Monetary policy reports are the result of the studies carried out by the Federal Open Market Committee (FOMC) showing how the United States economy behaves. With this report, you can analyse different local and foreign variables such as the real growth of the United States, inflation, unemployment rate, financial sector, the balance sheet of the central bank amongst others. In addition to exports and imports, the behaviour of the dollar with respect to other currencies such as the euro and the behaviour of its main trading partners.

The monetary policy report of the US central bank analyses the current state of the economy with its most important variables such as growth, inflation, the state of the internal financial market, and even the state of the economies of its trading partners, separating them according to the size of their economies. Also, depending on how the economy is at a given moment in time, short and long-term projections are made for the US economy, which can be taken as a signal about the possible measures to take by the federal reserve.

A review of the monetary policy report that was issued in February 2017 will be made first, then we will present the conclusions reached in its July report, and finally, we will analyse how the economy has behaved in recent months. Then we’ll try to assess if the central bank was right at the beginning of the year about its projections in the economy.

The FOMC is mandated to promote the highest possible level of employment, stable prices and moderate long-term interest rates. That is why their work is so important, given the fluctuations of the economy. So, the committee should periodically analyse how the state of the economy is, to decide whether to intervene or not, to reach their long-term goals. It is important to keep in mind that actions in monetary policy do not affect the economy immediately, they take time for the economy to react to these measures given the delay in transmission.

Monetary policy determines the rate of inflation in the long term, and the committee is the one that stipulates which long-term inflation target will be the most beneficial for the economy. When this objective is communicated to the public, the expectations of the agents are clarified, and the behaviour of the economy can be better predicted, given the knowledge about these expectations.

The maximum level of employment is determined mainly by non-monetary factors that affect the structure and dynamics of the labour market, for which no specific targets are set on the unemployment rate, since it would not be adequate, given the lack of tools to intervene this market. It is for this reason that when the monetary policy is determined, the committee seeks to mitigate deviations from the objective of long-term inflation and try to make the unemployment rate low without being its priority. Most times, these two variables are complementary, but in situations where both have imbalances and are far from the objectives, the committee will decide which will be the path of decisions for both variables to reach their objectives.

In February 2017, in its monetary policy report, the central bank observed a strengthened labour market, on the second semester of 2016. During this period, 200,000 new positions were added on average per month, which is a sign of a better behaviour of the economy compared to the first semester of that year; although slightly below the 2015 figures, when it reached up to 225,000 new jobs per month.

The unemployment rate decreased slightly from mid-2016 to 4.8% in January, which was in line with what was expected by the FOMC and with the figure that they estimate as the natural long-term figure in unemployment. The participation rate in the labour market rose at the beginning of 2017 thanks to its excellent labour market dynamics, but this effect they did not estimate it will continue, due to a demographic change in the population. Finally, concerning labour market, wages increased slightly since the end of 2016, which reflects a healthy market.

