Introduction

When you start in the trading game, you often heard people tell you to let your winners run and cut your losses immediately. Well, this piece of wisdom is true, but most of the traders failed to do so, and they end up in the losing side in the trading. As per the Wall Street report, nearly 95% of the traders in the market always end up in losing side; this is because they have a habit of booking their profits too early.

First of all, you must accept this fact that the market is random and it can do anything at any given situation, and the trading is a game of probabilities, there is no guarantee that your trade will end up in the winning side. If you genuinely desire to be in the top 5% of the traders, you must have big winners, and the smaller loses. This sound so simple, but in reality, it is so difficult. Remember when you are wrong in the market, you are not only in the losing trade, but you also have to pay commissions. So to be a winner in the game you must develop a healthy and abundant mindset which let you hold your trades for the more extended targets. Most of the traders end up closing their trade for no reason, and this is the number one mistake they made in their trading. From now on, you must promise yourself that you will only close your trade when the market gives you the valid reason to close it and if your purely closing the trade to book the profits, then simply you are missing tons of money in the market. In this article, we will share with you some tips and tricks on how to book your profits.

PROFIT TAKING STRATEGIES.

TREND LINES.

Every trader in the world desire to catch the trend, because that’s where the real money is. A strong trending condition helps you to reap the profits without much headache of the volatility effectively. So there are two ways to trade the trend, the first one is to by using any trading strategy enter in the direction of the trend and the second way is to let the price action pullback little bit and take the counter-trend trade to the most recent support and resistance area. In this way, by following the trend, you can catch the major moves, and by following the counter-trend, you can easily capture the minor moves also.

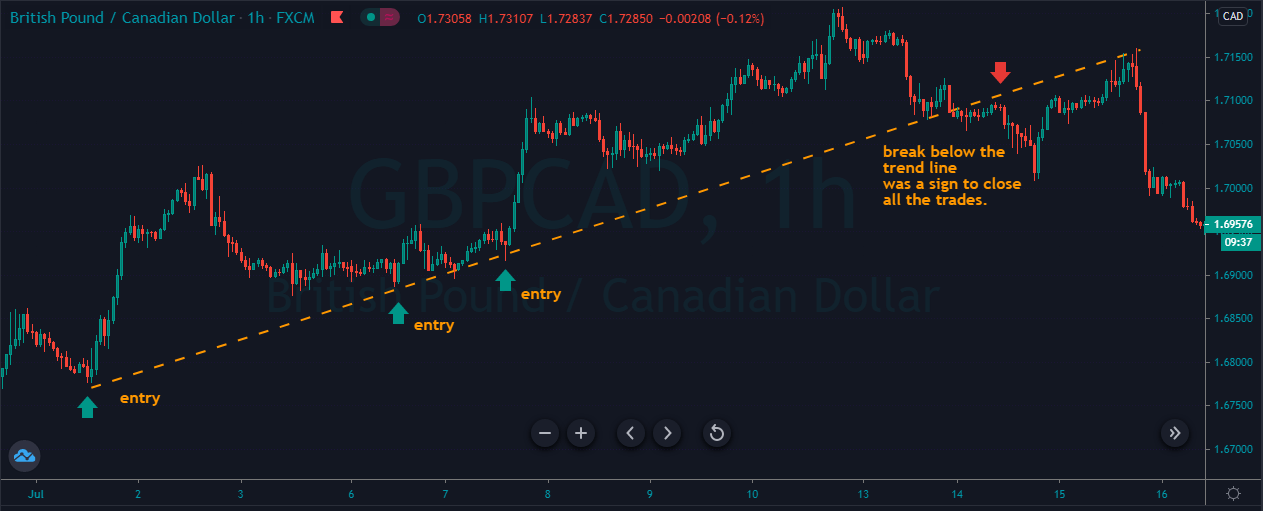

So by using any trading strategy you can enter in a trade, let’s say in trending conditions you use the trend line to take the buy entry, and when the price action breaks the trend line, it is an indication to close your trade.

The image below represents a couple of buying trades which we took when the prices hit the trend line, and the take profit was purely based on the trend line also. When the trend line failed to hold the price action, it means now the sellers are not strong enough and we can expect the reversal from here. What you need to do is to look for the break and closing below the trend line to close your buying trade.

CHANNEL PROFIT TAKING STRATEGY.

