What did we learn till now?

Sometimes in the forex market, the movement of prices seems random. In the previous series of courses, we have shown that most of the randomness you observe can be explained. By now, you should be capable of identifying the various news releases published daily. You should also be able to determine which currency pairs the news release is likely to impact.

In this final course, we’ll recap all that we have learned so far.

When it comes to news trading, a forex trader can either have a directional bias to trading or have a non-directional bias. For directionally biased traders, they have to:

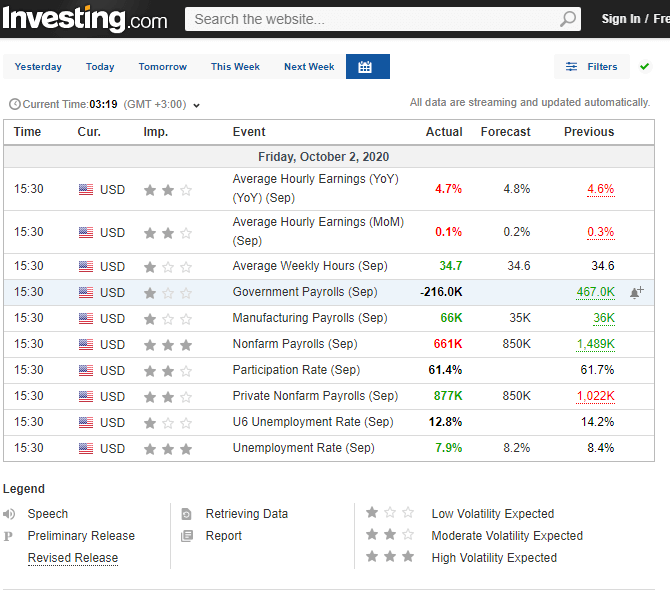

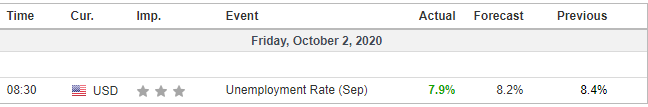

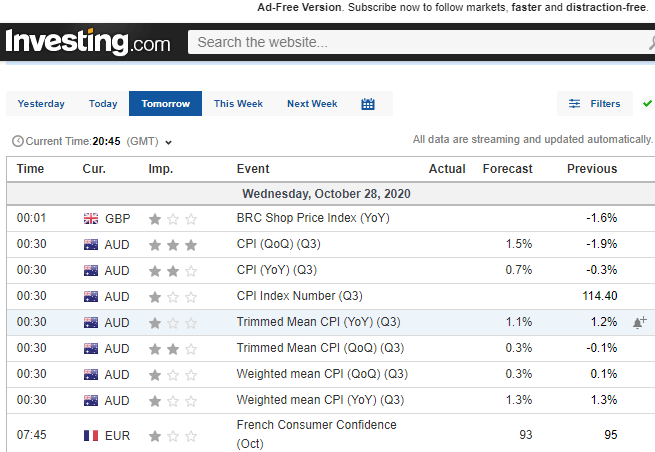

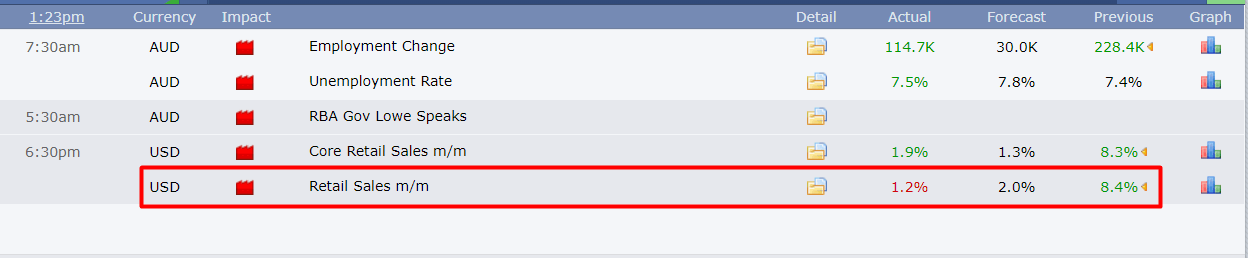

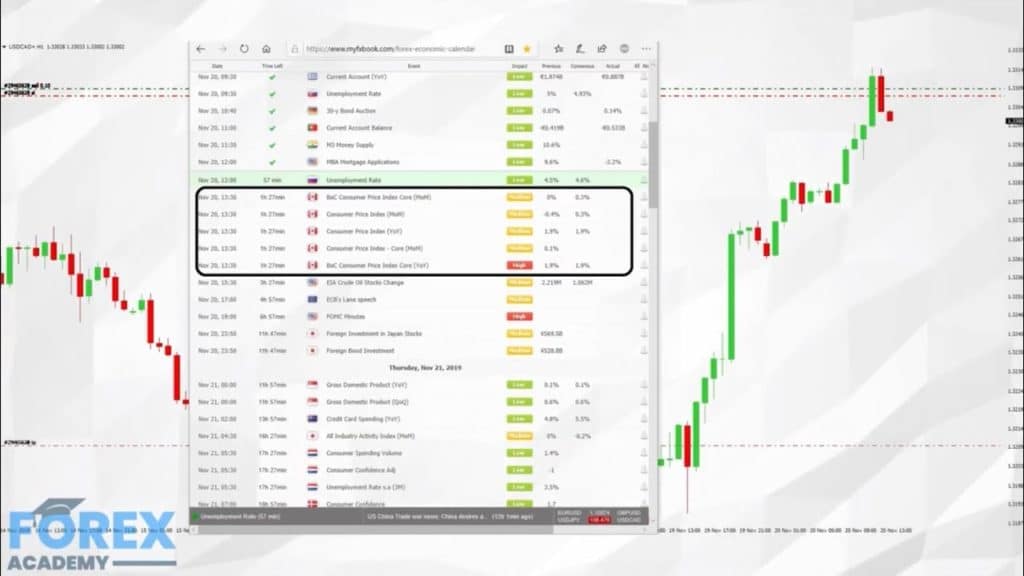

- Familiarise themselves with the economic calendar to know when economic indicators are scheduled for release

- Understand the impact that each indicator might have and which currency pairs are best to trade

- Understand that the analysts’ consensus or expectations are what determines if the news release is negative, positive, or in-line

- Know which news releases to avoid trading

On the other hand, forex traders who have a non-directional bias do not necessarily need to familiarise themselves with these conditions. Such traders only need to know two things.

- The scheduled release of economic indicators, speeches by influential people, and significant geopolitical events

