Introduction

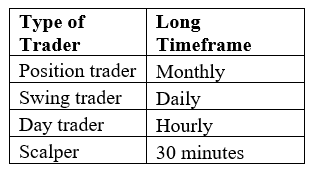

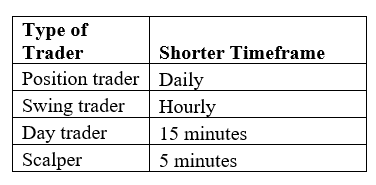

Our previous lesson covered how to use multiple timeframe analysis to find better entry and exit points. Timeframes in forex trading can be categorised into three: long timeframe, intermediate timeframe, and short timeframe. This lesson will illustrate how you can trade with three timeframes depending on the type of forex trader you are.

Depending on your forex trading style, the long timeframe is used to determine the prevailing market trend; the intermediate timeframe used to show the consistency of the observed trend, while the short timeframe used to determine the best entry and exit points for a trade.

Long Timeframes in Forex

The long timeframes are used to establish the prevailing primary trend of a currency pair. Depending on the trading style, the long timeframes in forex ranges from a 30-minute timeframe to a 1-month timeframe.

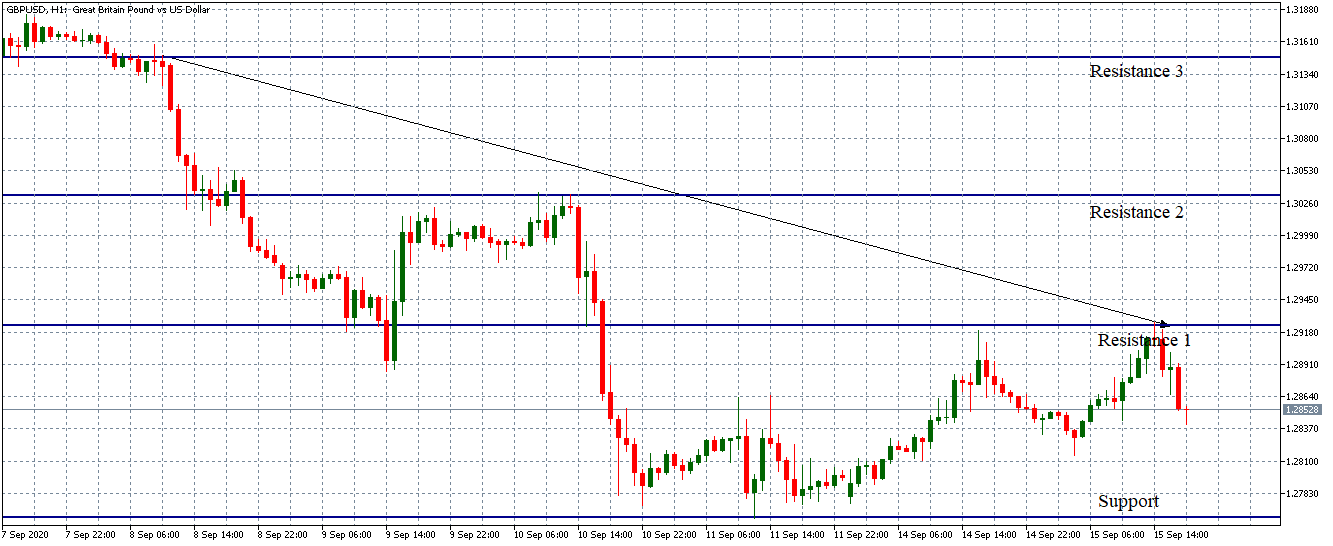

Day trader long timeframe: 1-hour GBP/USD chart

For a forex day trader, a 1-hour timeframe shows the prevailing and dominant downtrend in the GBP/USD pair. Using this timeframe, you can establish support and resistance levels.