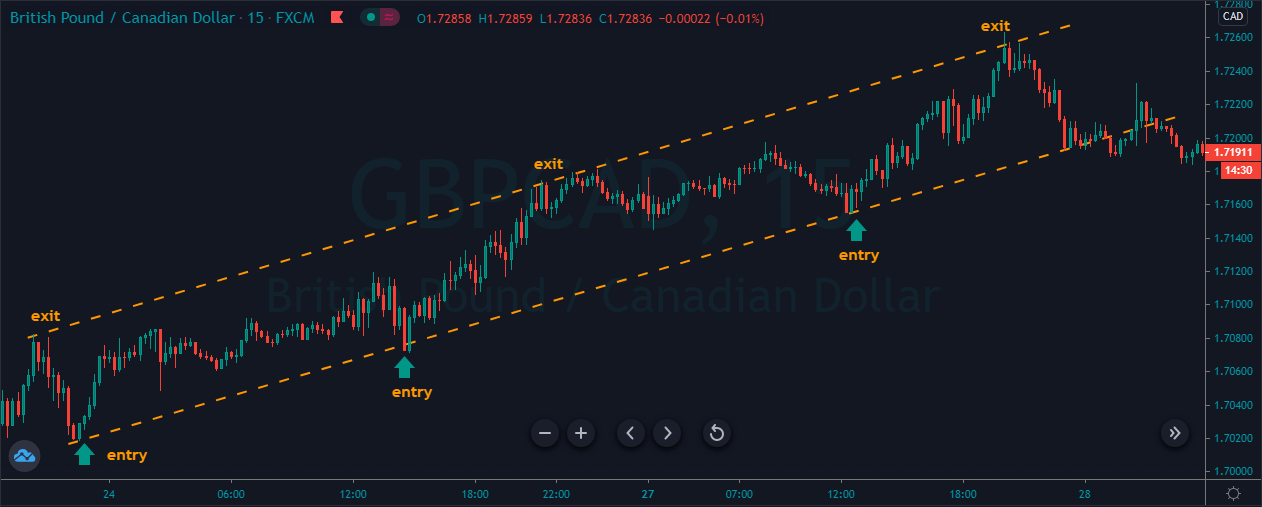

Here we are using the price channel to take an entry and exit in a trade. A price channel when the market is about to finish its trend, and in the channel, both of the parties hold equal power. So we are not going to take the buy-sell entry when the price action hits the channel. It’s a simple approach to trade the market. Instead, follow the market trend and only place the trade with the trend. For example, if the price action prints the buying trend channel then we only going to look for the buy trades and when the price action hits the upper line of the channel it is a sign to close our position.

The image below represents the buying entries and exits in the GBPCAD forex pair. As you can we first draw the price channel and every time prices hit the lower channel, it is a sign to go long, and every time when it hits the upper channel, it is a sign to book the profit. This is one of the easiest and simplest trading approach and keeps in mind the most straightforward approaches works best in the industry.

DIVERGENCE PROFIT TAKING STRATEGY.

