Introduction

When foreign investors prefer investing in the domestic economy, they strongly believe that they can get better returns than in any other market. The US is considered the leading economy in the world; therefore, hence US securities are highly trusted by most investors. Similarly, since the USD is the most traded currency in the international market, its value would fluctuate depending on investors’ optimism in the capital and money market of the US.

Understanding US TIC Net Long-Term Transactions

As an economic indicator, the US TIC Net Long-Term Transactions measures the net flow of financial securities in the US economy. The financial securities under consideration include; Treasury and agency securities, corporate bonds, and equities.

Therefore, the ‘net’ in the US TIC Net Long-term Transactions means the difference between US financial securities’ gross purchases and sales by foreign investors. This data provides a vivid overview of the participation of foreigners in the US capital and money markets. When the US TIC net long-term transactions data is positive, it means that more foreigners are buying into the US economy than those selling. Similarly, when the US TIC net long-term transactions data is negative, it means more foreigners are exiting the US economy compared to those buying into the economy.

So, what is TIC? TIC stands for Treasury International Capital, a financial report from the US Department of Treasury. It shows the flow of capital into and out of the US in both the short and long term. The TIC report is published monthly and quarterly; it details the flow of capital explicitly in the sale and purchase of US financial securities.

According to the TIC reports, the classification of foreigners does not necessarily mean individuals and institutions from abroad. Foreigners in this context also include foreign branches of US institutions. For example, if a US bank has a branch in London, that branch is considered a foreigner.

Using US TIC Net Long-Term Transactions in Analysis

The main point of the US TIC Net Long-Term Transactions Report is it shows the demand for USD stocks and investors’ sentiment towards the US economy. Let’s break down the US TIC Net Long-Term Transactions depending on the market.

If the US TIC net long-term transactions, it could signal that the US treasuries and bonds are in high demand. First, you should know why investors would demand more of US treasuries. The US treasuries and bonds are considered to be risk-free. The reason for this is because investors are guaranteed to receive a fixed amount of coupon rate until maturity.

More so, the US treasuries also come with an inherent guarantee that the US government will not default the interest payment and that investors will receive their principal upon maturity. Furthermore, the US’s interest rates are relatively higher than other developed nations; this means that investors in the US government securities stand to profit more by investing in the US.

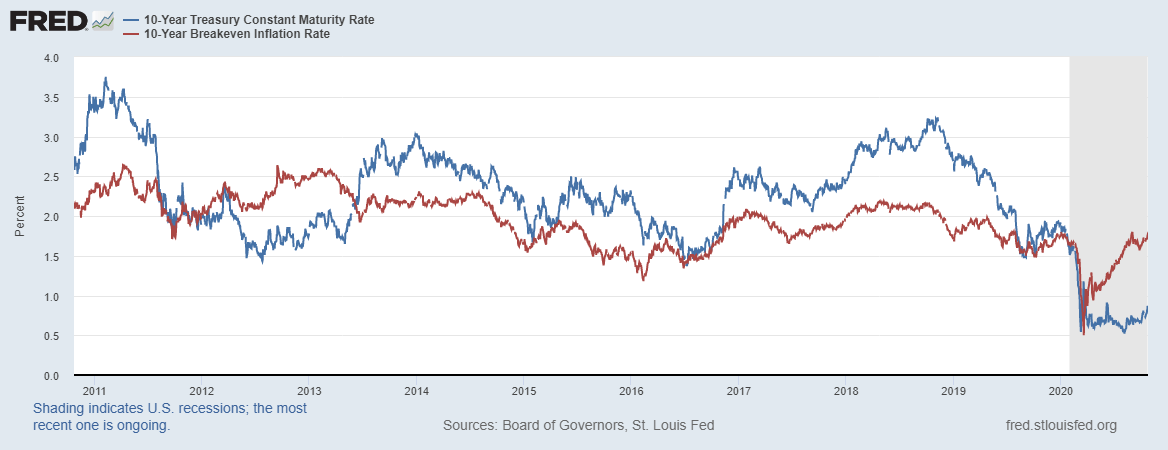

The level of purchase of the US TIC net long-term transactions also says a lot about the expected inflation. In the long term, most investors worry that if the rate of inflation increases rapidly, it will reduce their profits. Thus, any investor would prefer to invest in a country with stable inflation, which would ensure that their returns are not severely affected.

Therefore, when the US TIC net long-term transactions are positively increasing, it means that foreign investors expect the US economy to be relatively stable over the long term. It is taken as confidence that the Federal Reserve will keep long term inflation in check.

