KapitalFX is a Saint Vincent and the Grenadines-based forex broker. We will be using this review to look into the services offered by this foreign exchange broker and see if they live up to their priorities of putting their clients first or seeing if they fall short. The following is a statement that the brokerage has provided on its website:

“In the past years the Kapitalfx has come a long way, becoming an industry leader: by the middle of 2018 Kapitalfx clients’ monthly trading volume was more than 180 billion USD and the number of trading accounts opened each month by traders around the world exceeded 15,000. Currently, Kapitalfx offers the ability to trade more than 120 financial instruments, with some of the best-on-the-market order execution and record-tight spreads for the main currency pairs.”

Account Types

There are four different account types available, We have outlined them for you below including their entry requirements and trading conditions.

Micro Account: This account requires a deposit of $100 in order to open, it comes with access to MetaTrader 4 and has spreads starting from 1 pip. The account can trade forex pairs, indices, commodities, and shares and can be leveraged up to 1:500. It uses market execution and the minimum trade size is 0.01 lots, going up in 0.01 lots until it reaches the maximum trade size of 40 lots. The account can also have a maximum of 150 open trades and orders. The margin call level is set at 40% with the stop-out level being set at 10%. The account must be in EUR or USD and there is no added commission on the account, the account also does not have access to find management.

Standard Account: This account requires a deposit of $500 in order to open, it comes with access to MetaTrader 4 and has spreads starting from 1 pip. The account can trade forex pairs, indices, commodities, and shares and can be leveraged up to 1:300. It uses market execution and the minimum trade size is 0.01 lots, going up in 0.01 lots until it reaches the maximum trade size of 60 lots. The account can also have a maximum of 250 open trades and orders. The margin call level is set at 50% with the stop-out level being set at 20%. The account must be in EUR or USD and there is no added commission on the account, the account also has access to fund management.

Premium Account: This account requires a deposit of $25,000 in order to open, it comes with access to MetaTrader 4 and has spreads starting from 0.6 pips. The account can trade forex pairs, indices, commodities, and shares and can be leveraged up to 1:100. It uses market execution and the minimum trade size is 0.1 lots, going up in 0.01 lots until it reaches the maximum trade size of 80 lots. The account can also have a maximum of 300 open trades and orders. The margin call level is set at 50% with the stop-out level being set at 20%. The account must be in EUR or USD and there is an added commission of 5 USD or 5 EUR per lot traded on the account, the account also has access to fund management.

VIP Account: This account requires a deposit of $100,000 in order to open, it comes with access to MetaTrader 4 and has spreads starting from 0.2 pips. The account can trade forex pairs, indices, commodities, and shares and can be leveraged up to 1:100. It uses market execution and the minimum trade size is 0.1 lots, going up in 0.01 lots until it reaches the maximum trade size of 80 lots. The account can also have a maximum of 150 open trades and orders. The margin call level is set at 50% with the stop-out level being set at 20%. The account must be in EUR or USD and there is an added commission of 5 USD or 5 EUR per lot traded on the account, the account also has access to fund management.

Platforms

MetaTrader 4 is the only platform on offer and it is a good one to have, it is one of the world’s most popular trading platforms due to its massive selection of features. KapitalFX has detailed some of the benefits of using it with them as receiving one-hour response time on all customer inquiries, ECN trading on MT4, friendly user-friendly interface, a multiLingual Platform in 23 Languages, it’s secure, fast, and reliable. The platform is also highly accessible as you can use it as a mobile download, desktop download, or web trader.

MetaTrader 4 is the only platform on offer and it is a good one to have, it is one of the world’s most popular trading platforms due to its massive selection of features. KapitalFX has detailed some of the benefits of using it with them as receiving one-hour response time on all customer inquiries, ECN trading on MT4, friendly user-friendly interface, a multiLingual Platform in 23 Languages, it’s secure, fast, and reliable. The platform is also highly accessible as you can use it as a mobile download, desktop download, or web trader.

Leverage

The leverage that you receive is based on the account that you use, the Micro account can be leveraged up to 1:500, the Standard account up to 1:300, and the Premium and VIP accounts can both be leveraged up to a maximum of 1:100. You can select the desired leverage when opening up an account and can request for it to be changed by getting in contact with the customer service team.

Trade Sizes

The Micro and Standard accounts have starting trade sizes of 0.01 lots (1,000 units) while the Premium and VIP accounts have trades starting from 0.10 lots (10,000 units). All accounts go up in increments of 0.01 lots, up to their maximum of 40 lots for the Micro account,t 60 lots for the Standard account, and 80 lots for the Premium and VIP accounts.

The Micro and VIP accounts can have up to 150 trades or orders open at any one time while the Standard account can have 250 and the Premium account can have up to 300 open trades at any one time.

Trading Costs

The Premium and VIP accounts have an added commission of 6 USD or 5 EUR (depending on your base currency) added to their trades. This is in line with the industry average of $6 per lot traded. The Micro and Standard accounts do not have any added charges as they use a spread-based system that we will look at later in this review. There are also swap charges, these are fees that are either charged or received for holding trades overnight, they can be viewed within the MetaTrader 4 trading platform.