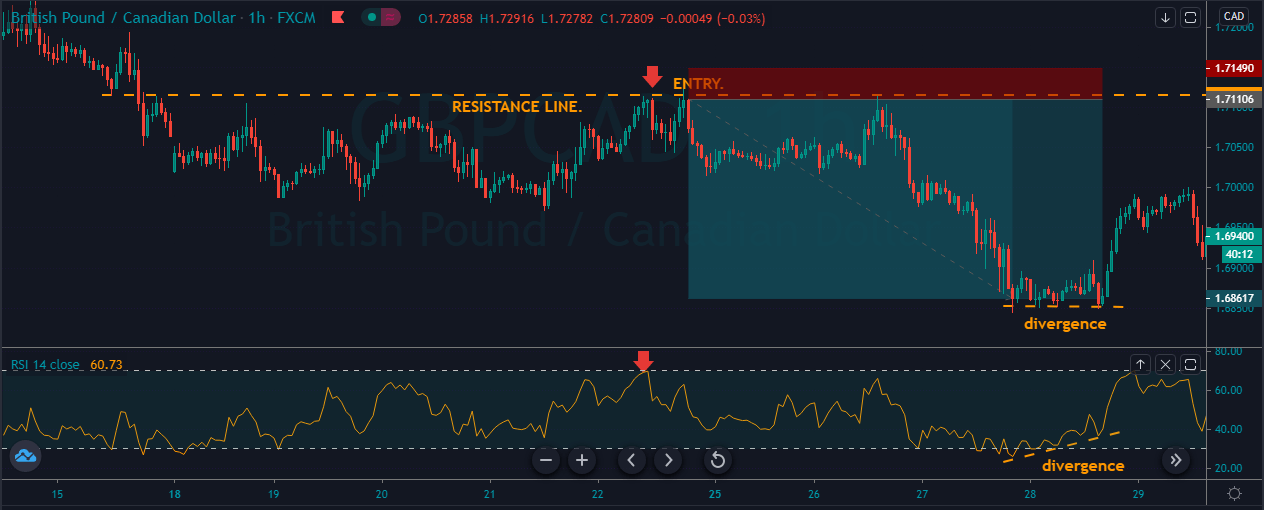

Divergence trading is a quite popular and easy way to make entry and exit in a trade. Most of the oscillator shows the divergence on the price action, which is a sign to take trade or exit in a trade. Here we are going to use the divergence to close our trade. Divergence is when the price action going in one direction and the indicator goes in another direction. When they both move in the opposite direction, it means that the indicator does not agree with the price of an asset or we can say the prices are overextended and the correction is mandatory.

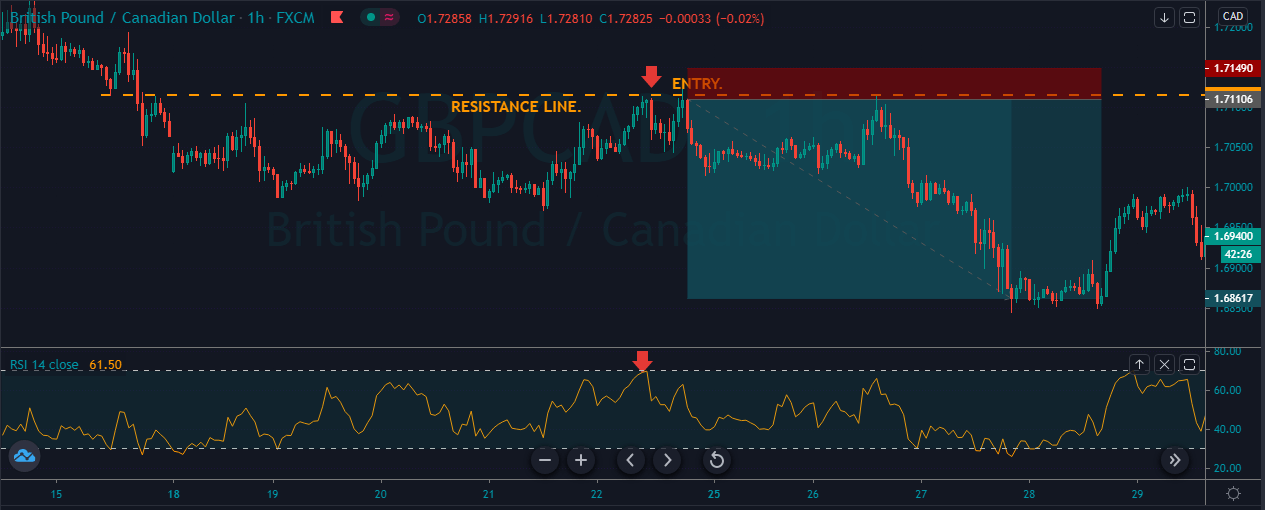

In this strategy, we are going to use the RSI indicator to identify the divergence on the price action.

RSI stands for RELATIVE STRENGTH INDEX, and it is an oscillator which moves above and below the 30 to 70 level. When the indicator goes to the 70 level, it means the market is overbought and soon expect the downside reversal. When the indicator approaches the 30 level, it means the market is oversold and expect the buy side reversal.

As you can see the image below it represents our selling entry in the GBPCAD forex pair. The price action kept testing the resistance level, and when the RSI approached the overbought area, it was a sign to go short. Soon after our entry, we witness the brand new lower low.

As you can see in the below image when the price action prints the brand new lower low, it started holding sideways for a couple of candles also at that time RSI indicator signals the buy trade but price action wasn’t moving upward. This was the sign that the indicator knew the price is overextended, and from here, the correction is mandatory. So when we got the divergence, we choose to close our whole selling trade. By using the divergence, you can accurately predict the market reversal; also, you can milk the market to the bottom level or the peak point. Divergence is the easiest most straightforward and most effective way to understand what is going on behind the scene in the market.

CONCLUSION.

Taking profit is the major component of trading; even the new traders always dying to book the profits. In contrast, the professionals always desire to hold their positions for the more extended targets. Your profit taking habits will determine how much amount of money you are going to make or not going to make. Impulsive behaviours often lead to failure in trading, so study yourself find out what triggers you to close the trades and always control yourself to hold for the more extended targets.