Introduction

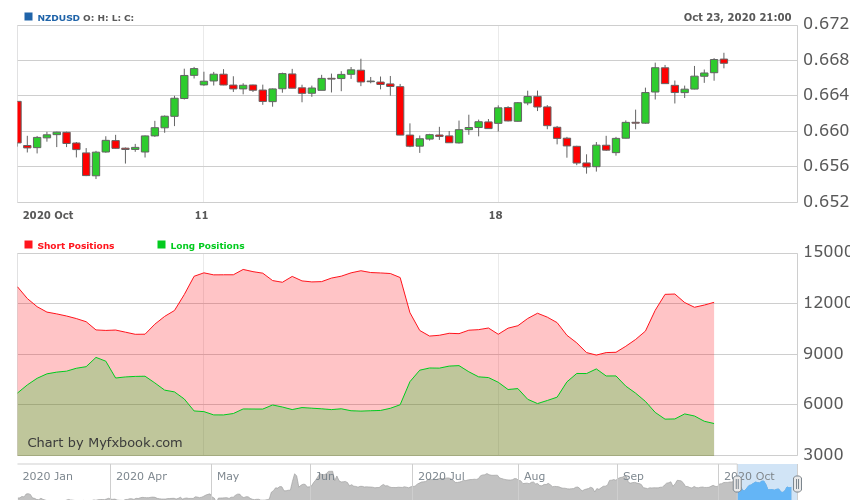

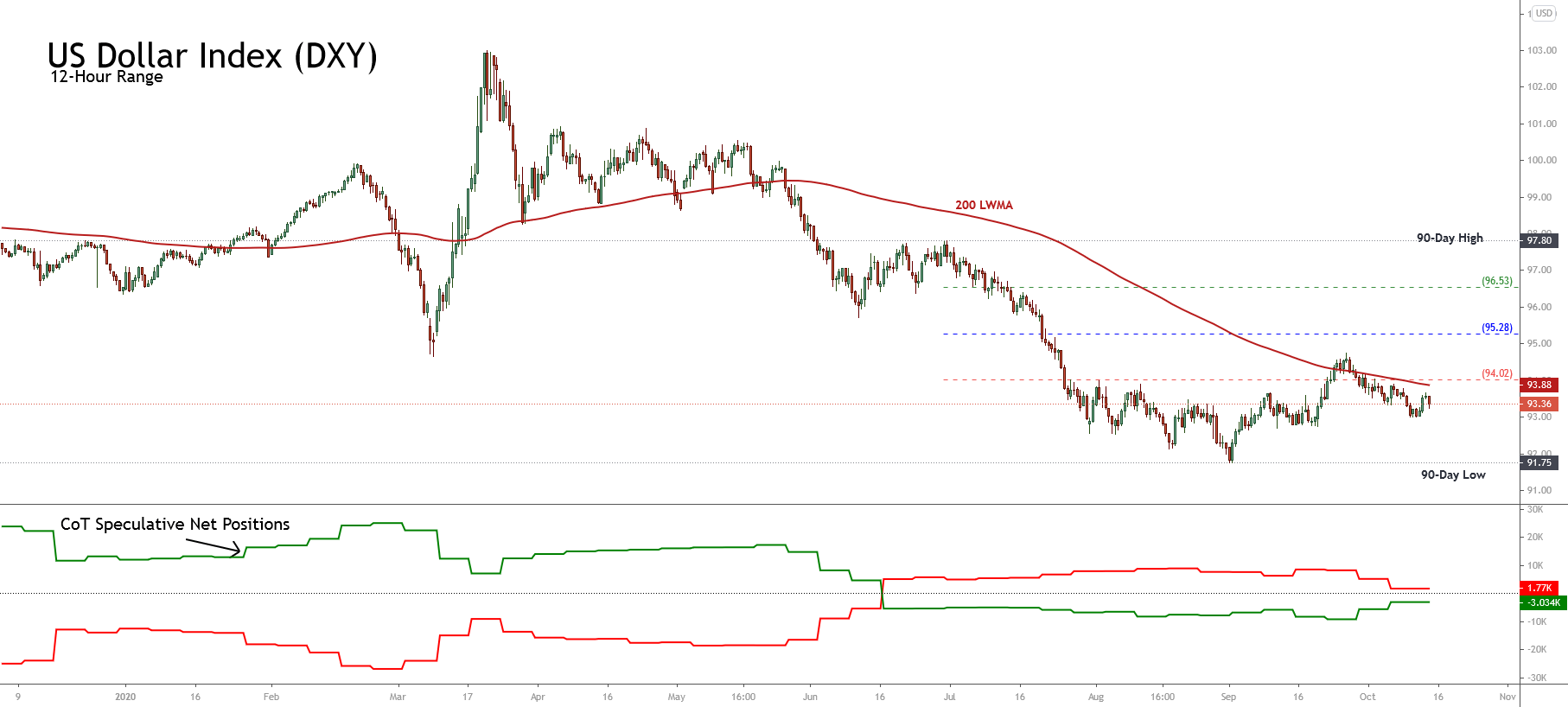

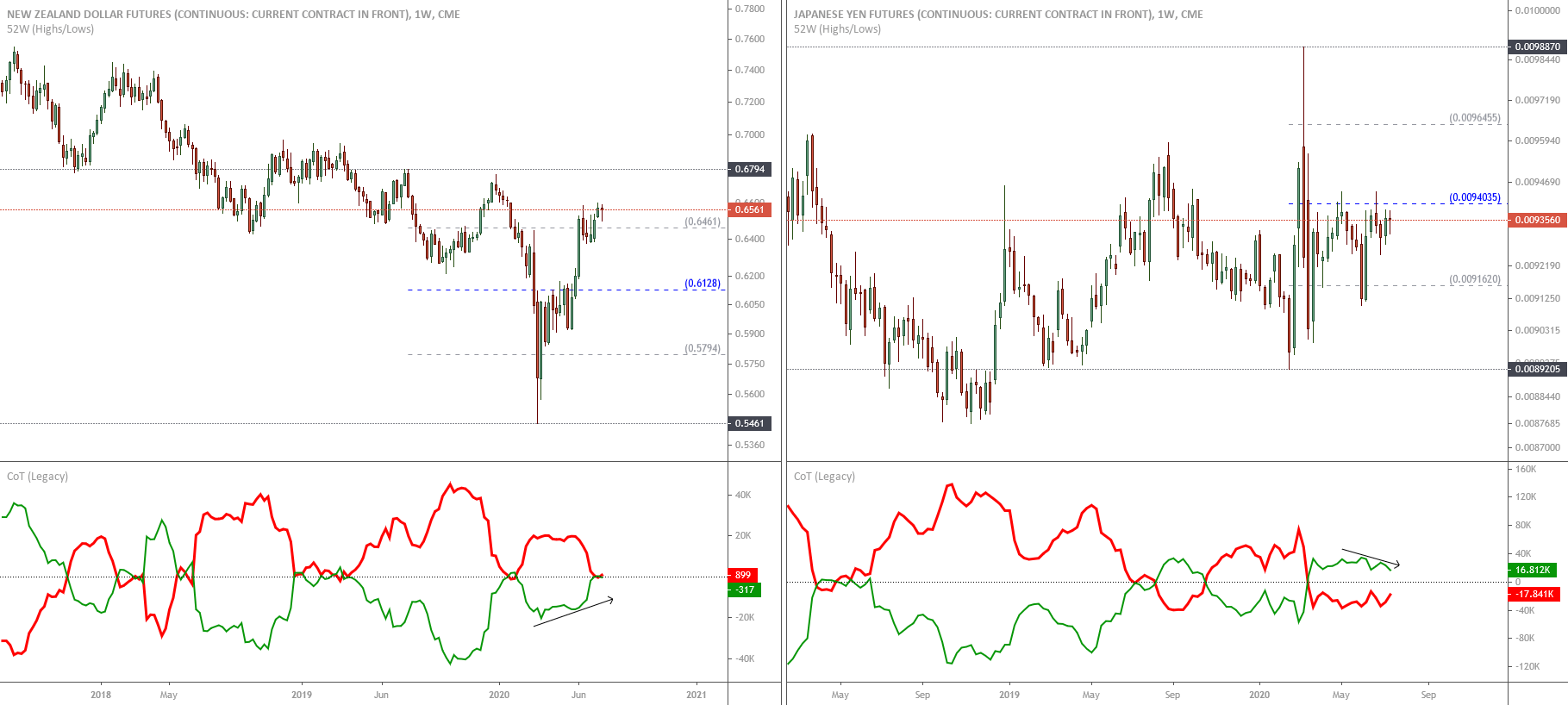

If you have gone through the previous courses, you already have a solid knowledge of what market sentiment is. You should also be able to create your COT index indicator to spot market trends and points of potential reversals.

To recap, here are a few things you should have in mind by now.