Intermediate timeframes in Forex

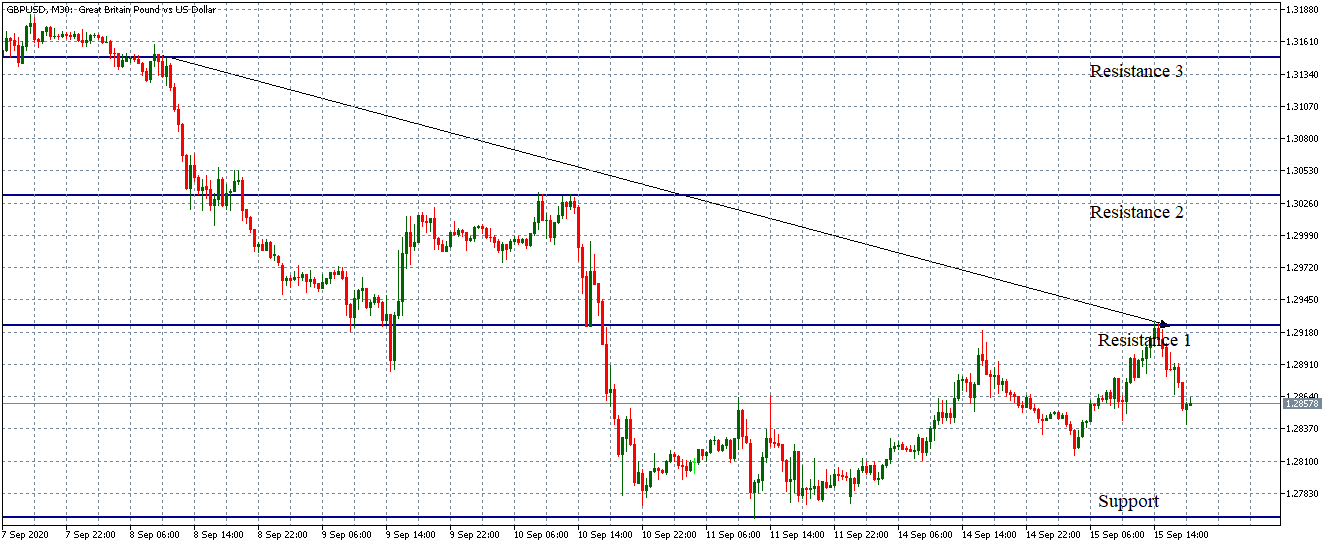

These timeframes are used to establish the current market trend. The intermediate timeframe in forex helps you to determine the magnitude of the trend observed with the long timeframe. It is expected to see more price fluctuations when using this timeframe, but the general trend should align with the long timeframe.

Day trader intermediate timeframe: 30-minute GBP/USD chart

As can be seen, the price pullbacks are more visible using the intermediate timeframe. The price fluctuations are more pronounced as you can see how the primary trend observed with the long timeframe is broken down.

Shorter timeframes in Forex

Depending on your forex trading style, the shorter timeframes show the most current and shorter changes in the price movements.

The shorter timeframes are used to determine the best entry and exit points of a trade. With shorter timeframes, you can quickly establish whether the price has reached the support and resistance levels.

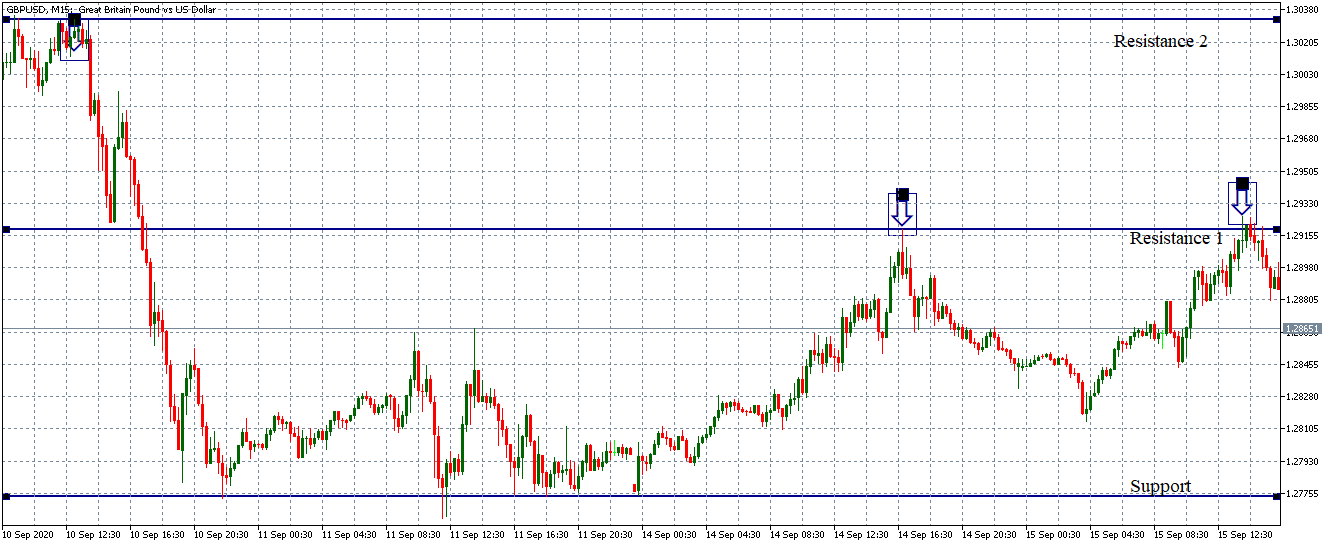

Day trader shorter timeframe: 15-minute GBP/USD chart

Using the 15-minute timeframe, the day trader can quickly establish the entry positions for shorting the EUR/USD when the price bounces from the resistance levels.

Trading three timeframes helps you establish the dominant trend, narrow this trend down while determining its magnitude, and finally establish the best entry and exit points. [wp_quiz id=”89198″]