Introduction

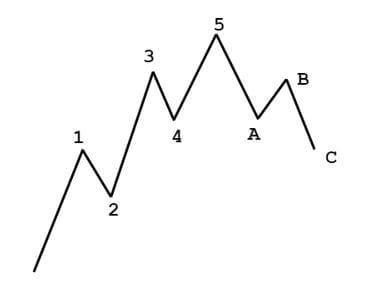

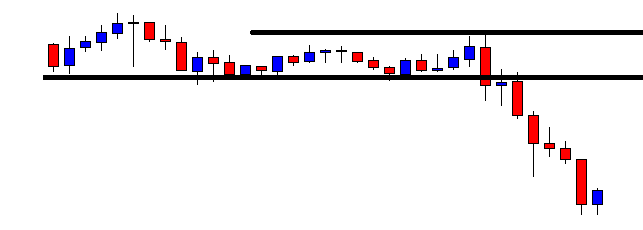

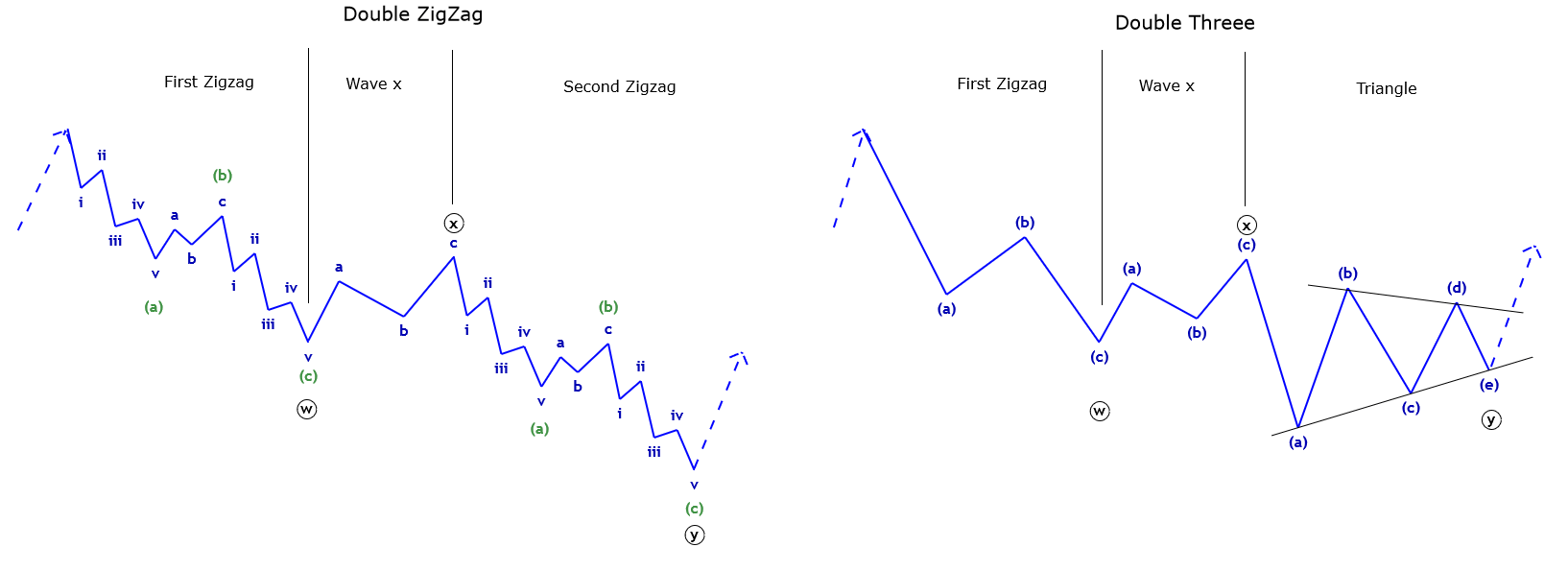

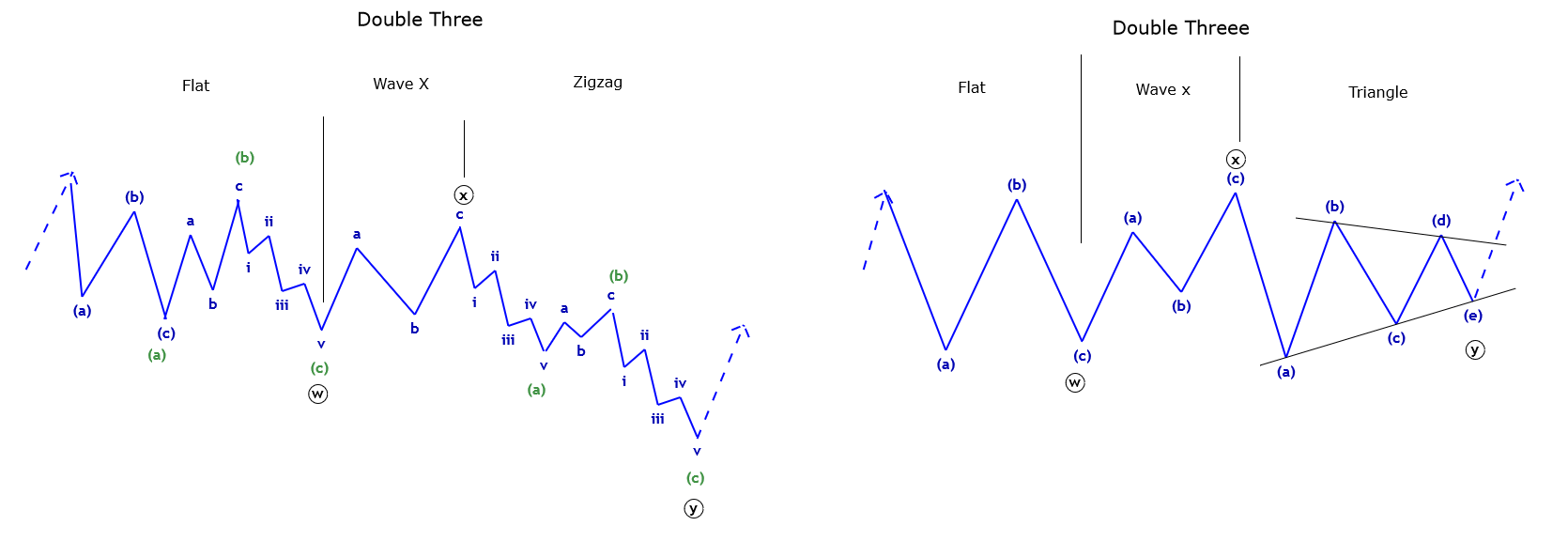

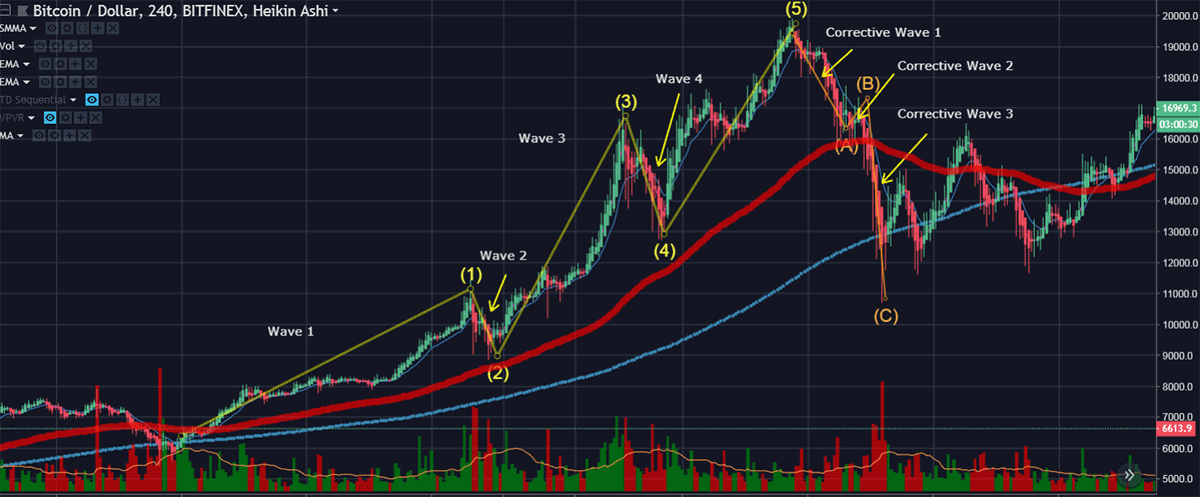

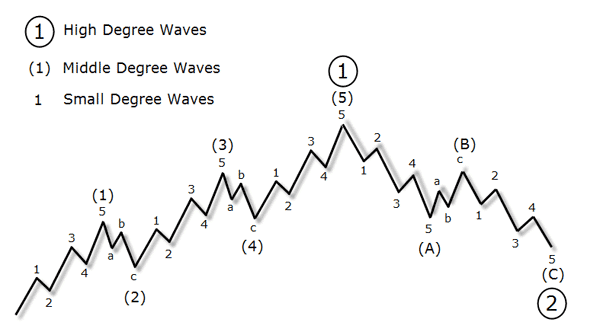

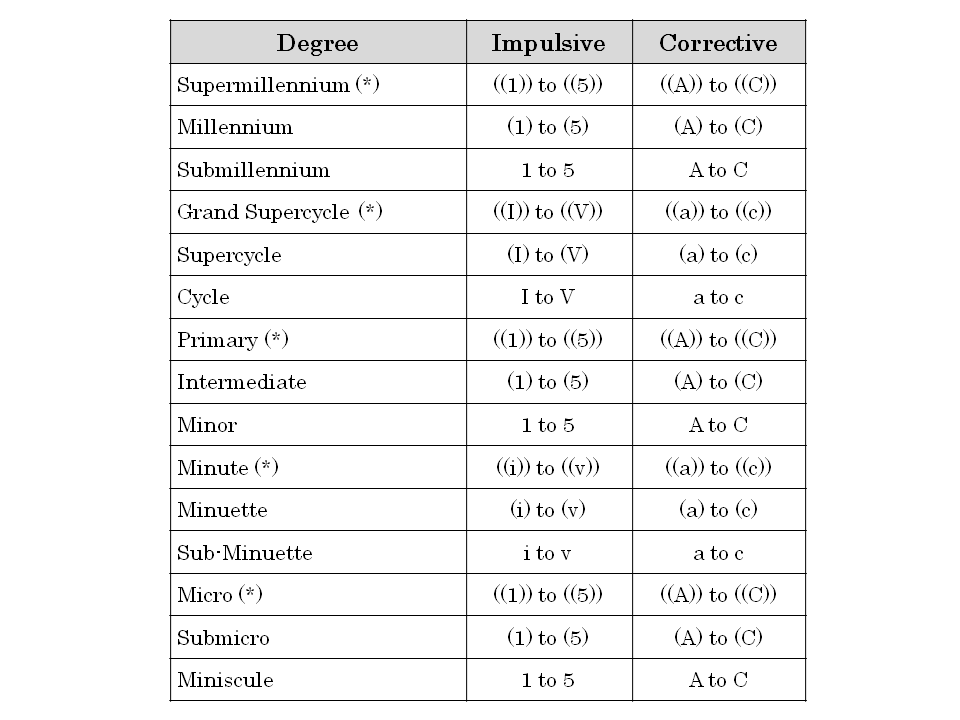

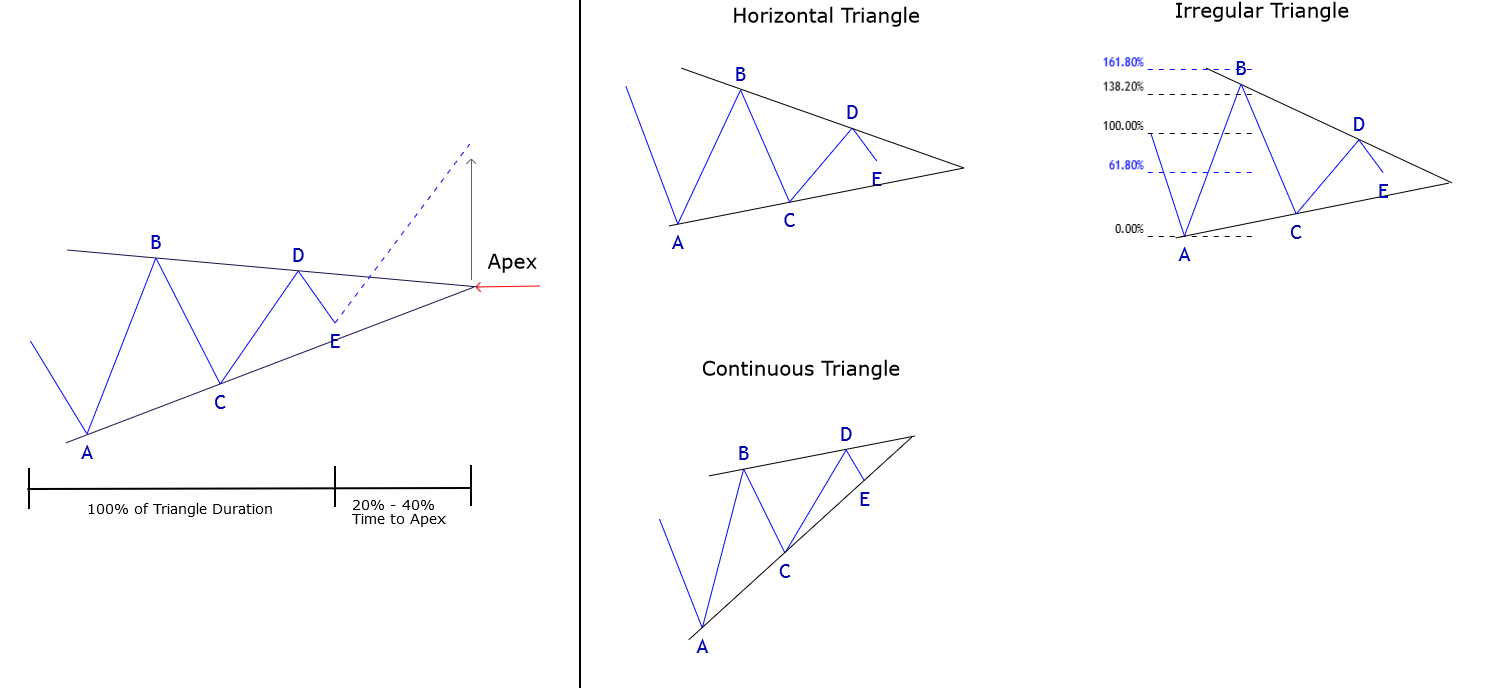

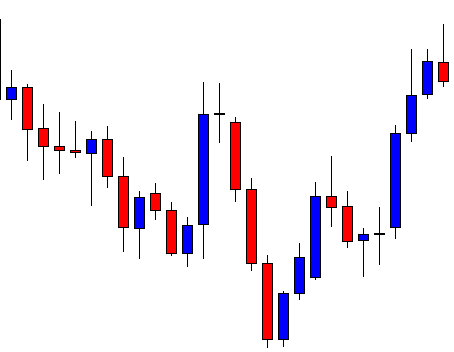

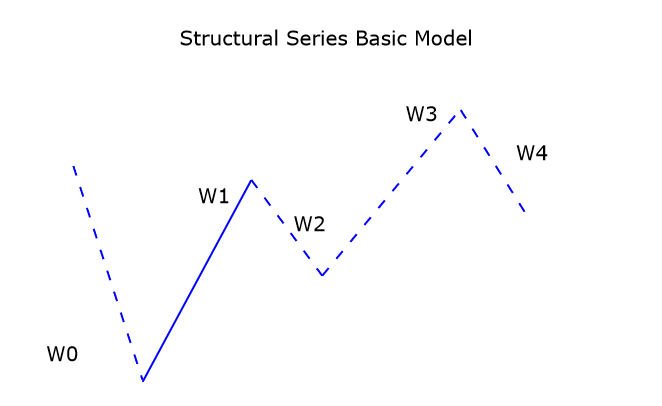

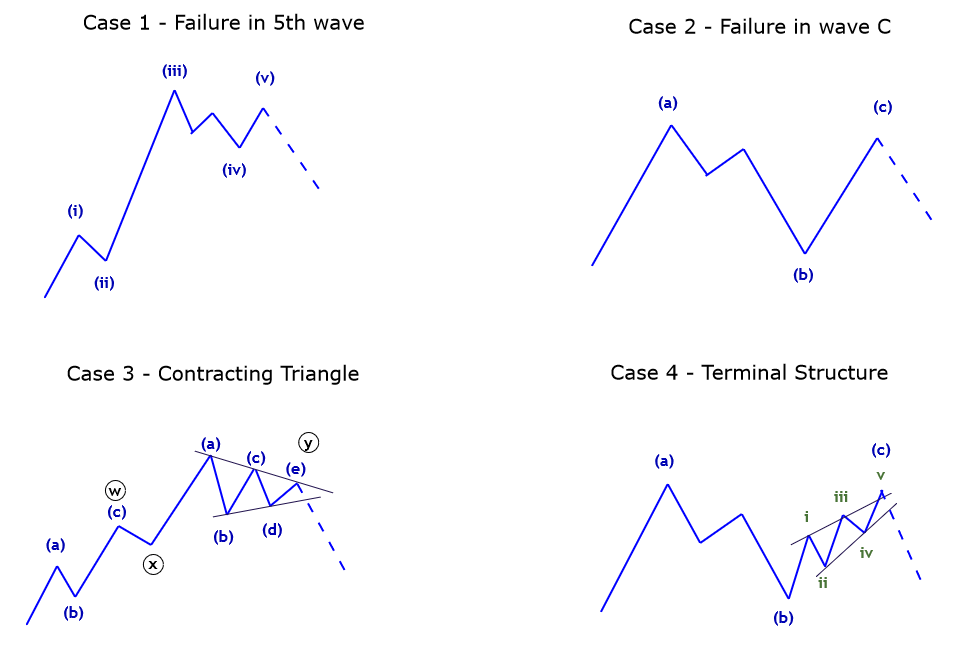

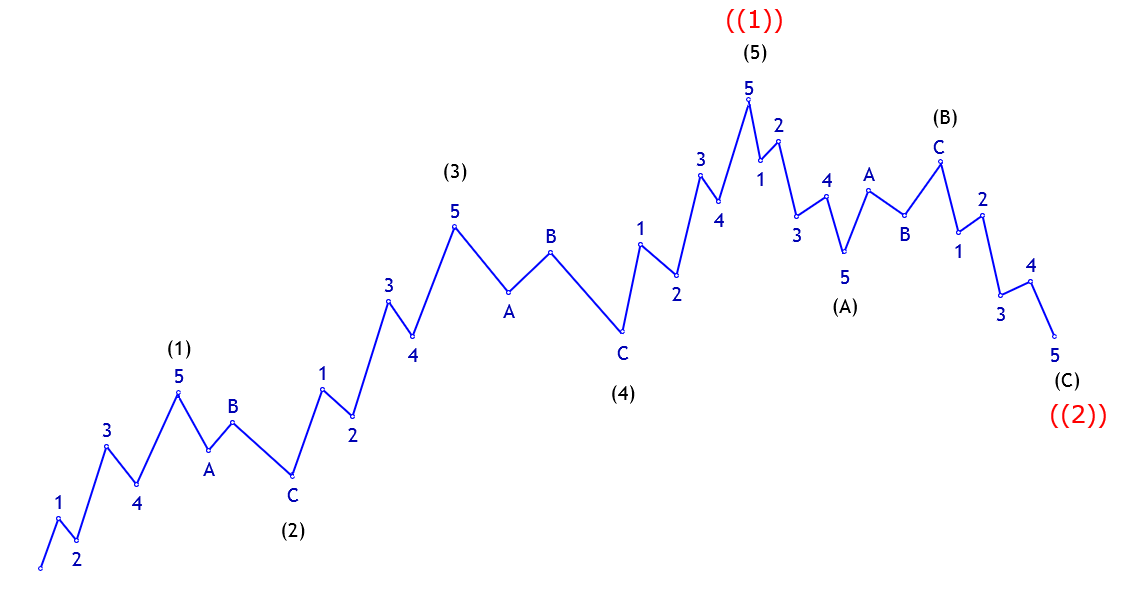

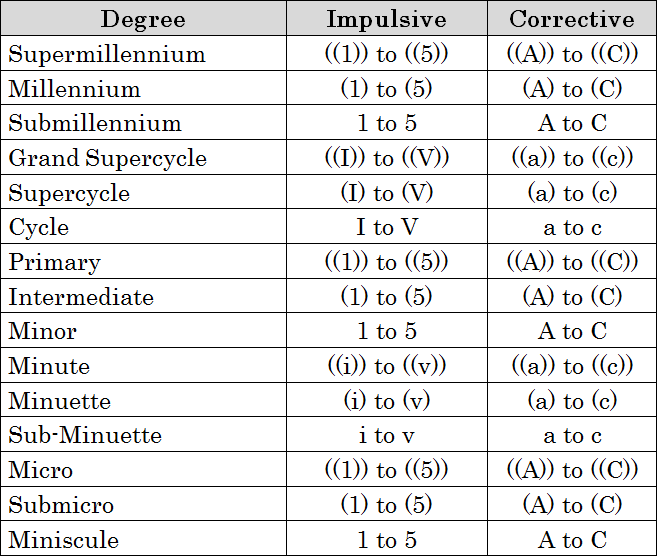

The triangle pattern is the third basic model of the corrective structures defined by R.N. Elliott. The triangle contains five internal segments and tends to appear in waves 4 and B.

Glenn Neely, in his work “Mastering Elliott Wave,” expands the definitions of contracting and expanding triangle introduced by Elliott proposing two subcategories identified as non-restricting and restricting.

In this educational article, corresponding to the third of four parts, we’ll present the triangle pattern variations and its implications in the wave analysis. In particular, we’ll discuss the contracting triangle pattern and its restrictive subcategory.

