In this article, we will examine Facebook’s Libra Cryptocurrency, its essence, its special features, the advantages and disadvantages, and the problems and prospects of this cryptocurrency. Is Libra the cryptocurrency of the future or a black mark for Facebook?

In 2018, Facebook announced that it would create a cryptocurrency platform, called Libra. In June 2019, the project was presented for the first time to the audience. Despite its relative transparency and interesting implementation of the idea, the project was not approved by regulators who saw in the first type of new cryptocurrency and blockchain a serious competition with the world bank and the financial system in general. Now, the issue is which of the members of the Libra Association will sign the statutes of the Association on 14 October, going against the regulators, and what the consequences will be.

By 2017, the cryptocurrency market was developing so fast that the world’s largest corporations were eager not to fall behind new technologies. In 2018, everything changed a lot, but those who had already begun to invest millions of dollars in the development of their own platforms simply could not go back. Firstly, blockchain data transfer technology was interesting for investment banks, which faced two paths: joining existing systems (for example, Ripple, be able to become an alternative to SWIFT) or develop your own cryptocurrency startup.

Citibank and JPMorgan chose the second form. It is true that the instability of the cryptocurrency market and the ambiguous attitude of the regulators forced them to slow down the pace of development a little and change to an attitude of waiting and seeing. However, Citibank eventually decided to abandon all of its cryptocurrency experiments, preferring SWIFT. The stable currency JPM Coin was ready to test in June 2019, but JPMorgan has yet to make any public announcement.

In the spring of 2018, Mark Zuckerberg, the founder of Facebook, made the world aware of the creation of a new cryptocurrency. Actually, it is an electronic payment system that has as a benefit instant messaging transactions from WhatsApp and Facebook Messenger in all countries where the social network is used. In theory, through this cryptocurrency, Facebook users will pay for various types of virtual purchases, which are now paid for with real money.