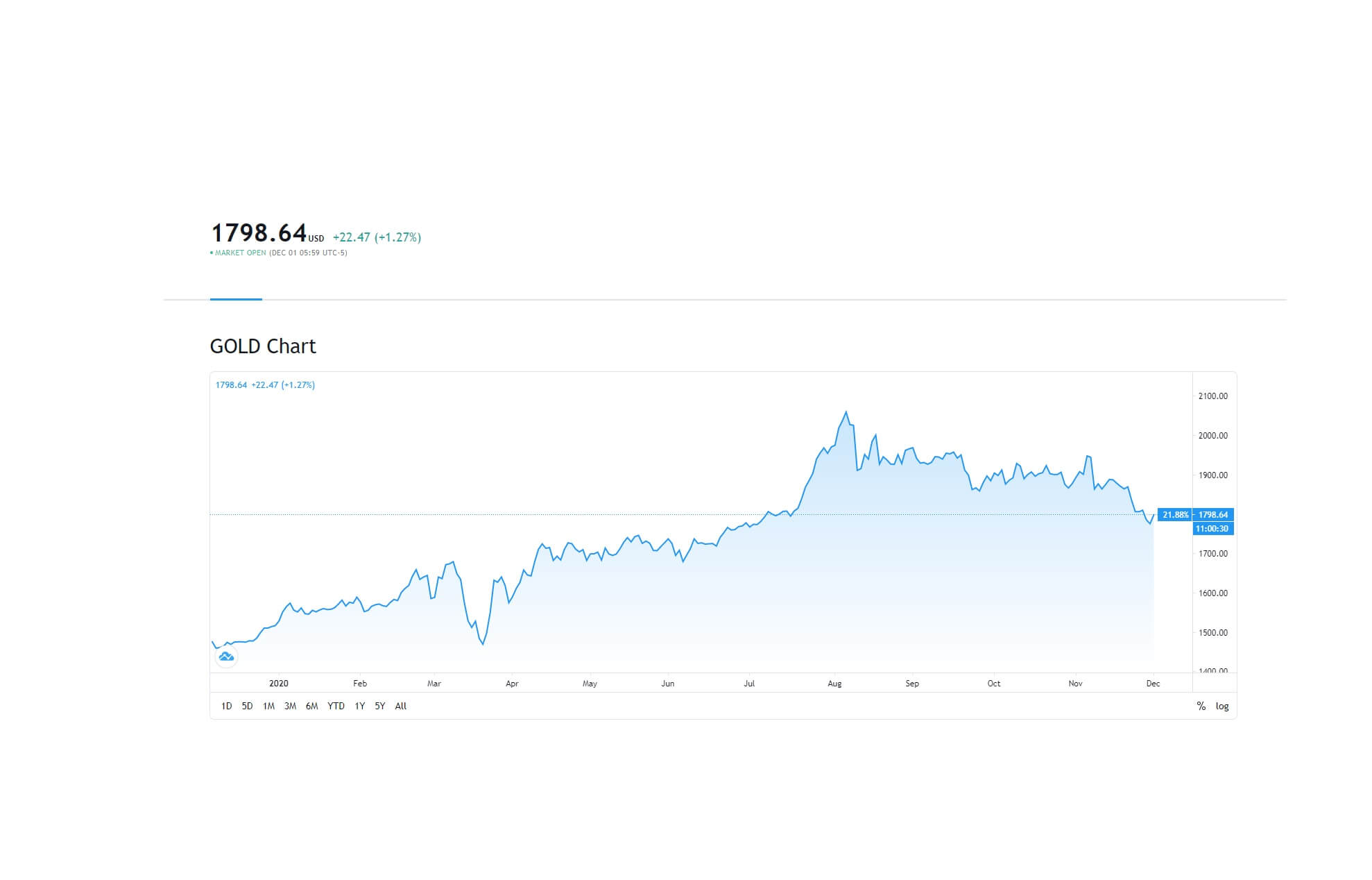

Regarding inflation, an increase was observed at the end of 2016 but remained below the expectations of the long-term FOMC, which is 2%. The 12-month inflation of 2016 was 1.6%, which means an increase of 1 point more than in 2015, which, in turn, reflects that the cost of energy has increased. That was a determining factor for inflation to be low in 2015. The personal consumption expenditure indicator, which excludes energy and food items, provides a better indicator of how the behaviour will be in the future. That indicator figure was at 1.7% at the end of 2016, which shows that during this period of time inflation has revived, and also its projections by different agents and analysts, but the 2% FED goal had not yet been achieved.

The real growth of the second half of 2016 was reported at an increase of 2¾%, only 1% more than in the first half of 2016. Expenditure on consumption has expanded but within moderate magnitudes, thanks to better income of the population and its effect on the wealth of families. The housing market has gradually recovered, and there were some stimuli with the fiscal policy on all levels of government, which stimulated the economic growth observed in 2016. The levels of business investment were weak throughout that period, but they achieved a reasonable level of earnings growth at the end of 2016.