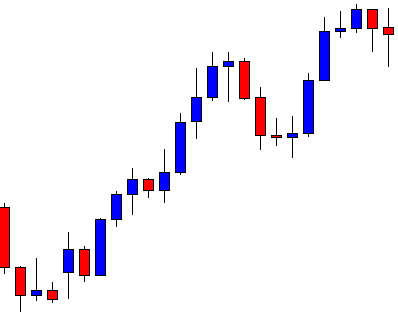

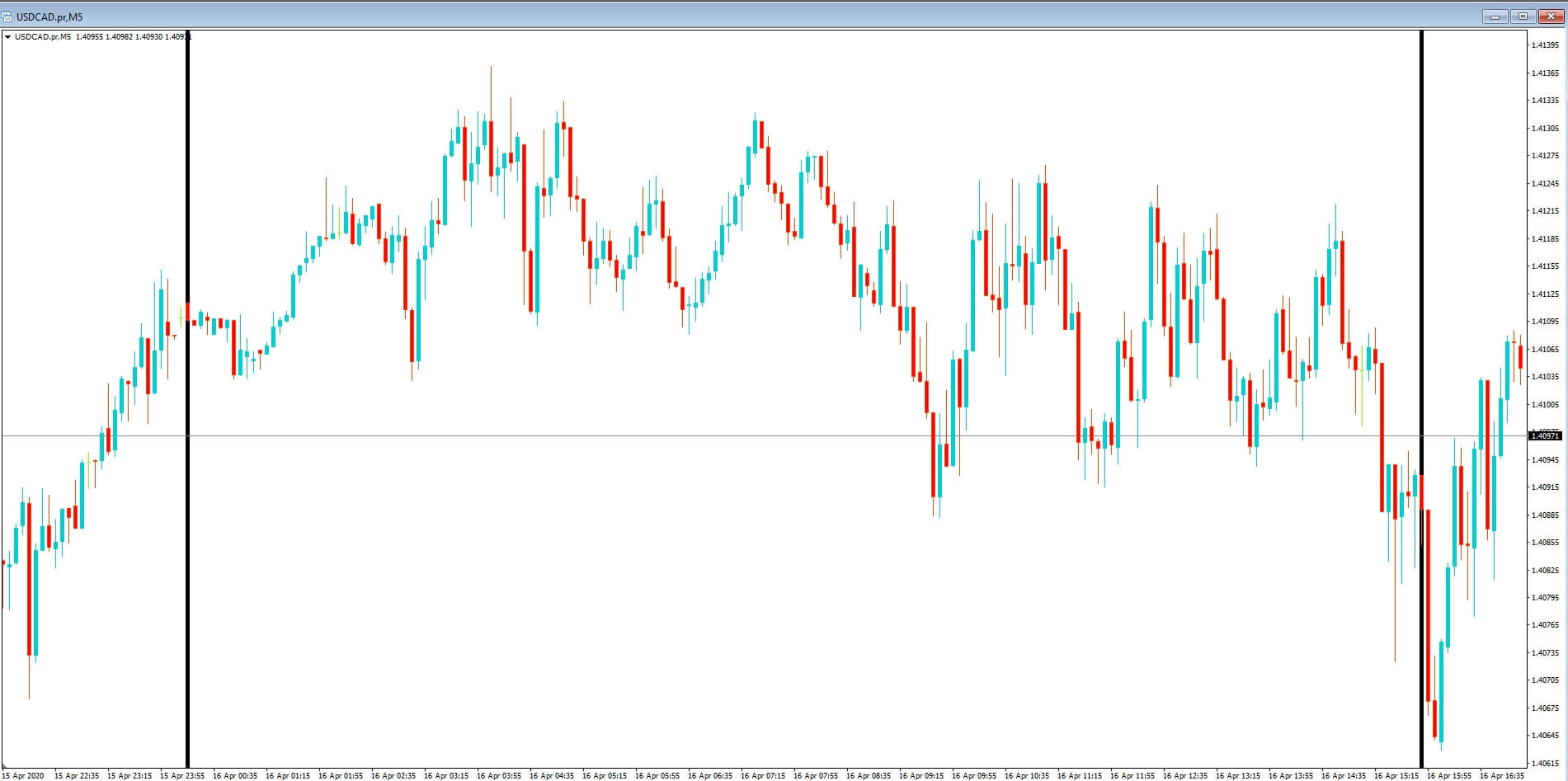

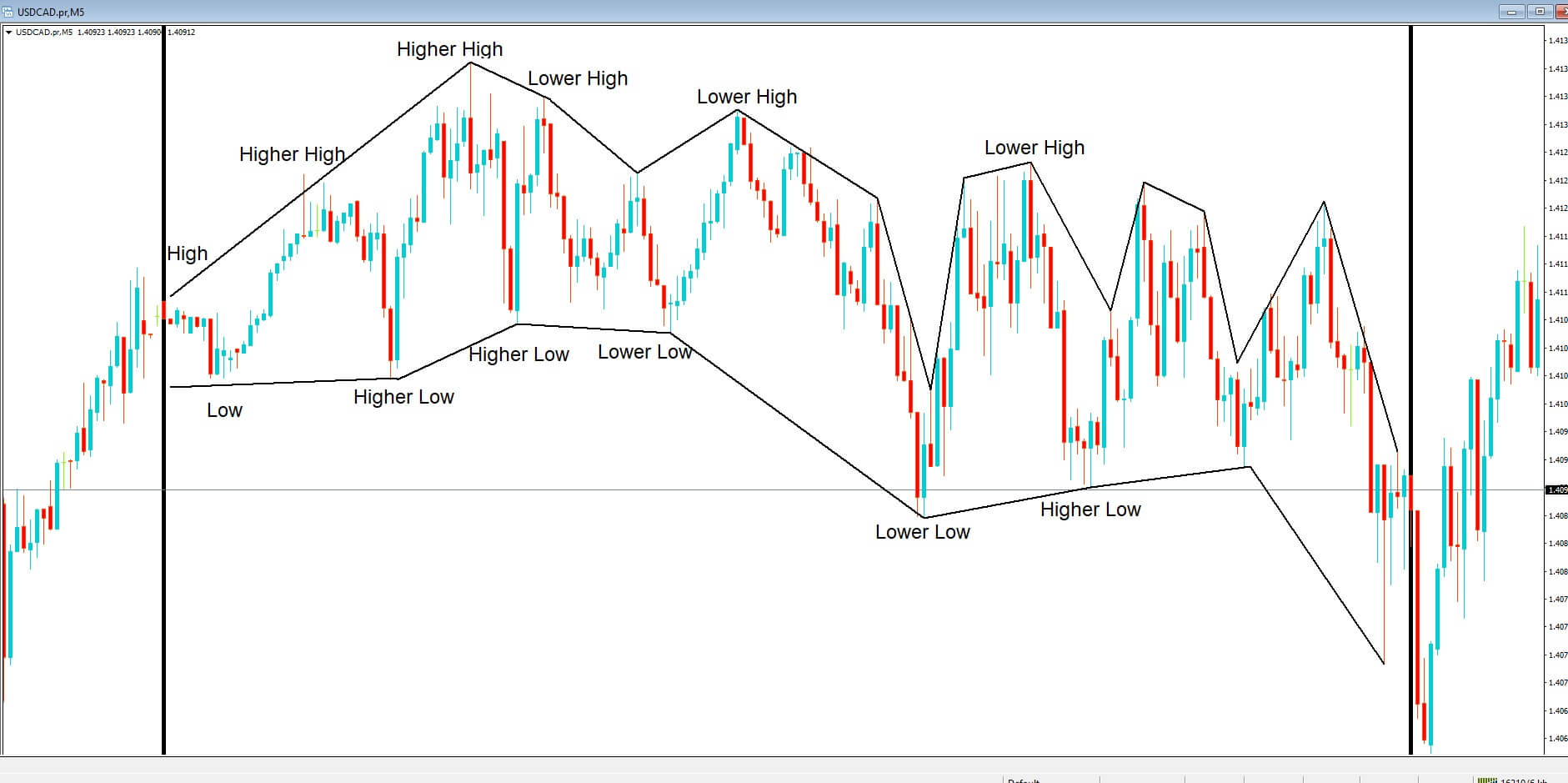

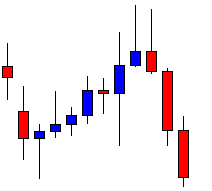

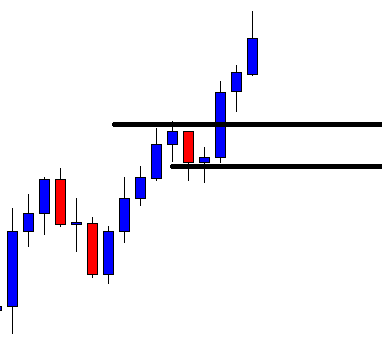

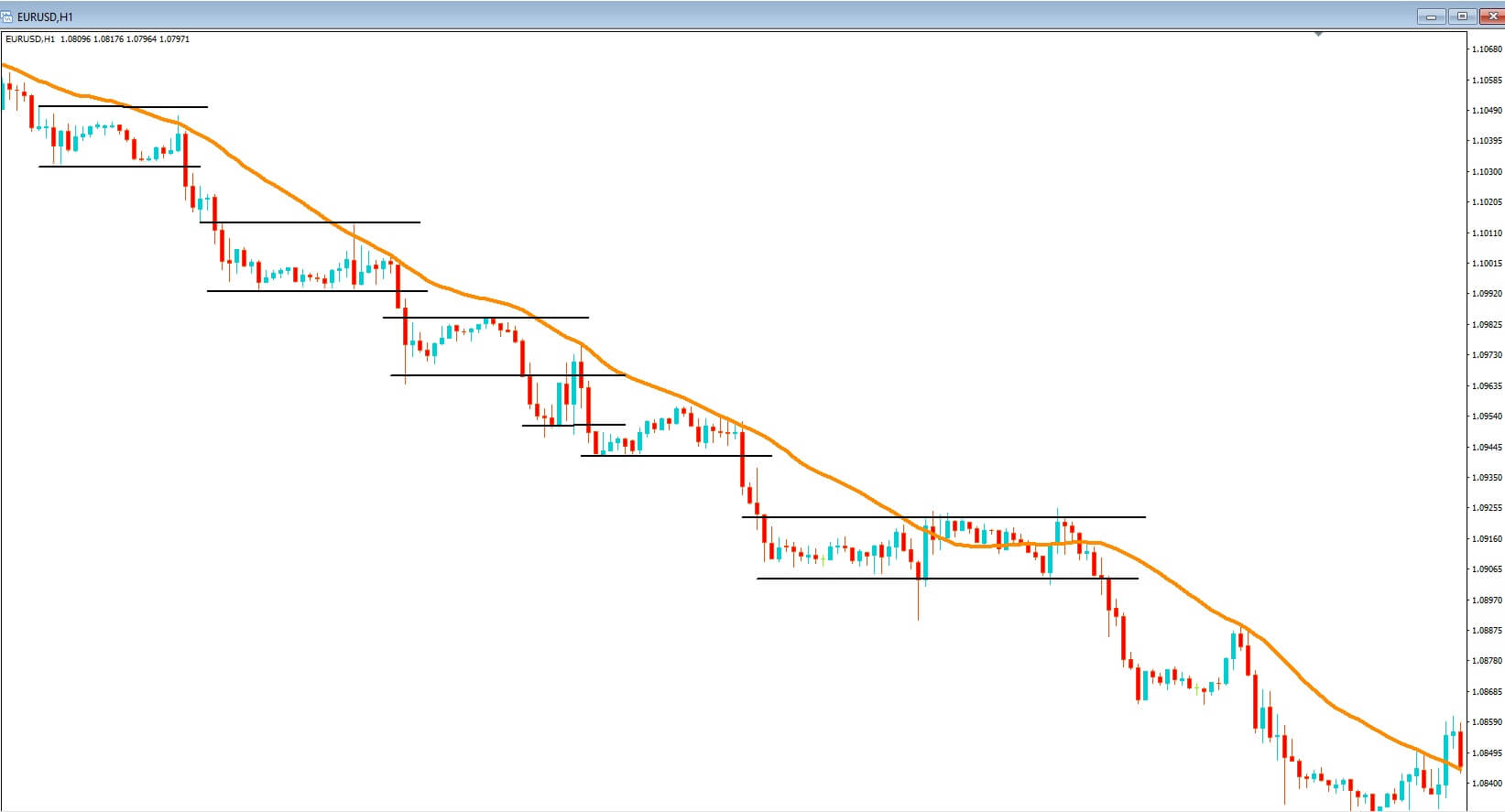

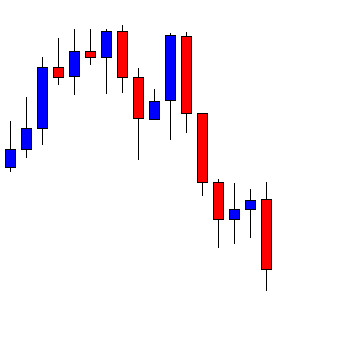

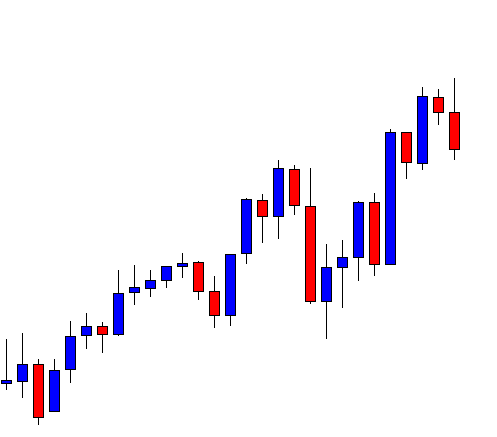

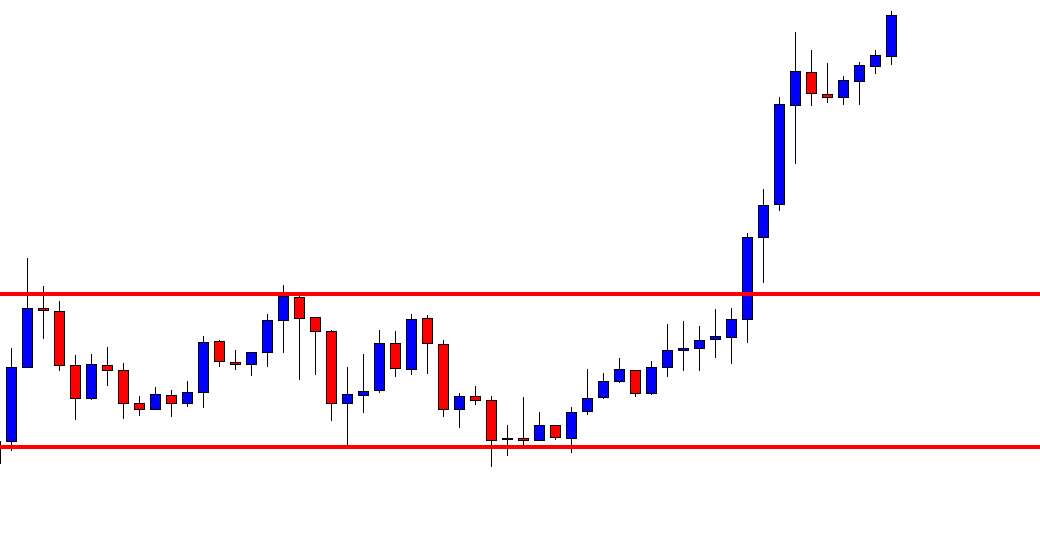

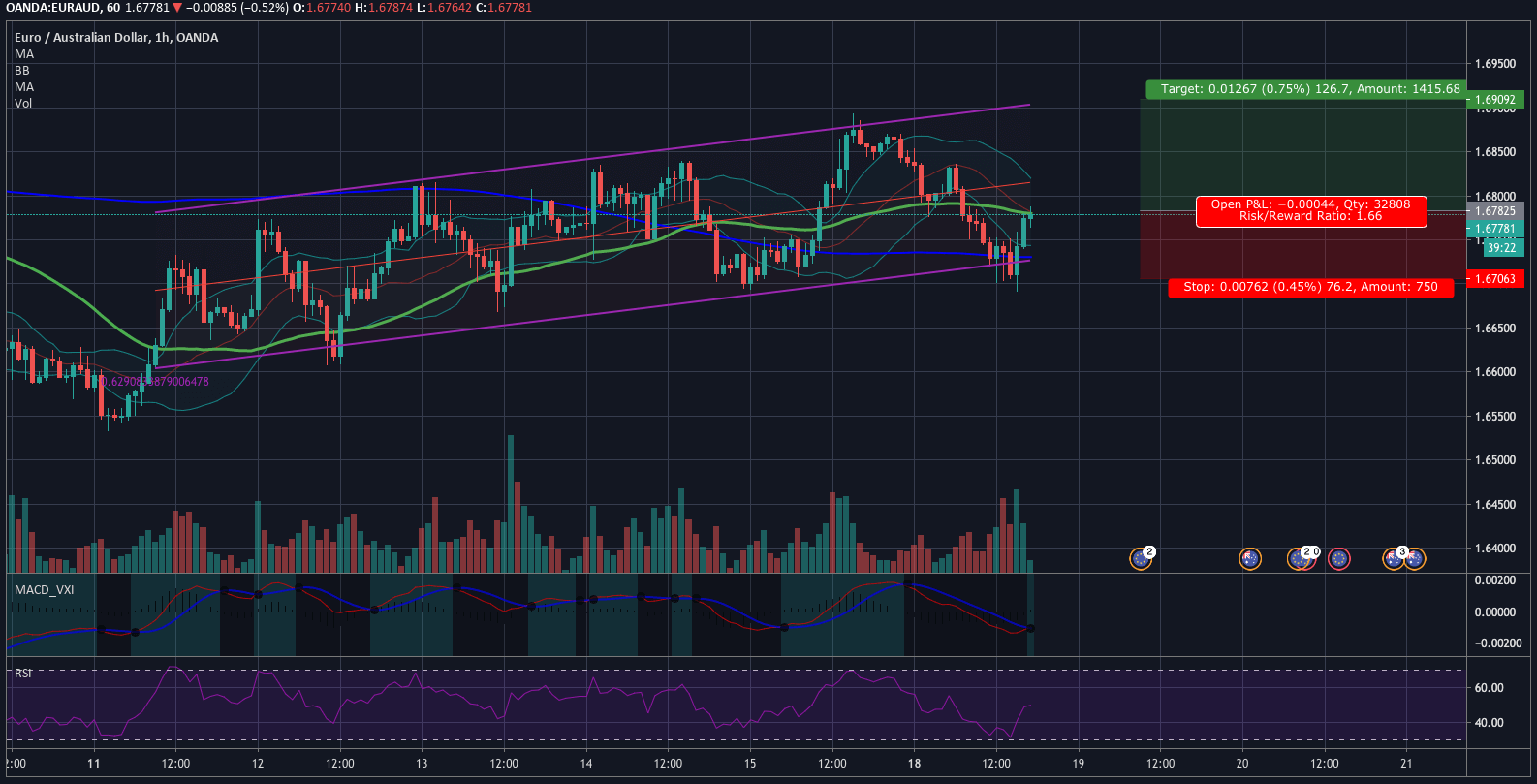

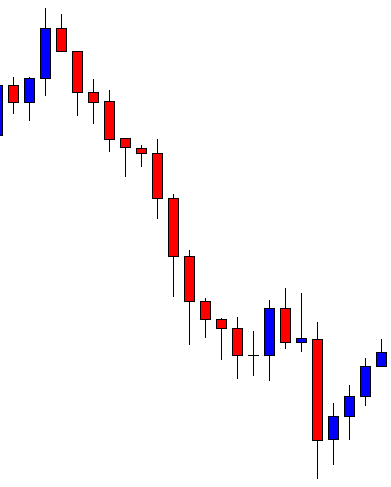

Contracting Triangles

This type of triangle is the most frequently identified in the real market. In this group, there are two types of triangles, restrictive and non-restrictive contracting triangles.