- Whether the upcoming event is of a high or low impact

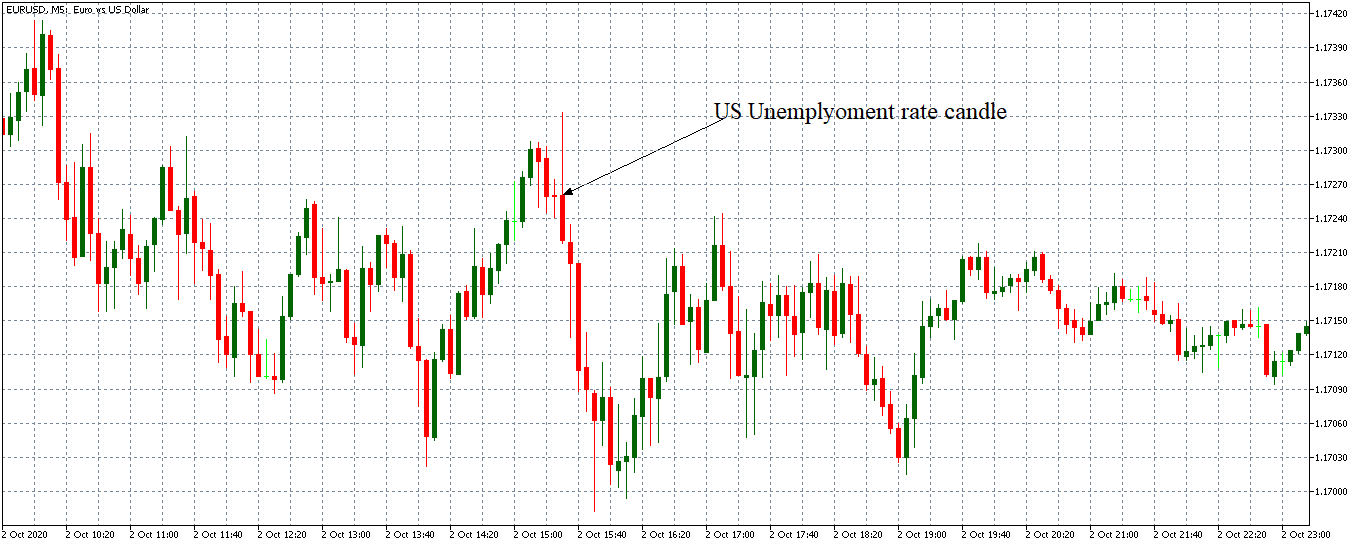

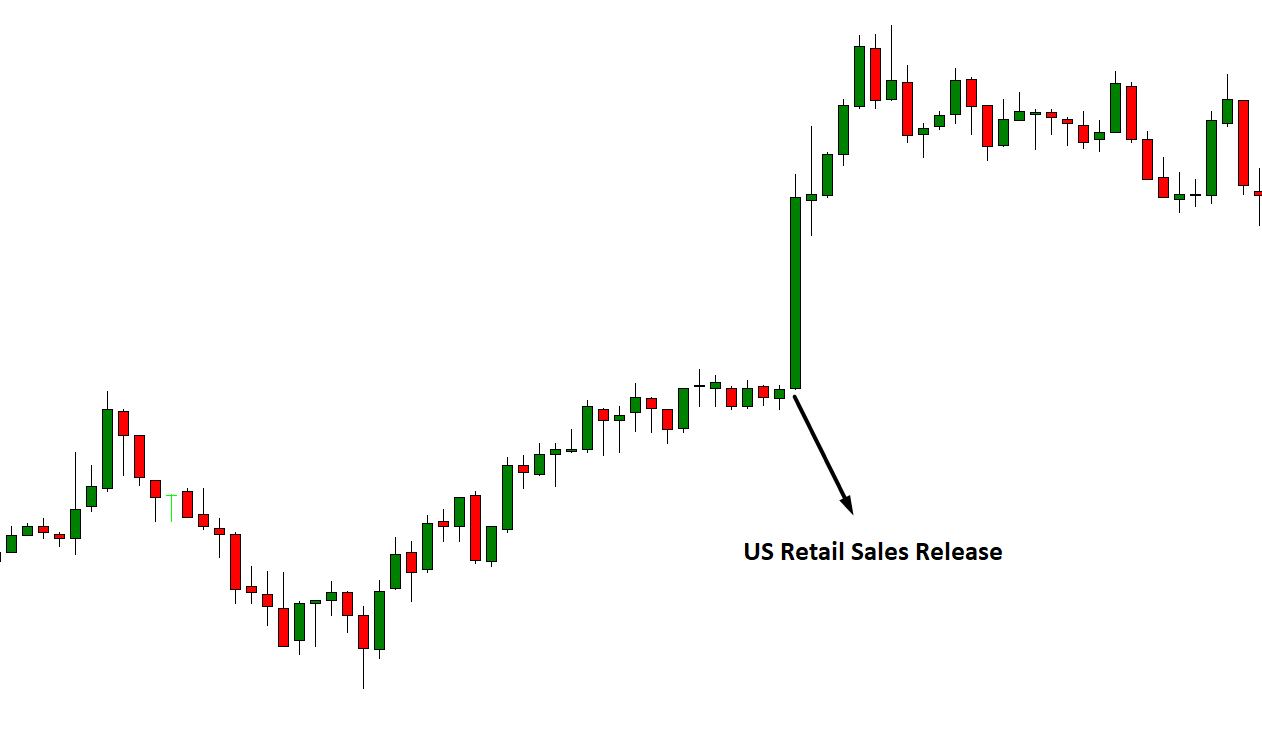

Traders with a non-directional bias only concern themselves with the magnitude of the price movement after an event – not the direction. That is why they adopt the straddle strategy.

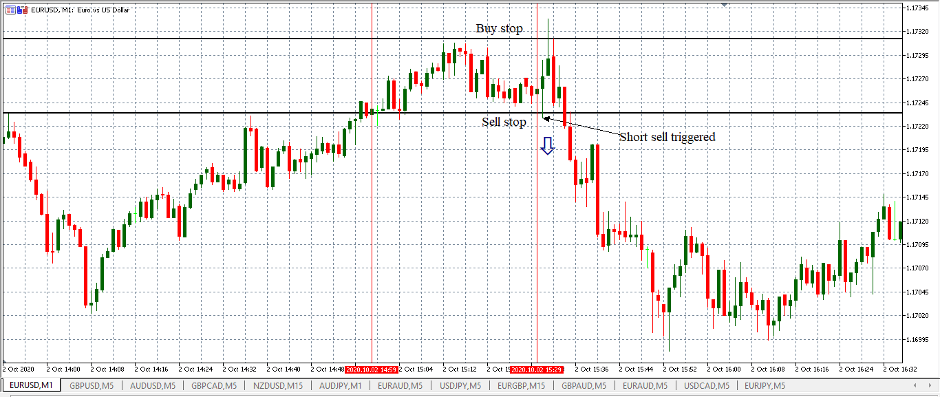

The straddle strategy uses forex stop orders, which triggers long or short positions if the market significantly moves in either direction. The buy stop order will trigger a long trade if the news release results in a bullish market. With the sell stop order, s short sell will be executed if the news release results in a bear market.

Remember to be careful when trading the news. Always keep an eye on the prevailing macroeconomic trends and geopolitical events. The overall market sentiment can sometimes amplify or dampen the impact of a news release.

If, for example, moments before the release of UK manufacturing data, the market receives news that the ongoing Brexit negotiations have hit a snag. If the manufacturing data is positive, its impact on the market will be dampened; if the release is negative, its impact will be magnified. All the best.