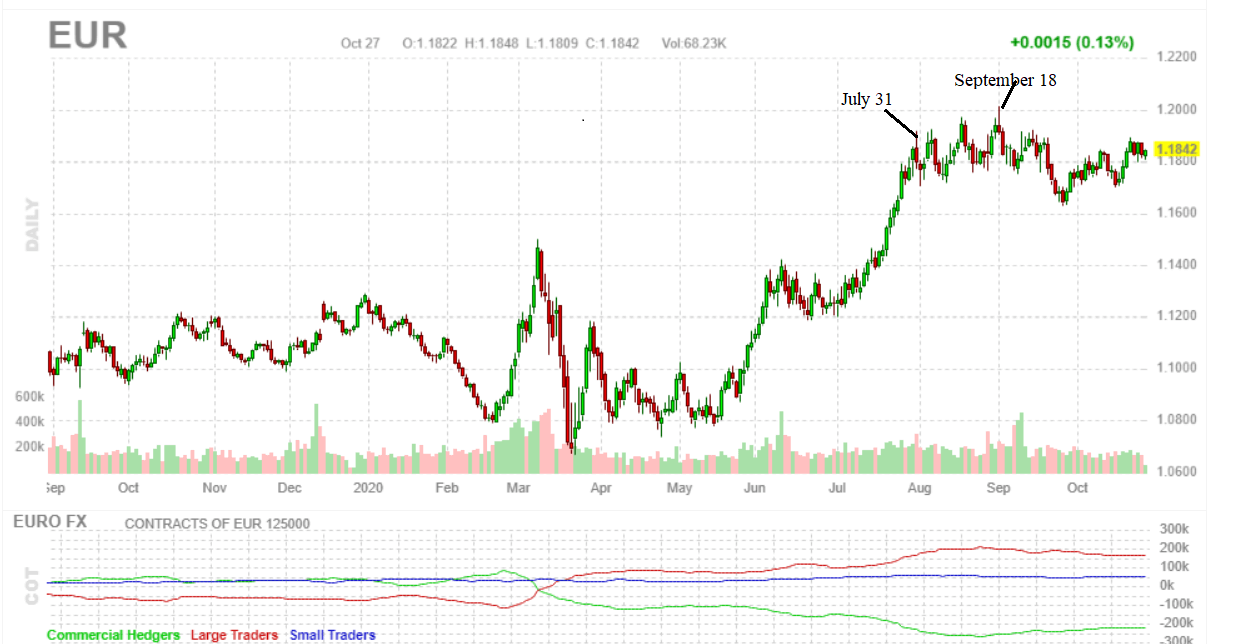

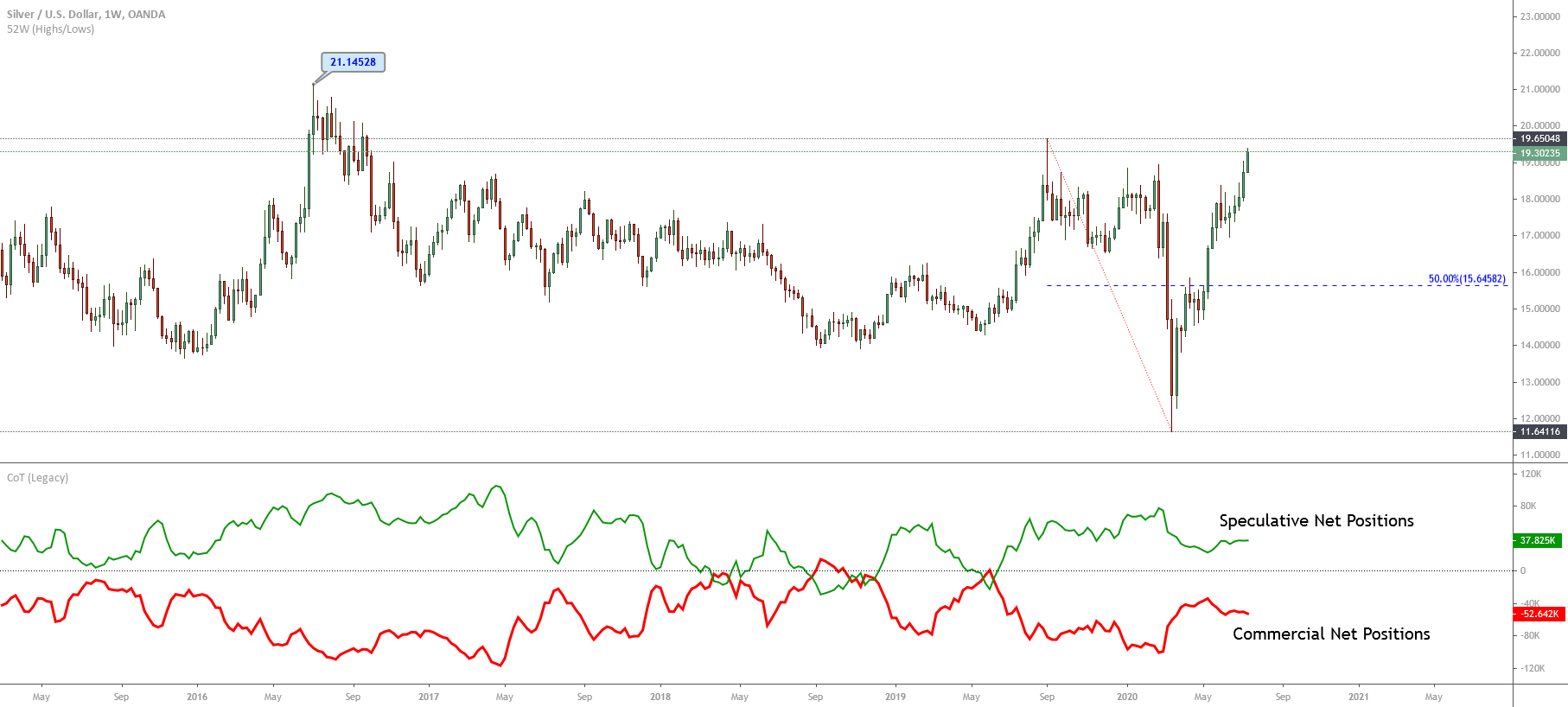

- The Commitment of Traders (COT) report is the best gauge of the forex market sentiment in

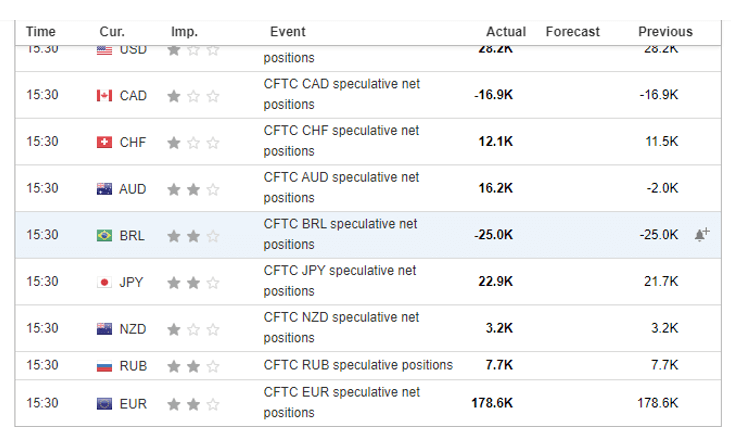

- The COT report tracks the trading activities by commercial, non-commercial, and retail traders in the futures market.