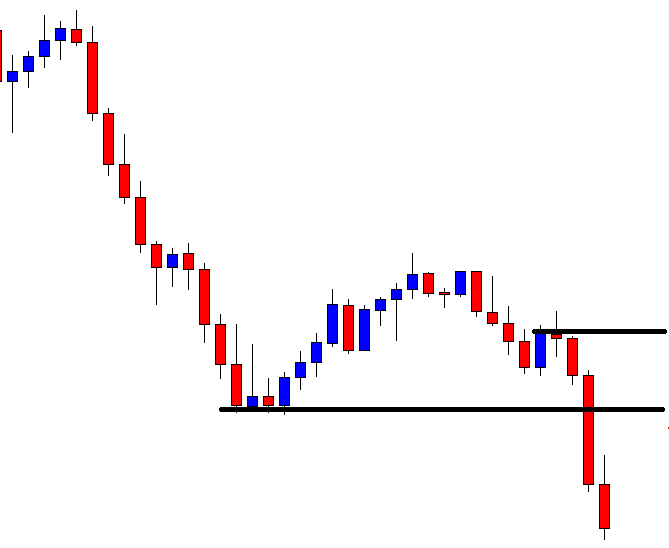

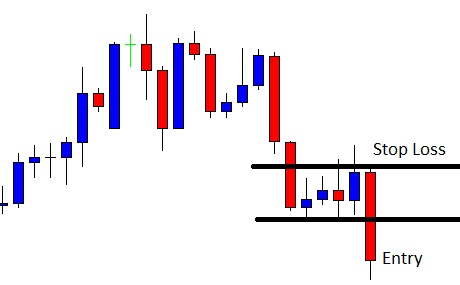

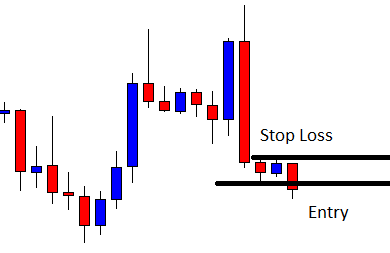

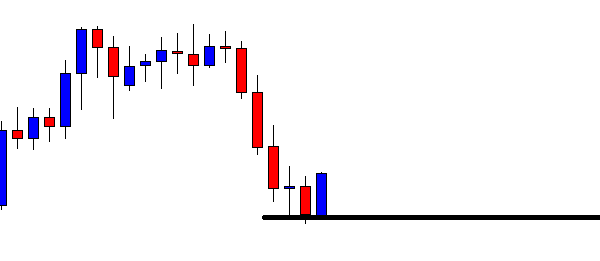

Restrictive Contracting Triangle

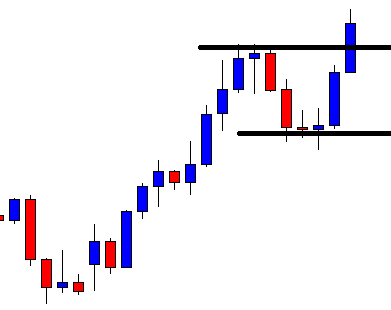

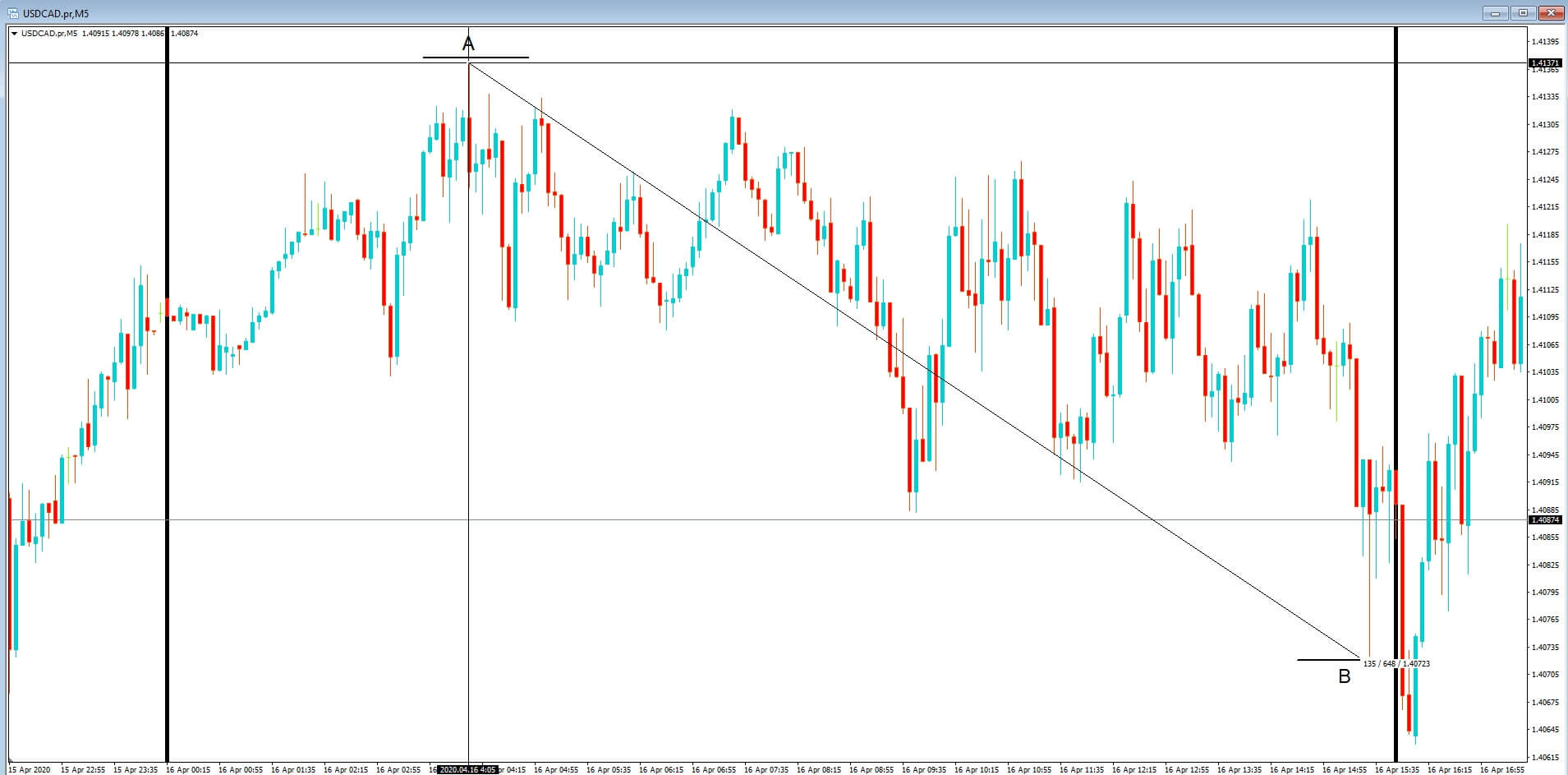

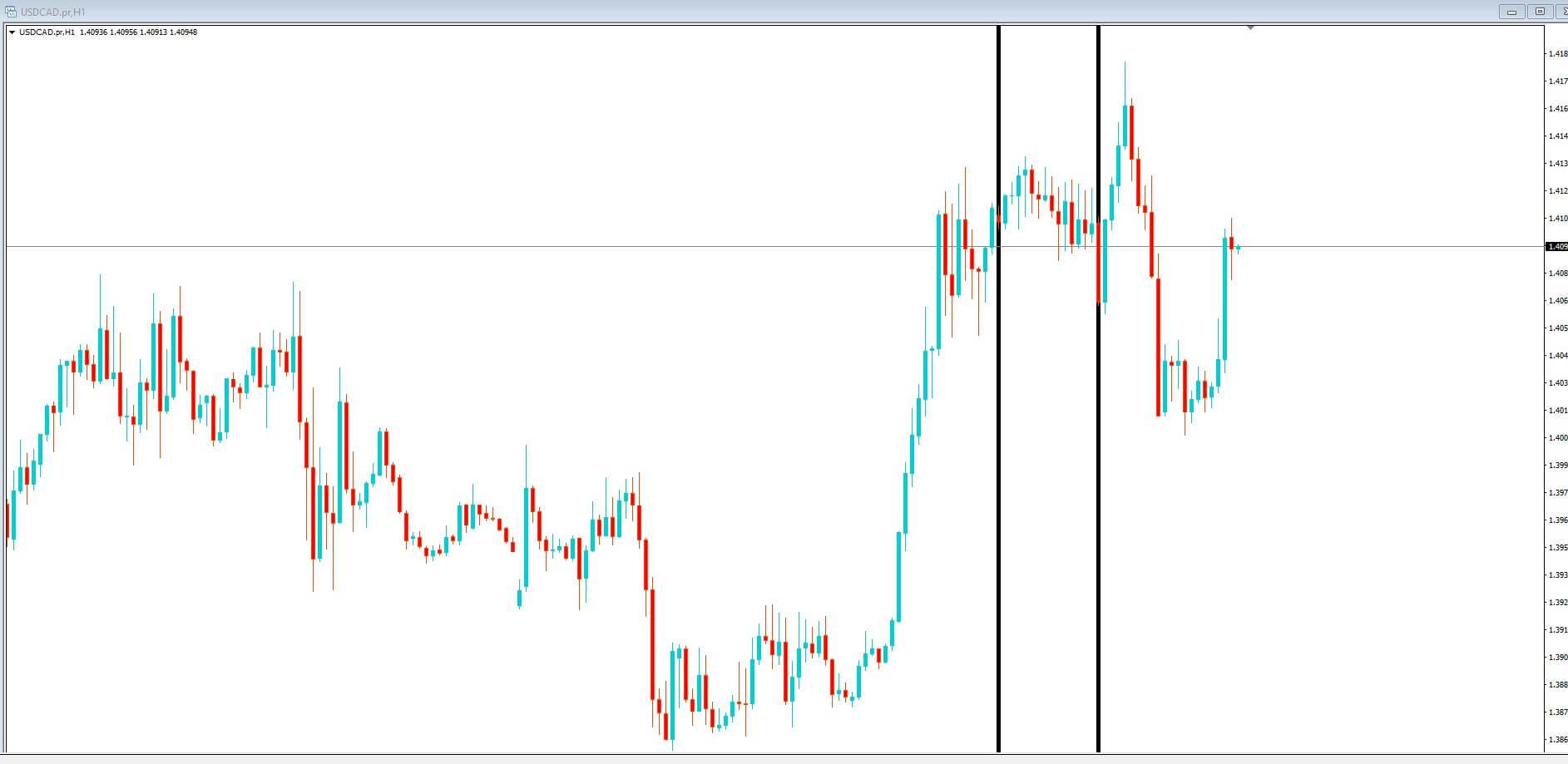

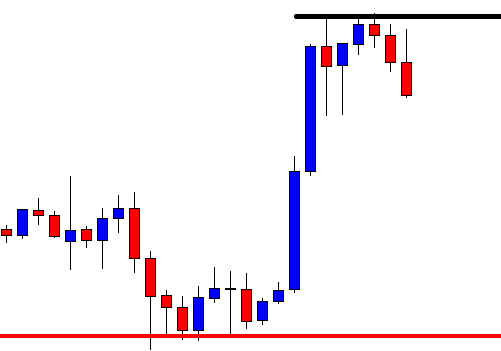

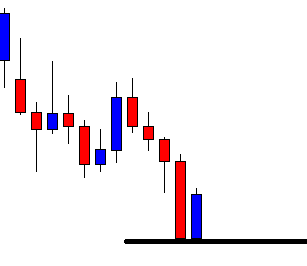

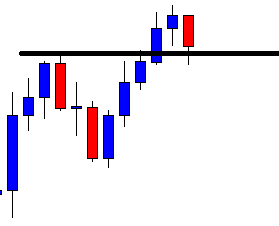

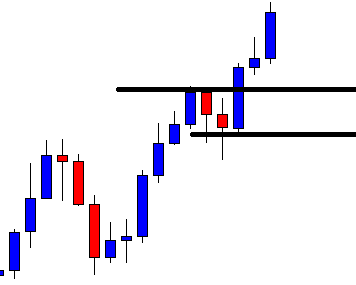

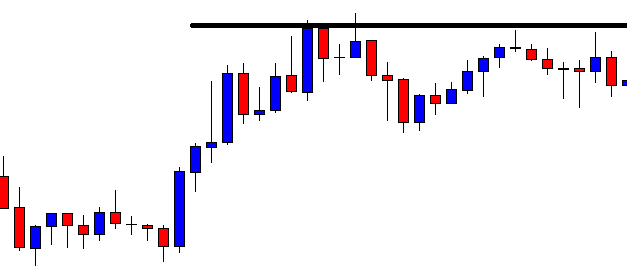

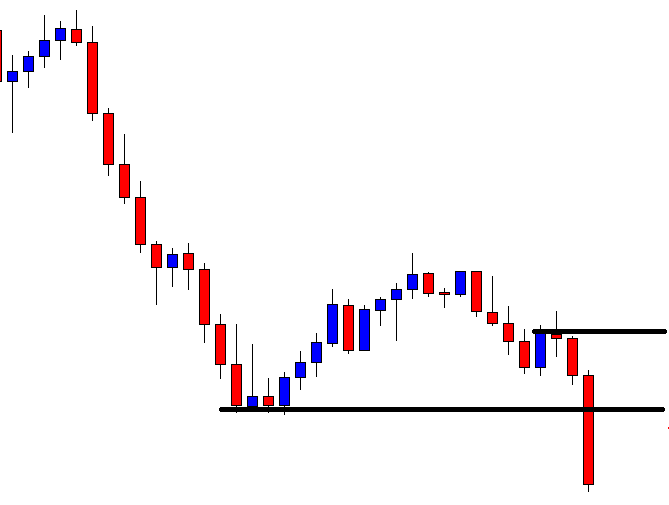

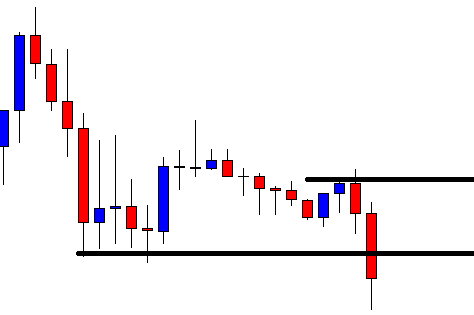

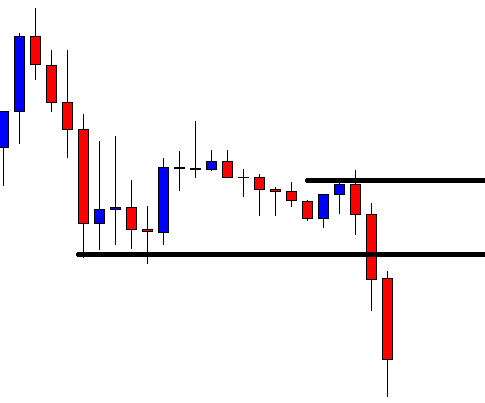

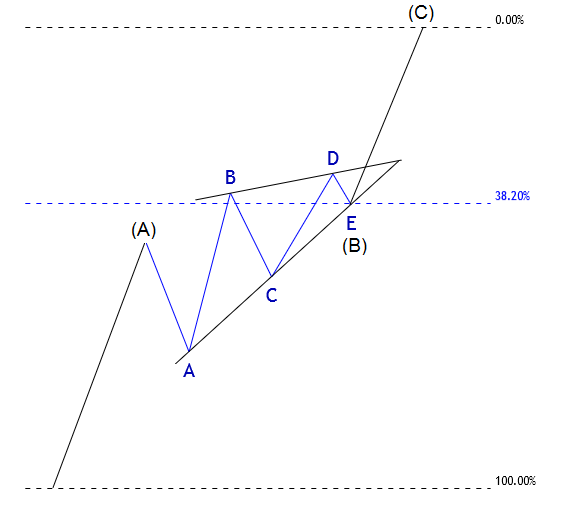

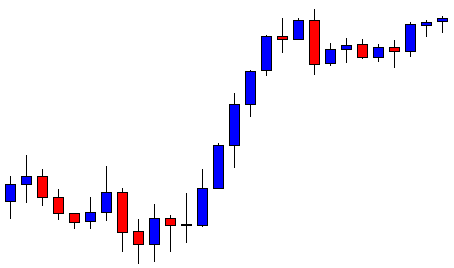