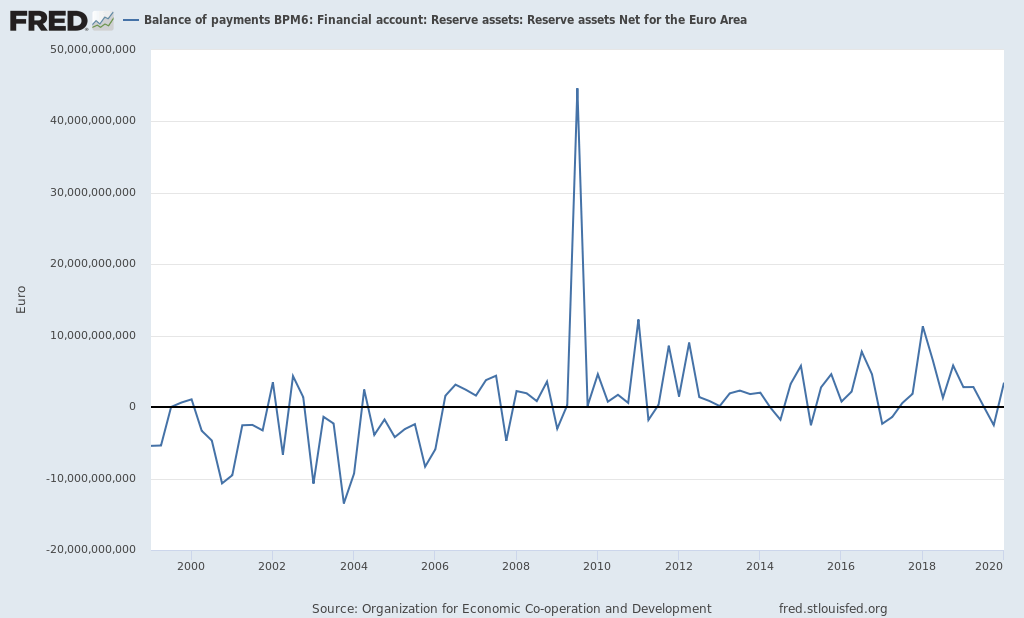

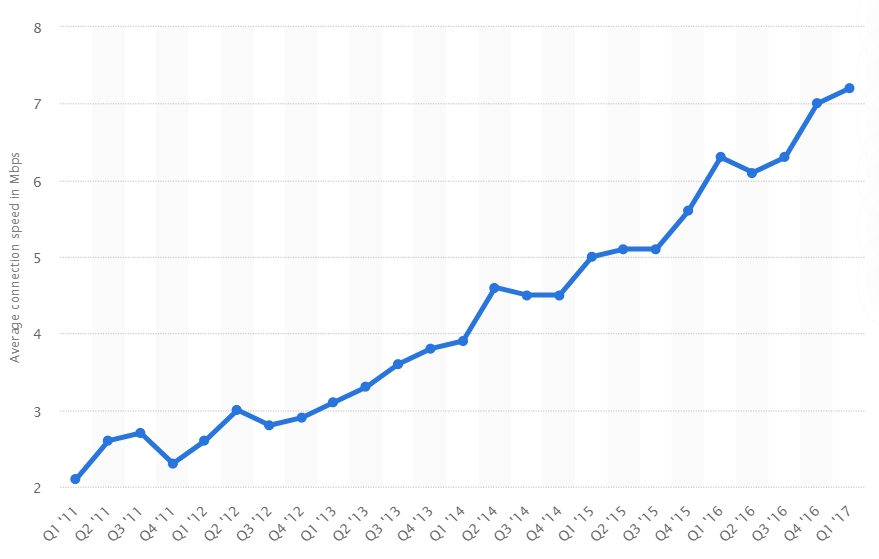

Source: St. Louis FRED

Conversely, if the US TIC net long-term transactions are negative, it implies that there are more sellers than buyers. This scenario could imply that foreign investors believe that the long-term inflation rate will exceed the rate of returns they will receive from their investments. Since their expected real returns will be diminished, they prefer to invest their money in other economies.

The US TIC net long-term transactions can also be used to show impending recessions and optimism about economic recoveries. Let’s use the recent coronavirus pandemic as an example. In the first quarter of 2020, the US TIC net long-term transactions plunged to historic lows. It means that more foreign investors were exiting the US capital and money markets and presumably investing their funds elsewhere. This net outflow was a result of the uncertainty of what the pandemic might bring.

Source: Trading Economics

In the second quarter of 2020, the US TIC net long-term transactions jumped back to positive territory, implying that foreign investors were pouring back into the US capital and money markets. Note that this net inflow coincides with the passing of the $2 trillion stimulus package. Therefore, we can argue that the net inflow of US TIC net long-term transactions was a vote of confidence by foreign investors that in the long term, the US economy will rebound from the pandemic-induced recession.

