Trade Fintech is an online foreign exchange broker, their aim is to stand out from the other 100s of forex brokers out there, they are trying to do this by offering no dealing desks, a dedicated support team, offering multiple trading platforms, efficient trade execution, trader education, safety & security, to offer global markets and to allow you to trade your way. This does not say a lot about themselves so we will be using this review to look deeper into the services that are on offer.

Account Types

When joining Trade Fintech, they will offer you six different account types to choose from, each one has its own entry requirement as well as trading conditions/features. We will now give a brief overview of each one so you can see what is on offer from them.

Bronze Account: This account requires a deposit of at least $250, it has forex and CFDs available to trade as well as access to the MetaTrader 4 trading platform. There is live chat support and trial access to daily market reviews, the online education centre, trading central signals, a trading specialist, and one on one academy lessons. The account has normal trading commissions and swaps and can be leveraged up to 1:200.

Silver Account: This account requires a deposit of at least $5,000, it has forex and CFDs available to trade as well as access to the MetaTrader 4 trading platform. The account has access to live chat support as well as full access to daily market reviews, the online education centre, trading central signals, a trading specialist, and one on one academy lessons. The account also comes with market event opportunities and has normal trading commissions and swaps and can be leveraged up to 1:200.

Gold Account: This account requires a deposit of at least $10,000, it has forex and CFDs available to trade as well as access to the MetaTrader 4 trading platform. The account has access to live chat support as well as full access to daily market reviews, the online education centre, trading central signals, a trading specialist, and one on one academy lessons. The account also comes with market event opportunities, quicker withdrawals, exclusive access to trading groups and has normal trading commissions and swaps, and can be leveraged up to 1:200.

Platinum Account: This account requires a deposit of at least $10,000, it has forex and CFDs available to trade as well as access to the MetaTrader 4 trading platform. The account has access to live chat support as well as full access to daily market reviews, the online education centre, trading central signals, a trading specialist, and one on one academy lessons. The account also comes with market event opportunities, quicker withdrawals, exclusive access to trading groups and has platinum trading commissions and swaps and can be leveraged up to 1:200.

Premium Account: This account requires a deposit of at least $10,000, it has forex and CFDs available to trade as well as access to the MetaTrader 4 trading platform. The account has access to live chat support as well as full access to daily market reviews, the online education centre, trading central signals, a trading specialist, and one on one academy lessons. The account also comes with market event opportunities, quicker withdrawals, exclusive access to trading groups and has premium trading commissions and swaps, and can be leveraged up to 1:500.

VIP Account: This account requires a deposit of at least $10,000, it has forex and CFDs available to trade as well as access to the MetaTrader 4 trading platform. The account has access to live chat support as well as full access to daily market reviews, the online education centre, trading central signals, a trading specialist, and one on one academy lessons. The account also comes with market event opportunities, quicker withdrawals, exclusive access to trading groups and has VIP trading commissions and swaps and can be leveraged up to 1:1000. This account also has access to the VIP department.

Platforms

Trade Fintech uses MetaTrader 4 as its trading platform, the platform can be used in a number of ways, primarily as a desktop download, mobile application, and web trader within your internet browser. Some of its many features include real-time quotes, a full set of trading order types, trade directly from the charts, a complete trading history, multiple chart windows, multiple timeframes, over 30 built-in indicators with thousands more available, and expert advisor to allow for automated trading, there is a lot more to this platform which is one it is one of the worlds most used platforms.

Leverage

The leverage that you can get depends on the account type that you are using, they are as follows:

- Bronze Account: 1:200 maximum

- Silver Account: 1:200 maximum

- Gold Account: 1:200 maximum

- Platinum Account: 1:200 maximum

- Premium Account: 1:500 maximum

- VIP Account: 1:1000 maximum

These are the maximum amounts of leverage that can be selected when opening up an account. We are not sure if it can be changed once an account is open, if you need to we would suggest contacting the customer service team with your change request.

Trade Sizes

Trade sizes start from 0.01 lots which are known as micro-lots. Unfortunately, we are not sure what the maximum trade size is or how many open trades and orders you are able to have at any one time.

Trading Costs

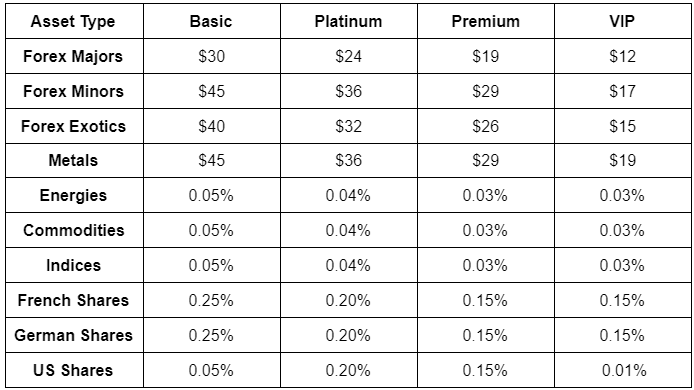

There are commissions for each account, we have outlined them below so you can get an idea of what the costs of trading are.

All figures are per lot traded.

As you can see the commissions are very high, charging $30 per lot for forex majors is extremely high considering the industry average seems to be around $6.

