As you may know, today there are hundreds of different trading strategies and martingale is one of the best known. Is it because it is the most profitable? What is the reason for this fame? Can you really win with a Martingale system?

How Does the Martingale System Work?

This method began to be used in the world of betting with the aim of great profits in exchange for the risk of being able to end up in bankruptcy. It even started to be limited in casinos because customers ended up losing a lot more than they expected to win.

Its creator was Paul Pierre Levi in the 18th century, who made strategy popular in the world of chance since it is basically a matter of doubling the bet after having generated a loss.

Yes, as such, the intention is to keep doubling the bet until a win is generated. In case of a hit, the bettor can recover everything played and add up the win of the initial bet. If this is not the issue and there is no success, the player, having run out of chips, can only withdraw with empty pockets.

I’ll give you a simple example. When you toss a coin in the air, you only have two alternatives: heads or tails. Your initial bet is 10 euros in favor of a face on the next throw. You will be with me here there is both the same chance that the bet will fall on the same side as it will fall on the other side (50%).

Considering, that each throw is independent and after several pitches with a result against your bet, after having doubled the bet 3 or 4 times and only one win, you will recover the loss and gain a win of double with respect to the initial investment. A single victory not to lose everything, this is one of the great attractions of martingale.

Applying the Martingale System to Trading

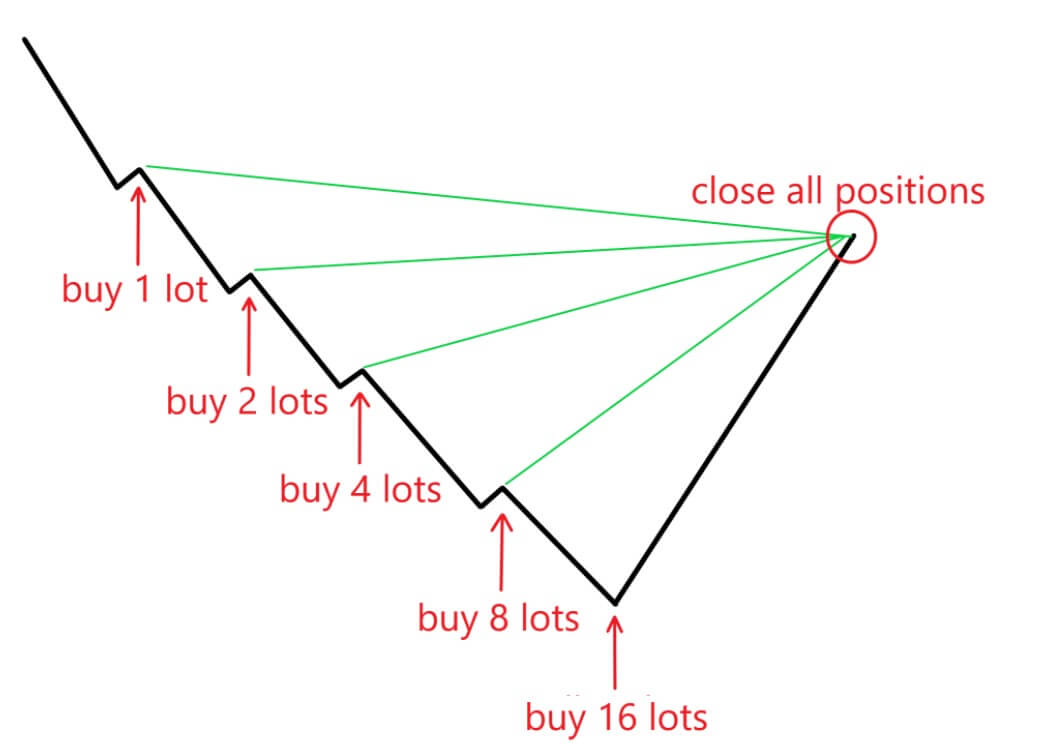

In trading, this applies in a similar way, as the key to Martingale strategies when you do trading is to go up the size of the position as the price goes in the opposite direction. Trading instead of doubling can increase the bet size by 1.1, 1.2, 1.3 A multitude of variants and scenarios although as we will see below the effects usually have the same end.