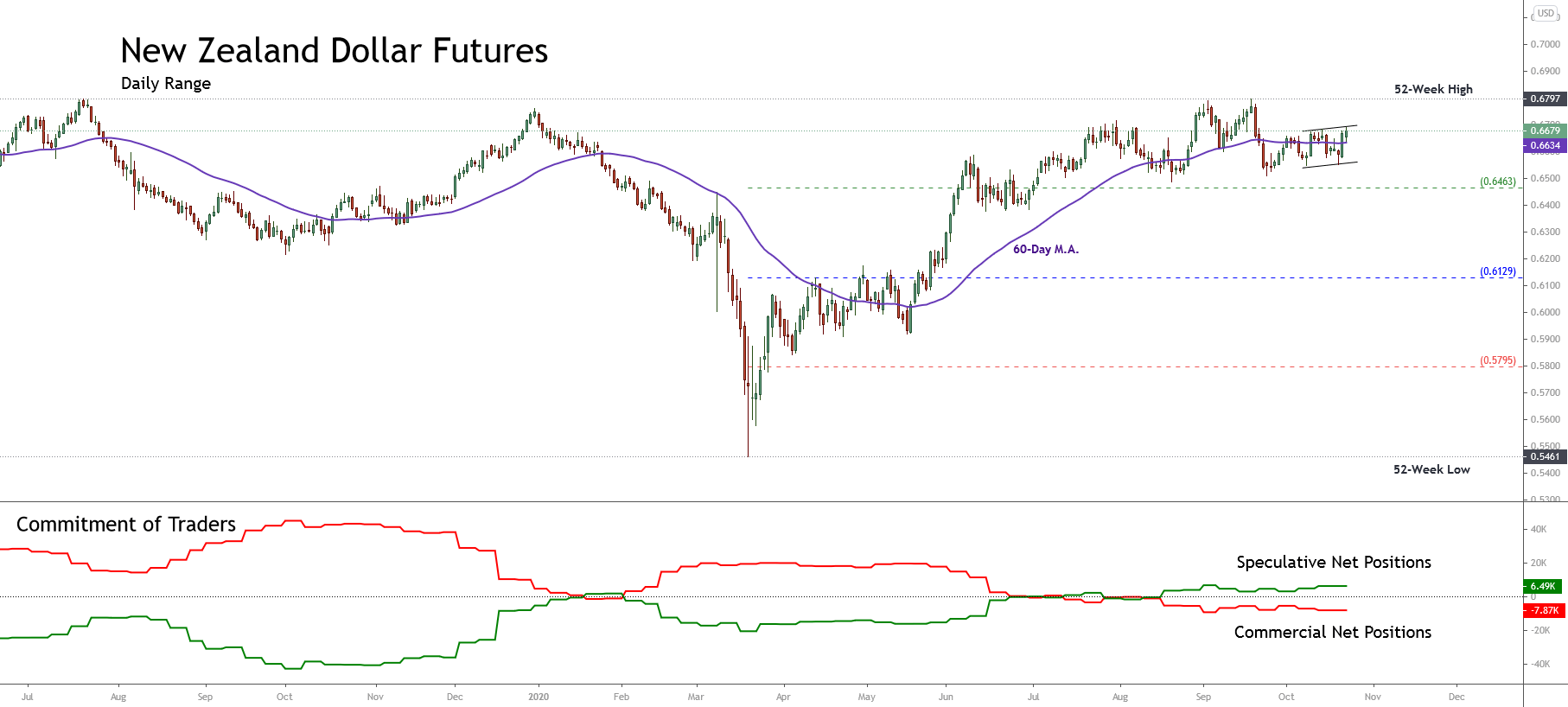

- In the futures market positioning, the commercial and non-commercial traders are usually on opposite sides. i.e., when non-commercial traders are long, commercial traders are short.

