Is forex trading riskier than stock trading? And Why? To answer this question we must analyze what is the best market to trade, whether Forex or stocks, and that is what we will try to reveal in this article because a person who is just beginning in order to know the different markets you have to decide in which of them you will make your investment and two of the best options are precisely Forex or stocks.

Over time, money is losing value as a result of inflation and a large part of your capital may disappear if you don’t work. So what you should do is have your resources constantly work for you. In order to achieve this goal, one of the ways to achieve this is to become a trader, a race full of emotions that begins when you choose a market to start trading. In the following paragraphs, we will make a comparison between two giants of the modern economy: stocks vs Forex.

The Stock Market

Stocks are financial instruments that provide the ownership of a company. Depending on the number of stocks held, a person can become the owner of a business together with the other shareholders and is entitled to the profits (or losses) that are given. It should be mentioned that the percentage of the company controlled by the investor is equal to the number of its stocks. The higher the number of shares you have, the greater your participation will be and you will enjoy better profits.

Thousands of people and institutions gather in the stock market to negotiate securities that represent ownership of several companies listed on the market. The stock market has been the main asset exchange market since the time of the industrial revolution. But thanks to the arrival of new technologies and the expansion of the Internet, other markets have emerged that counterbalance traditional actions.

The Forex Market

Forex, also known as the currency market, refers to the market where participants trade and exchange coins from any country. Currency is how money is officially issued by a nation’s central bank and serves as a means of exchange outside and within a given economy. There are people and companies that carry out transactions from different nations, therefore it is necessary a scenario in which it is possible to exchange these different currencies.

“We will analyze the most relevant aspects of Forex vs Stocks to determine which may be the best investment.”

Ease of Access

Forex trading, in contrast to the stock market, is not based on physical stock exchanges but is OTC (over the counter). This means that negotiations are conducted via the Internet and people can access them anytime and anywhere, which translates into superb accessibility.

We must know that today, the negotiations with stocks (and in general with any financial instrument) are conducted via the Internet. Anyone who wants to trade, whether with currencies or stocks, just select a broker, open an account and download the trading platform. In this respect, both the Forex and stock markets are easily accessible.

Leverage

First of all, it should be borne in mind that, both in stocks and in the foreign exchange market, entry requirements are minimal and in some cases, it is possible to open accounts without making any deposits. An important element to consider is leverage, which can be accessed when negotiating. This leverage is like a loan that the broker makes to its clients to make a trade with more money than we have.

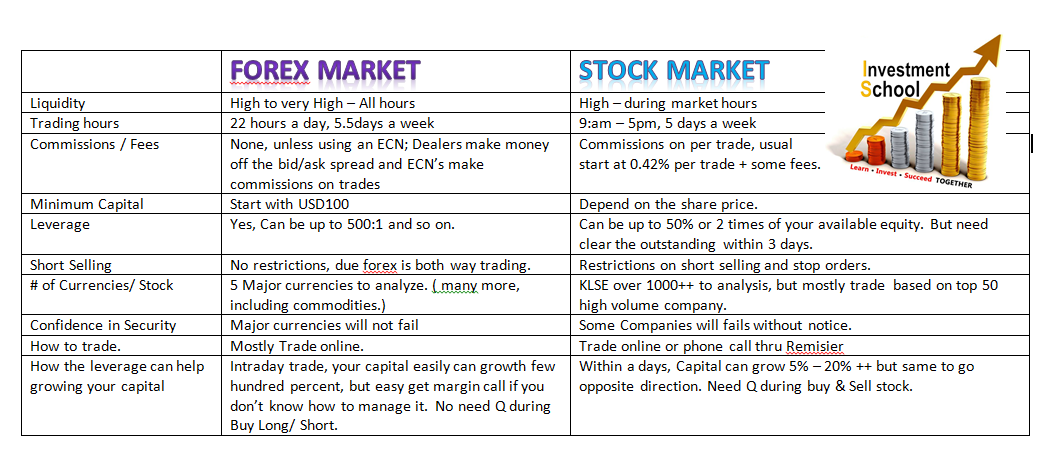

In the stock market, the usual leverage is 1:2 (you can borrow 2 dollars for every dollar you have of capital), while in Forex it can reach 500:1. There is no need to be too smart to choose the best option. The high margins offered by brokers give this point to the currency market. But…leverage can become a problem for some traders, especially for those starting out in this market. This tool allows you to multiply profits, but the same will happen with losses. So you need to use leverage with responsibility and knowledge.

Another aspect to compare between Forex and the stock market is the different trading costs. In Forex, commissions are usually lower due to the large number of brokers that exist. On the other hand, stock exchange brokers charge commissions, spreads, and other fees that can significantly increase commercial costs.

It may seem that these small costs do not have much incidence because they will mean a few cents, but as time goes by you will see how they add up and become a major expense. These small expenses can deplete a portion of your earnings. At this second point, the Forex market takes the lead with its higher leverage ratios and lower transaction costs.

Operating Hours

Probably the most obvious difference, when comparing Forex to stock trading, is trading schedules. The stock market is limited by timetables of exchanges worldwide. Forex is open 5 days a week and 24 hours a day. This Forex feature allows people to trade at any time, providing for investors who have traditional jobs. But, although the Forex market is widely accessible, there are hours with higher volumes and therefore better opportunities.

One of the features of Forex is that volatility and liquidity levels remain relatively constant over time, allowing traders to generate profits in the short term. However, that doesn’t mean that you should envy yourself to the market and spend all your time viewing the graphics. The market won’t go anywhere.

