Introduction

Our previous lessons have covered trading multiple timeframes in forex and which timeframes are suitable for your trading style. To some forex traders, trading multiple forex timeframes can seem tedious and time-consuming. Here are some of the most important reasons why you should look at multiple timeframes when trading forex.

1. To easily identify trends and their momentum

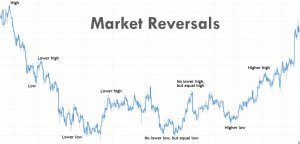

Depending on the type of forex trader you are, multiple timeframes will enable you to see the prevailing market trends at a glance by filtering out periodic price spikes. It is easier to identify the direction of the market trends and consolidations, whether in the short- or long-term.

For the long-term market trend, you can use the weekly and the monthly timeframes, while the intermediate market trend can best be identified by the 4-hour to daily timeframes. Timeframes of between five minutes and one hour can be used to determine the short-term market position.

The longer timeframes filter out the short-term price fluctuations, which might otherwise result in trend inconsistencies when viewed alone. The periodic fluctuations in the short-term add up in the long-term. With multiple timeframe analysis, the strength and consistency of the short-term trend can be compared to that in the long-term. This comparison is made by observing whether the prevailing long-term trend was dominant in the short-term as well.

2. To establish the significance of fundamental indicators

Using multiple trend analysis, you can easily establish the magnitude that news release of economic indicators has on a given currency pair. To determine the significance of the economic indicators, you can use different timeframes to establish how long the news release affected price action. The effects of high-impact fundamental indicators can be traced from the shorter timeframe to the longer timeframes. Low-impact indicators only affect price action on the shorter timeframe.

3. Identifying the support and resistance levels

Based on the forex trading style you choose, you can use the more extended timeframe within your category to establish the support and resistance levels in the market trend. Shorter timeframes can then be used to trigger entry and exit points for a trade.

These support and resistance levels are crucial in deciding the forex order type you want to execute. Say, for example, you want to use a buy limit order. You will use the support level as your trigger price. Similarly, the support level can be used as the trigger price for a sell stop order. You can use the resistance level as the trigger price for the sell limit and buy stop orders.

4. To avoid the lagging effects of technical indicators

Technical forex indicators are lagging since they derive their properties from the price action of a forex pair. Therefore, the forecasting significance of multiple timeframe analysis in the forex market can be said to be leading that of the technical indicators. Furthermore, some technical forex indicators can produce conflicting signals. Thus, trading with multiple timeframes improves your forex analysis.

We hope you understood why it is crucial to consider analyzing various timeframes while analyzing the Forex market. Please take the below quiz to know if you got the concepts correctly. Cheers! [wp_quiz id=”89156″]