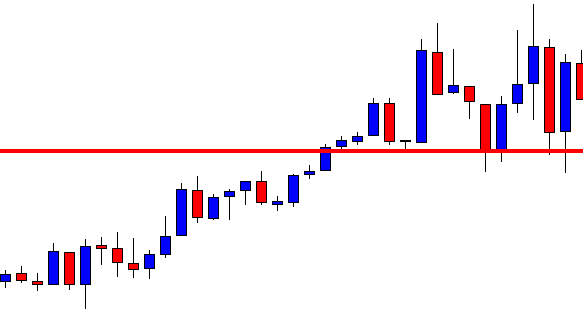

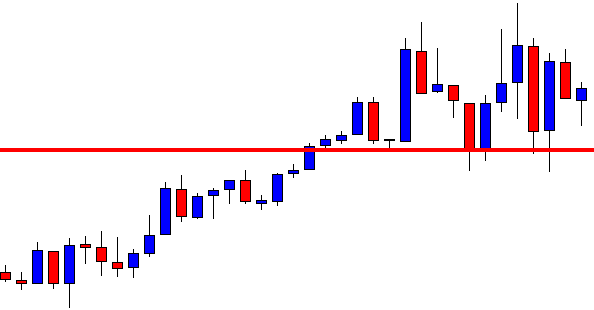

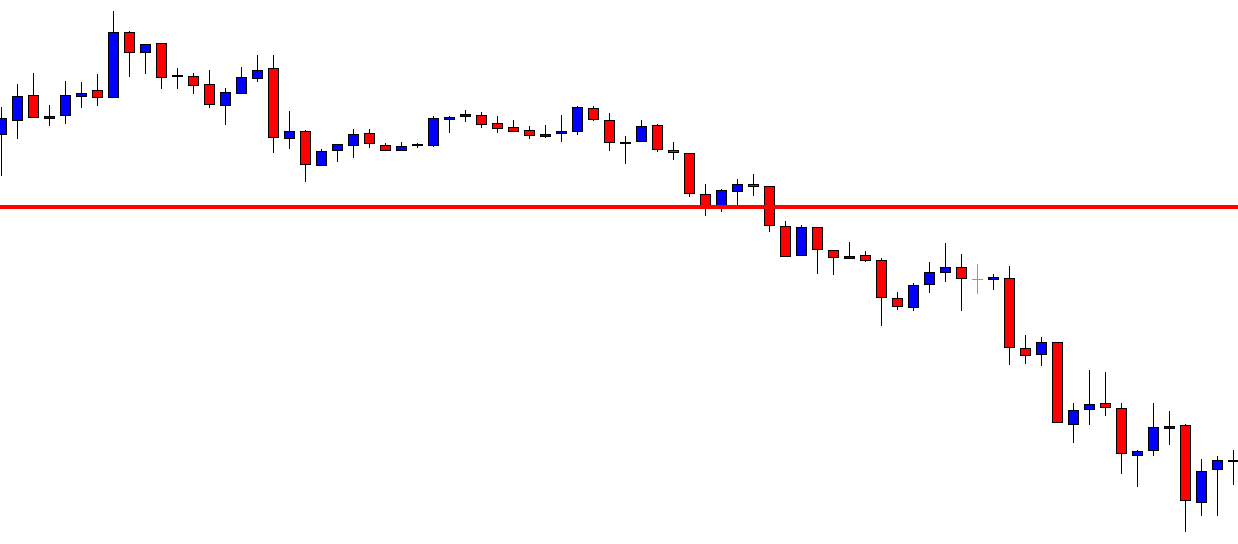

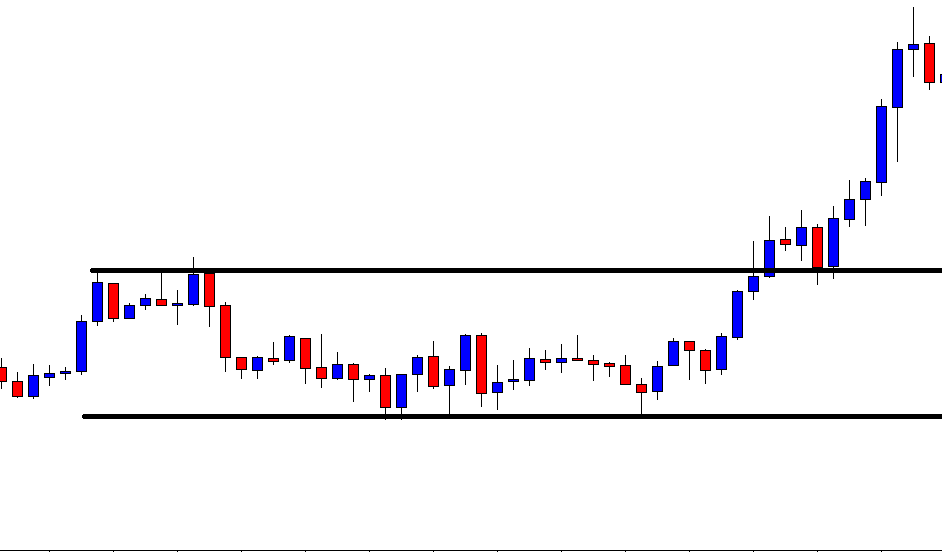

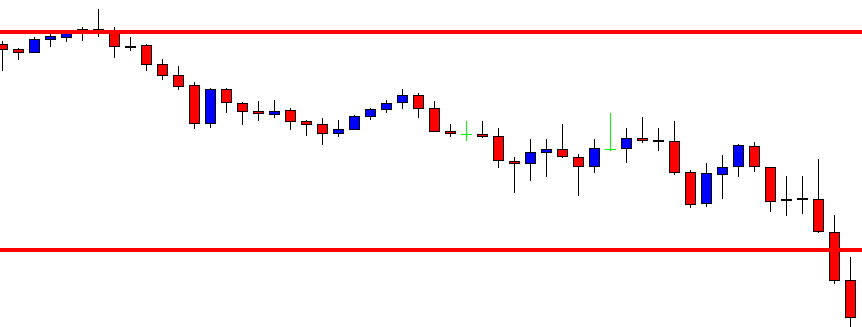

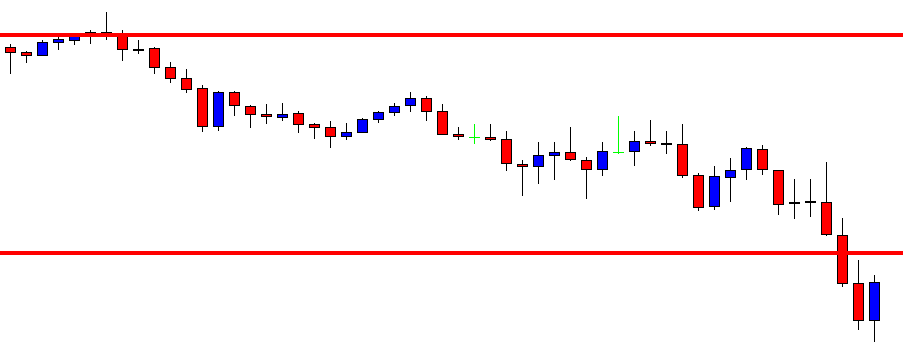

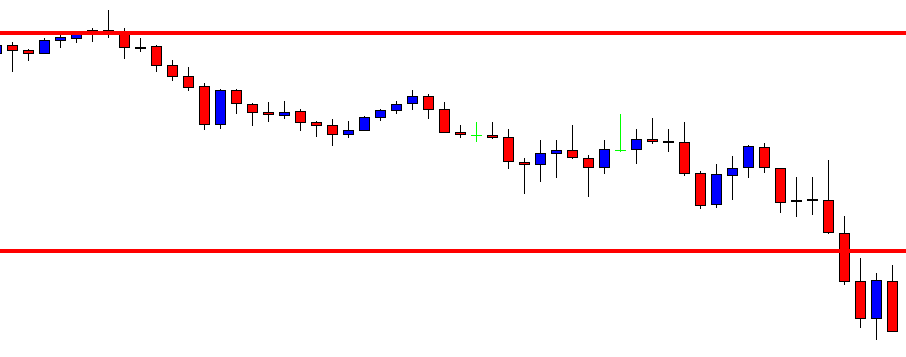

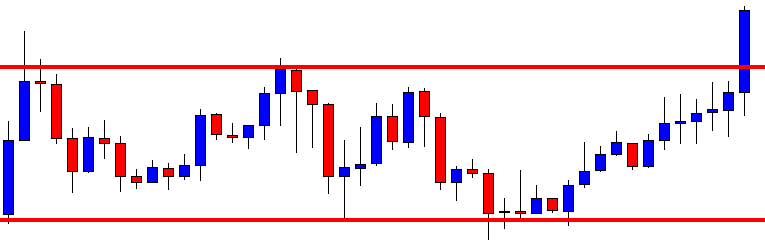

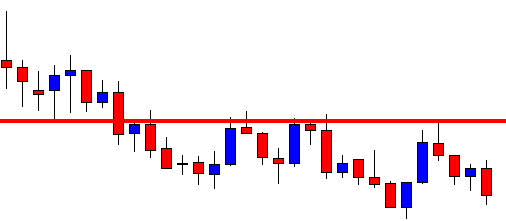

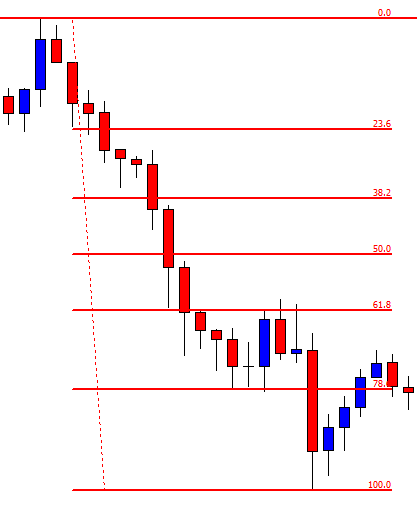

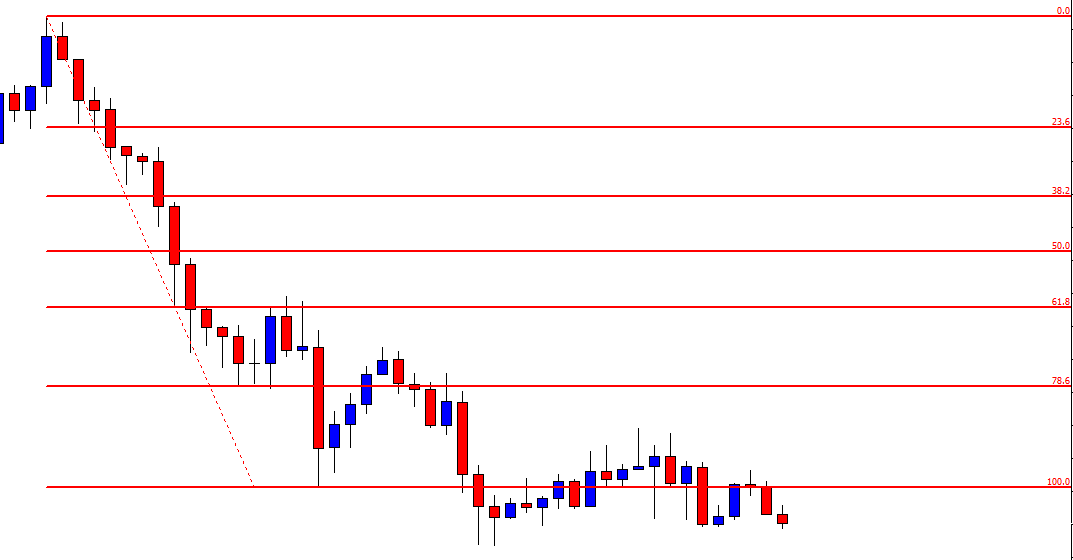

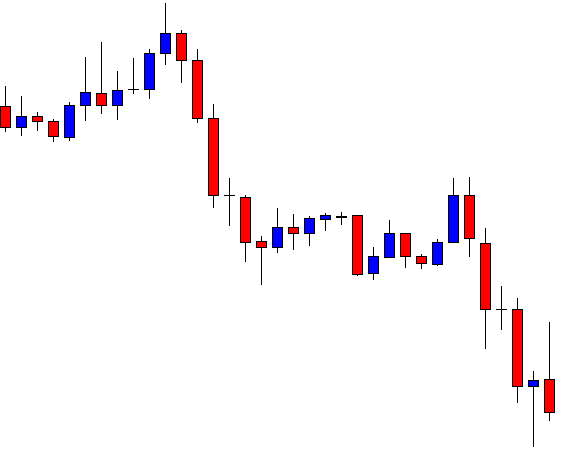

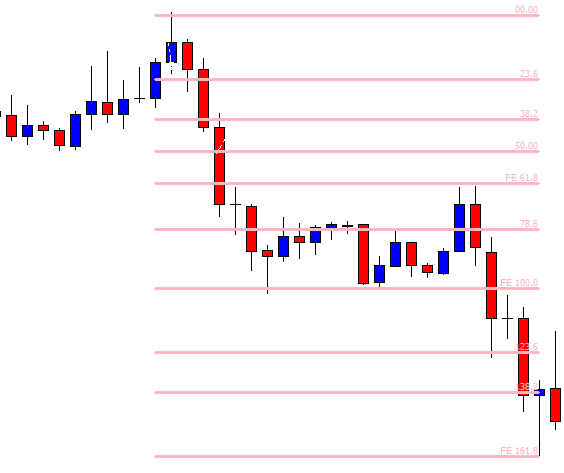

All contracting triangles have a similar shape in its construction. The main characteristic is that wave E ends before the apex of the triangle. The apex tends to occur in a range of 20% to 40% of the total triangle time extension.

