CornerTrader is a Switzerland-based foreign exchange broker. They claim to offer a trading-based solution, powerful multi-asset platforms, top solidity, and a legacy of strength. CornerTrader was launched in 2012 and has established its own ways of offering its trading solutions. We will be using this review to look into the services on offer to see how they compare to the competition and so you can decide if they are the right broker for you.

Account Types

When signing up with CornerTrader you can choose between 3 different account types. We have outlined them below along with the features and requirements.

Private Trader Account: There is not a deposit requirement in order to open up this account. It comes with spreads on EURUSD starting from 4 pips, CFDs from 4.5 pips, and Futures from 12 pips. The account comes with access to a multi-device platform, free financial news, and you can get financial research for 10 CHF a month and Traders Card from 40 CHF per year. The account also comes with an account opening meeting, free live chat, trading support, post-trading support, stock transfers, and free in-house seminars.

Capital Trader Account: This account requires a minimum deposit of at least 75,000 CHF or equivalent. It comes with spreads on EURUSD starting from 3 pips, CFDs from 3.75 pips, and Futures from 8 pips. The account comes with access to a multi-device platform, free financial news, free financial research, and Traders Card from 40 CHF per year. The account also comes with an account opening meeting, free live chat, trading support, post-trading support, stock transfers, and free in-house seminars. It also comes with a dedicated service manager, free external workshops, free webinars, and free personal product training.

Pro Trader Account: This account requires a certain amount of trading volume to open. It comes with spreads on EURUSD starting from 0.2 pips, CFDs from 2 pips, and Futures from 2 pips. The account comes with access to a multi-device platform, free financial news, free financial research, and Traders Card for free. The account also comes with an account opening meeting, free live chat, trading support, post-trading support, stock transfers, and free in-house seminars. It also comes with a dedicated service manager, free external workshops, free webinars, and free personal product training, as well as free access to the pro-platform and tailormade pricing.

Platforms

There are two different platforms available from CornerTrader, we have detailed them below along with some of their main features.

CornerTrader Flexibility:

Some of the features of this platform include that it is ideal for traders and investors who are looking for an easy-to-use platform or are often on the move, it has a simple, modern & user-friendly, cross-device platform: trade from your smartphone, tablet, and desktop, it has single-screen support: max. 2 monitors, offers chart-trading: Trading by Chart Analysis, it allows for automated buy orders (algorithm orders), including USA Pre-Market, and it has access to market analyses & news, financial calendar.

CornetTrader Advance:

Some of the features of this platform include that it is ideal for experienced active traders, brokers, and investors, it offers extensive customization options & extended functions, it has multi-screen support: max. 6 monitors, chart-trading: trading by chart analysis, market-depth-trading (requires the purchase of real-time data Level 2), it offers algorithm orders, including USA Pre-Market, and it has innovative risk management tools.

Leverage

We do not know what the available leverage is on the CornerTrader accounts. There is mention of leveraging products but no figures are given.

Trade Sizes

Trade sizes strangely seem to start from 0.05 lots, they go up in increments of 0.01 lots until the maximum trade size is reached, these vary by currency to currency but are seen up to 100 lots. We would recommend not trading over 50 lots in a single trade though due to execution and potential slippage issues.