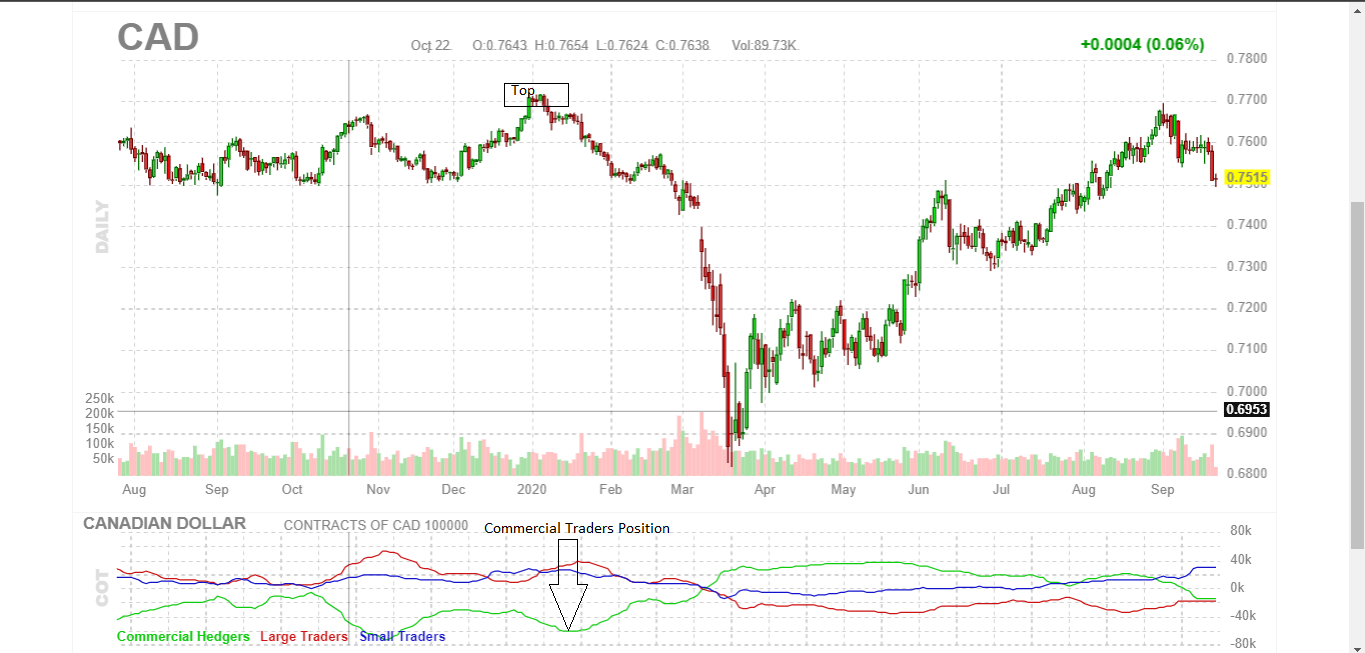

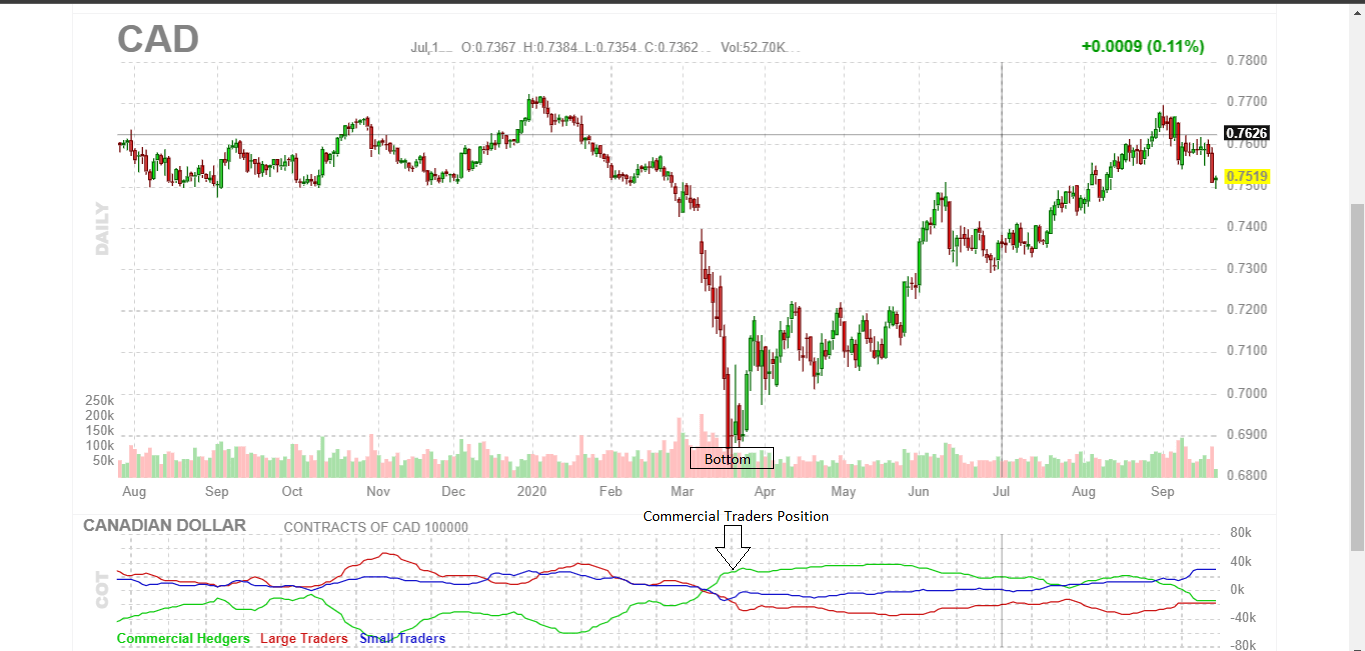

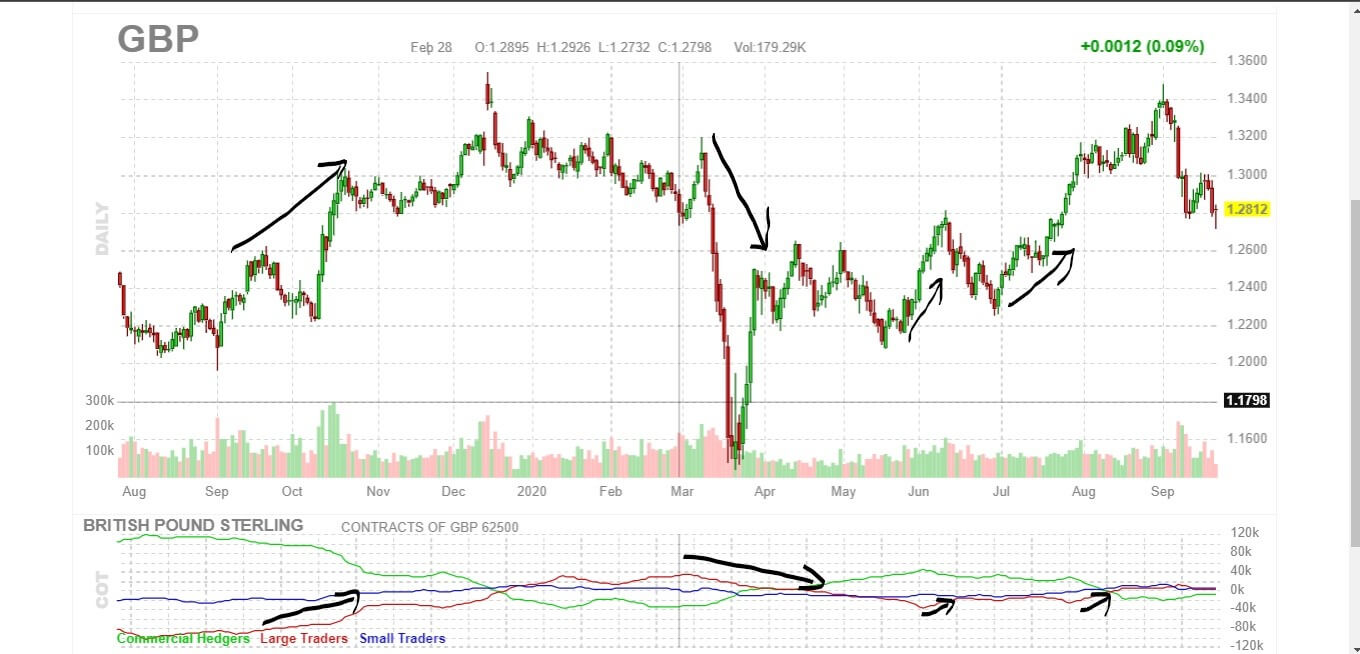

- A market reversal can be anticipated when the spread between commercial and non-commercial traders is the widest.