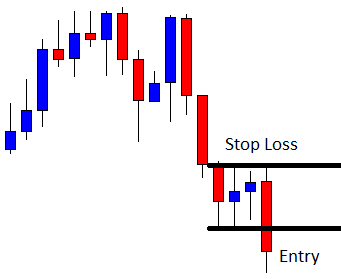

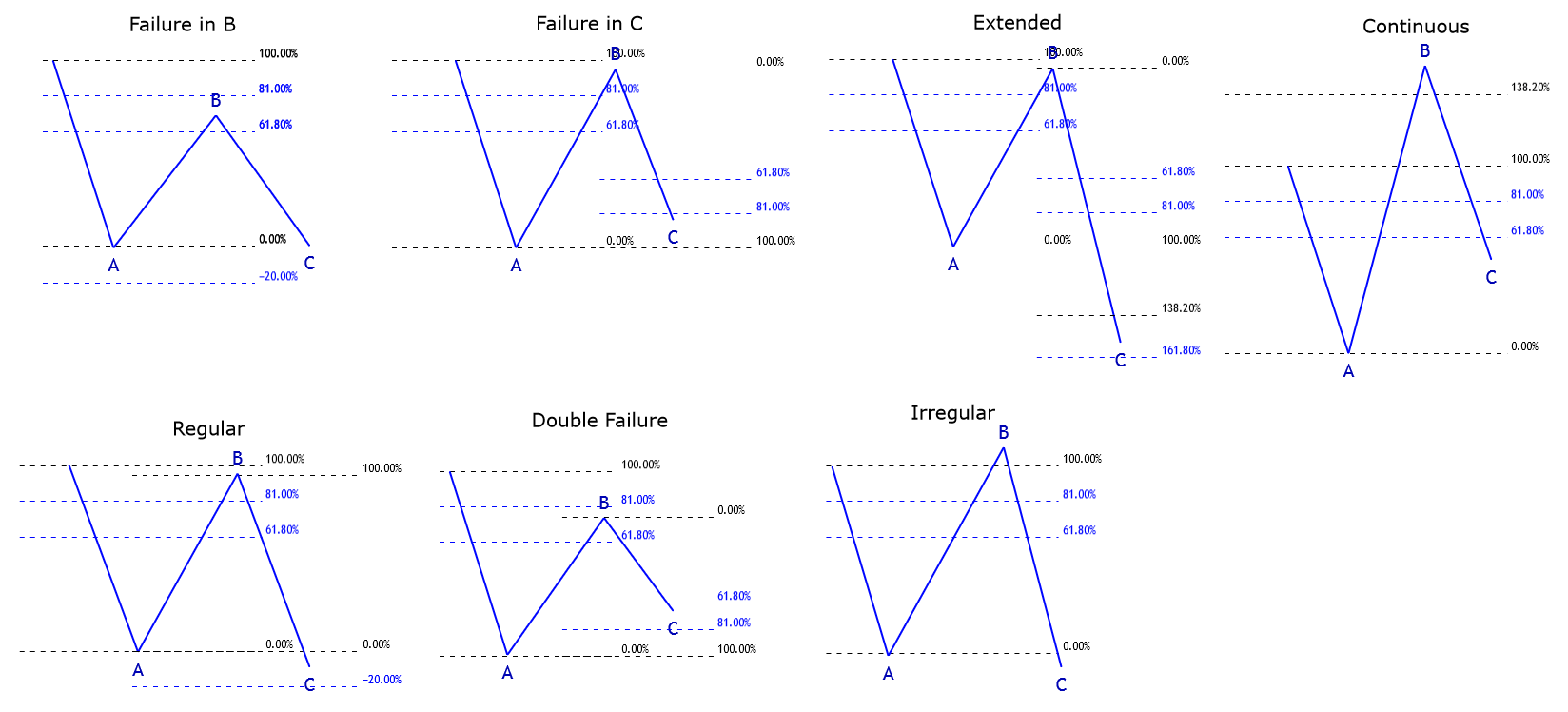

Concerning the thrust, in restrictive contracting triangles, it is limited by the most extended segment of the triangle (25% approx.) This type of triangles corresponds to the formations described by Elliott in his Treatise. Moreover, these patterns tend to appear in waves 4 and B.

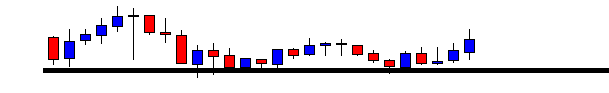

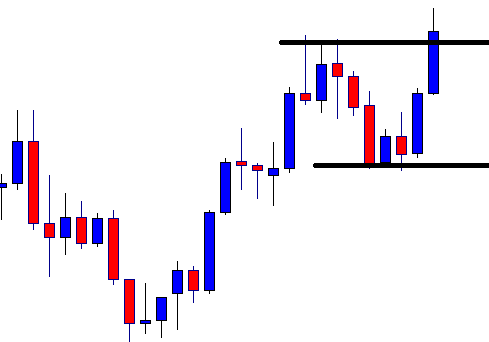

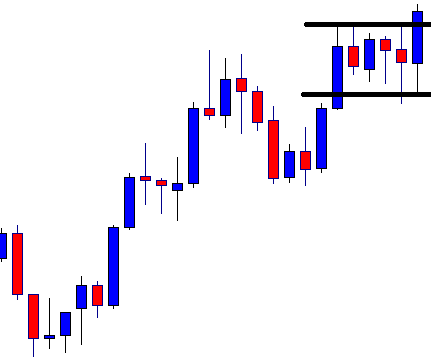

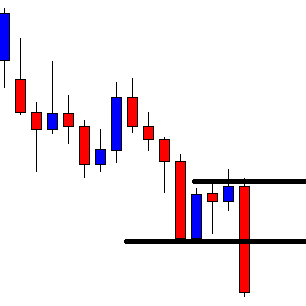

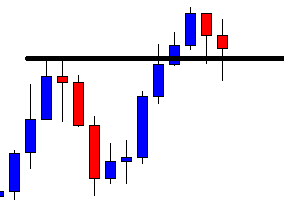

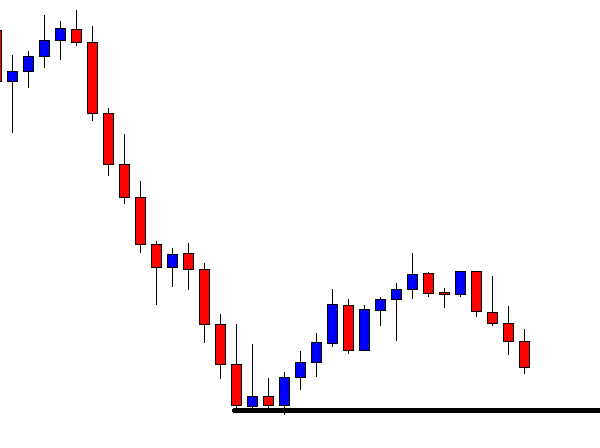

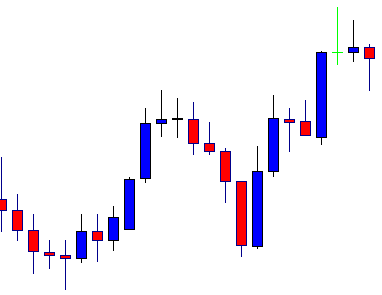

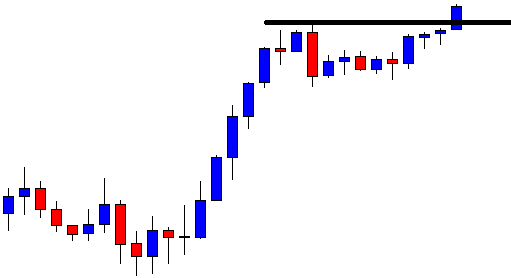

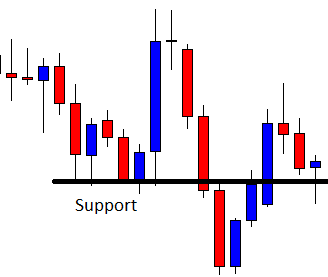

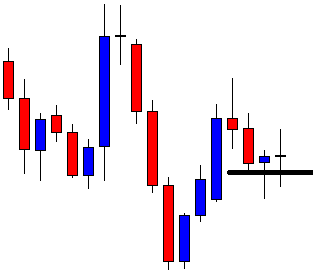

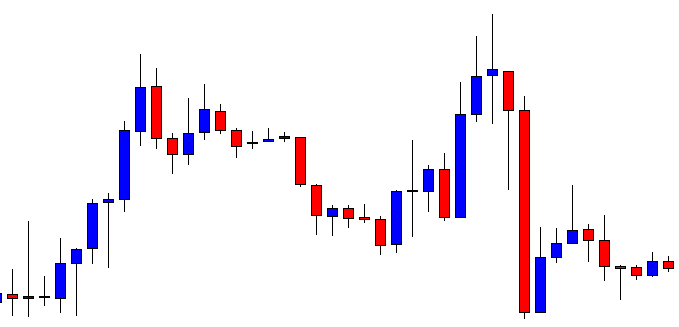

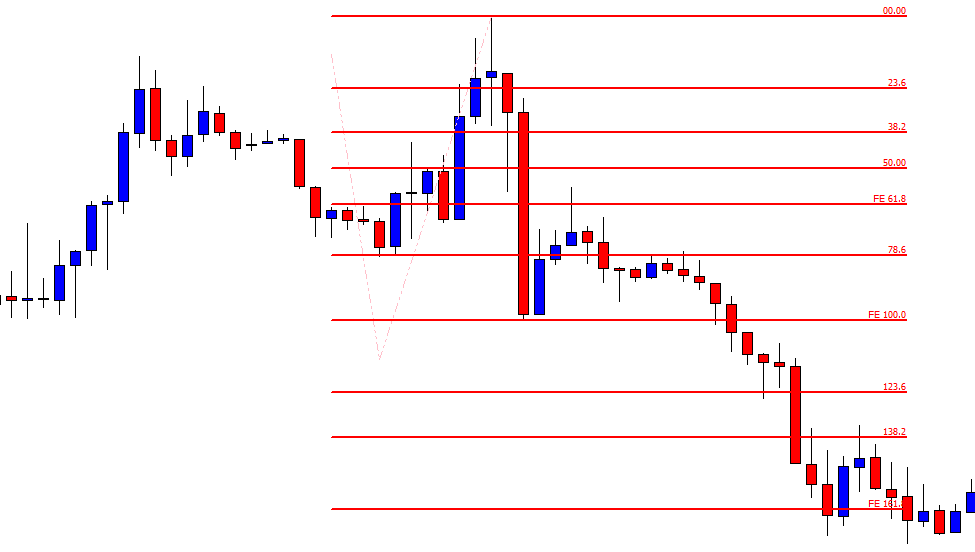

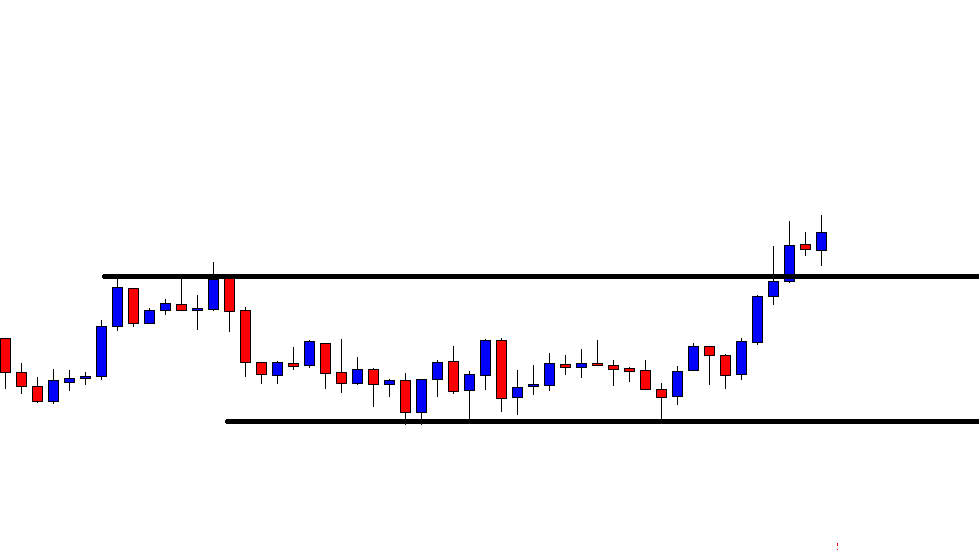

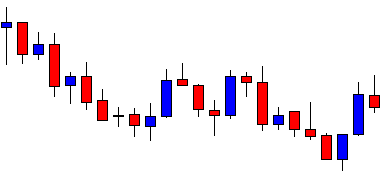

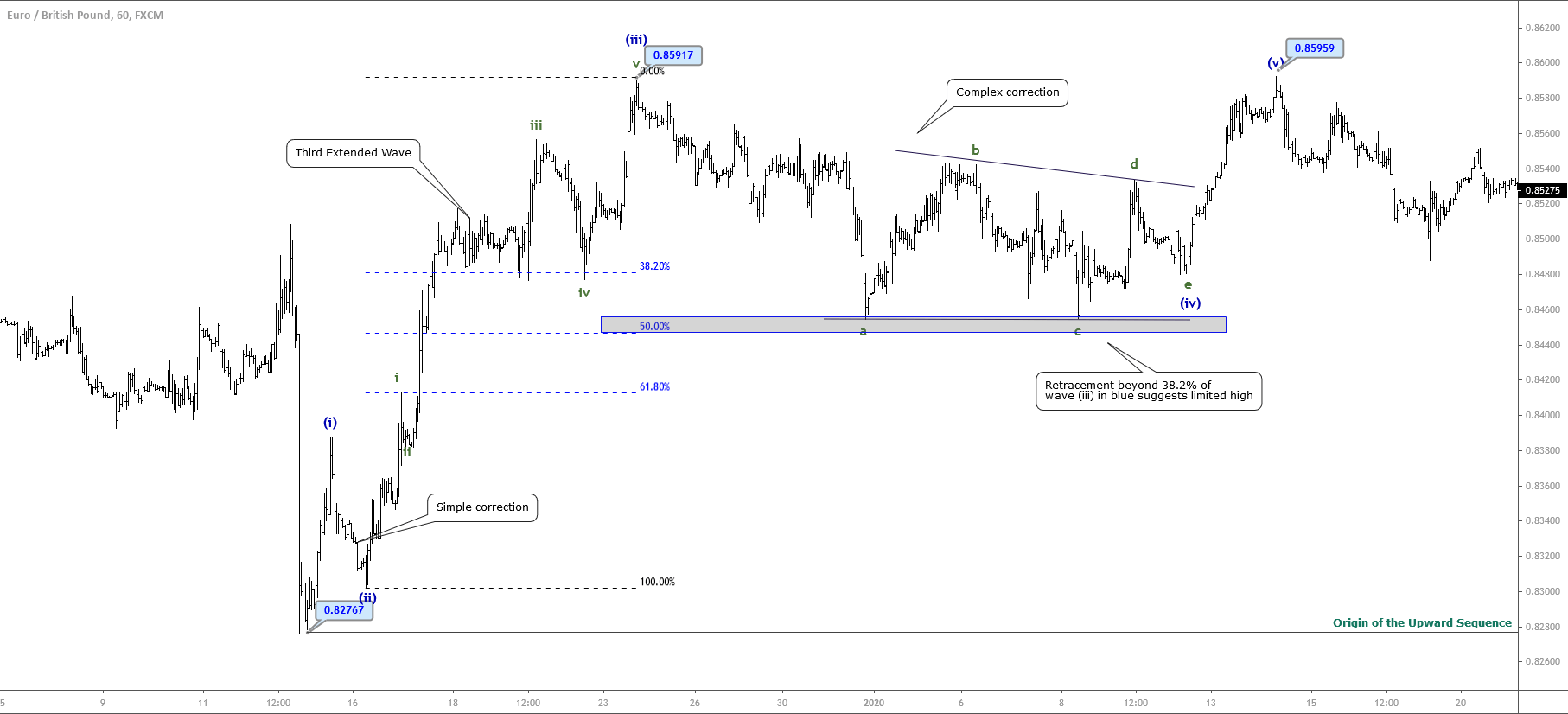

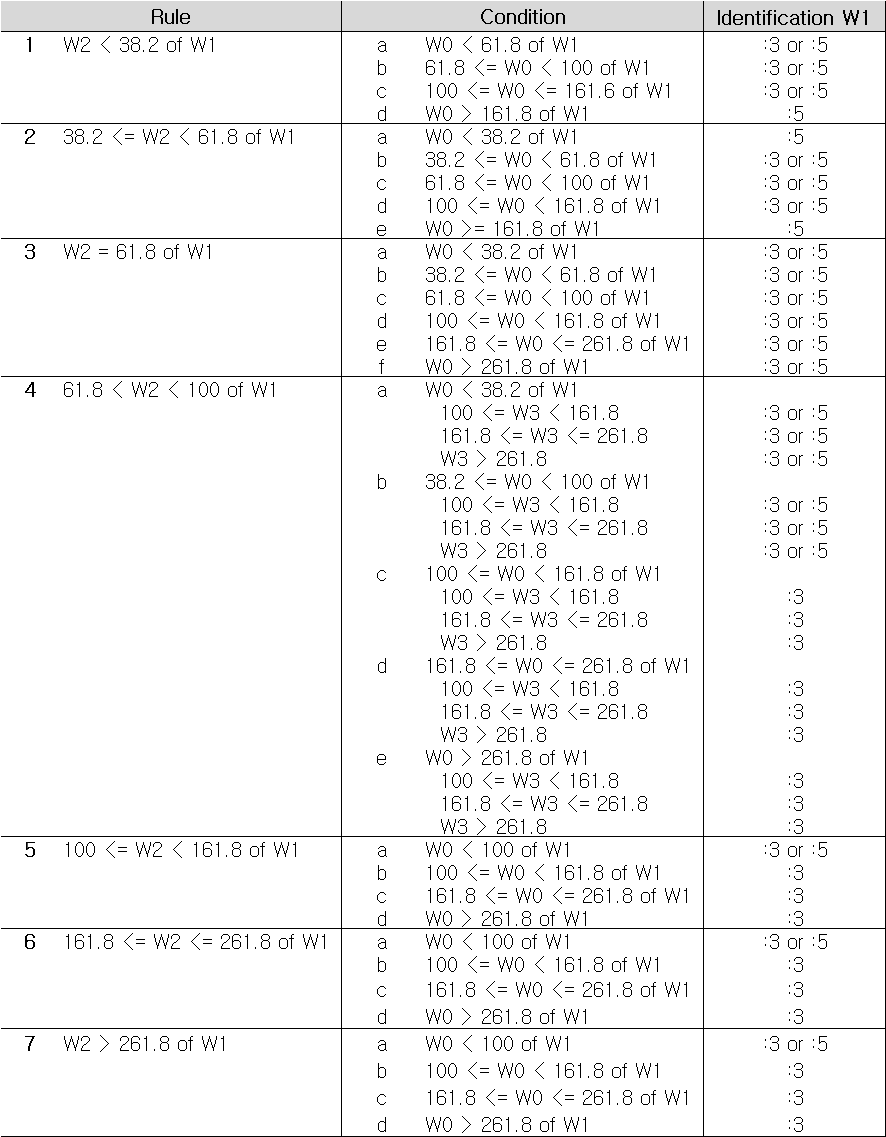

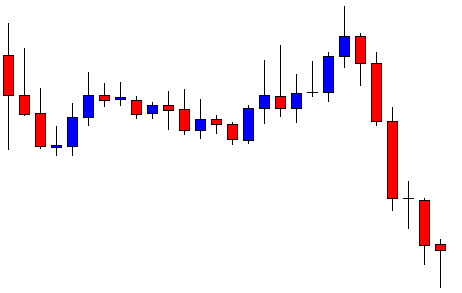

- Horizontal Contracting Triangle. Each segment must measure at least 38.2% of the previous segment, except for wave E. Wave B can’t be more than 261.8% of A, wave C can’t extend more than 161.8% of B. Wave D must be shorter than wave C, and wave E must be shorter than wave D.