Another positive aspect of foreign exchange trading is that if you open a position and get important information that forces you to close the position, you can do it immediately without waiting for the opening of the stock exchange. When deciding between trading stocks or currencies, the advantage of Forex is obvious. Its great accessibility is a plus.

Diversity of Offers

One of the most diverse markets is the stock market. There you will find the stocks of hundreds of open capital companies belonging to a wide variety of sectors and industries. This may seem positive, but such diversity can become confusing and prevent a quick analysis of available options. Can you imagine having to analyze hundreds of stocks and then buy just one of them?

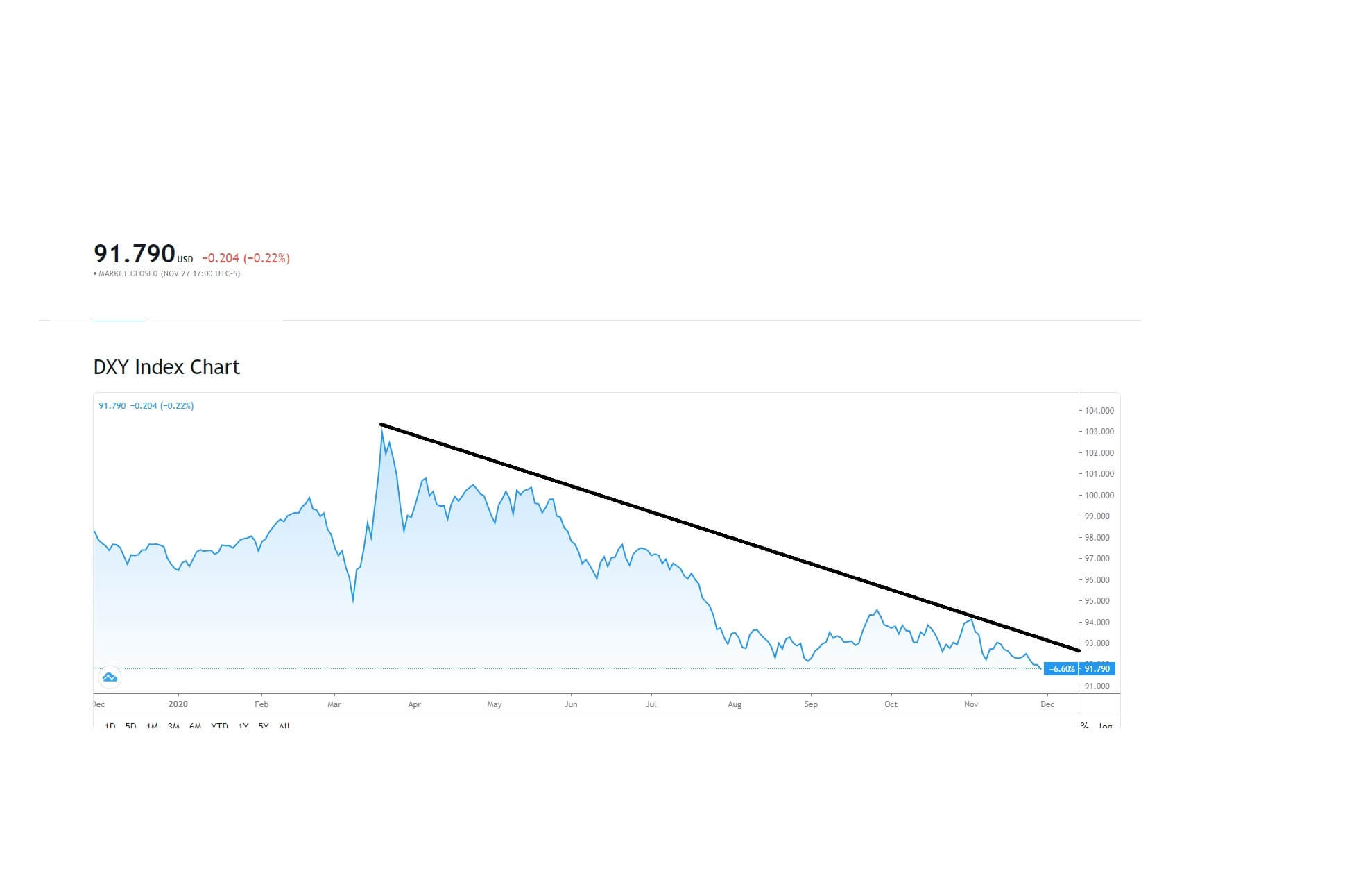

Looking at the Forex market versus the stock market, it is possible to show that with currencies the scenario is significantly different. In Forex, the most quoted instruments are the so-called major pairs (groups of currencies composed of the most important currencies) and the US dollar is part of the vast majority of transactions. A trader who is aware of the key factors affecting the dollar will have a good overview of the other currencies.

Similarly, most Forex brokers offer one more possibility: CFDs (difference contracts). These instruments allow transactions with different assets without actually having them. ¡ That means even on Forex you can trade stocks! And so, when comparing Forex vs stocks, it is the currency market that takes the lead once again thanks to CFDs.

In conclusion, thanks to its greater accessibility, vast amount of possibilities, and superior freedom, Forex manages to position itself as a better investment option than stocks. While it is true that Forex risk may be higher because of increased leverage, we have options to have good risk management and minimize them.