Pure Market is a foreign exchange broker that operates under the jurisdiction of Vanuatu and is authorized and regulated by the Financial Services Commission. The management of Pure Markets has trading experience going back as far as 1999. They aim to bring their experience and knowledge to the brokerage world to help bring you the best broker available. Throughout this review, we will be looking into the services on offer to see exactly what is on offer and to see how they compare next to the competition.

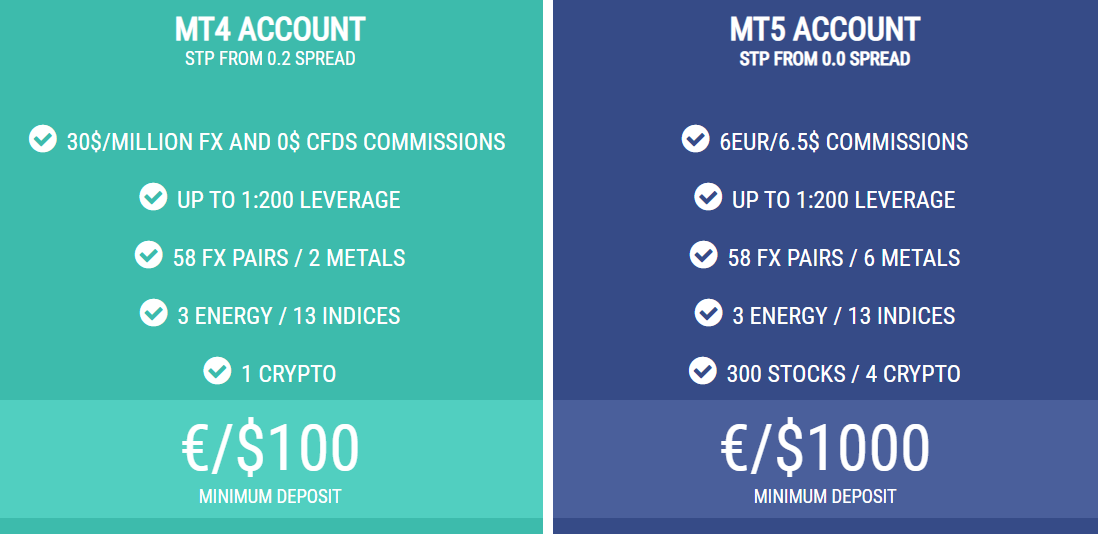

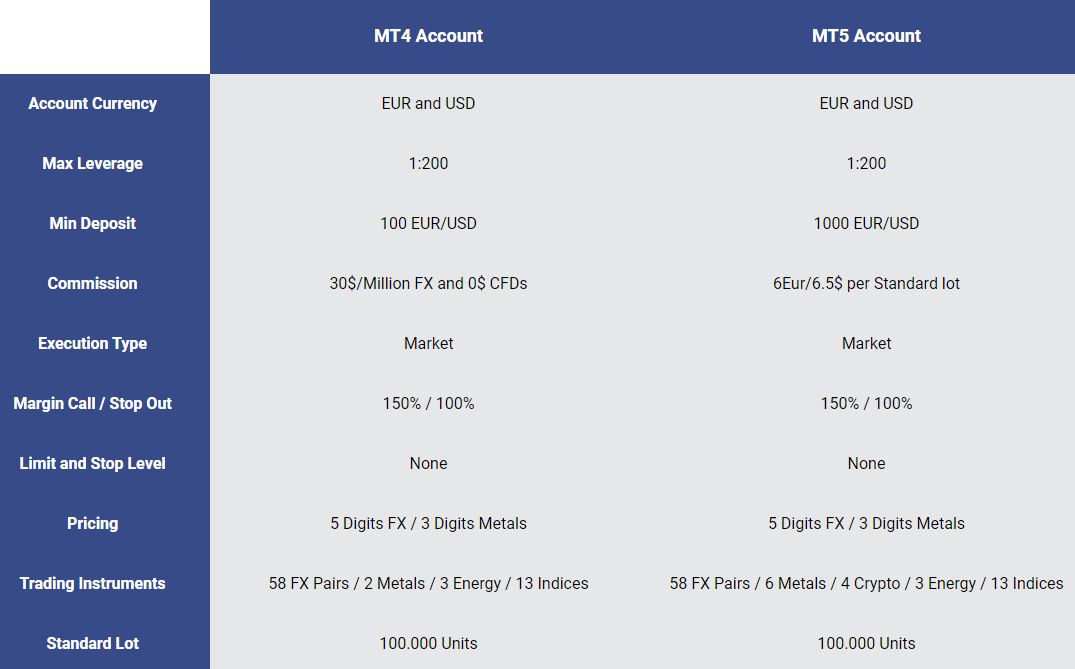

Account Types

There are two different accounts available, they both have their own conditions and features. Let’s briefly look at what they are.

STP – Forex Only: This account requires a deposit of 100 EUR or USD, it can be leveraged up to 1:100 and there is a spread starting from 0.9 pips with no added commissions. It uses a market execution style with the margin calls set at 150% and the stop-out level set at 100%. There are 58 currency pairs available to trade along with 2 metals. The standard lot size is 100,000 units and the minimum trade size is 0.01 lots for both forex and metals. The maximum trade size is 50 lots with a maximum of 300 orders at any one time.

STP – Forex + CFDs: This account requires a deposit of 100 EUR or USD, it can be leveraged up to 1:200 and there is a spread starting from 0 pips with an added commission of $30 per million traded on forex and $0 for CFDs. It uses a market execution style with the margin calls set at 150% and the stop-out level set at 100%. There are 58 currency pairs available to trade along with 2 metals, 3 energies, and 13 indices. The standard lot size is 100,000 units and the minimum trade size is 0.01 lots for both forex and metals. The maximum trade size is 30 lots with a maximum of 300 orders at any one time.

Platforms