- Wave A. This wave will not necessarily be the largest in terms of the price of the triangle. Likewise, it will not be the shortest wave of the pattern.

- Wave B. In this case, if wave B is shorter than wave A, then the rest will be shorter. If the wave is longer than wave A, there are a few possibilities that wave C will be longer than wave B, and the triangle formation corresponds to a contracting triangle. If wave C is longer than wave B, then the structure corresponds to an expanding triangle.

- Wave C. Under a few circumstances, wave C could get longer than wave B. If this scenario occurs, then the base-line should be traced connecting waves C and E.

- Wave D. This wave must be shorter than wave C, although it could last longer than wave C.

- Wave E. This one must be the shortest wave of the triangle pattern.

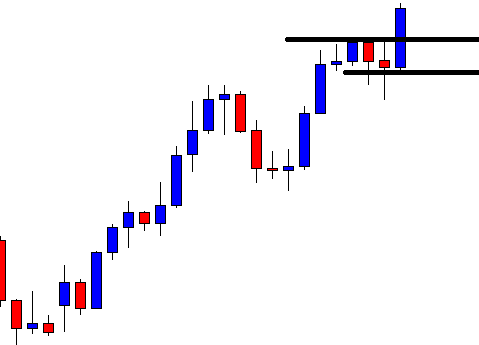

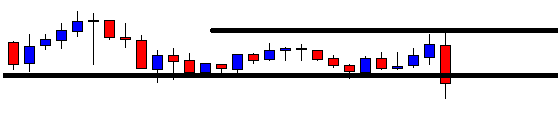

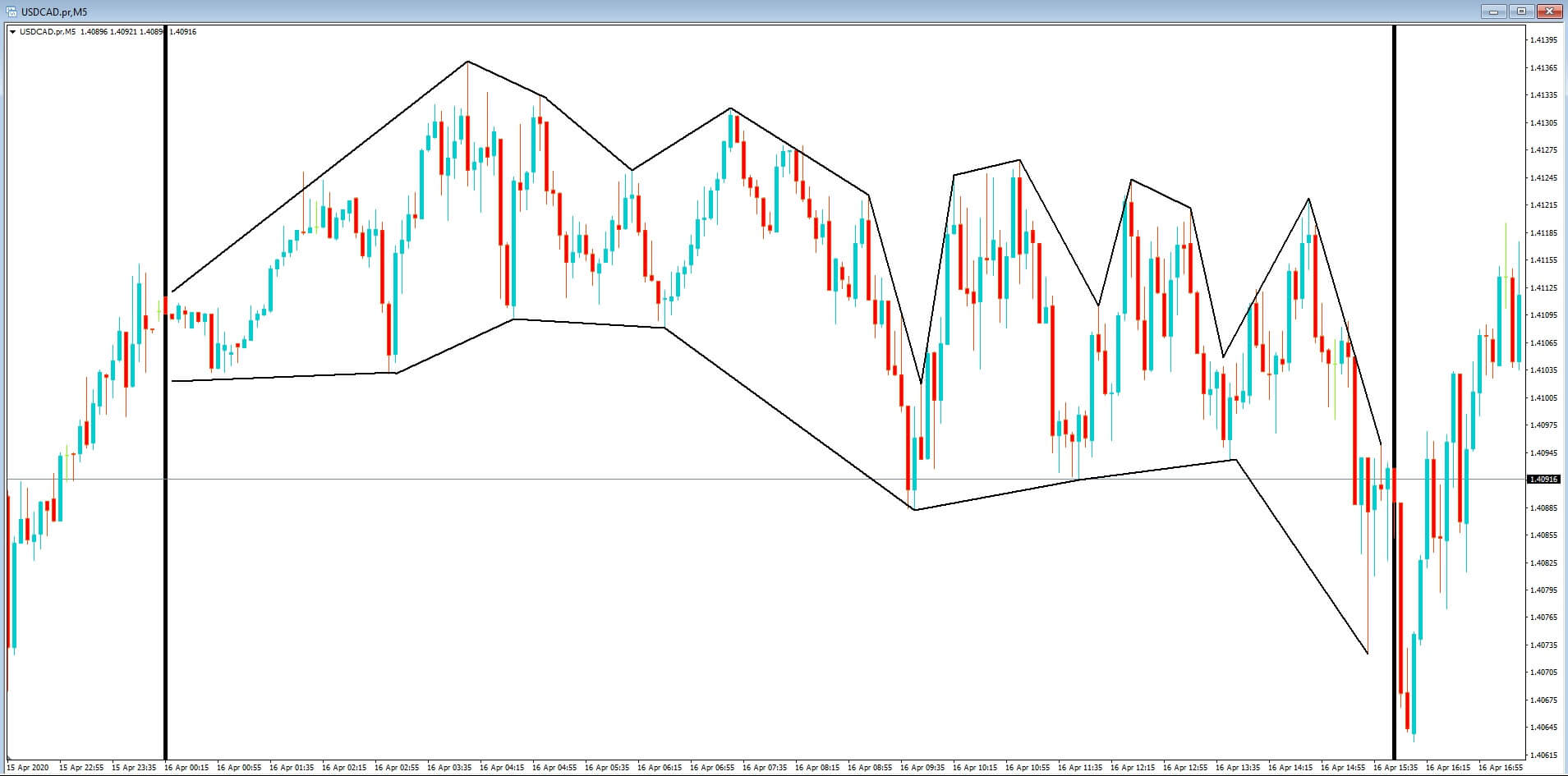

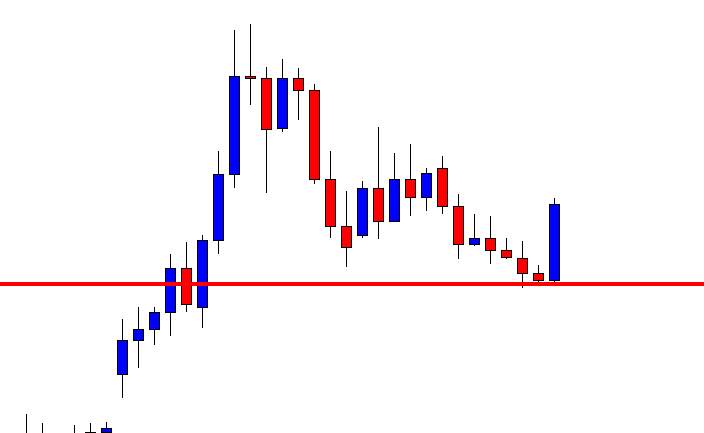

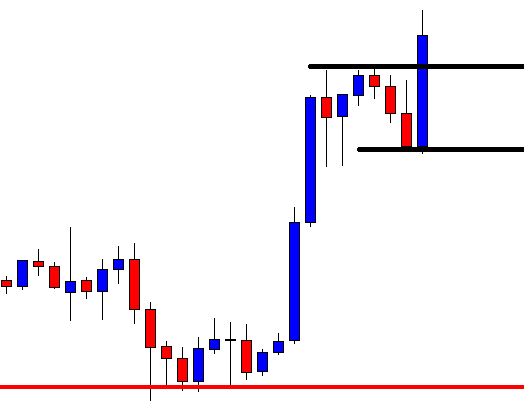

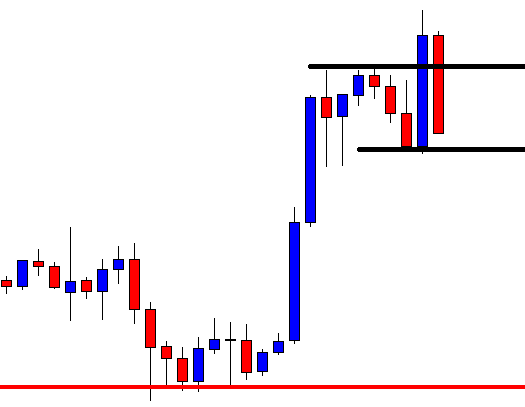

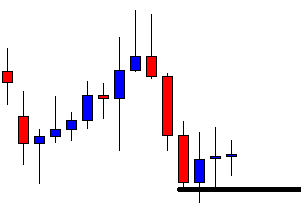

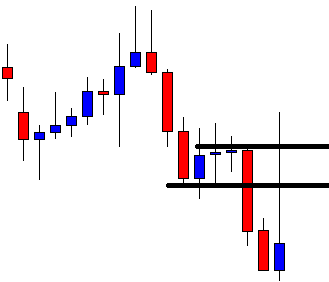

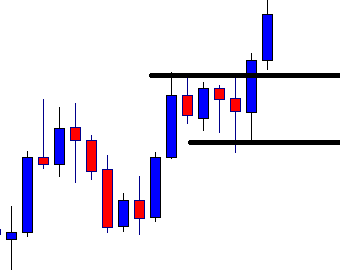

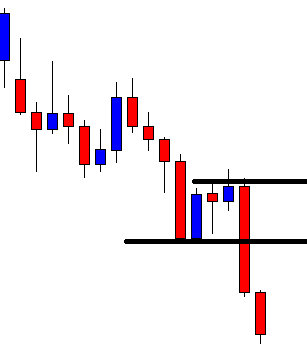

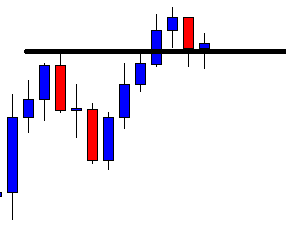

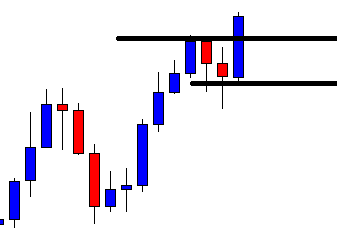

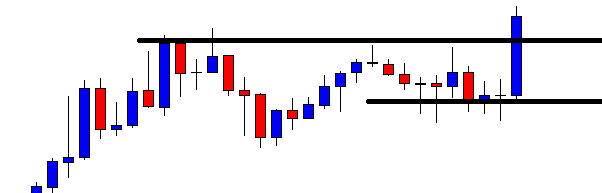

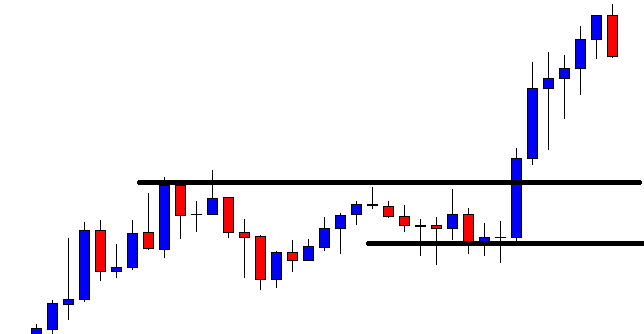

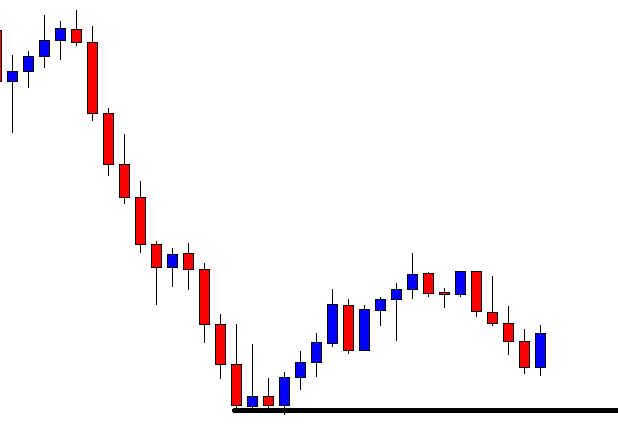

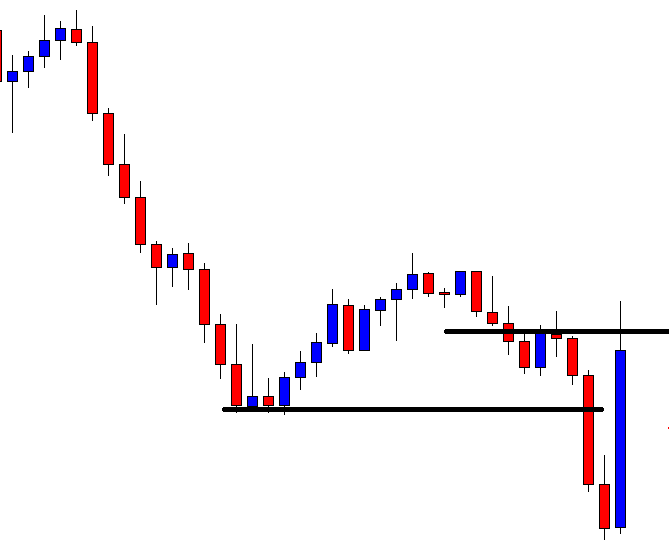

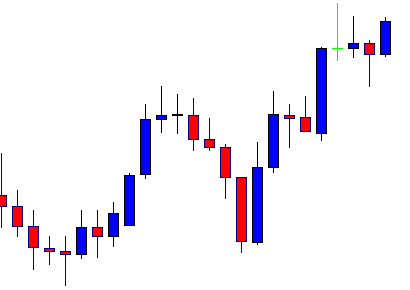

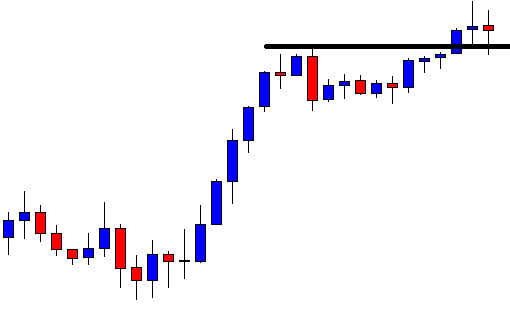

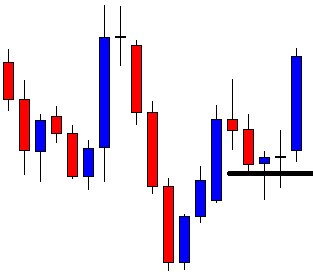

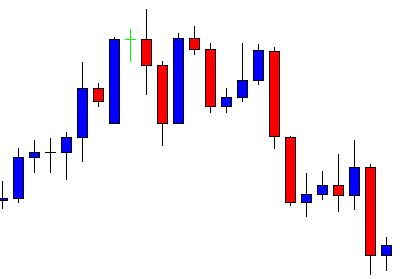

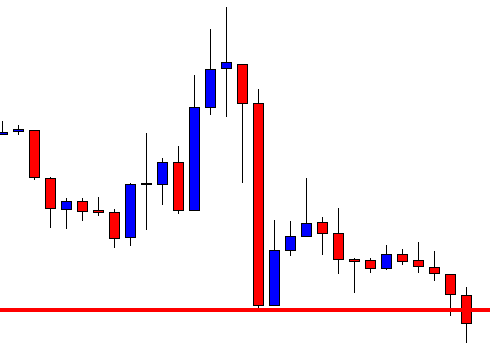

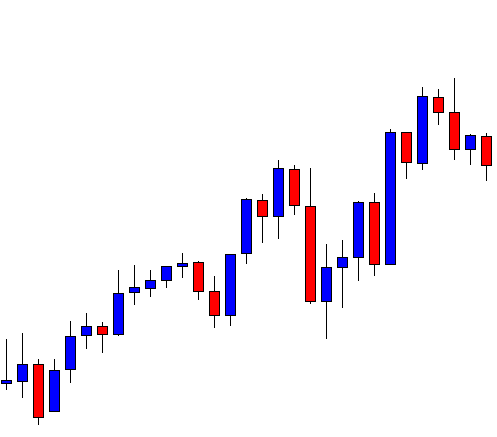

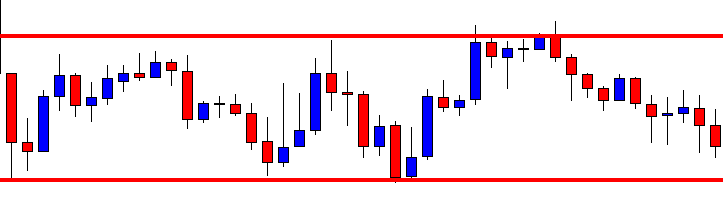

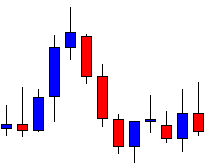

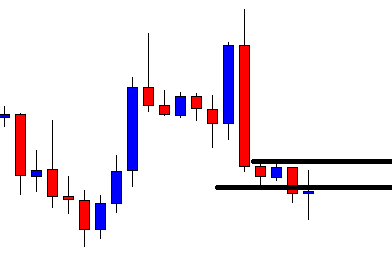

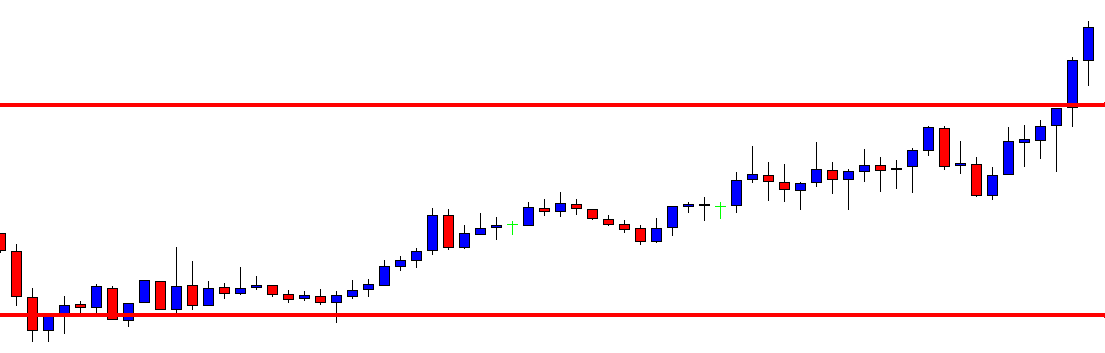

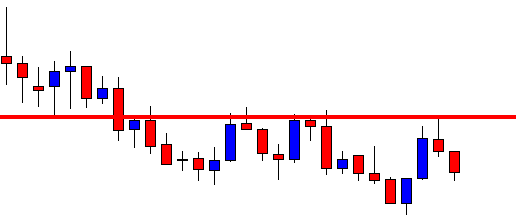

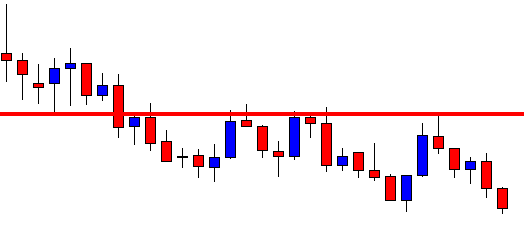

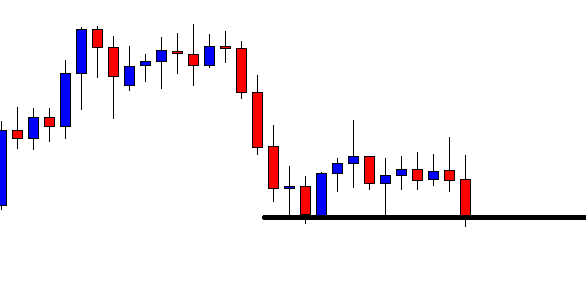

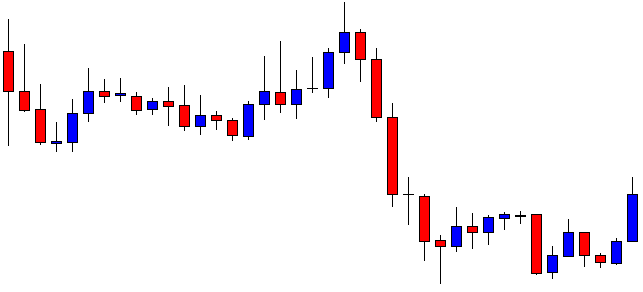

- Irregular Contracting Triangle. This variation is characterized by wave B being the most extended of the structure.

- Wave A. In this case, wave A will tend to be shorter in terms of time than wave B. The extension of wave B should be longer than 161.8 of wave A. Wave A could be any corrective pattern except for a triple zigzag or an extended flat.

- Wave B. This wave should be the largest wave of the entire formation, extending until 161.8% of wave A, but never beyond 261.8%. Wave B tends to be a zigzag or a double zigzag.

- Wave C. This wave will be shorter than wave B and should retrace at least 38.2% of wave B. Wave C could be a zigzag, flat, or an extended flat.

- Wave D. This wave will be shorter than wave C and should retrace at least 38.3% of wave C. Wave D could be any corrective pattern that alternates with wave C.

- Wave E. This wave will be the shortest wave of the triangle pattern in terms of price. Generally, wave E will tend to be a triangle pattern.