One day someone introduces you to a seemingly very winning trading system. It’s December 2012 and it’s been over a year and a half with excellent results. You decide not to listen because you already know what is the martyr strategy and its consequences. Weeks later you decide to review it again and you see an 87% drop. About to lose everything in a few days. When you figure this out, you’ll know where don’t have to put your time and money and how they can end up if you do.

Martingale Forex Strategy

Let’s go with an example of forex martingale. You enter in EUR/USD buying two lots. Your goal is to make a move up to 1.1598. However, the price drops and you add two more lots in 1568. Now the price will only have to reach 1.1583 (the new break-even point) for you to make a profit. The higher the number of lots you enter, the lower the even point (the average entry value between all trades already opened).

We’re talking about one of the reasons why a person with higher capital has a higher level of security to recover after a few losing trades. Although for this method to work you should have infinite money. Why? Because your pocket is always going to be less than the chance that the next operation is a loser or the price goes against you.

Investment and Trading Systems Based on Martingale

One of the most famous systems based on martingale is the grid, which is associated with Forex because it is where it is quite popular. There are many traders who use this technique to do Forex trading, but this does not mean much that it can be considered a winning system.

The idea here is to divide the chart into grids and put purchase and sale orders in each section, with the intention of being able to take advantage of the rise in the market. In the traditional method, you enter a purchase and a sale in each section and you take advantage of the idea that side movements in Forex trading are common. If you look at a 5 or 15-minute chart, you can see how many times the price has been without a clear trend for several days. They are usually rather broad ranges and can provide many operations, the problem that can be found in the price going out of range and generating insurmountable losses.

The only advantage and so it is so common and applied this type of system is because they do not need to predict the trajectory of the market because if it is directed in one direction or another, they always cover the position of the same.

Over time, you can find some of the winning grid systems, usually have a component of preference, in addition to cordon off maximum losses, so as not to get into unsustainable situations. There are many variants of martingales on the Internet, more or less aggressive, but the vast majority have positive negative hope, they are losers.

Martingale Works Best on Forex?

One of the reasons why martingale is so well known in the foreign exchange market with respect to the stock market is because it is almost unlikely that the exchange rate of a currency pair will reach zero. Listed companies can fail, a country’s currency will hardly fail.

Surely there are times when a currency can be devalued, but at times when there is a strong drop, the value of the currency does not reach zero. It is not impossible, but what would be needed for this to happen is very, very extreme.

You may have heard some traders talk about applying martingale in currency pairs with positive swaps. With lots of lots, interest income can be very important and reduce risk. Sounds good, doesn’t it? With a high number of lots the account can go bankrupt with a small move.

Risks in Martingale

If you are willing to implement this strategy, you first need to ask yourself if you are willing to lose most of the account capital in a single transaction. Considering that martingale offers a very high risk-benefit pattern, it is unacceptable in any professional practice, as it is not considered in itself as a strategy that offers strength when properly implemented.

Such strategies are good in theory, but a scam in practice. If you want to develop a professional trade, you must understand that it is necessary to contemplate the loss and assume it within a normal scenario, without in any case supposed to lose all your money.

Martingale Trading Methodology

The vast majority of automatic systems sold on the Internet are martingale-based systems, with a real, short-term account. Then they go bankrupt, they delete that account and they create a new one. It pays to lose that money because their real business is selling the systems.

How can you identify them? They are systems with a high percentage of success and have little volatility, constant earnings. too pretty to be real. They are usually depicted with almost perfect curves. If you don’t see falls and negative operations shut down, there’s a chance it’s a martingale.

This does not mean that all systems sold or all automated systems are like that. But there’s a lot of undercover scam going on about this, and I recommend you be on the lookout for it.