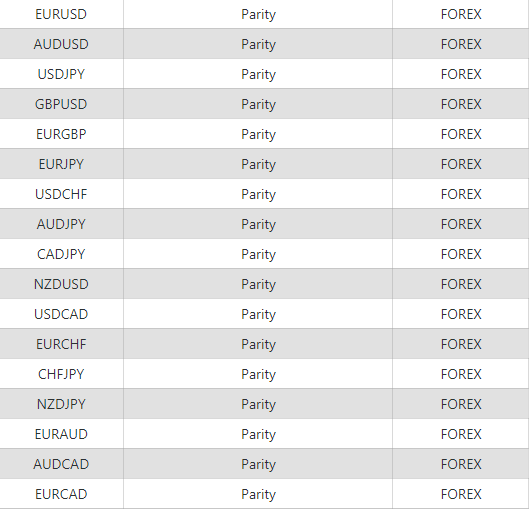

Assets

Sadly there isn’t a full breakdown of the available trading assets or instruments, this is a shame as a lot of potential clients may be looking out to see if a broker offers their preferred assets, not knowing if it is available could make them look elsewhere. It is also helpful to see how many assets are available. The website simply states that there are forex pairs, indices, commodities, and shares available, but no outline of which ones exactly.

Spreads

The starting spread again depends on the account type that you have opened. The Micro and Standard accounts both have spread starting from 1 pip, while the Premium account has spread starting from 0.6 pips and the VIP account has spreads starting from 0.2 pips. The spreads are variable which means they move with the markets, during times of higher volatility they will be seen higher than these startling figures. Different instruments will also have different spreads, so while one may start at 1 pip, another may start higher at 2 pips.

Minimum Deposit

The minimum amount required to open up an account is $100 which will allow you to open up a Micro account. The Standard account requires a deposit of $500, the Premium account $25,000 and if you want a VIP account you will need to deposit a massive $100,000 which will price out the majority of retail traders. Usually, the minimum will reduce once an account has been opened but there was no mention of a reduction on the site.

Deposit Methods & Costs

When looking through the deposit and withdrawal page they really do not make it clear exactly what is available to use or even how to deposit. We have learned that both Bank Wire Transfer and Visa/MasterCard are available to use but there isn’t a mention of any other methods, so it is most likely that just those two methods are available.

Another bit of information missing for the deposits is regarding any potential fees, there is nothing mentioned on the deposit/withdrawal page, we would recommend contacting your own bank or card issuer to see if they will add any potential transfer fees of their own to the deposits.

Withdrawal Methods & Costs

You can only use Bank Wire to withdraw with, the FAQ of the site very clearly states that you are not able to withdraw using a Credit/Debit card, either as a withdrawal or as a refund, so you are stuck with Bank Wire Transfers for now.

There is a statement on withdrawal fees which states:

“If the receiving bank uses an intermediary bank to send/receive funds, you may incur additional fees charged by the intermediary bank. These charges are usually placed for transmitting the wire to your bank. Kapitalfx is not involved with and nor has any control over these additional fees.”

So it seems like KapitalFX does not add any fees of their own but you should check with your own bank or processor for their fees.

Withdrawal Processing & Wait Time

KapitalFX will generally process a withdrawal request within 2 to 5 business days, the amount of time it will then take will depend on the method used and your own bank’s processing times, it will normally take an additional 1 to 5 days to be fully processed by your bank, so the withdrawal times are a little on the long side when comparing to the competition.

Bonuses & Promotions

We had a good look through the site but it did not appear that there were any promotions or bonuses taking place, at least not at the time that we were looking. This does not mean that there won’t be any so be sure to check back regularly or you could contact the customer service team to see if there are any coming up that you could take part in.

Educational & Trading Tools

There are a few small tools available to you, the first is an economic calendar, this details any upcoming news events that could affect the markets and it also states which currencies and markets the news event may have an effect on. There is then a profit calculator as well as a pip calculator to help you work out some of the details of your next trade. There is also a news and events section, but it isn’t very detailed and simply lists 5 different news articles taken from another site.

There is also an opportunity to get access to a free VPS, in order to do this you will need to close at least 7 lots and keep your balance above $500. If you fall below these numbers then your monthly VPS will not be renewed.

Customer Service

The contact page offers the broker’s online submission form. You can fill it in with your name, email, and query and you should then get a reply via email. They have also provided you with a postal address. In order to find an email address, we have to scroll to the footer of the page where one is present. It does not look like there is a phone number or a way to speak to someone directly.

Demo Account

Once you have signed up you are able to select a demo account to pen. The demo account allows you to test out the trading conditions and strategies without any real risk to your capital. The demo account expires after 30 days and you will need to open a new one to continue practicing. The pricing and execution on demo accounts, while indicative of live pricing and execution, is not a mirror image of what you will see if you sign-up for a live account. The pricing and execution are indicative and should give you a hint about how a live account would function.

Countries Accepted

The following statement is present on the site:

“Kapitalfx.de brand does not provide services to residents of the USA, Japan, British Columbia, Quebec and Saskatchewan, and some other regions.”

If you are still not sure of your eligibility we would recommend contacting the customer service department to find out prior to opening up an account.

Conclusion

There are plenty of options available when we look at the accounts, the trading conditions vary in relation to the different account tiers. We, unfortunately, do not have an accurate list of available spreads due to an asset breakdown or specification being missing, however, on paper, the trading conditions seem quite competitive. There is a distinct lack of deposit and withdrawal methods, being stuck with just Bank wire transfer as a withdrawal method can be quite limiting, the good news is that there are no added fees from KapitalFX.