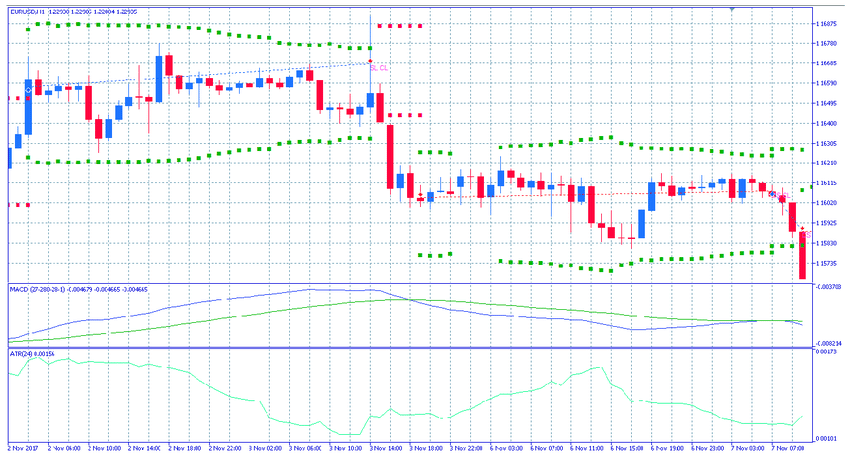

EUR/USD Breaking Below Upward Channel – ECB Under Spotlight!

The EUR/USD currency pair erased some of its previous day gains and dropped below the 1.1400 level while represented 0.05% losses on the day. However, the modest losses in currency pair could be attributed to the broad-based U.S. dollar strength backed by the renewal of Sino-American tension, which kept the currency pair lower. The hopes that European Union leaders may agree on stimulus and deepen fiscal integration to protect the Eurozone economy from the coronavirus crisis helped the currency pair limit its more profound losses.

At the moment, the EUR/USD currency pair is currently trading at 1.1406 and consolidating in the range between 1.1393 – 1.1421. However, the traders seemed cautious to place any strong position ahead of European Central Bank’s (ECB) rate decision, scheduled to happen on the day.

As we already mentioned, the European Central Bank’s (ECB) rate decision is scheduled to happen. So, some analysts widely expected that the European Central Bank will keep its policy unchanged as the impact of recent measures loosens, and the economic recovery pace remains uncertain.

However, the actual amount of the economic damage caused by the coronavirus outbreak in the second quarter would become apparent only at the end of the month with the first estimates for GDP growth. Thus, there is little reason for further action from the European Central Bank (ECB) at this moment.

As per the senior analysts, the coming European Central Bank meeting could leave a significant impact on the shared currency. Whereas, the member nations stand divided on the scale and composition of the stimulus package, with the richer northern nations like Germany and the Netherlands opposed taking the long-term step of polling debt with the fiscally-profligate Mediterranean governments.

The shared currency recently benefitted as investors expect member nations to reach a compromise close to Germany and France’s proposal of a 750-billion euro fund, which will deliver 500 billion euros as grants and guarantees and 250 billion in loans.

At the US-China front, the US-China tussle took a breath earlier after U.S. President Donald Trump personally avoided imposing further sanctions against Chinese entities involved in enacting Hong Kong’s national security law while saying that he does not want to further escalate tensions with China. Despite this, the tensions remain on the cards as China is still threatening to retaliate because the U.S. imposed sanctions on diplomats from Beijing while signing an executive order ending preferential treatment for Hong Kong on Wednesday.

At the USD front, the broad-based U.S. dollar did not give any significant heed to the vaccine success and took bids on the day, possibly due to the worse situation of ever-increasing coronavirus numbers and an ongoing tussle between the US-China which exerted some downside pressure on the S&P 500 futures. However, the gains in the U.S. dollar kept the currency pair lower as the price of oil is inversely related to the U.S. dollar price. Whereas, the U.S. Dollar Index that tracks the greenback against a basket of other currencies gained 0.01% to 96.032 by 10:12 PM ET (3:12 AM GMT).

The market traders keep their eyes on the U.S. economic docket, which will show the release of Retail Sales m/m, Philly Fed Manufacturing Index, Unemployment Claims, and Business Inventories m/m, which could play a key role in influencing the intraday momentum. On the EUR side, all traders keenly awaiting the European Central Bank’s (ECB) rate decision, scheduled to happen on the day.

Daily Support and Resistance

S1 1.1297

S2 1.1358

S3 1.1385

Pivot Point 1.1419

R1 1.1446

R2 1.1479

R3 1.154

The EUR/USD is trading with bearish bias after posting a high near 1.1446 mark. Recently, the formation of candles beneath the 1.1446 mark is likely to extend bearishness until the 1.1370 level. While candles closing over 1.1370 can also trigger a bullish bias in the EUR/USD pair. Alternatively, the bearish breakout of 1.1370, the EUR/USD prices may slip further until 1.1305 level. Good luck!