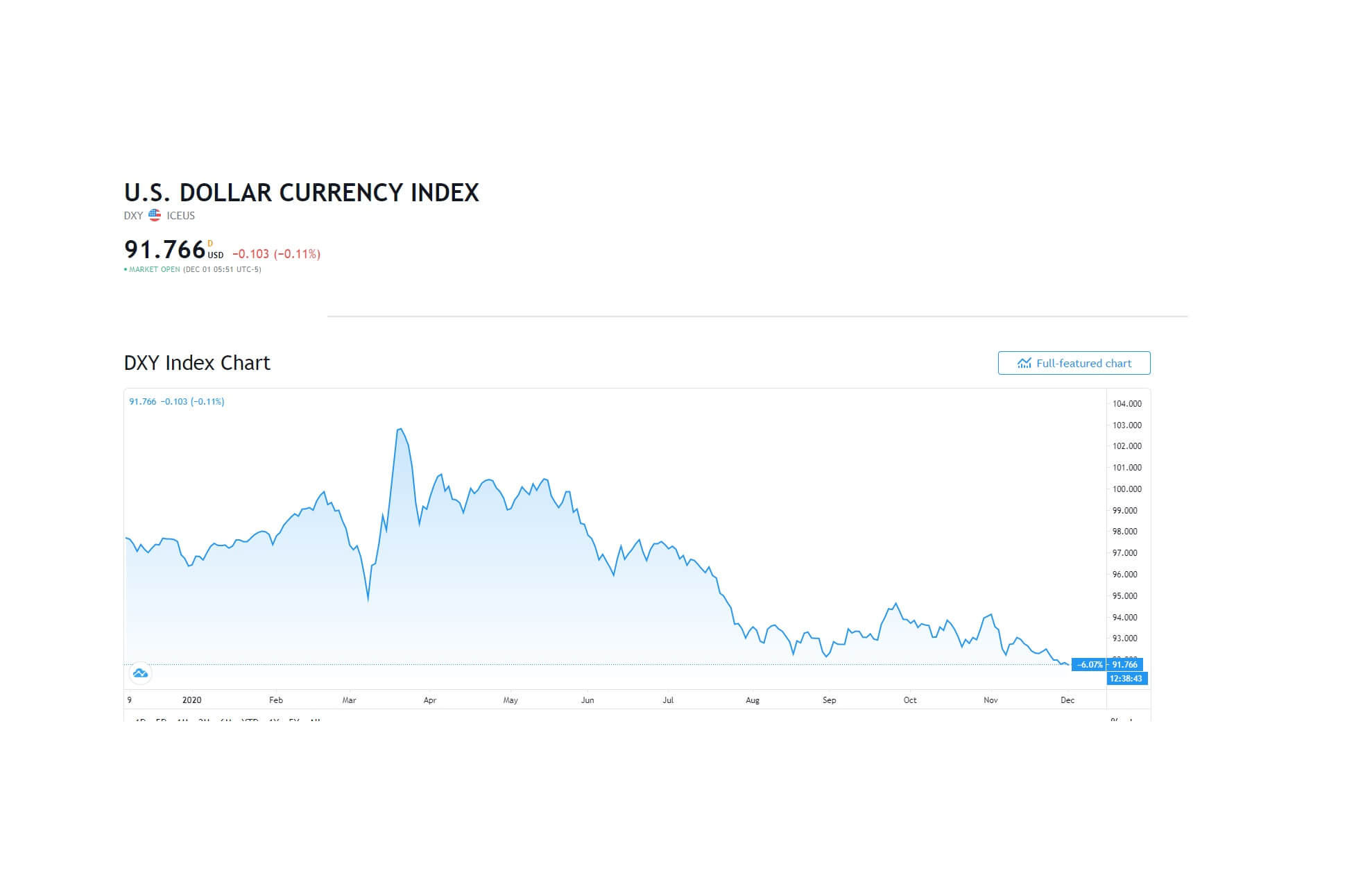

A slight recovery on exports was observed in the third quarter of 2016, but in general, throughout the year the behaviour of exports was weak, showing the effects of a strong dollar worldwide and the mediocre growth of the economies that trade with the United States.

