Introduction

Our previous lesson covered how you can use the Commitment of Traders report to trade in the forex market. In this lesson, we will learn how you can use the COT report to identify the tops and bottoms, i.e., the levels where a currency is overbought or oversold.

Any forex trader would know that the best timing for a reversal trade is when the market is at extreme levels. The COT report helps us understand the trades’ volume and how the different types of traders are positioned. In the previous lesson, we learned that non-commercial traders’ positioning could be used to determine the market trend. On the other hand, commercial traders accumulate their trades around extreme levels where they believe a market reversal could occur. Thus, the positioning of hedgers can be used to determine the market tops and bottoms.

Now, let’s see how you can identify these extreme levels in forex using the COT report.

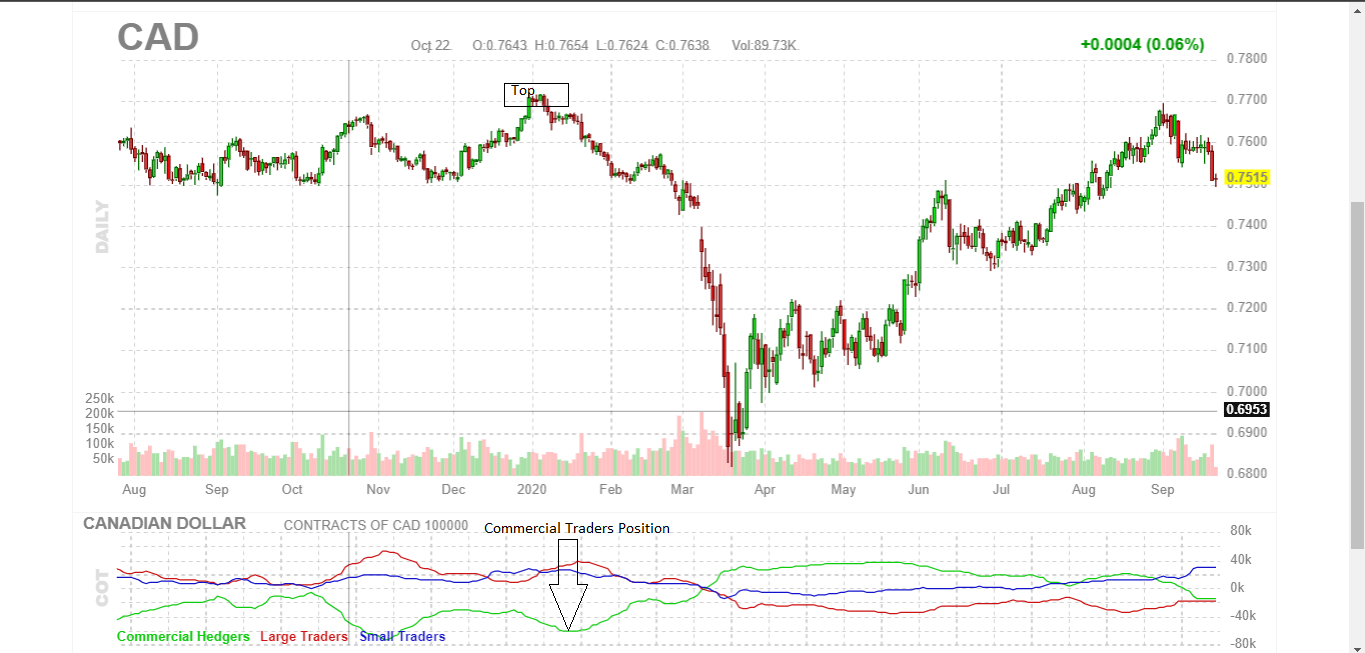

How to identify Tops (Overbought Levels) Using the COT Report

It is worth noting that when the markets are rising, the non-commercial traders are buying, i.e., they are bullish. Conversely, the commercial traders (hedgers) are bearish when the markets are rising, meaning they are actively shorting the futures contracts in a bullish market. Therefore, in a bullish market, when speculators continually go long as the hedgers keep shorting, a market top will form.

