforward guide on how to trade and use the trading platforms. There is also an economic calendar present, this details different upcoming news events and gives an indication of the effect that it could have on the markets and currencies. That seems to be all that is available when it comes to tools and education.

Customer Service

Stock STP offers a few different ways to get in touch with them, you can use the online submission form, fill it in and then get a reply via email. You can also use the postal address provided along with the number of phone numbers based in the UK, Cyprus, and Spain and an email address for support.

Stock STP offers a few different ways to get in touch with them, you can use the online submission form, fill it in and then get a reply via email. You can also use the postal address provided along with the number of phone numbers based in the UK, Cyprus, and Spain and an email address for support.

- Address: 11 Vizantiou str, 4th Floor, Strovolos 2064, Nicosia, Cyprus

- Phone (Cyprus): +357 25056454

- Email: [email protected]

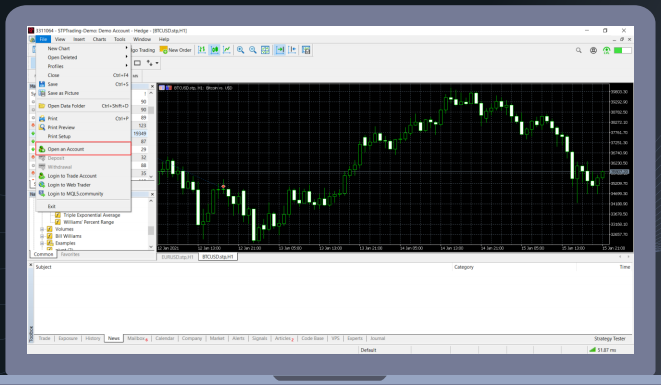

Demo Account

Demo accounts are a great way to test out a broker’s trading conditions and also new strategies without having to risk any of your own funds. Demo accounts are available from Stock STP however we do not know which account they mimic, you can select the base currency and the use of MetaTrader 4, but there doesn’t seem to be any further customization options. We also do not know if there is an expiration time on the demo accounts.

Countries Accepted

The following statements on the site:

“Information and services contained within this website are not directed at residents of the United States of America & Canada.”

If you are still not sure of your eligibility or would like to check, we would recommend contacting the customer service team to find out.

Conclusion

There is a wide selection of accounts on offer, each delivering you a different trading environment, when going through the assets it can be a little confusing as to what each account offers. The leverage is unfortunately rather low as Stock STP is following the recommendations from the ESMA, so the broker is limited in this department. There is also a small lack of deposit and withdrawal methods, being stuck with just Bank Wire and Credit/Debit Cards can limit those that prefer to use other methods. While the overall conditions of the broker seem ok, the small little issues detailed throughout the review are enough for us to recommend looking elsewhere.