Impact of US TIC Net Long-Term Transactions on Currency

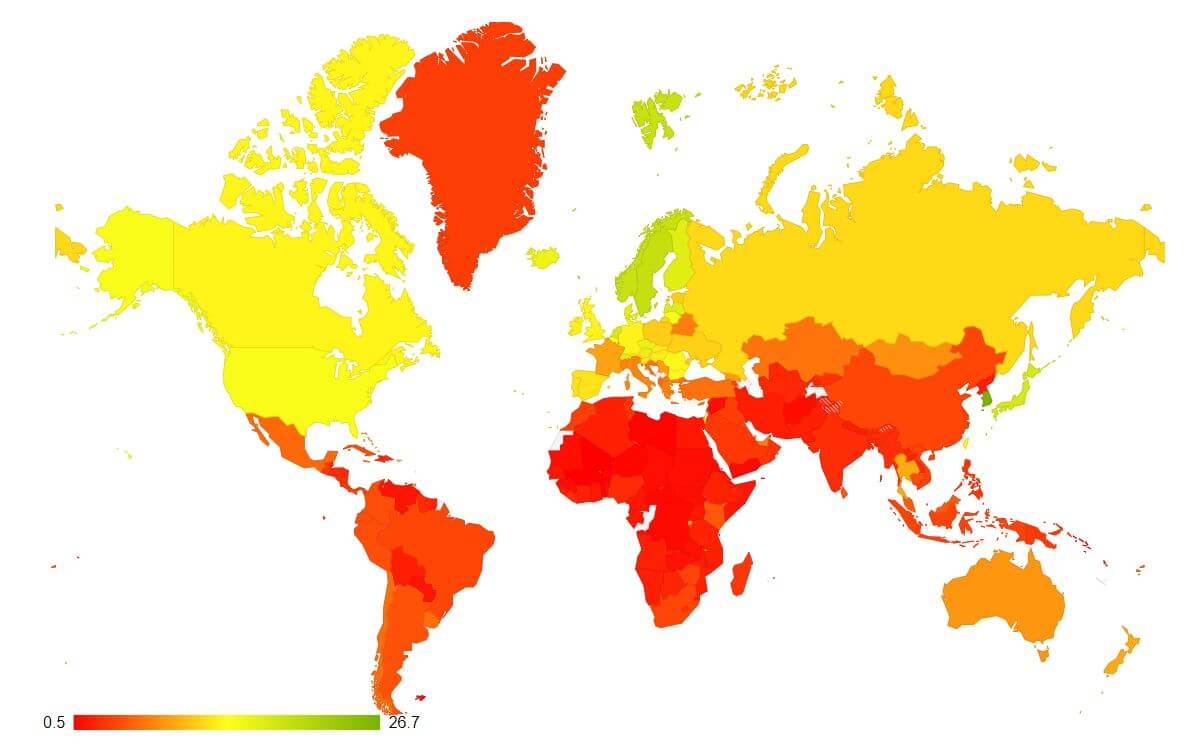

The impact of the US TIC net long-term transactions on the USD is pretty straightforward. In the international market, foreigners are obliged to convert their currencies into the USD. Therefore, an increase in the US TIC net long-term transactions means that the demand for the USD increases as well. Consequently, the increase in the demand for the USD makes it appreciate relative to other currencies.

Conversely, when US TIC net long-term transactions show net outflows, the USD will depreciate relative to other currencies. This is because when foreigners sell the US financial securities, they will convert the USD to their domestic currencies when repatriating their money.

Data Sources

The US Department Of The Treasury is responsible for collating and publishing the monthly and quarterly US TIC net long-term transactions. Trading Economics has detailed historical data on the US TIC net long-term transactions.

How US TIC Net Long-Term Transactions Release Affects The Forex Price Charts

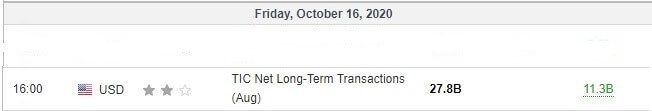

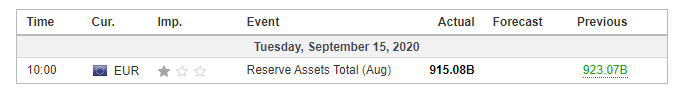

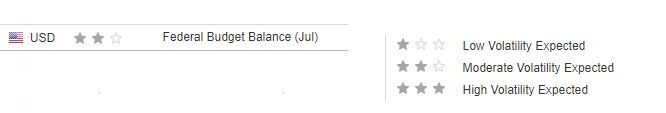

The latest monthly publication of the US TIC net long-term transactions was on October 16, 2020, at 4.00 PM EST. The release can be accessed at Investing.com. Moderate volatility on the USD can be expected when the US TIC net long-term transactions report is released.