However, it is almost impossible to predetermine a market top. The best way to spot a market top is to notice a reversal beginning to occur in the market when the spread between the commercial traders and non-commercial traders has widened.

The screengrab above shows a market top formed when the short positions by commercial traders were at maximum. Also, notice that the spread between the commercial and non-commercial traders was wider.

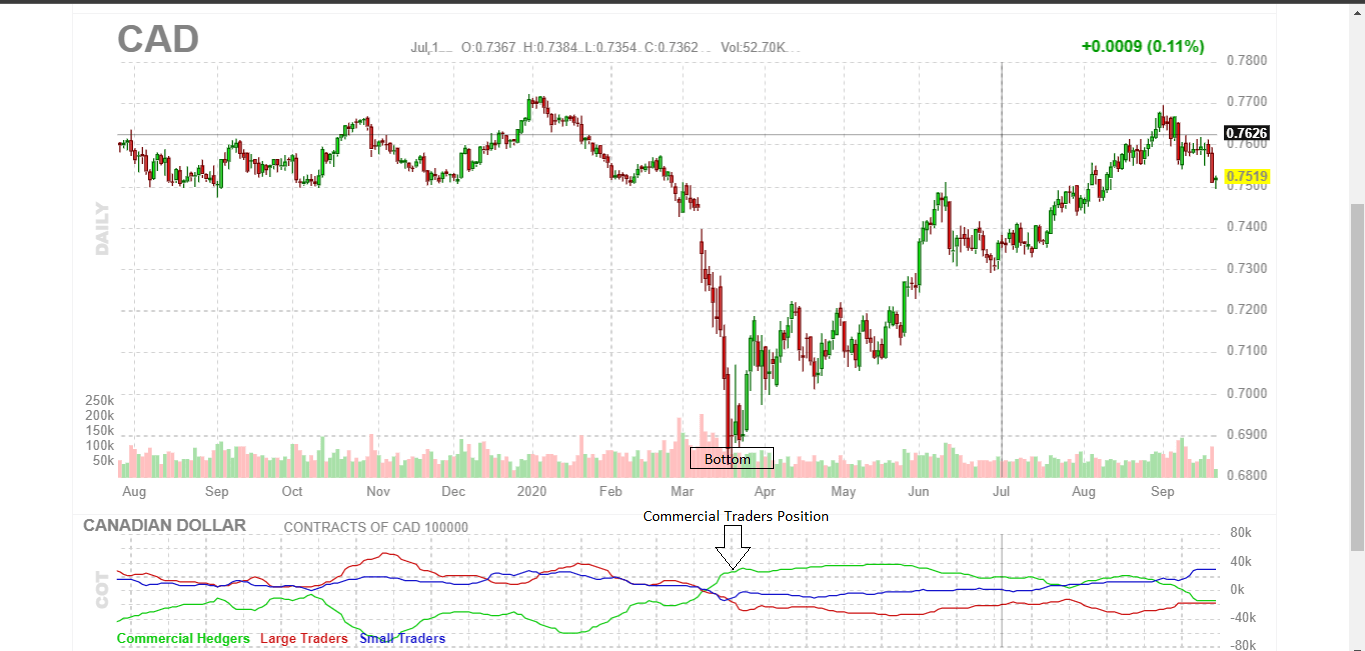

How to identify Bottoms (Oversold Levels) Using the COT Report

When the market prices are falling, non-commercial traders are bearish while the commercial traders are bullish. Therefore, a bearish market will reach the bottom when the non-commercial traders keep selling, and the commercial traders maximize their futures bullish positions.

The best way to spot a market bottom is to notice a bear market trend reversing while the spread between the commercial traders and non-commercial traders has widened.

The screengrab above shows a market bottom forming when the long futures position by the commercial traders was at the maximum. Also, note that the spread between the commercial and non-commercial traders was widest at this point. [wp_quiz id=”89702″]