Domestic financial conditions have sustained economic growth despite slight increases in the interest rate by the FED in the last months of 2015 and 2016. The vulnerability of the financial system of the United States remained moderate since mid-2016, thanks to well-capitalised banks and significant liquidity reserves. The relationship between household debt and income changed little in the last quarter of 2016 and was well below the maximum level reached about a decade ago.

In December, the FOMC increased the objective of the federal funds’ rate, which reflects that, in the future, inflation will reach the objective 2%, and in addition to the good performance of the labour market. The committee also clarified that it did not know when these rates or their magnitude were going to increase since it would depend on how the economy behaved, and on inflation and the labour market for 2017. The committee expected that, for the current year, the conditions remained positive, as well as inflation, which would lead to gradual increases in the federal fund’s rate, but below the long-term level expected by the agent’s rate.

In conclusion, in the February 2017 report, the committee observed that economic growth was driven by financial conditions due to the low cost of debt for many households and businesses, and some gains in household wealth, thanks to the advance in the stock market at the end of 2016 and better conditions in the labour market. The negative aspect was the poor performance of exports due to the strength of the dollar with respect to the currencies of its trading partners.

In terms of inflation, a slight recovery was observed in 2016, which is a relief for the central bank, since, in previous years, the fall in oil prices and the increase in terms of the dollar trade since 2014 caused prices to fall. Given this recovery in inflation, the FOMC’s goal in the federal reserve rates will increase for 2017, which will be added to the increase in the rate in 2016 and 2015 after the rate was close to 0% in years after the 2008 crisis, which was low to encourage growth and recovery of the economy.

Despite having observed good economic performance in 2016, the objective of the federal funds rate was below the long-term objective, which showed that the bank, despite seeing good signs in the economy, was cautious at the beginning of 2017, because of the drastic increases in interest rates.

The projections made in the February 2017 report show that, under an appropriate monetary policy, real gross domestic product growth should increase in 2017 and 2018, but not much beyond the long-term potential. Most analysts project that unemployment will be below long-term unemployment over the next few years. Finally, they expect inflation to reach or exceed 2% in 2018 and 2019, which would be positive since it would stay at the FOMC target. The following table shows the projections made in February by the bank’s committee.

Graph 41. Economic projections of Federal Reserve Bank. Retrieved December 30, 2017, from https://www.federalreserve.gov/monetarypolicy/mpr_default.htm

In the July 2017 report made by the central bank committee, there was a slight increase in economic activity in the first half of the year for the United States and the labour market continued to strengthen. The downside is that inflation slowed a bit in these months which contrasted with the projections made months ago when it was believed that inflation would be close to the 2% goal set by the committee. Despite this, at the July meeting, the FOMC increased its target of the federal funds rate and gave clues to the reduction in the size of its balance sheet in a gradual manner.

As for the labour market, it has continued to strengthen in the first half of 2017, just as it did in the two previous years. The jobs created were 162,000 per month on average which shows a slowdown in the figures shown by the market in 2016, but remaining with positive numbers for people seeking employment. The unemployment rate decreased to 4.3% in May, which was below the level expected by the FOMC for the long-term rate.

Consumer price inflation, year-to-year, reached 2% (FOMC objective) at the beginning of the year, but as the months advanced, inflation softened its trend, staying below the committee’s objective. The reading reached in May was 1.4%, slightly higher than the previous year’s inflation for the same period, which excludes food and energy prices, (Core inflation) as indicated above. It is an indicator reflecting how the behaviour of total inflation will be in the following periods, and May’s 1.4% figure reflects a deceleration in inflation. These are some historical hints showing that the inflationary trend has slowed down in the first half of 2017.