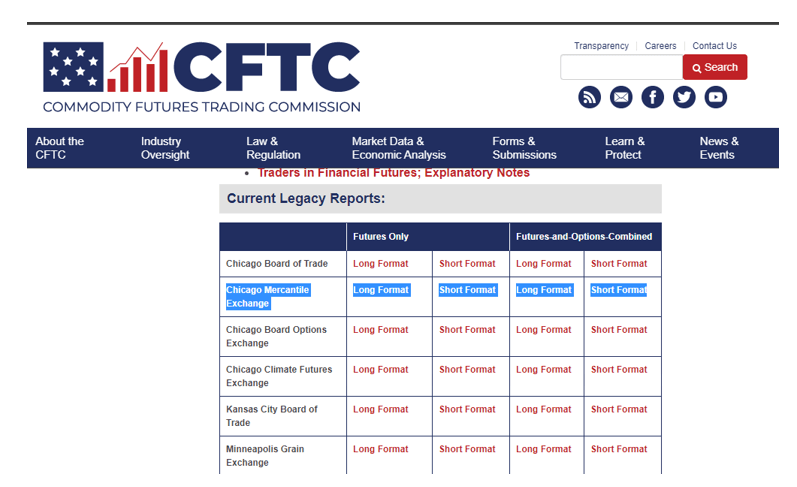

- The ‘Chicago Mercantile Exchange’ section of ‘Current Legacy Reports’ in the COT report is best suitable for forex traders.

Let’s now conclude this segment with a few things you MUST always keep in mind.