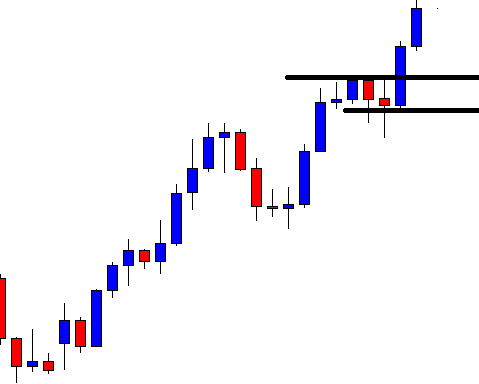

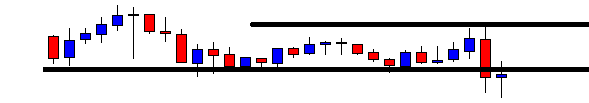

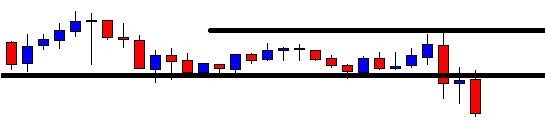

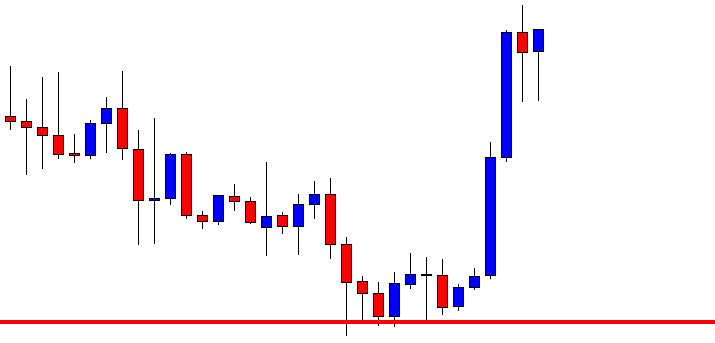

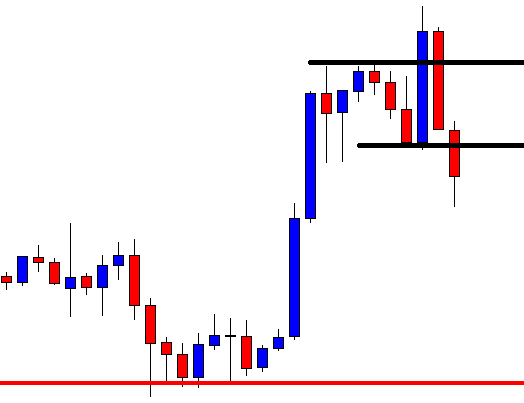

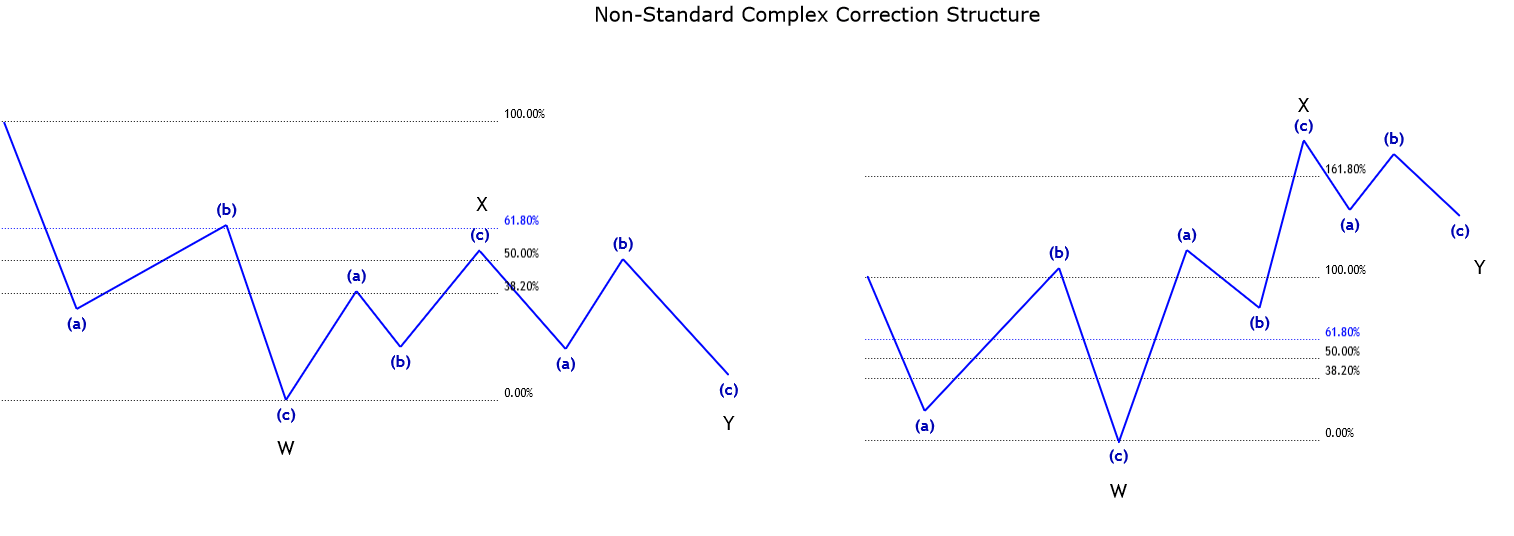

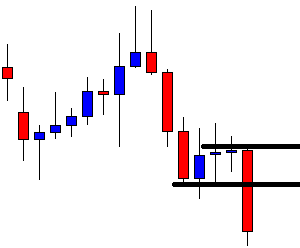

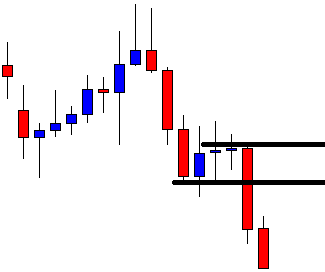

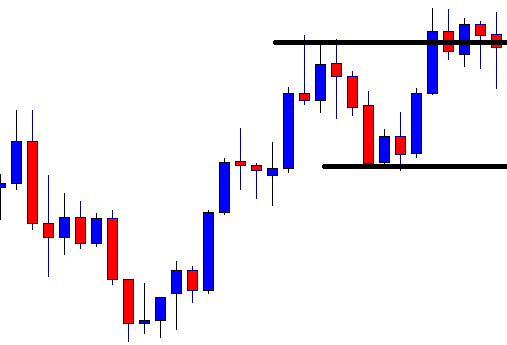

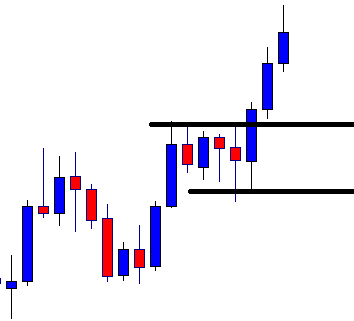

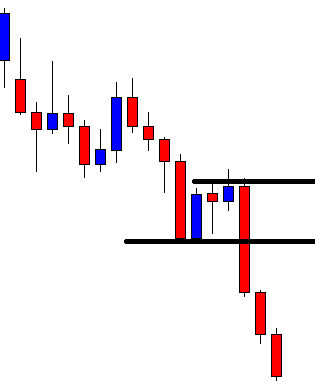

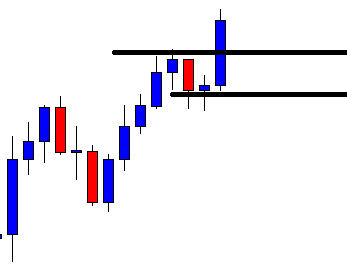

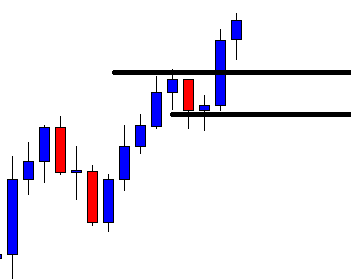

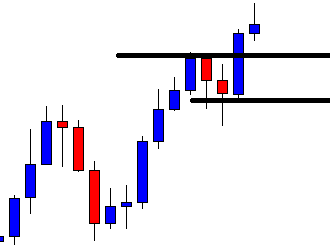

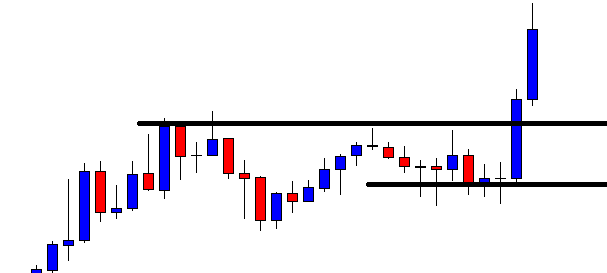

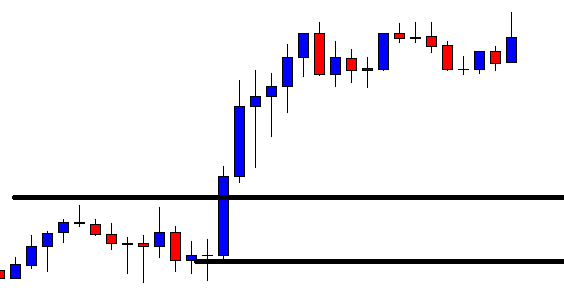

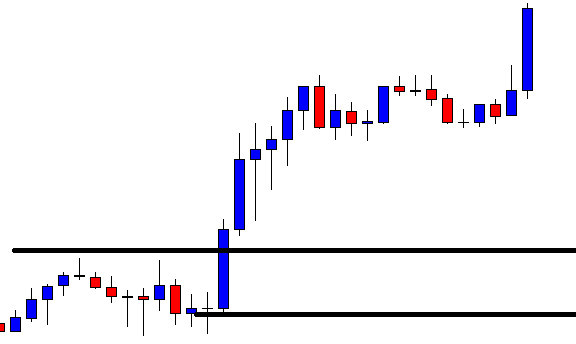

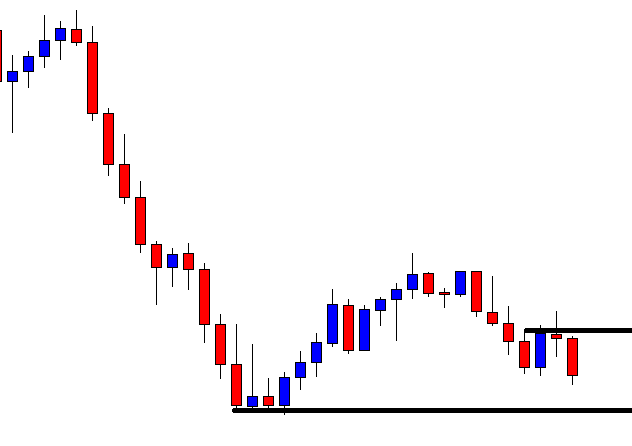

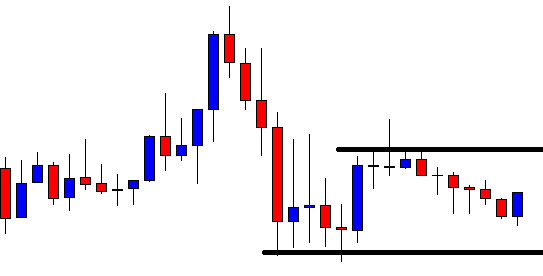

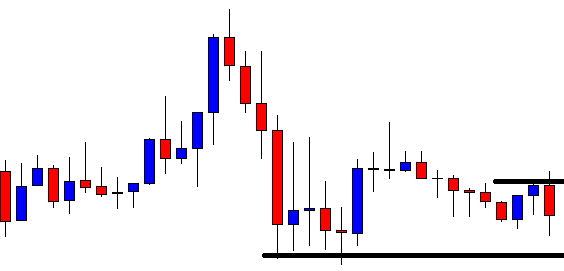

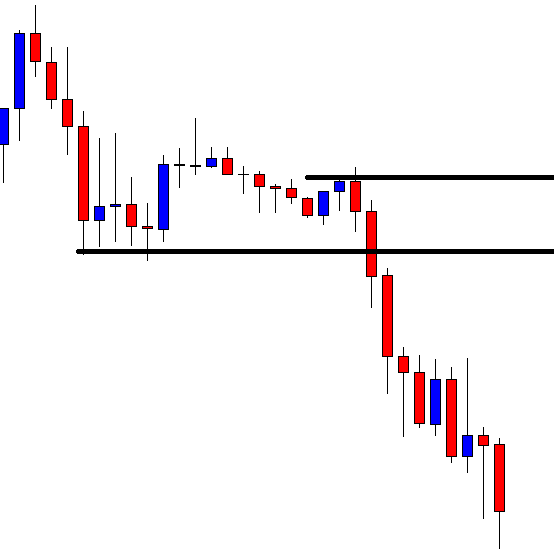

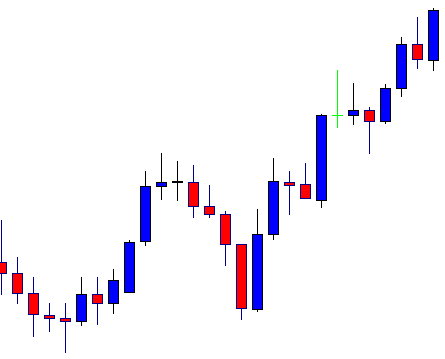

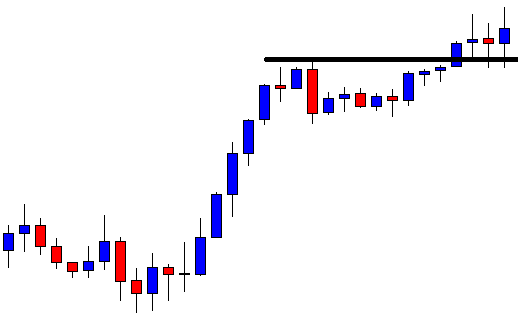

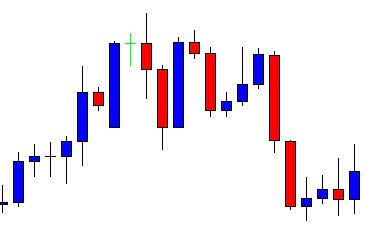

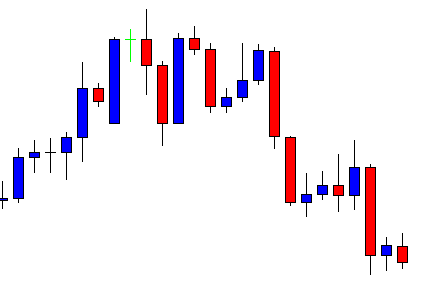

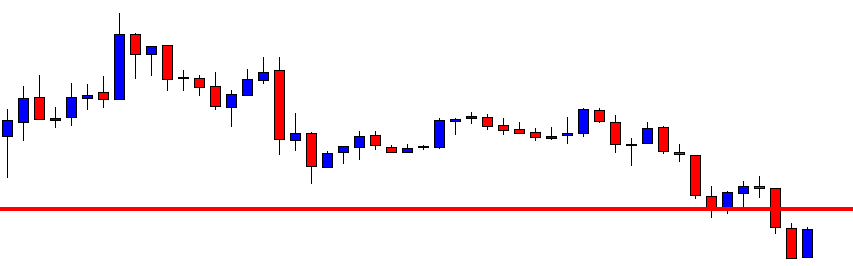

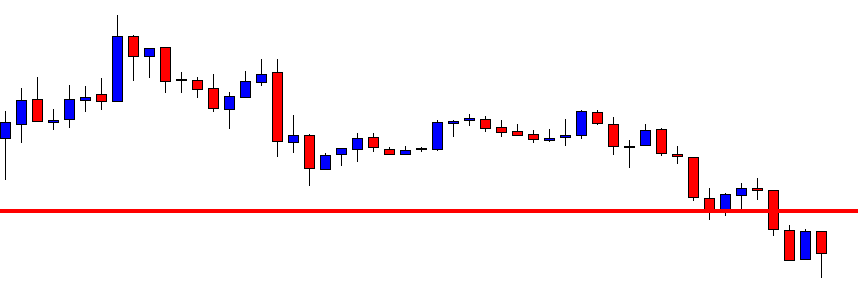

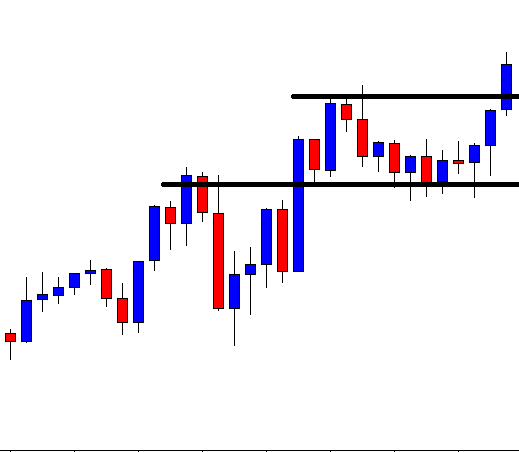

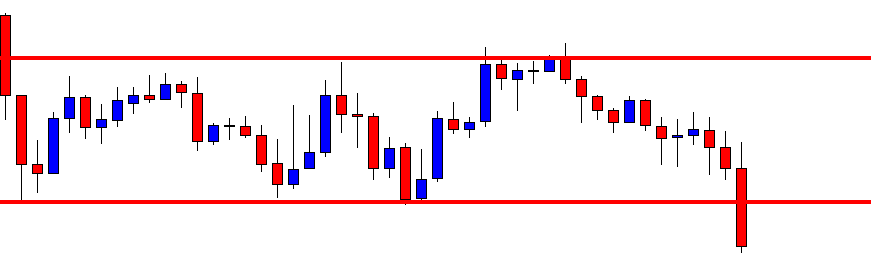

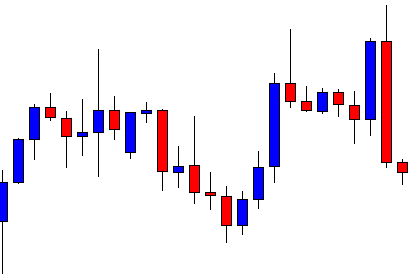

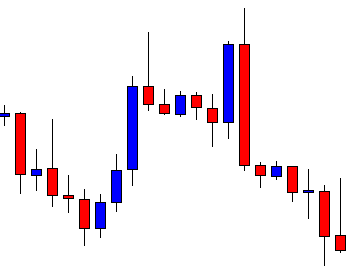

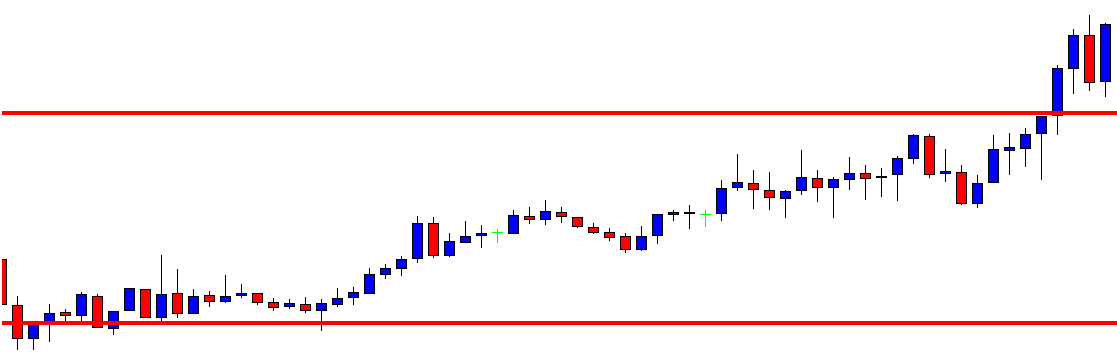

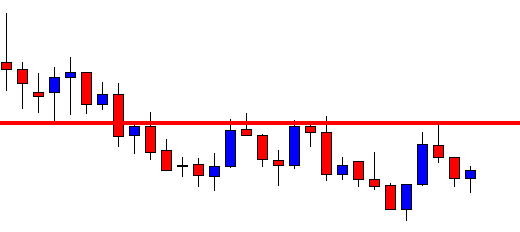

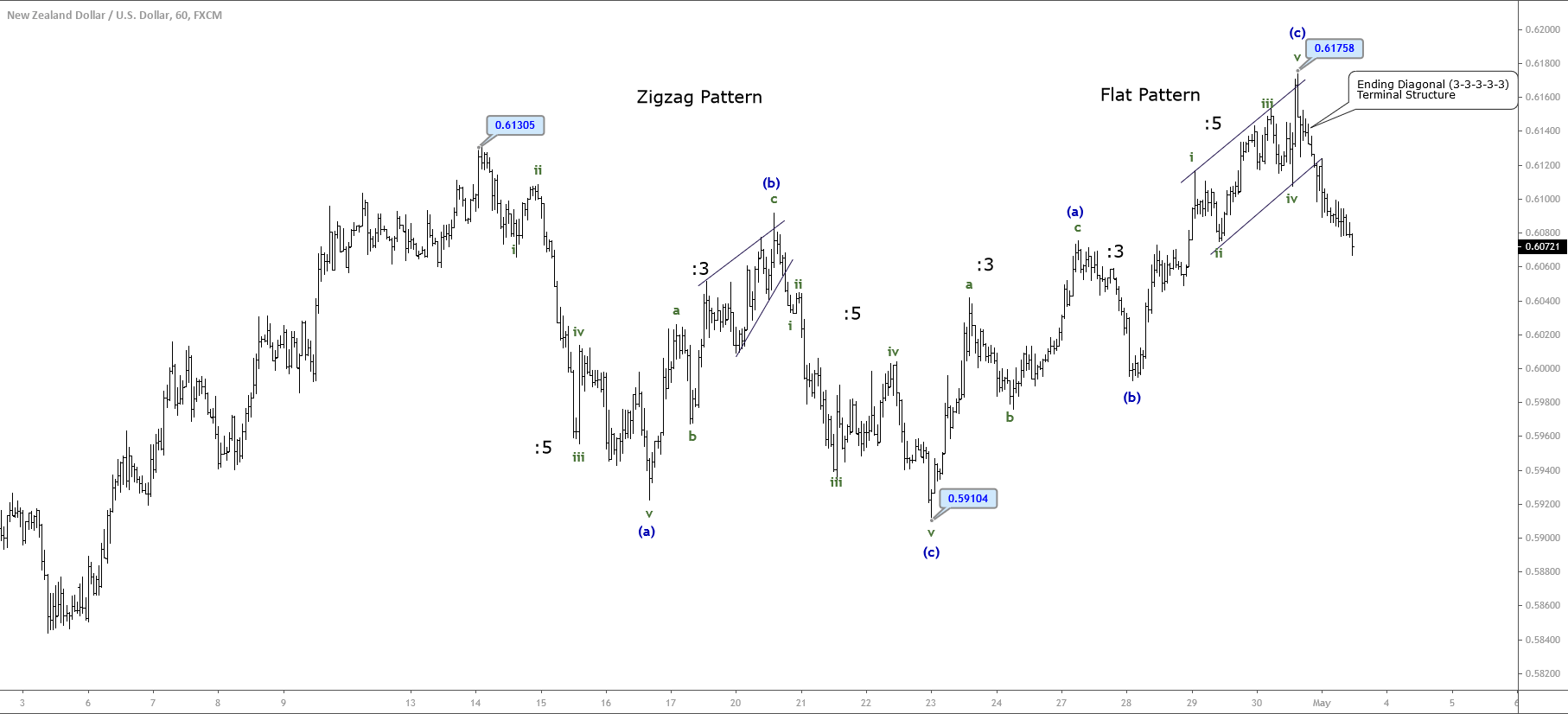

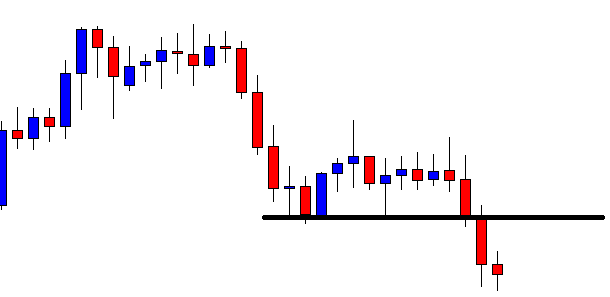

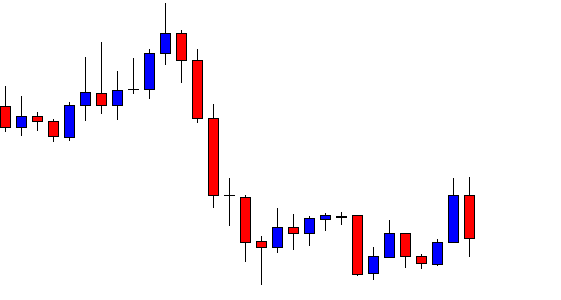

- Continuous Contracting Triangle. This pattern is detected through the advance of waves B and D. Wave B will be larger than wave A, and simultaneously, wave D will be larger than wave C. The thrust of this pattern would be at least 161.8% respect to the largest segment of the triangle.