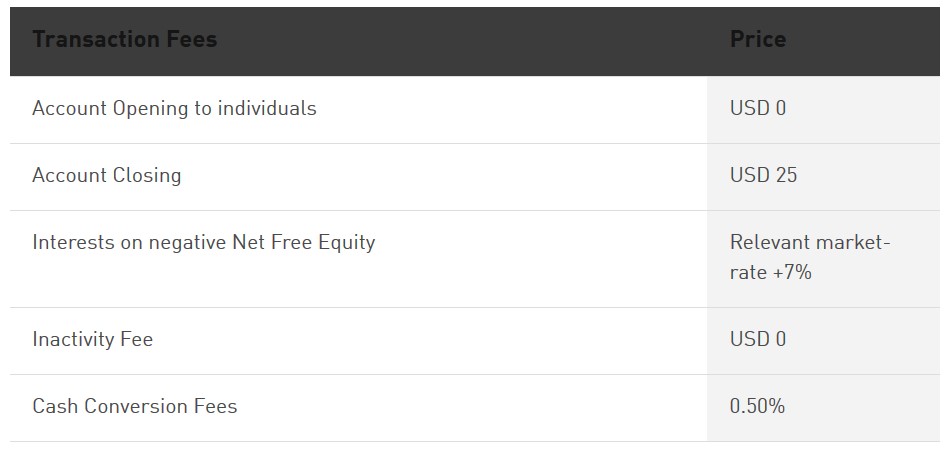

Trading Costs

There is an added commission of $10 per lot traded on the Private and Capital accounts, we do not know if there is an added commission on the Pro account but we suspect that there will be due to its lower spreads. There are also swap charges for holding trades overnight, these fees can be either positive or negative and can be viewed within the trading platform you are using. A PDF containing the full list of trading costs can be accessed here: https://www.cornertrader.com/export/sites/cornertraderCOM/.content/.galleries/downloads/website/Commissions.pdf

Assets

The assets have been broken down into various categories, we have outlined some of them below along with the instruments within them.

Global Currencies: AUDCAD, AUDCHF, EURAUD, EURCAD, GBPAUD, GBPCAD, HKDJPY, NZDSGD, USDAUD, USDCAD, USDCHF, and many more.

Metals: XAGAUD, XAGEUR, XAGHKD, XAGJPY, XAGUSD, XAUAUD, XAUCHF, XAUCNH, XAUEUR, XAUHKD, XAUJPY, XAURUB, XAUUSD, XAUXAG, XPTUSD, XPTZAR.

Stocks: Plenty of stocks are available including the London Stock Exchange, New York Stock Exchange, and the Nasdaq Global Markets.

Indices: Netherlands 25, Australia 200, France 40, Germany 30, Denmark 20, US 30 Wall Street, Spain 35, Germany Mid-Cap 50, US Tech 100, Japan 225, Switzerland 20, US SPX 500, EU Stocks 50, Sweden 30, Belgium 20, Norway 25, Germany Tech 30, Hong Kong.

Commodities: Copper, UK Crude Oil, USCrude Oil, Heating Oil, Gasoline, Gas Oil, Natural Gas, CO2 Emissions, Corn, Wheat, Soybeans, Sugar #11, Coffee, Cocoa, and Live Cattle.

Spreads

The spreads depend on the account you are using, the Private account has a spread starting from 4 pips, the Capital account has a spread starting from 3 pips and the Pro account has spreads starting as low as 0.2 pips. Different instruments will also have different spreads, so while EURUSD on the Pro account may start from 0.2 pips, GBPCHF on the same account starts from 2 pips. The spreads are also variable which means they will move with the markets, the more volatility in the markets will cause the spreads to grow larger.

The spreads depend on the account you are using, the Private account has a spread starting from 4 pips, the Capital account has a spread starting from 3 pips and the Pro account has spreads starting as low as 0.2 pips. Different instruments will also have different spreads, so while EURUSD on the Pro account may start from 0.2 pips, GBPCHF on the same account starts from 2 pips. The spreads are also variable which means they will move with the markets, the more volatility in the markets will cause the spreads to grow larger.

Minimum Deposit

There are no minimum deposit requirements when opening up an account as you can open a Private Trader account with any amounts. If you want the Capital Trader account you will need to deposit at least 75,000 CHF (or equivalent), if you want the Pro Trader account then you will need to contact the team in order to find out how much you will need.

Deposit Methods & Costs

Unfortunately, there is little to no information regarding deposits on the site, so we currently do not know how we can deposit funds into the broker, this is a shame as it is quite important, clients don’t want to sign up to then realize they do not use one of the accepted methods.