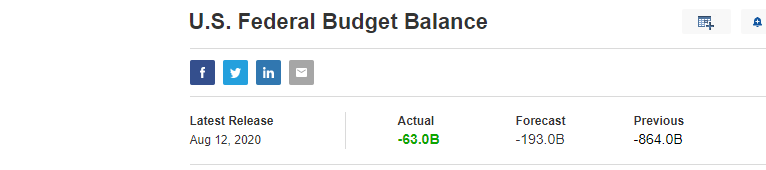

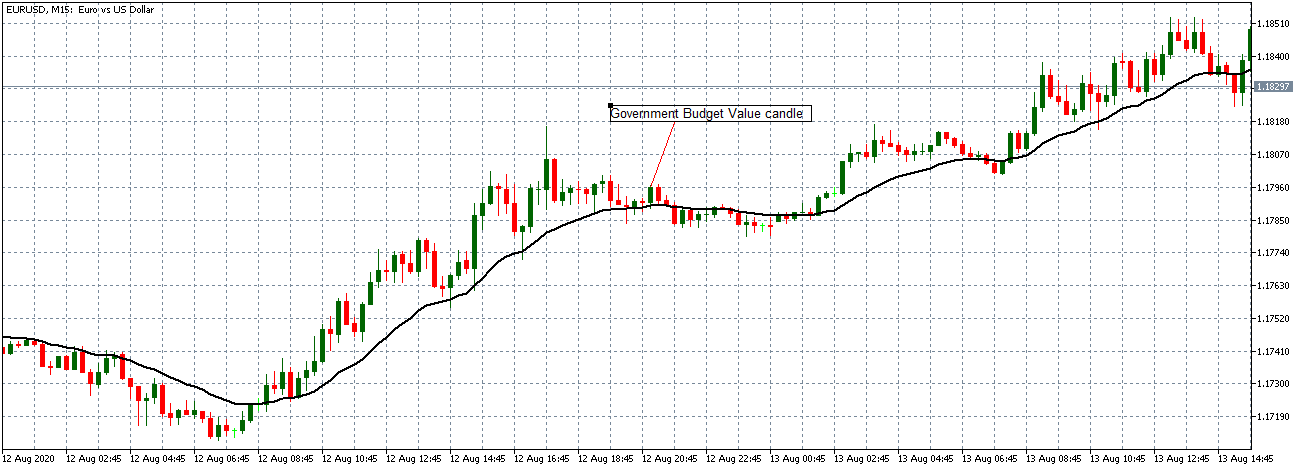

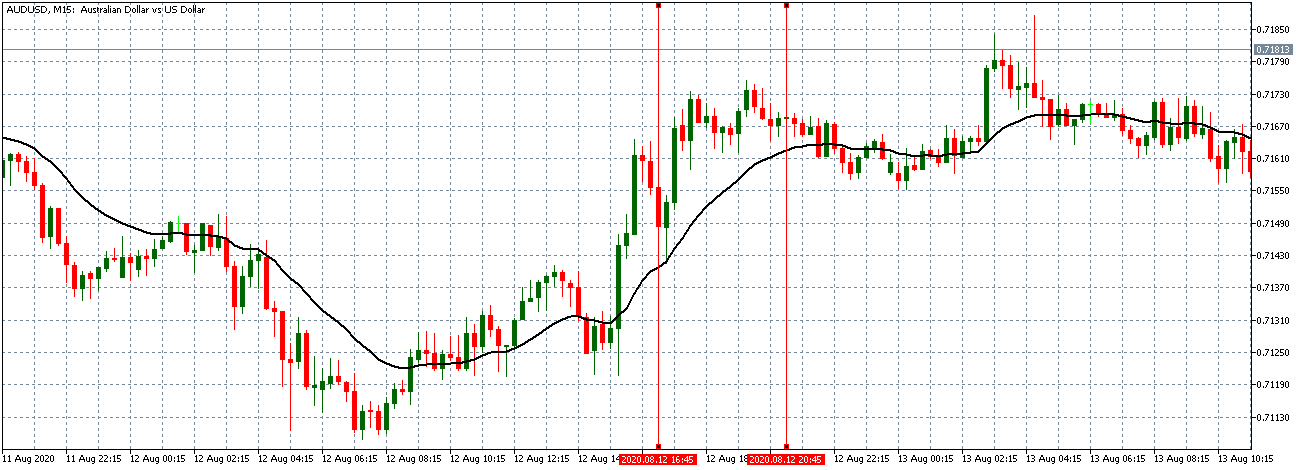

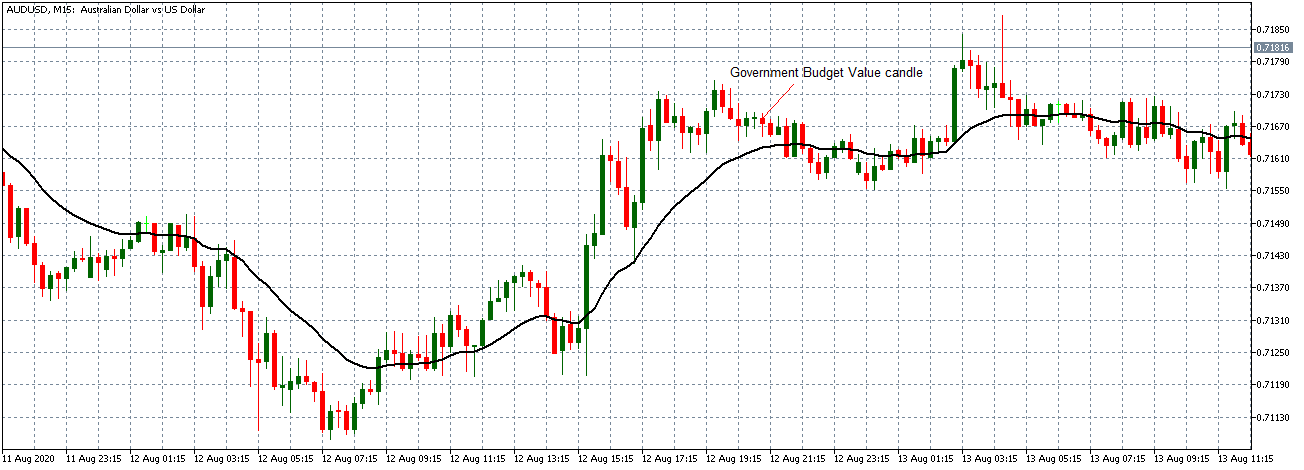

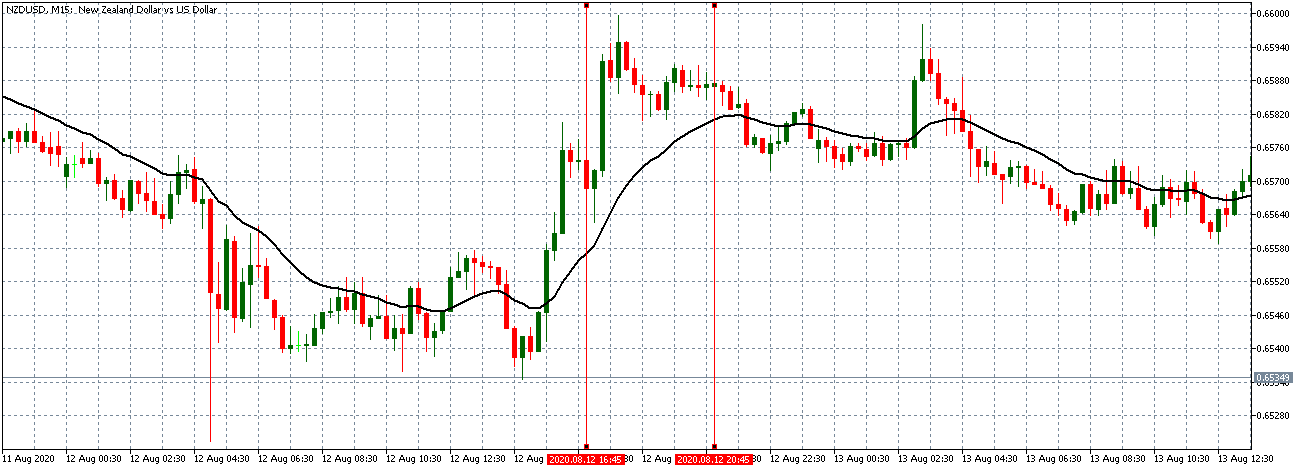

In August 2020, the US TIC net long-term transactions were $27.8 billion compared to $11.3 billion in July 2020. In theory, this increase should be positive for the USD.