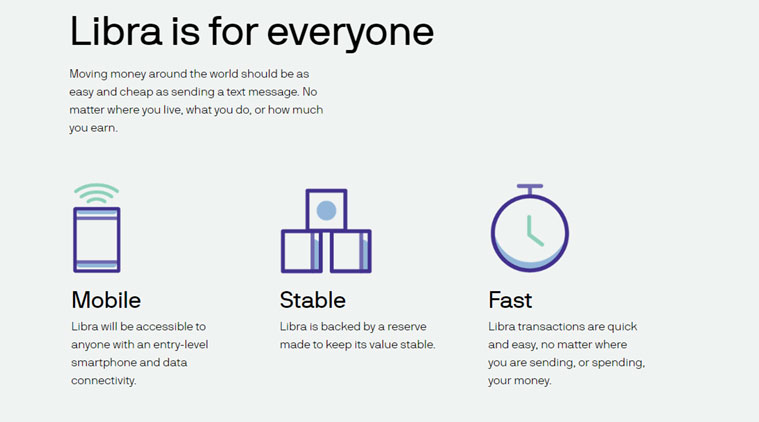

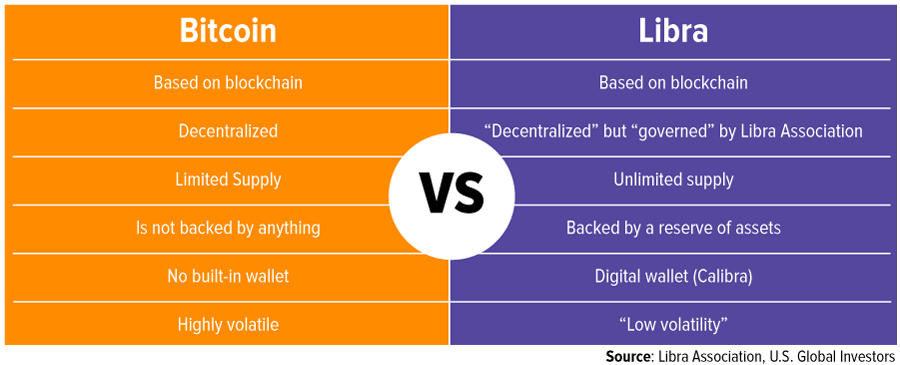

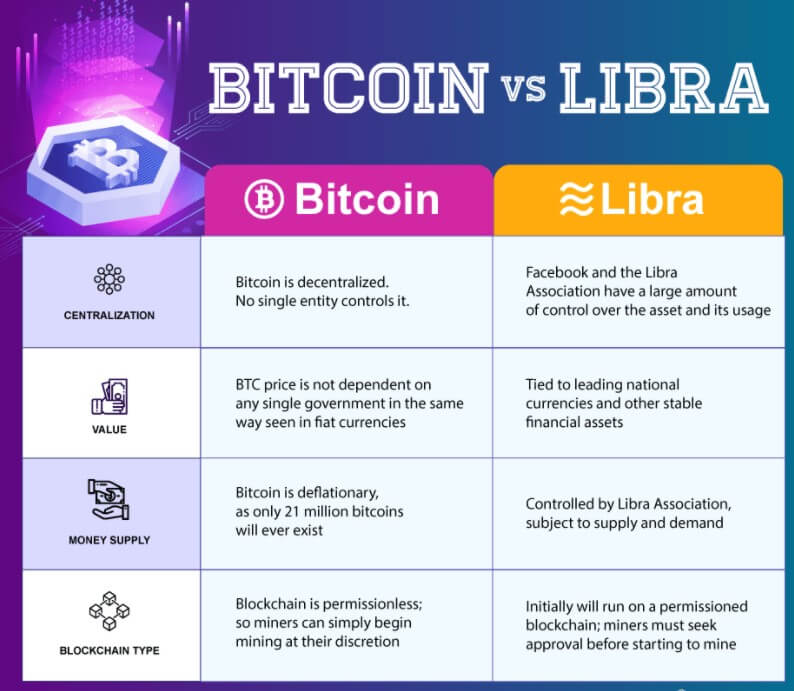

As the creators of the project say, the need to have created their own means of payment is due to the excessive volatility of cryptocurrencies in general, as well as that of fiduciary currencies. To ensure that the currency is not as volatile as traditional cryptos, Libra will be a stable currency backed by several currencies (including the US dollar and the euro).

Features of the Libra Cryptocurrency

-The Libra consensus algorithm suggests 100 validators in the initial stage, 66% of the votes are enough to make any changes in the network (similar to DpoS). It is suggested that validators be the largest participants in the network, and the number of validators may increase further in the future.

-Pound will be of less interest to speculators, as developers aim to maintain a stable exchange rate within social networks.

-It has been studied that the use of Libra within the network could increase the speed of transactions, much faster than the banking service and, in addition, would reduce the fees. We think that in the future different applications can be combined into one, in short, the public covered by this system will be more than 4 billion people in the world.

-The only wallet compatible with WhatsApp and Facebook Messenger is Calibrate. To open an account we only need a smartphone, and it will not be necessary to open a bank account.

-The share of USD in the support of Libra exceeds 50%. The intention is that Libra is also backed by the euro, the pound sterling, the yen, and government values.

-Facebook publicly unveiled its Libra project in June 2019 and presented its technical documentation. The coin is ready for final release in 2020. Although the platform’s codebase was developed by Facebook programmers, the company is not willing to reserve the right to exclusive control. In addition, developers have assured that they will not run the project until regulators (especially Americans) are completely satisfied.

-According to the developers, Libra is basically not a common cryptocurrency. This is a means of payment within a social media network, which may fall into the category of goods.

Contentious Points Associated with the Platform

-Libra is not ready to compete with the banks, although this statement may be questioned.

-It is not clear whether people blocked on the Facebook network can use the Calibrate wallet for any or other reason (political opinions, incitement to conflict, etc.). Even if it is temporarily locked, a user cannot use the wallet.

-Companies from countries where Libra is prohibited will not be able to participate in the association or receive validation votes. Doesn’t seem like a good idea, but this problem has not yet been decided.

-It is not clear how votes will be allocated if one validation company buys from another. Theoretically, a company receives a vote. The new company will have 2 votes in the event of a merger (this is the potential danger of centralisation).

-The platform has not established any mechanism to combat changes that have not been authorized in the Libra protocol.

