Both aspiring and expert forex traders can benefit from learning informative statistics about the forex market; however, you’ll often find a long list of boring facts and numbers when you look up the subject. We wanted our readers to have the chance to learn something new without feeling bored, so we scoured the internet to find the most surprising stats about the forex market out there.

Statistic #1: Only 10% of forex traders succeed

Our first statistic is both depressing and surprising, but the good news is that it isn’t difficult to avoid becoming one of the failed traders we’re speaking of. The majority of this percentage is made up of aspiring traders that either opened a trading account without proper education or with unrealistic expectations. The misconception that forex trading is just a quick way to get rich draws in traders, then they give up quickly when they realize that they may have unrealistic expectations.

Statistic #2: 51.6% of traders prefer Android smartphones over iPhones

People across the world have been arguing over whether Android or iPhone is better for more than a decade. We’ve heard a lot of arguments supporting the iPhone for all of its unique features; however, iPhone users might be surprised to hear that Android not only sells more phones than Apple, but the smartphone brand is also preferred by forex traders by approximately 14.3%.

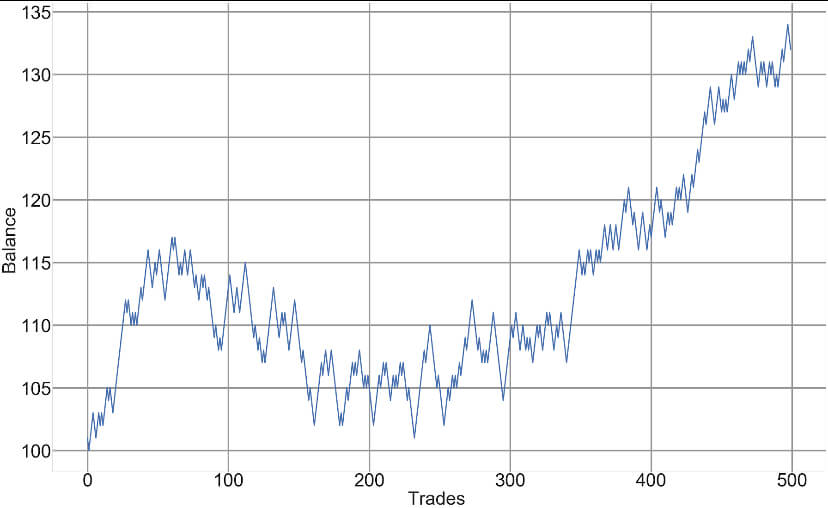

Statistic #3: A Whopping 90% of successful forex traders claim to use expert advisors

An expert advisor is a trading robot that executes trades on behalf of the trader. There are a lot of different types of EAs out there that enter and exit trades based on different principles. Although there are highly profitable trading robot options out there, many traders can be apprehensive about using them because they may fail and also because many EAs cost at least a few hundred dollars, meaning that you’ll be out of a decent chunk of money if you invest in an unprofitable robot. This is why it’s surprising to hear that so many successful traders actually depend on these services.

Statistic #4: 27% of forex traders are aged between 18 to 32 years old

When you picture a forex trader, your mind might think of someone in their forties or fifties, or maybe even older. However, forex traders are getting started at much younger ages these days. Another 28% of forex traders are between 35 to 44 years old, meaning that younger traders make up more than half of the total forex traders in the world.

Statistic #5: More than $5 trillion is traded in the forex market each day

It’s surprising enough to hear that an almost unheard of amount of money passes through the forex market every single day, but did you know that forex trading has more money flow through it than the stock market? It can be harder to find exact figures, but price points seem to fall more in the range of billions when you’re looking at the stock market, which gives forex a substantial lead.

Statistic #6: 41% of all forex transactions occur in the United Kingdom

The most popular currency pair is the United States Dollar, so you might be shocked to learn that almost half of all forex transactions actually occur in the United Kingdom. If you’re wondering how many transactions take place in the United States, the answer is only about 19%.

Statistic #7: Only 7% of traders have 10 or more years of experience

If you’re feeling like you’re at a disadvantage because you have little experience trading forex, you might be surprised to hear that traders with 1-3 years of experience make up 39% of forex traders, while another 31% have less than one year’s worth of experience.

Statistic #8: 40% of forex traders choose to trade because they want to be their own boss

The number one reason why people decide to trade comes down to being their own boss, with almost half of all traders claiming this to be their top motivation, even more so than simply making money. Of course, forex does offer a lot of perks that you can’t find with a regular job.

Statistic #9: More than 45% of traders don’t spend money on learning resources

When you become a trader, you can find a lot of resources online for free, but some may believe that the resources you pay for would offer better educational opportunities. This isn’t necessarily the case, as nearly half of all forex traders opted not to pay a cent for any learning resources in the past year.

Statistic #10: Approximately 89.1% of forex traders are men

You might have assumed that the number of male traders outweighs the number of female traders, but it’s surprising to hear just how much larger that percentage is. Of course, this is a great incentive for aspiring female traders to get out there and even out those stereotypes.