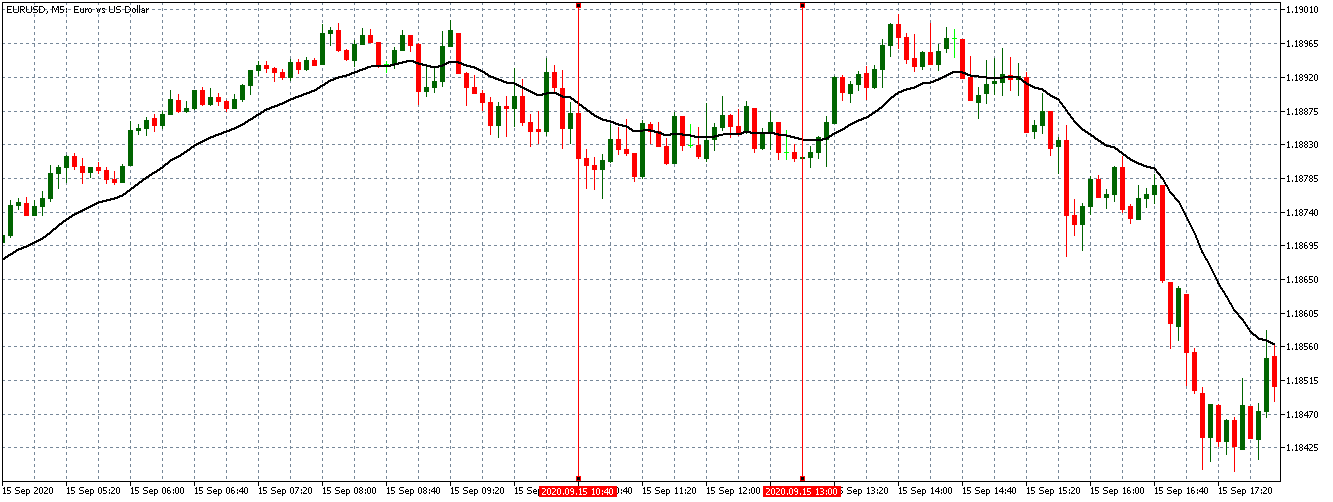

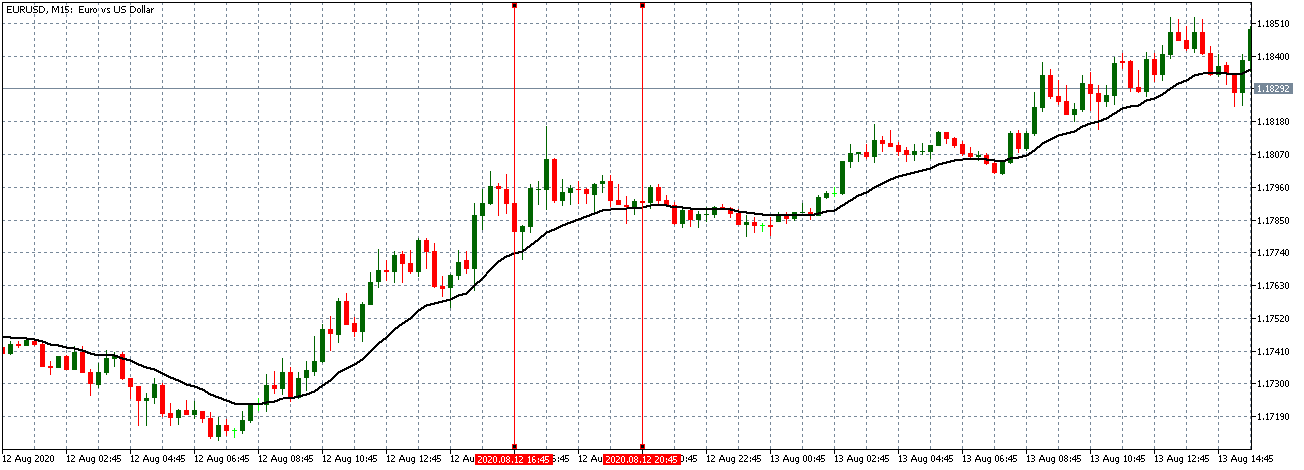

Let’s see how this release impacted the GBP/USD pair.