The only platform on offer from Pure MArkets is MetaTrader 4. MetaTrader 4 is a highly accessible platform available to be used as a web trader, mobile application, or desktop download. It offers a whole host of features that helped it become one of the world’s most used trading platforms. Some of the features include its user-friendly interface, advanced order types such as market, limit, stop loss, and trailing stops. It has over 50 financial instruments available with the power of analysis with 4 types of charts, 9 timeframes, 33 built-in indicators, and 30 elements for graphical analysis. It’s also compatible with hundreds and thousands of expert advisors and indicators to help with your trading, this also allows for automated trading.

Leverage

The Forex only STP account can be leveraged up to 1:100 while the Forex and CFD STP account can be leveraged up to 1:200. You can select the leverage when you first open up an account and this can be changed by sending a request to the customer service team.

Trade Sizes

Trade sizes start from 0.01 lots for all instruments except one. Trade then goes up in increments of 0.01 lots until they reach the maximum trade size. The max trade size of the Forex only account is 50 lots, while it is slightly reduced for the other account and sits at 30 lots. Both accounts can have a maximum of 300 trades open at any one time. The only instrument not starting at 0.01 lots is Bitcoin which starts at 1 lot as its minimum size.

Trading Costs

The Forex and CFD account has an added commission of $30 per million traded on forex, this equates to $3 per lot traded, there is no commission on trading CFDs on the account. The Forex-only account does not have any added commissions as it uses a spread-based payment structure that we will look at later in the review. There are also swap charges which are fees for holding trades overnight, they can be viewed within MetaTrader 4 and can be both positive or negative.