Withdrawal Methods & Costs

As there is no information on deposits there is also none for the withdrawal methods, not only do we not know the methods available, we also do not know if there are any fees for getting your money out. Again, this is important information, not being present means it can be hard for clients to build trust.

Withdrawal Processing & Wait Time

We also do not know how long it takes for CornerTrader to process requests, we would hope that any withdrawals would be fully processed within 7 days from the request being made, this would depend on the methods that are available to use.

Bonuses & Promotions

Bonuses & Promotions

There does not seem to be any active bonuses or promotions at the time that we were writing this review. If you are really interested in them, we would recommend contacting the customer service team to see if there are any promotions coming up that you could take part in.

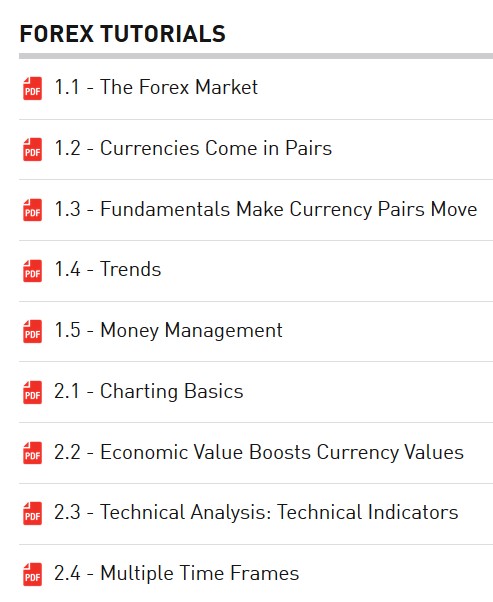

Educational & Trading Tools

There are some trading events available, these seem to be quite basic courses for beginners, there are also trading signals available, they are available on the site in the form of videos, while we can see a few of the recent ones, we do not know of their accuracy or profitability. There is also a set of tutorials, going from the basics of trading up to how to analyze the markets. The final section is a list of live exchange rates.

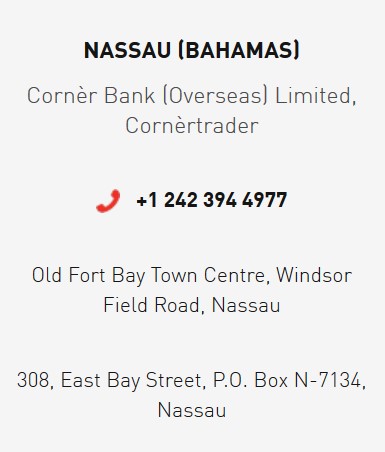

Customer Service

At the bottom of the page there is a phone number, email address, and postal address available to use, we do not know the opening times of the customer service team.

At the bottom of the page there is a phone number, email address, and postal address available to use, we do not know the opening times of the customer service team.

Address: Cornèr Bank Ltd. Tödistrasse 27, CH-8002, Zurich – Switzerland

Phone: +41 58 880 80 80

Email: [email protected]

Demo Account

You can sign up for a demo account, you are able to select to mimic any of the three available accounts and the demo account allows you to test out the markets and strategies without any real risk, they last indefinitely so you can keep on testing for as long as you need.

Countries Accepted

This information is not stated on the site, so if you are thinking of joining, we would recommend contacting the customer service team to find out if you are eligible for an account prior to opening up.

Conclusion

The trading conditions are actually a little confusing, we don’t know some of the details such as the leverage available, and the trading costs that we do know are quite expensive with a $10 commission on account with spreads as high as 4 pips. The financial side of the broker is completely unknown which is really disappointing to see. We do not know how we can get our money in or out of the broker and we also do not know how much it will cost us. With all of this information missing, we would recommend looking elsewhere for a slightly more transparent broker.