Scandinavian Capital Markets is a Sweden-based foreign exchange broker that offers its clients a safe and secure trading environment. Companies like Scandinavian Capital Markets who are on the Finansianspektionen’s list of registered brokers, promote transaction transparency, no conflict of interest, and are highly trusted worldwide. Sweden’s regulatory environment provides unique opportunities for global Forex trading, while at the same time provides a stable and safe financial system. Throughout this review, we will be looking into the services offered to see how they compare to the competition.

Account Types

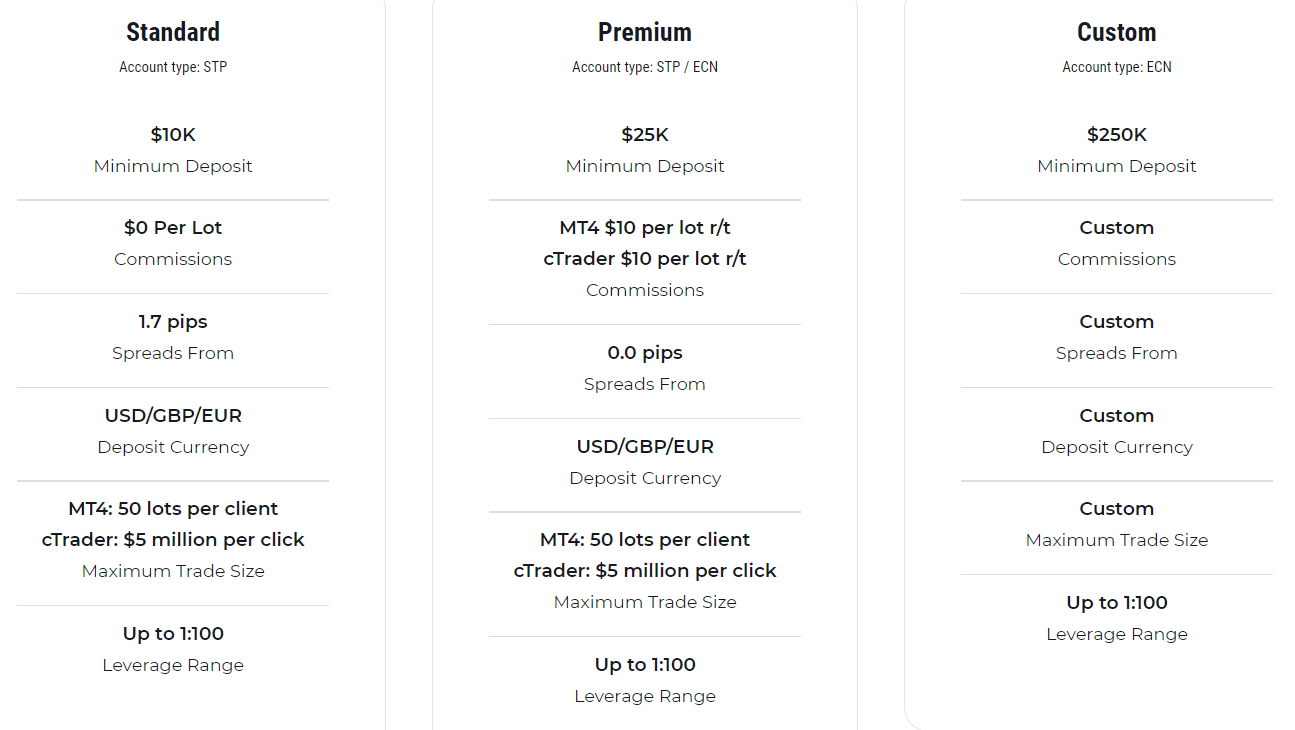

When signing up with Scandanavian Capital Markets there are three different accounts to choose from, we will briefly outline the differences and features of these accounts.

Standard Account: This account has a minimum deposit of at least $10,000. It is an ECN style account and has 58 different currency pairs available. Its base currency can be in USD, GBP, EUR, or SEK, and the spreads start from 1.7 pips. The account can be leveraged up to 1:100 and the minimum trade size is 001 lot with the maximum trade size being 1M (10 lots). There is no added commission on the account and it has access to 24/5 support, hedging is allowed and so is one-click trading, there are no minimum volume requirements on this account.

Advanced Account: This account has a minimum deposit of at least $25,000. It is an ECN style account and has 58 different currency pairs available. Its base currency can be in USD, GBP, EUR, or SEK, and the spreads start from 0.0 pips. The account can be leveraged up to 1:100 and the minimum trade size is 001 lot with the maximum trade size being 10M (100 lots). There is an added commission of $10 per lot traded on the account and it has access to 24/5 support, hedging is allowed and so is one-click trading, there are no minimum volume requirements on this account.