Assets

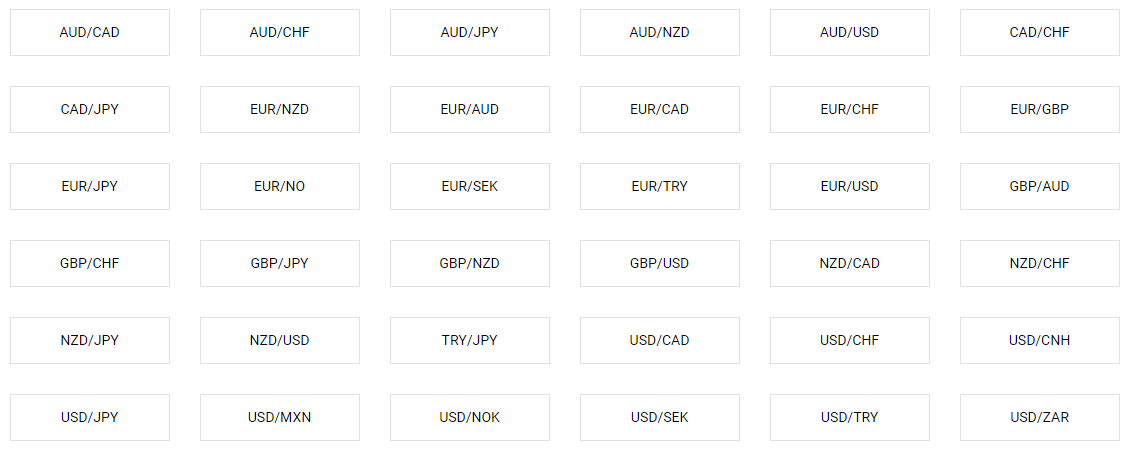

The assets have been split into categories. Let’s look at what instruments are available within them.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, EURNZD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNO, TRYJPY, EURSEK, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, TRYJPY, USDCAD, USDCHF, USDCNH, USDJPY, USDMXN, USDNOK, USDSEK, USDTRY, USDZAR, ZARJPY.

Metals: Both Gold and Silver are available to trade.

Energies: UK Oil, US Oil, and Natural Gas are available for trading.

Indices: UK FTSE 100, Euro Stoxx 50, France CAC 40, Germany DAX 30, Spain IBEX 35, Switzerland SMI, Hang Deng, AUS 200, HK 50, JPN 225, NAS 100, US 30, US 500, US 2000.

Spreads

The minimum spreads are based on the account you are using. The Forex only account has spreads starting from 0.9 pips which the forex and CFD account has spreads starting from as low as 0 pips. The spreads are variable which means that they are influenced by the markets, the more volatility in the markets the higher they will be, different instruments will also have different spreads.

Minimum Deposit

The minimum amount required to open up an account is $100, this will enable you to use either of the two available account types. Once an account has been opened the minimum deposit requirement is reduced, but we are not sure exactly what figure it reduces to.

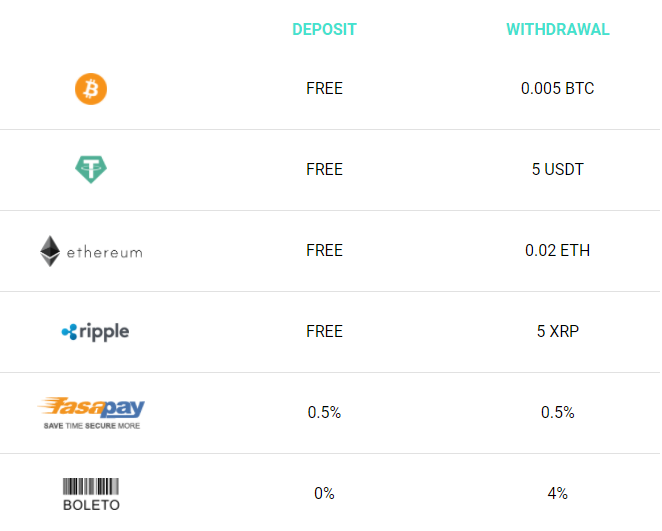

Deposit Methods & Costs

There are a few different methods available, we have outlined them below along with any applicable fees for each method.

- Bank Wire Transfer – SEPA FREE, SWIFT 20€ + 1.5%

- Etana Custody – $20 fee

- GTBank – No fee

- Neteller – 3.9% fee

- Skrill – 3.9% fee

- Bitcoin – No fee

- Bitcoin Cash – No fee

- Ethereum – No fee

- Ripple – No fee

- VLoad – 4% fee

- FasaPay – 0.5% fee

Withdrawal Methods & Costs

The same methods are available to withdraw with, we have once again listed them along with any applicable fees.