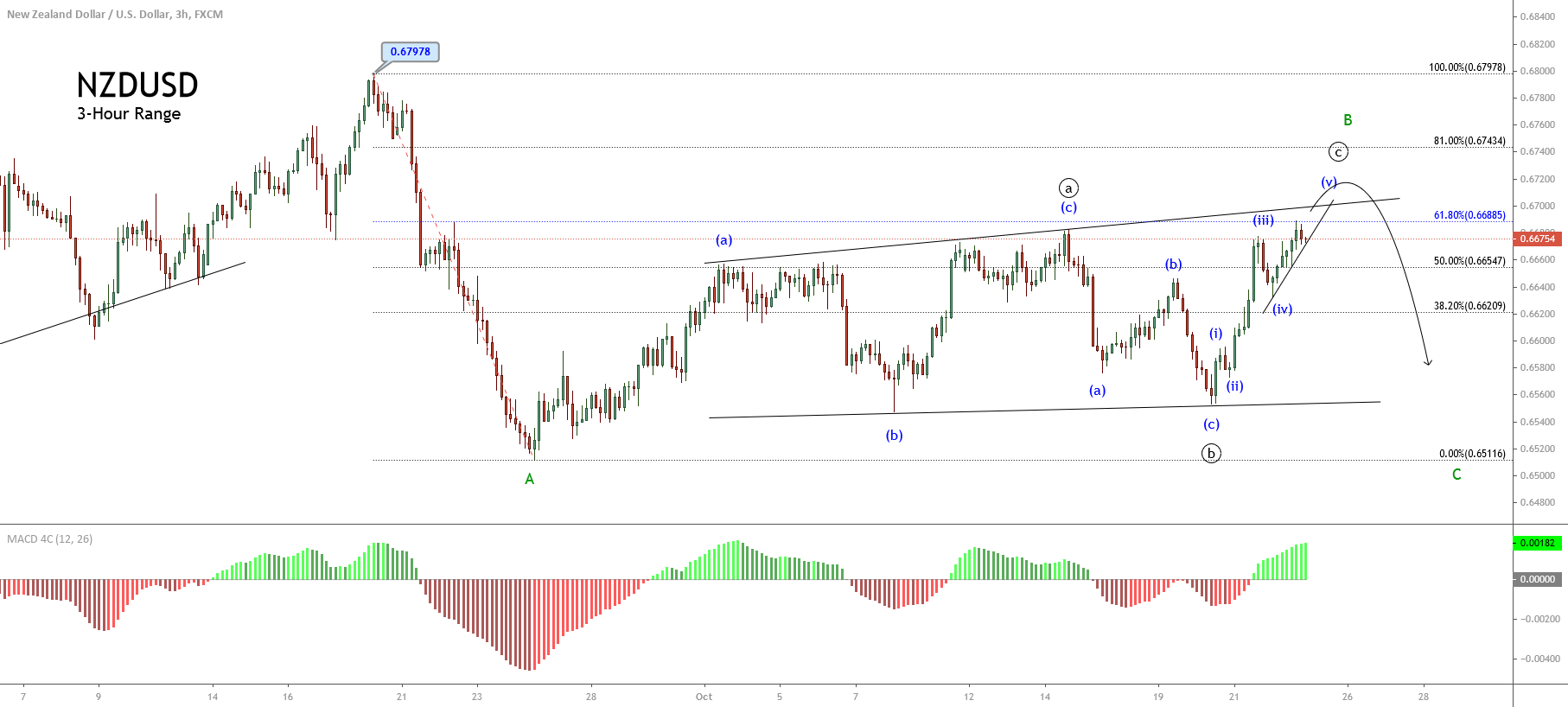

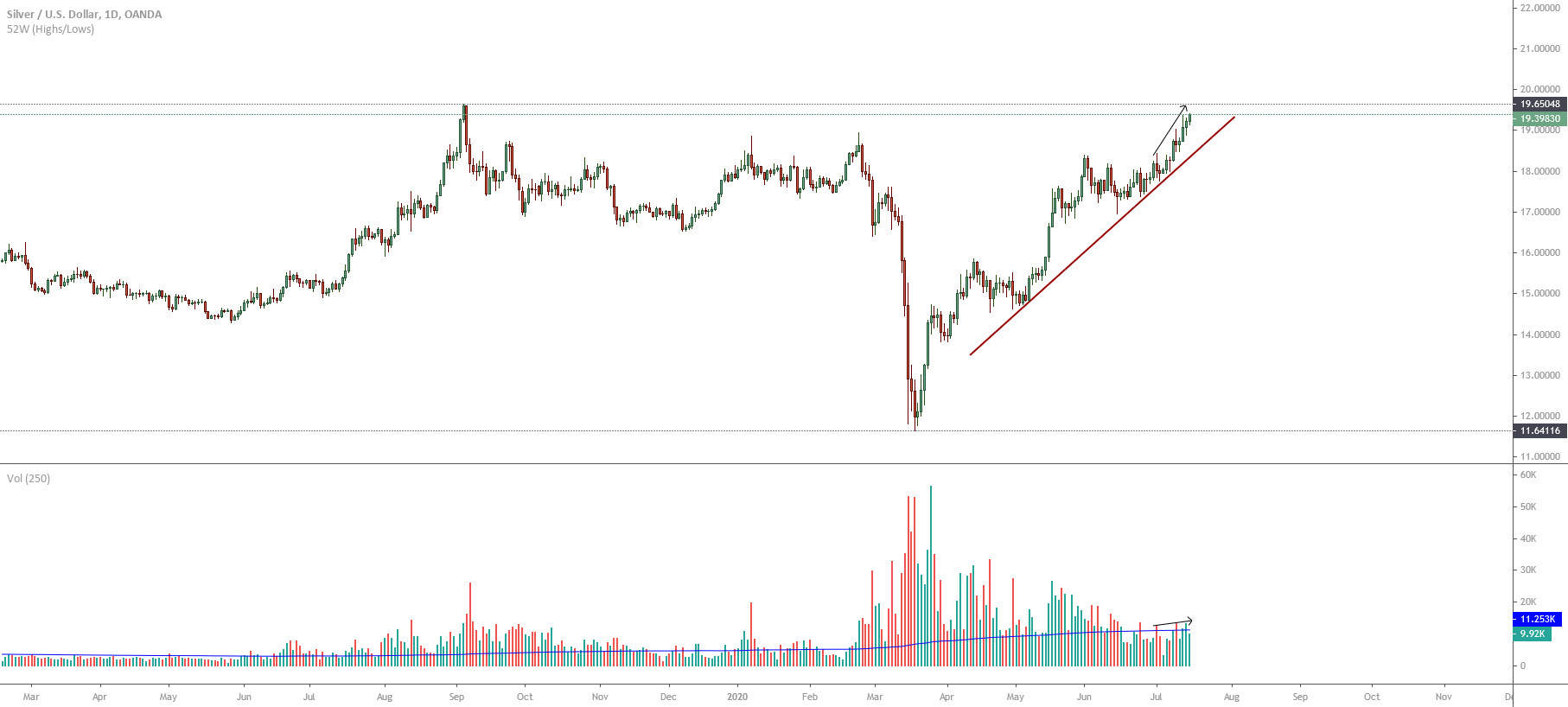

If you haven’t noticed by now, the COT report is best suited for long term trading. If you are a shorter-term trader, you might be inconvenienced if you solely rely on the COT report for a trading signal. You see, the trends established by the COT report index take time to form. But this shouldn’t discourage you; it’s always good to know how the market is trending.