Custom Account: This is a special account that requires a minimum deposit of at least $250,000. You need to contact the support team to set one up as it has a custom selection of tradable assets, leverage, spreads, base currencies, and trade sizes. Leverage remains at 1:100 and the minimum trade sizes stay at 0.01 lots. The account requires a minimum trading volume of $250 million.

Platforms

Platforms

There are a few different platforms available, including MetaTrader 4, cTrader, and Currenex. Each of these platforms is well-known and well-liked among traders, so there are no problems to report in this area.

Leverage

Leverage on all accounts goes as high as 1:100, this can be selected when opening up an account and should you wish to change it you can do so by sending a request to the customer support team.

Trade Sizes

Trade sixes on all accounts start from 0.01 lots (known as micro-lots) and go up in increments of 0.01 lots. The maximum trade size depends on the account used, the Standard account has a max trade size of 10 lots while the Premium account has a maximum trade size of 100 lots, the limit for the Custom account can be chosen on setup. We don’t know how many open trades you can have at any one time though.

Trading Costs

The Premium account has an added commission of $10 per lot traded on MT4 or $100 per million traded on cTrader which equates to a similar amount. The Custom account has commissions but this needs to be negotiated before opening up the account. The Standard account uses a spread-based system and so there are no added commissions.

The Premium account has an added commission of $10 per lot traded on MT4 or $100 per million traded on cTrader which equates to a similar amount. The Custom account has commissions but this needs to be negotiated before opening up the account. The Standard account uses a spread-based system and so there are no added commissions.

There are swap charges for all three accounts, these are fees for holding trades overnight and can be both positive or negative and can be viewed within the trading platform of choice.

Assets

We only have a breakdown of the available forex and metal pairs so we will outline the below.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDCNH, USDDKK, USDHKD, USDJPY, USDMXN, USDNOK, USDPLN, USDSEK, USDSGD, USDTRY, USDZAR.

Metals: XAGUSD and XAUUSD.

Spreads

The spreads that you get depends on the account you are using, the Standard account comes with a starting spread of 1.7 pips while the Premium account comes with a starting spread of 0 pips. The spreads are variable which means they move with the markets and when there is added volatility they will be seen higher. Different instruments will also naturally have different starting spreads.

Minimum Deposit

The minimum deposit amount required to open up an account is $10,000 which could price out a lot of potential retail traders. It is not clear if this amount reduces once an account is open but as it is so high we would expect that it does.

Deposit Methods & Costs

It seems that only Bank Wire Transfers are available to deposit with, deposits can be made in USD, EUR, GBP, and SEK. It is not clear if there are any fees added for withdrawals but nothing is mentioned.

Withdrawal Methods & Costs

As Bank Wire Transfer is the only deposit method it is also the only withdrawal method. Just like with the deposits it is not clear if there are any added fees but you should check with your own bank to see if they will add any transfer or processing fees.

Withdrawal Processing & Wait Time

Withdrawal requests will be processed within 24 hours if made on a business day or the next business day if made over the weekend or on a bank holiday. Once it is processed it will take a further 1 to 5 working days for your own bank to process the transfer.

Bonuses & Promotions

There doesn’t seem to be any promotions or bonuses running at the time we are writing this review. If you are looking for bonuses we would recommend contacting the customer service team to find out if there are any coming up.

Educational & Trading Tools

There are a few different aspects to the educational side of the site, the first is a simple news section, the news seems quite in-depth, the main problem is that there are no timestamps, so we do not know when it was posted or if it is at all relevant anymore. There is an analysis section, which is actually the same section. There are webinars, but they have not been running since October 2019. The final section is events, which is just the news and analysis section again.

Customer Service

The customer service team is available 24 hours a day 5 days a week, closed over the weekends and on bank holidays. You can use the online submission form in order to send in your query and then get a reply via email. There is also a postal address along with an email and a number of phone numbers for your choice of communication method.

Address: Scandinavian Capital Markets SCM AB, Kistagangen 16, 164 40 Kista, Stockholm, Sweden

Phone: + 46 8 559 26 151

Email: [email protected]

Demo Account

Demo accounts allow you to test out the trading conditions and new strategies without risking any of your own capital, so it is good that they are available here. You can create a demo account of either of the three account types and also chose the currency and platform of the account. We do not know of a potential expiration time so hopefully, there won’t be one.

Countries Accepted

The following statement is present on the website: “Scandinavian Capital Markets does not accept clients from the U.S, Iran, Syria, North Korea, Yemen, and Cuba.” If you are still not sure if you are able to sign up, simply contact the customer service team to find out.

Conclusion

The three accounts on offer give you a choice of three distinct trading conditions, a low spread commissions account or a spread-based commission-free account. The trading conditions on both are ok, the commission-based account has a commission of $10 per lot which is a fair bit higher than the average $6 per lot. There wasn’t a huge selection of tradable assets available on the site, whether there are more or no we do not know. Deposit and withdrawals are a little limited with just Bank Wire Transfers available so they may push those that do not want to use this method away. You have all the information now, so the decision to use them or not is up to you.