-And, obviously, the biggest problem is that it is not defined how Libra will be able to avoid transfers out of purses and exchanges that fall under the category of illegal operations (money laundering, terrorist financing, etc.).

Opposition to Libra

Members of the Libra Association will meet on October 14 in Geneva, Switzerland, to sign the statute. Originally, 28 companies were announced to participate in the partnership. Before the project is already official, they must integrate their own system into the platform and perform test transactions. The “entry fee” is unclear: Facebook asked each member to commit an initial $10 million to join the group, but the reality is that no company has transferred the money today. Moreover, it was currently not clear which member would sign the document.

On 4 October 2019, PayPal, a well-known digital payment platform, officially refused to participate in the Libra cryptocurrency project. Therefore, the company became the first of 28 previously announced Libra Association members, who refused to support the platform. Reasons for the decision were not made public. The company representatives just pointed out that PayPal intends to focus on its own trading priorities.

It is not well defined if other electronic payment systems such as Stripe, Visa, or Mastercard can participate in this association, as they also plan to withdraw from the agreement. One of the unidentified sources explained this position simply: payment systems do not need excessive control by regulators over their businesses, which will inevitably follow after public support for Libra fell out of favor. In short, payment systems chose not to go against the regulator.

After Facebook launched Libra in mid-June, regulators and central banks responded immediately:

- French Finance Minister Bruno Le Maire said the central bank refuses to support the development of the Facebook Pound cryptocurrency in Europe because it endangers the monetary sovereignty of states. In his opinion, the danger is that Facebook has 2 billion users worldwide. Any failure in the network threatens financial problems.

Commentary: We have not defined the reason why other cryptocurrencies have never been accused of endangering the monetary sovereignty of states, and why BTC, being a stronger competitor, is not so much criticized.

- Germany went even further and adopted a blockchain strategy that prevents parallel coins from being issued in the country.

Commentary: It doesn’t seem easy to figure out how to implement this prohibition in reality, and how to ban cryptocurrency in general in the European legal framework.

- The European Commission began to investigate possible anti-competitive behaviour related to Libra. According to their representatives, the launch of Libra can lead to the creation of a completely separate economy, which will place those who do not use cryptocurrencies in a difficult position.

Commentary: It is surprising why this rhetoric has not been seen in relation to BTCs. Nor is it common for the European Commission to give its support to technically backward segments of the population, rather than promoting new technologies among people.

- The US Fed Advisory Council opposed Libra because Facebook would create a shadow banking system. US banks fear that Libra will reduce payment volumes in the banking system.

Commentary: The Council is made up of 12 presidents of the largest banks in the United States. It stands to reason that they are concerned about a slowdown in their business. But this is what is called competition, where the most technologically advanced systems displace the least developed. I wonder what exactly Libra provoked to have such strong criticism. This gives the reason for those who think that Facebook is a very strong competitor and others fear it.

- Most US congressmen think that Libra should apply for a banking license and be regulated by the US Financial Sector Advisory Council (FSAC). Their argument: the payment systems involved in the Libra project a close connection. And when no one expects it, the digital portfolio could start to present systemic risks along with large banks (alluding to the Libra Association audience).

Commentary: These concerns have some reasons. If a third of the world’s population starts using Libra, the attitude towards banks and fiduciary money can change. And the problem of managing risks becomes one of the key issues here. On the other hand, we have the information that the congressmen themselves claim to admit that cryptocurrencies and the blockchain have been completely integrated into everyday life during the 10 years of their operation. And breaking the future of technology makes no sense.

FINMA, the Swiss regulator, decided to support the platform. The country’s financial market supervision service believes that the project is being developed in a transparent manner and does not see any particular risk in digital currency, provided that it is developed in accordance with the relevant established rules. It is therefore reasonable that the Libra Association consortium should be registered in Switzerland.

There is a very clear algorithm in the actions of the SEC and all European regulators. Cryptocurrencies and regulators are like two opponents, and each is trying to cross a line in the defense of the enemy. Attempts to take control of token issuance, ban mining and ICOs, and restrict crypto-swap operation have ultimately had no effect. It is very difficult to have control of something that does not have a single focal point and has an intangible electronic form.

