Introduction

This lesson is basically an overview of what we have covered so far in the Multiple Timeframe series. Multiple timeframe analysis in forex is observing the price action of a selected currency pair under different timeframes. Most forex brokers will provide you with several timeframes. These timeframes are categorized in minutes from 1-minute timeframe to 30-minute timeframe, hourly timeframes from 1-hour timeframe to 12-hour timeframe, the daily timeframe, weekly timeframe, and the 1-month timeframe.

Everything we learned so far!

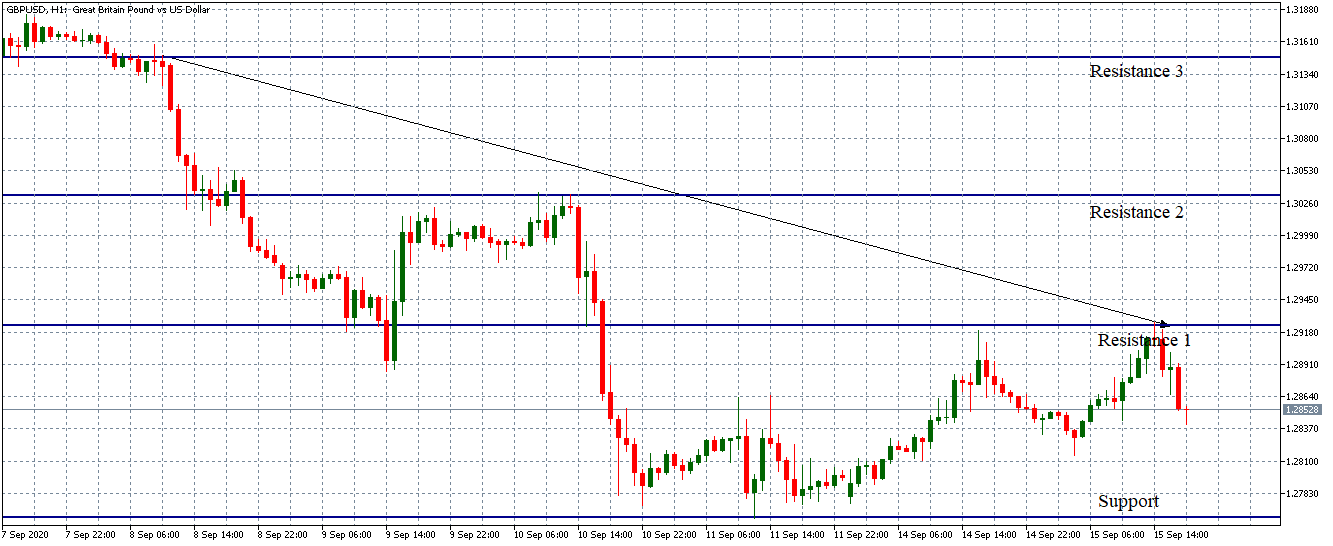

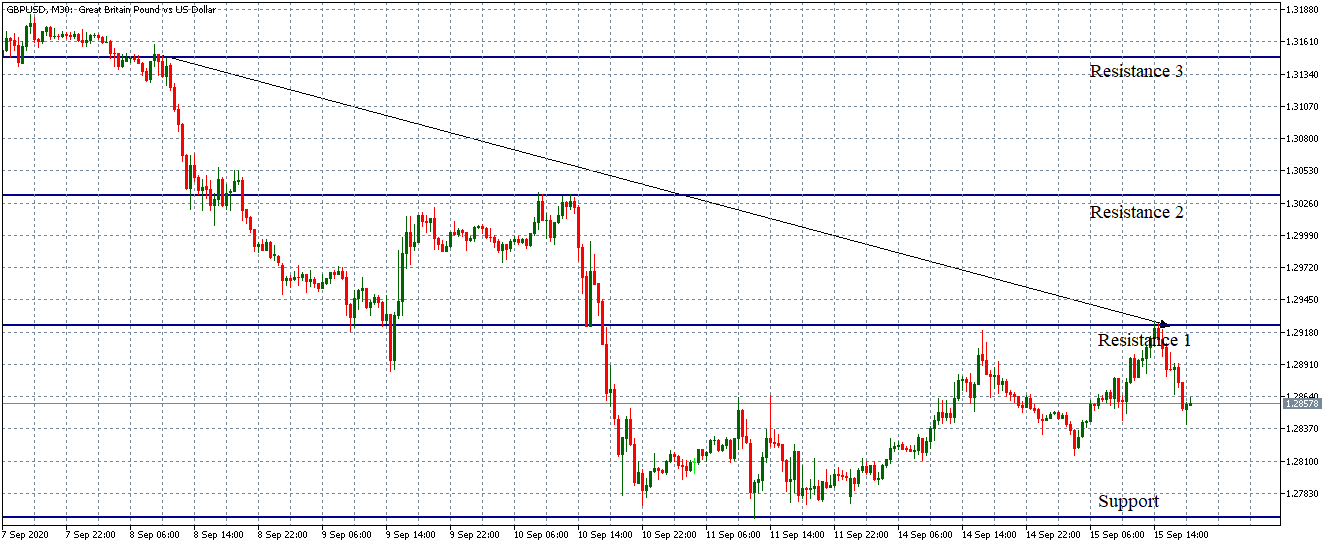

As we discussed in our first lesson, multiple timeframe analysis involves using at least three timeframes to make a trade. A longer timeframe is used to establish the dominant market trend. Depending on your forex trading style, this dominant trend is used as the prevailing primary trend to anchor your trades. The rationale behind using the longer timeframe to establish the primary trend is because longer timeframes take long to be formed and are not susceptible to the micro fluctuations in price.