- Bank Wire Transfer – SEPA €5, SWIFT €30 + 2%

- Etana Custody – $25 fee

- GTBank – 1% in USD, 1$ in NGN

- Neteller – 2% fee

- Skrill – 1% fee

- Bitcoin – 0.005 BTC (we find this hard to believe)

- Bitcoin Cash – 0.005 BCH fee (we find this hard to believe)

- Ethereum – 0.02 ETH fee (we find this hard to believe)

- Ripple – 5 XRP fee (we find this hard to believe)

- VLoad – Not available to withdraw with

- FasaPay – 0.5% fee

Some of the fees mentioned are extremely high and hard for us to believe so they may just be mistyped.

Withdrawal Processing & Wait Time

We could not locate information surrounding the processing times of Pure Market, we would hope that any withdrawal requests would be fully processed within 5 working days depending on the method used.

Bonuses & Promotions

We did not notice any bonuses or promotions as we went through the site, that does not mean that there won’t be any in the future. If you are looking for bonuses you could always send a message to the customer service team to enquire about any potential upcoming promotions that you could take part in.

Educational & Trading Tools

The two bits of education on the site is a market news section which details different news articles, however, they are taken from another site. There is also a tutorial section which is video tutorials going over subjects like how to withdraw or how to place a trade, very basic things.

There is a trading tools section, however, we are not fully clear on what it actually is, it states that there is something called a Super Trader Package that has 30 tools in, but no indication of what they are. You require a deposit of at least 1,000 EUR or USD to get this mystery package.

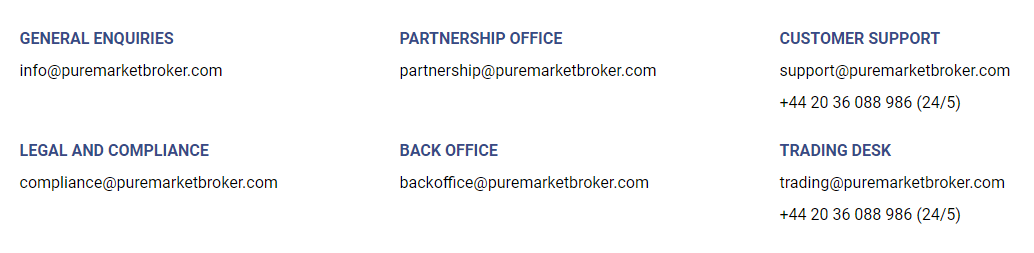

Customer Service

You can contact the customer service team using the online submission form, fill it in and wait for a reply via email, you can also use the provided postal address. There are email addresses for the trading desk, customer support, general inquiries, partnership office, back office, and the compliance team as well as a phone number for the trading desk and customer support.

- Address: Pot 805/103 Rue D’Auvergne, Po BOX 535, Port Vila, Vanuatu

- Email: [email protected]

- Phone: +44 20 36 088 986

The team is available 24 hours a day 5 days a week and close over the weekend and on bank holidays.

Demo Account

Demo accounts allow you to trade without any risk, a perfect way to test out new strategies or trading techniques, so it is good that they are available from Pure Market. There isn’t much info about them though, you can use it on MT4 and can select a practice balance between 100 and 100,000 but that is about it, we do not know which account it mimics or if there is an expiration on the account.

Countries Accepted

The following statement is available on the website:

“The information on this site is not directed at residents of the United States and Vanuatu and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.”

This doesn’t make things too clear so if you are thinking of joining, we would recommend contacting the customer service team to find out if you are eligible for an account first.

Conclusion

The two accounts available from Pure Market are pretty similar, the main difference being that the second account has some additional instruments to trade and also has a lower spread (with an added commission). Talking of instruments, there is a fair selection of them, so there should always be something there for you to trade. There are also plenty of deposit and withdrawal methods including a variety of cryptocurrencies. There are some fees for both depositing and withdrawing which is a shame and some of them seem extremely high so that may be a type that hasn’t been changed. The overall conditions from Pure Market seem ok if you are ok with the funding fees then they could be a worthy broker to use.