On the other hand, economic growth had an annual increase of 1½% in the first quarter of 2017, but evidence was found that this behaviour was not as positive in the second quarter. Consumer spending slowed in the first half of the year, but there were some signs at the end of May that suggested a rebound in consumption thanks to increases in household wealth and better expectations on the part of consumers. Investment in business increased in the first semester which is positive given the poor performance of this item in 2016. Finally, the housing market continued its slow recovery, and the foreign activity helping the economic growth in the United States had good behaviour.

In terms of financial conditions, domestic credit conditions for businesses and households have continued to support economic growth and stock market prices have continued to rise. The risk of the banking system has remained moderate thanks to the liquidity of the banks. Household debt as a proportion of GDP remains moderate and debt contracted by non-financial companies, although high, has been flat, and, even reduced in comparison to recent years.

The interest rate policy saw its target increase by the FOMC by the end of the year but remaining suitable for the US economy to continue growing, and for the inflation rate to remain at 2%; which would be utmost beneficial to the economy. The FOMC continues to hope that the economy will continue to grow for the next few years, the labour market will continue strong and inflation will reach 2% with the slight adjustments it will make with monetary policy.

Although these are the long-term objectives, in the short term, it expects inflation to stay below 2%, which will limit the interest rate hikes and therefore affect the decisions that the committee may take to direct the economy towards its objectives. Consistent with this, most agents expect the federal funds rate to be below the long-term rate in 2018.

Global productivity slows down, and this may be due to lower contributions in technological advances in the production of goods and services, as well as being a consequence of the crisis that occurred in 2008, which could have generated a significant impact in the development of new technologies.

The strength of the labour market is evidence of other indicators such as lower unemployment insurance claims, higher hiring and low dismissal rate. The only point that is not that positive in the labour market is the increase in salaries, which has been minimal due to those already mentioned productivity problems. Since 2008, productivity has only increased by 1% per year.

US exports increased more rapidly in the first half of 2017 than in 2016 thanks to the agriculture sector. At the same time, the real growth of imports was reduced in contrast to the behaviour they had during 2016. This could be due to a slight depreciation of the dollar at the beginning of 2017, as opposed to its former trend, between 2014 and 2016.

The following graph shows the main projections of the committee for the following years. The main estimates were that real product growth would be above natural long-term growth in 2017, an unemployment rate lower than that expected by the FOMC. Inflation is projected to be below its 2% target, but expecting it to accelerate in the next few years, leaving more space for monetary policy.

Graph 42. Economic projections of Federal Reserve Bank, June 2017. Retrieved December 30, 2017, from https://www.federalreserve.gov/monetarypolicy/mpr_default.htm

If we examine the latest two reports of the central bank, we could observe that they presented more optimistic projections about the real growth of the economy at their June meeting compared to the one carried out at the end of 2016. The projections for the next two years continued to be stable relative to this variable. The change in labour market projections was also positive, observing a lower unemployment rate than projected in the previous year.

The negative aspect for the committee was the slowdown in the inflation rate for 2017, which caused the bank to refrain from raising rates in some meetings, limiting monetary policy and the decisions the FED expected to make. Even long-term inflation expectations were reduced, showing some concerns about prices. This is the only concern now due to the good performance of the economy in general, and by the labour market.

In conclusion, the bank’s monetary policy reports agree from one period to the other without drastically changing its conclusions about the behaviour of the economy, the labour market, inflation and other indicators. But since some variables are more sensitive than others, and therefore they may experience higher variability, it is normal that the inflation projections may change from report to report. As it was analysed, the United States economy is healthy with specific sectors that have marked the real growth, very good performance in the labour market allowed for an increase in the wealth of households, and a solid financial system that made possible to inject liquidity to the housing, investment and consumer market. When reading both reports, we recognise that the sectors of the economy are dynamic, and not always growth was generated by the same sectors. For instance, consumption was important in 2016 and agriculture in 2017 in conjunction with the external sector, which, conversely, had poor behaviour during 2016.

©Forex.Academy