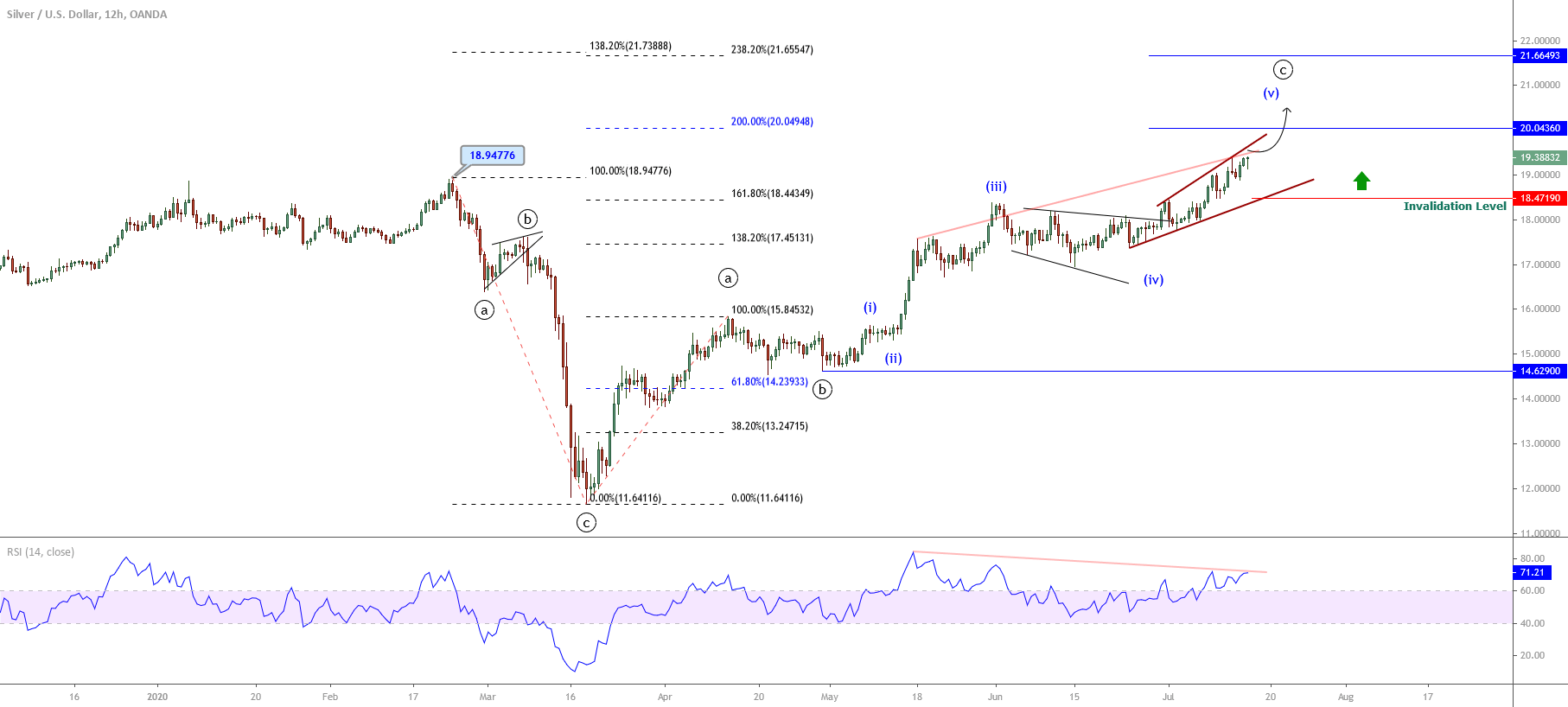

For traders who opt to use the COT report to generate trading signals, the COT report trading indicator is not foolproof. Like thousands of other indicators in the forex market, it is bound to fail at some point. So, you should conduct thorough backtesting with different timeframes to get a proper feel of how the indicator works. Note that with backtesting, you can be able to spot instances where using the COT report can generate false signals, which will help you avoid such conditions in live trading.

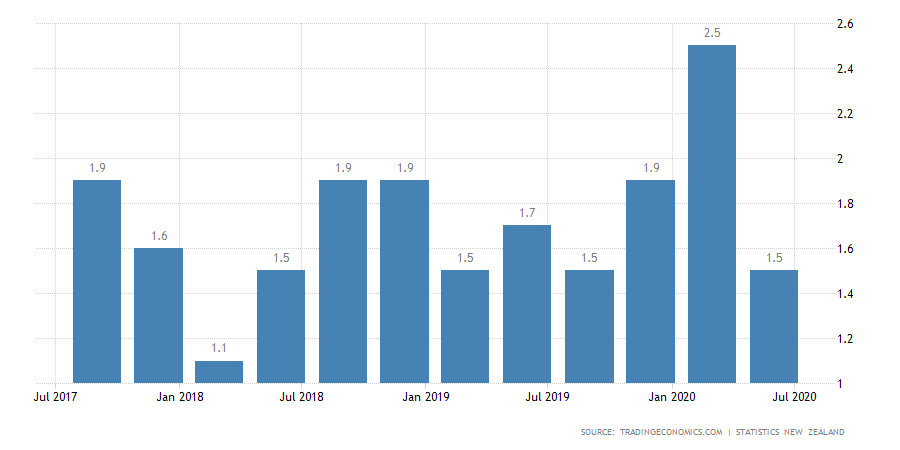

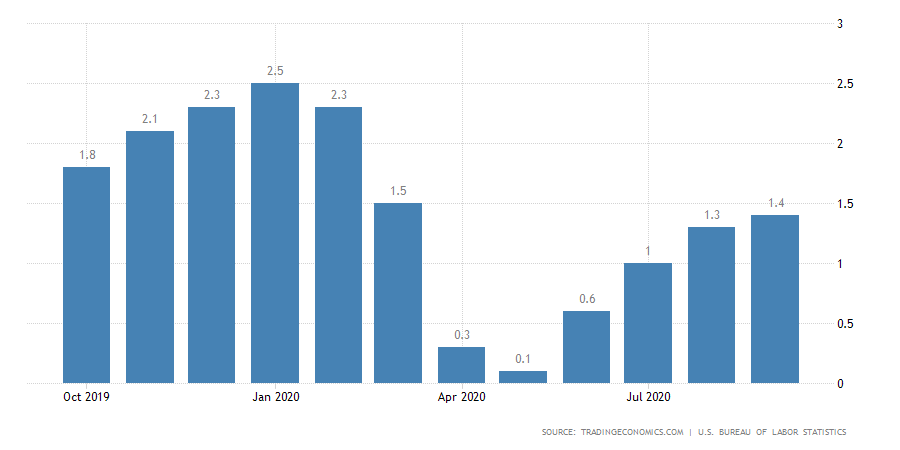

Well, even after you have conducted your thorough backtest, you must know that the forex market trends are not solely driven by market sentiment. Several other factors could lead to reversals in the forex market other than the COT report. In any given month, hundreds of high-impact economic indicators and geopolitical developments can significantly influence trends in the forex market. So, be sure to double-check with your economic calendar to know what else is going on in the economy.

[wp_quiz id=”94030″]