The cryptocurrency community actively promotes the idea of future bitcoin and ETF funds, which goes against the policy of the SEC. In turn, the SEC, trying to gain control of the situation, can do nothing against developers “private” and, therefore, confrontation with Libra is an ideal opportunity to show their power and avoid such attempts by global corporations in the future.

Imagine a community where people pose a potential danger. Civilians are easily controlled, while potentially dangerous people create their own clandestine organizations that cannot be controlled. However, these organizations do not yet present any particular danger, because the authorities sometimes establish an exemplary punishment so that the other cannot do the same, As long as the authorities catch one of those illegal organizations in the act. And this is not easy.

And on a certain occasion, a dissident leader, who is quite popular, tries to create a product that is unfavorable to the authorities. The authorities understand that if they do nothing, the rest can go their way, and then it will be even more difficult to maintain authority. So it is not important whether the product may appear to be a threat or, on the contrary, a benefit. It’s important to show who’s boss here, what happened in the confrontation between regulators and Facebook.

In other words, regulators have simply seized the opportunity to demonstrate their power by attempting to dismantle a great project that has been created by one of the world’s most powerful technology companies. And the score is one to zero for the regulators so far.

Why Libra and Similar Startups Have No Real Prospects

They have no proper place in the global financial system. The unstable position of cryptocurrencies is due to the fact that there is no legal framework or a clear system of regulation/control. If “private” developers can still market their product in a narrow circle of cryptocurrency enthusiasts, then large corporations interested in cryptocurrency are immediately put at risk. So far, according to the SEC, cryptocurrency is an asset to the shadow business, and there are still no prospects.

They do not provide sufficient return or return on investment. It is impossible to estimate the performance of the platform if there is more than a year before its launch. While 90% of new companies in the cryptocurrency market are currently in development, it is impossible to assess the effectiveness of investments. “Private” developers at their risk perform ICO and expect to cover costs and earn money at the pre-sale and pump. Corporations cannot take that step, as their reputation would be at stake in this case.

Some economies are closed and lagging behind economically. First of all, it’s serious for China, which has its own messengers, so it’s unclear how Facebook could promote its product in China. Secondly, these are economically backward countries where there is no developed banking system or general knowledge of cryptocurrencies and electronic purses. In those countries, even smartphones are not common.

In attempting to capture exaggerations, Facebook, on the contrary, now has to follow the slow path of global cryptocurrency development, led by the SEC and European regulators. The corporation has not benefited from the early release of the product into the market. Many investors remember the 2018 scandals about leaked information, according to which Facebook, according to the policies of the FTC (the United States Federal Trade Commission) issued on July 24, 2019, must pay a record fine for social media of $5 billion. The refusal of payment systems to cooperate with the Libra platform could give a new blow to Facebook’s reputation.

Conclusion

It’s hard to blame Facebook for anything, but the situation is definitely not on the corporate side. One of Zuckerberg’s mistakes was that, with the aim of beating competitors, he offered the market a flawed and unfinished product without a clear development strategy and aligning all questions with regulators. And now, any of the big corporations will hardly want to follow their example and stand up to regulators. US and European regulators, on the other hand, took the opportunity to demonstrate their power and ruin the new project.

Another Facebook flaw was the focus on advertising and positioning itself as a leader. JPM Coin developers preferred to remain in the shadows. JPM Coin is only a tokenization trust, so the project will hardly be of interest to a wide range of financial institutions. In this way, developers avoided unnecessary advertising. Facebook, on the other hand, carried out its aggressive marketing policy, trying to get the support of major corporate investors. But he got opposition from the regulators instead.

Unfortunately, Libra is one of many examples of how remotely distant cryptocurrencies can be a complete financial instrument that investors and venture capital trust. Especially when political intrigue is in the foreground.

This volatility is also the reason why cryptocurrencies have been slow at real-life adoption since users fear making losses. Stablecoins such as Tether exists to provide cryptocurrency users with both security and speed of cryptocurrencies with the stability of Fiat currency.

This volatility is also the reason why cryptocurrencies have been slow at real-life adoption since users fear making losses. Stablecoins such as Tether exists to provide cryptocurrency users with both security and speed of cryptocurrencies with the stability of Fiat currency.