There are also swap charges available, the higher tier account that you are the better they will be, they are charged for holding trades overnight and can be both positive or negative, they can be viewed within the MetaTrader 4 platform.

There is also a dormancy fee on the account, if you do not trade for three months straight then a monthly fee of $50 will be charged to the account.

Assets

The assets at Trade Fintech have been broken down into various categories, unfortunately, there doesn’t seem to be a way to view all the available products without having to download the MetaTrader 4 trading platform. The assets have been divided into Forex, CFDs, Shares, and Indices. Sadly we cannot give any examples within the groups due to there not being a product specification available.

Spreads

Sadly as we do not have a product specification available, we also do not have any information on the available spreads. On the front page the website states that they offer spreads as low as 0 pips, we assume that these will be for all the accounts due to them all having commissions added to them. Of course, they will not always remain at 0 pips due to the spreads being variable, this means that they can be influenced but the markets will move up and down depending on the volatility.

Minimum Deposit

The minimum amount required to open up an account is $250, this will allow you to open up the Bronze account, the next available account is $5,000 so quite a big jump. We do not know if this amount reduces once an account has been opened, but we suspect that it does.

Deposit Methods & Costs

Looking at the deposit and withdrawals information page, there is only the mention of Bank Wire Transfer and Credit/Debit Cards being available, however looking at various other sources on the internet it seems like there will be more methods available, but as they are not mentioned on the site directly we won’t list them here either.

There isn’t any information mentioning any fees for depositing but we would always suggest contacting your own bank or card issuer just to check whether or not they will add any outgoing transfer fees of their own.

Withdrawal Methods & Costs

The same methods are mentioned for withdrawals which are Bank Wire Transfer and Credit/Debit Cards, there is also a mention of ePayments, however, no specific names are used.

There are some added fees, we have outlined them below.

- Bank Wire Transfer: 50.00 USD/GBP/EUR

- ePayments: 25.00 USD/GBP/EUR

- Credit/Debit Card: 25.00 USD/GBP/EUR plus a processing fee of 10.00 USD/7.00 EUR/5.00 GBP

Withdrawal Processing & Wait Time

The terms state that withdrawal requests will be processed within 5 to 7 working days this is a long time compared to the usual time of 1 to 2 days that we often see. Once it has been processed it will take a further 1 to 5 working days based on the processing time of the method you have selected to use.

Bonuses & Promotions

In terms of bonuses, as we were going through the site, we did not come across anything that we would class as a promotion or bonus. We also did not see anything that led us to believe that there had been any in the past, however, if you are interested in bonuses, we would suggest contacting the customer service team to see if there are any coming up that you could take part in.

Educational & Trading Tools

The educational side of the site has a few different aspects to it. The first section is e-books, there are books on forex, stocks, and CFDs which go over the basics of what they are and how to trade them. There is also a video library, which goes over different aspects of trading such as forex trading, market analysis, and trading psychology. A trading glossary is also provided, this gives you the definitions of various trading terms so you can refer back to it just in case you come across a term you do not understand. There is also an economic calendar that details upcoming news events as well as the markets that they may have an effect on.

The educational side of the site has a few different aspects to it. The first section is e-books, there are books on forex, stocks, and CFDs which go over the basics of what they are and how to trade them. There is also a video library, which goes over different aspects of trading such as forex trading, market analysis, and trading psychology. A trading glossary is also provided, this gives you the definitions of various trading terms so you can refer back to it just in case you come across a term you do not understand. There is also an economic calendar that details upcoming news events as well as the markets that they may have an effect on.

There is also a news section, in which you can guess details of different news events, some free trading signals are also on offer, but we cannot see them work out how profitable or accurate they are. The final section is a section called Trading Central, this is a place that can give you some trading analysis, as well as an MT4 plugin for technical analysis and a daily newsletter.

Customer Service

The contact us page doesn’t indicate the opening times of the support team, but we would expect that they would be closed over the weekends. You are able to get in touch using the online submission form, they have also provided a postal address along with an email address and various phone numbers.

- Email: [email protected]

- Phone: +27 212053114

- Address: Suite 2 5 St Vincent Street, Edinburgh, Scotland, United Kingdom

Demo Account

Demo accounts are available to sue, however, we were not able to open one up as people from the UK are not able to sign up (according to a pop-up on the site). The demo account should mimic the trading conditions of the live accounts, however, we do not know the actual details and conditions used, we also do not know if there is an expiration time on the demo accounts.

Countries Accepted

The following statement is available on the website which indicated which countries are currently restricted: “TradeFintech does not provide products or services to residents or citizens of the United States (US), Canada (CA), Australia (AU), New Zealand (NZ), France (FR), Belgium(BE) or citizens with dual citizenship. The information on this website is not intended for any countries where FOREX and/or CFDs trading is restricted or prohibited by local laws or regulation.”

Conclusion

Trade Fintech is offering a range of trading conditions, leverage ranging from 1:200 all the way up to 1:1000 give a lot of choices, the spreads are kept low which is great, the downside is the huge commissions being added to the account, they are as high as $45 per lot on some assets which are crazy, considering that the industry average seems to be around $6 per lot traded. The full range of assets and funding methods are also not known, but even if there were loads and had no fees (there are fees to withdraw), with the number of commissions being added, we would have to recommend looking for a slightly cheaper broker to trade on.