The dominant trend is broken down using a medium timeframe to establish the magnitude of the trend. Finally, a shorter timeframe is used as a trigger timeframe by finding the best points to enter and exit a trade. The most common technique of trading multiple timeframes in the forex market is trading three timeframes.

Trading multiple timeframes in forex, therefore, means using multiple timeframe analysis to inform your trading decision. The choice of timeframes used in your analysis entirely depends on the type of forex trader you are.

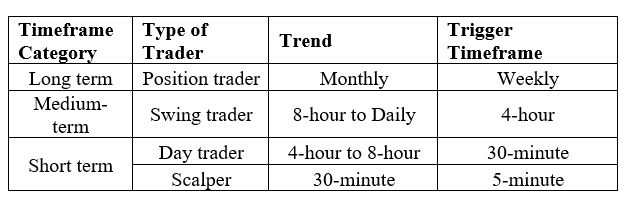

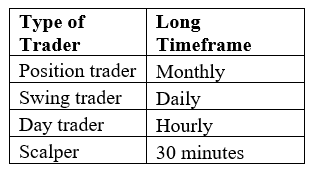

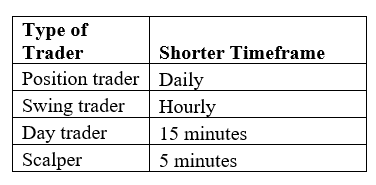

The table below summarises the type of forex trader and the preferred timeframes.

Note that the above table is merely a guideline. We recommend selecting your desired timeframes for analysis based on your trading style and comfort of analysis. Therefore, the best timeframes to trade in forex will depend on factors such as market volatility and your trading style.

Some of the importance of multiple timeframe analysis in forex include:

- The ability to determine the magnitude and significance of economic indicators;

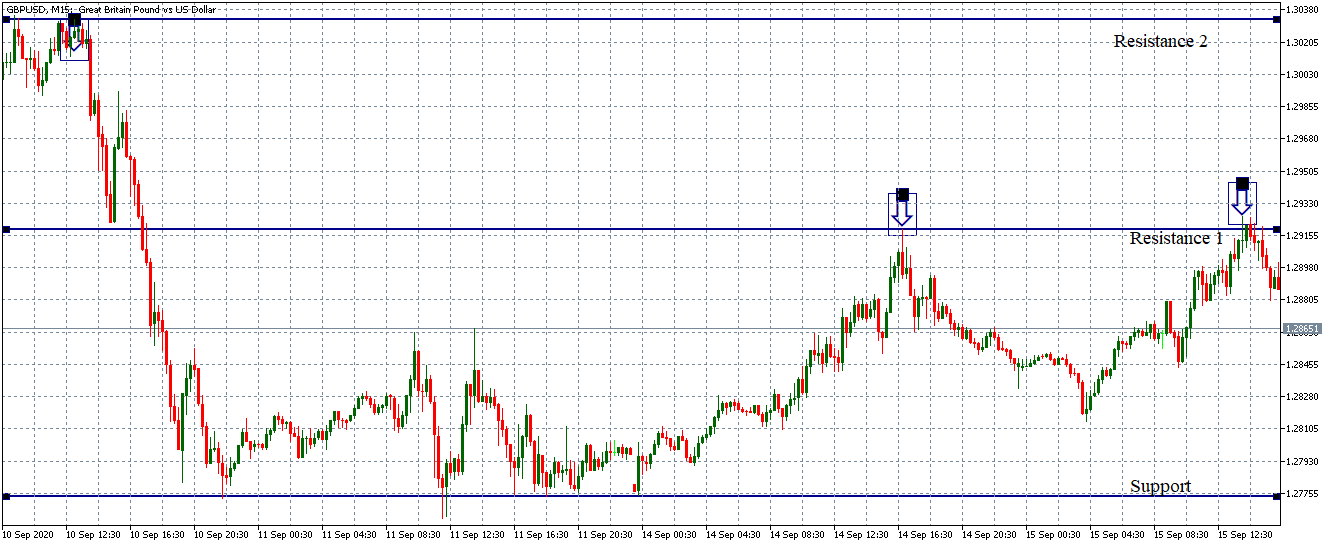

- Identifying support and resistance levels which aid to execute various forex orders and in setting ‘take profit’ and ‘stop-loss’ levels;

- Helps to identify market trends and their magnitude at a glance quickly; and

- Helps in forex forecasting by eliminating the lagging effects of most technical forex indicators.