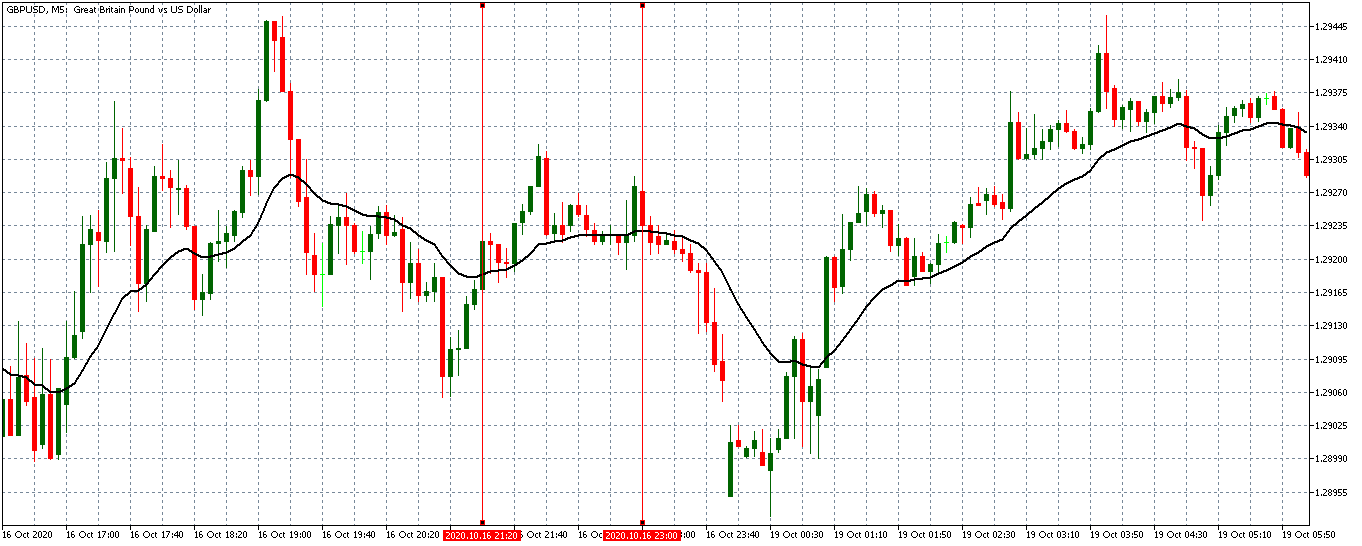

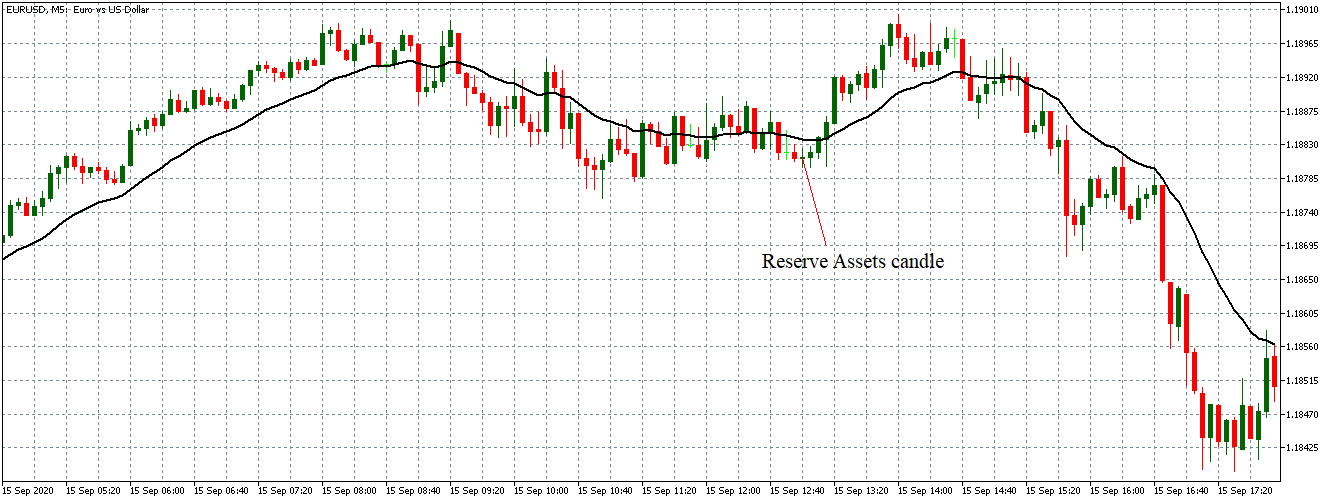

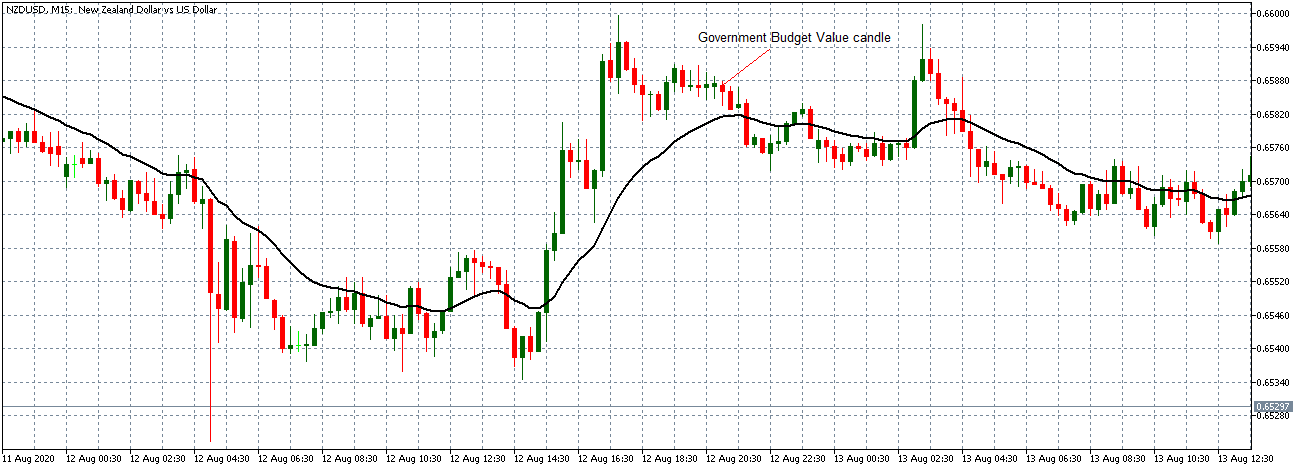

GBP/USD: Before US TIC Net Long-Term Transactions Release on October 16, 2020, just before 4.00 PM EST

Before the publication of the US TIC net long-term transactions, the GBP/USD pair was trading in a subdued uptrend. The 20-period MA was almost flattened with candles forming just above it.

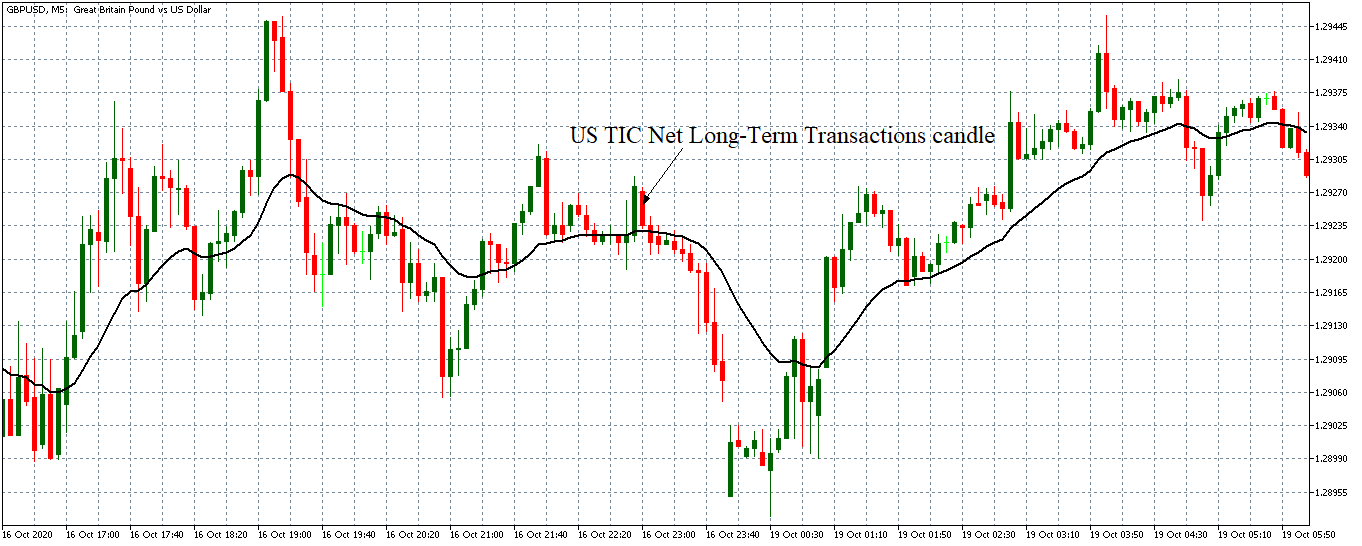

GBP/USD: After US TIC Net Long-Term Transactions Release on October 16, 2020, at 4.00 PM EST

After the publication of the US TIC net long-term transactions, the pair formed a 5-minute bearish candle. Subsequently, GBP/USD adopted a bearish trend showing that the USD significantly strengthened against the GBP. The 20-period MA steeply fell as candles formed further below it.

Bottom Line

From this analysis, it is evident that the US TIC net long-term transactions release has a significant impact on the forex market. The report shows the confidence of investors in the US economy and the demand for the US Dollar.