Introduction

Our previous lessons have covered where you can access the Commitment of Traders Report and the components contained within the report. In this lesson, we discuss how you can use the Commitment of Traders Report in forex trading.

Since the COT report gives the market sentiment in forex, this report’s publication should affect the price action in forex. Most forex traders pay attention to the non-commercial traders’ category of the COT report. The interest with the non-commercial traders is because these traders are considered speculative participants.

The nonreportable positions held by small-scale retail traders are not significant enough to move the markets. Similarly, since commercial traders are not considered speculative traders, the impact of their positions on price action tends to be subdued.

How the COT Report Affects Price Action?

When the non-commercial traders are accumulating their positions, it affirms a particular trend. Let’s take the AUD/USD, for example. When non-commercial traders, over time, are accumulating futures short position on the AUD as the AUD/USD pair falls, is a confirmation that this downtrend will persist. Conversely, when the non-commercial traders are accumulating future long positions of the AUD as the AUD/USD keeps rising, it is a confirmation that the uptrend will continue. This way, you can use the COT report as a trend confirmation indicator.

The COT report can also be used to indicate the overbought and oversold regions. The non-commercial traders, i.e., speculators, have a limit on how much they can buy or sell. These traders will reach a point where they would want to close their positions and take profits. Furthermore, when in a persistent uptrend, speculators might feel it’s no longer profitable to keep buying futures contracts at higher prices. Similarly, in a downtrend, these traders might not consider it profitable to keep selling at lower prices.

When the speculators have reached their critical limits in the forex futures, they begin reversing their trends. For day traders, the impact of the COT is diminished since its effects are long-term.

How the COT Report Publication Affects Forex Charts?

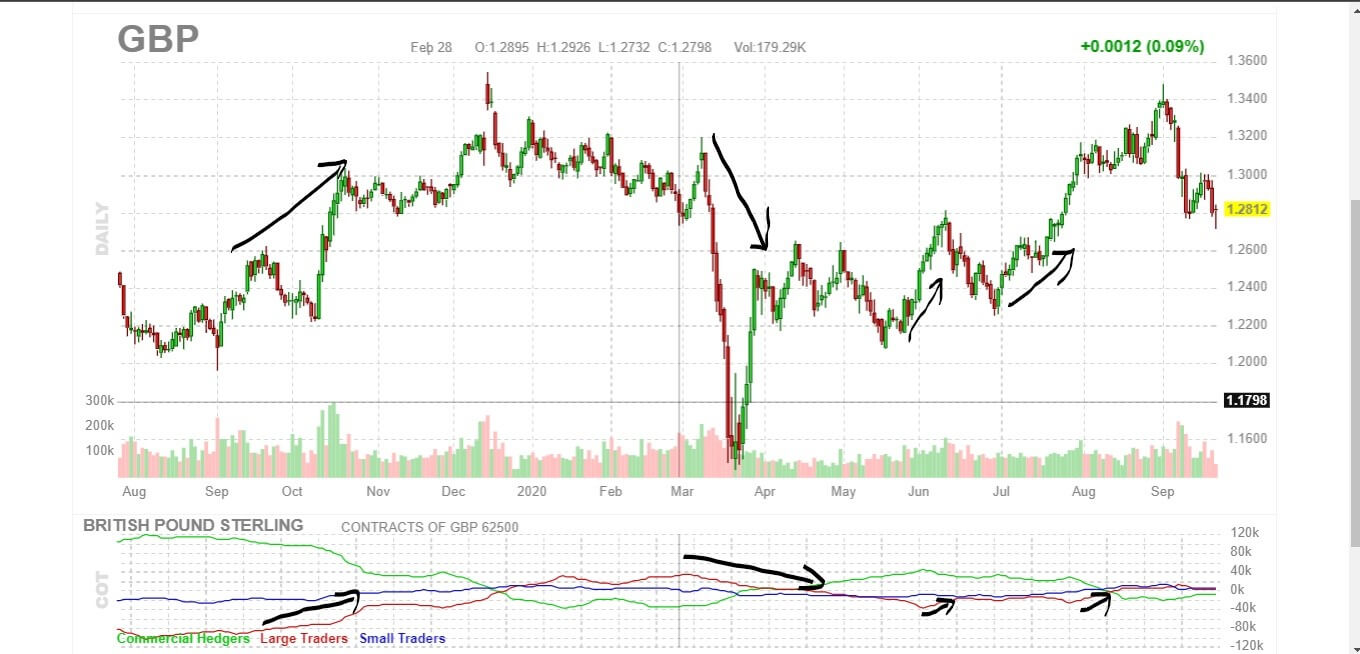

The screengrab below is GBP futures. At the bottom, if the COT indicator is showing the trend of commercial traders, non-commercial traders, and retail traders. In this case, we are interested in the non-commercial traders (i.e., large traders) since their positions influence the trend.

As you can see, the market moves at pace with the changes in the positioning of the large traders. [wp_quiz id=”89690″]