- Wave A. This wave should not be lower than 38.2% of wave B. Wave A could be a flat or a zigzag, but never a triangle or a double or triple zigzag. Most of the time, wave A will be a flat pattern.

- Wave B. This wave must be the largest segment of the complete formation. Its formation could correspond to a zigzag, double zigzag, or rarely a triple zigzag.

- Wave C. This segment must be shorter than wave B, and can’t be more complex than wave B.

- Wave D. This segment must be larger than wave C in terms of price and could be any type of corrective pattern except a triple zigzag.

- Wave E. This segment must be the shortest wave of the triangle. If the continuous triangle moves in wave B, this wave will frequently end at 61.8% or 38.2% of the entire movement.

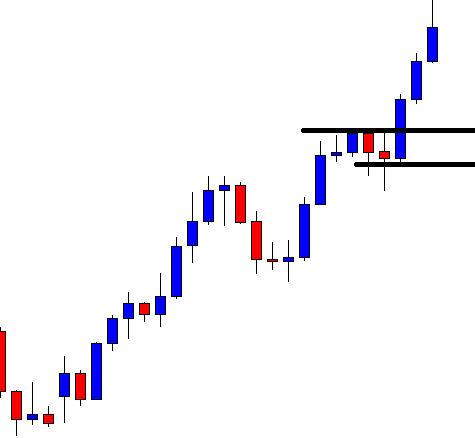

Conclusions

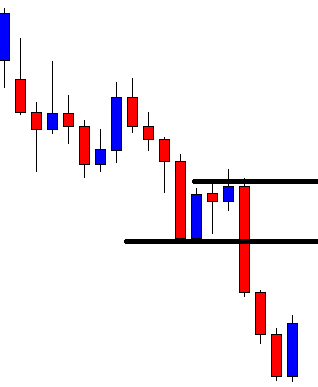

In this educational article, corresponding to the third part of the four-part series, we presented the contracting triangle pattern under the restrictive subcategory.

The contracting triangle tends to be the most common corrective pattern in waves 4 and B. As said by R.N. Elliott in his Treatise, the knowledge of the corrective formations and its implications provides to wave analyst an advantage of the potential next move of the market.

In the next article, we’ll end this four-part present the non-restrictive contracting triangles and the expanding triangles.

Suggested Readings

- Neely, G.; Mastering Elliott Wave: Presenting the Neely Method; Windsor Books; 2nd Edition (1990).

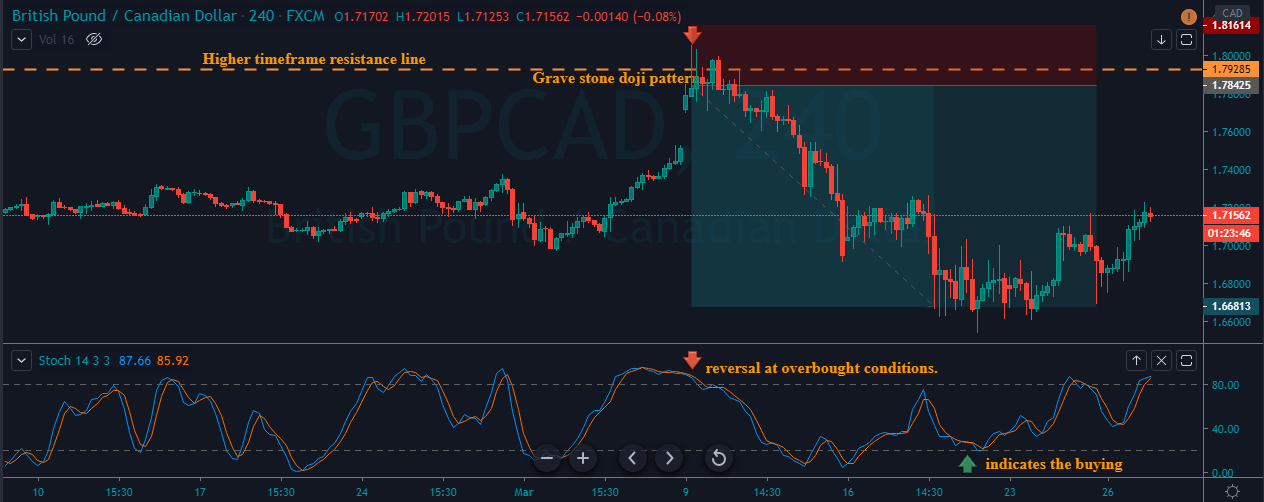

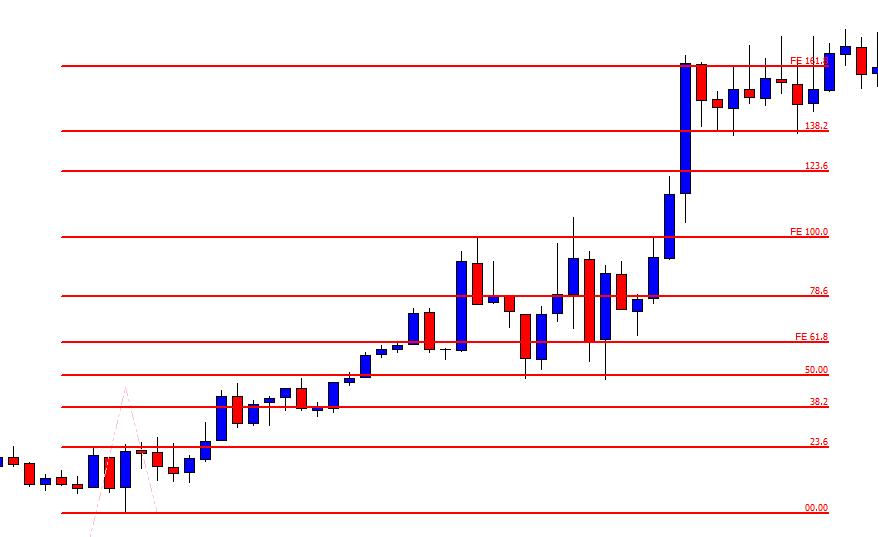

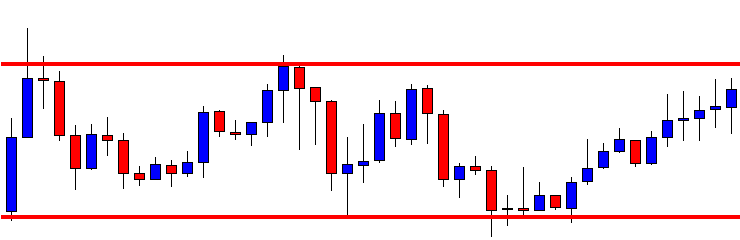

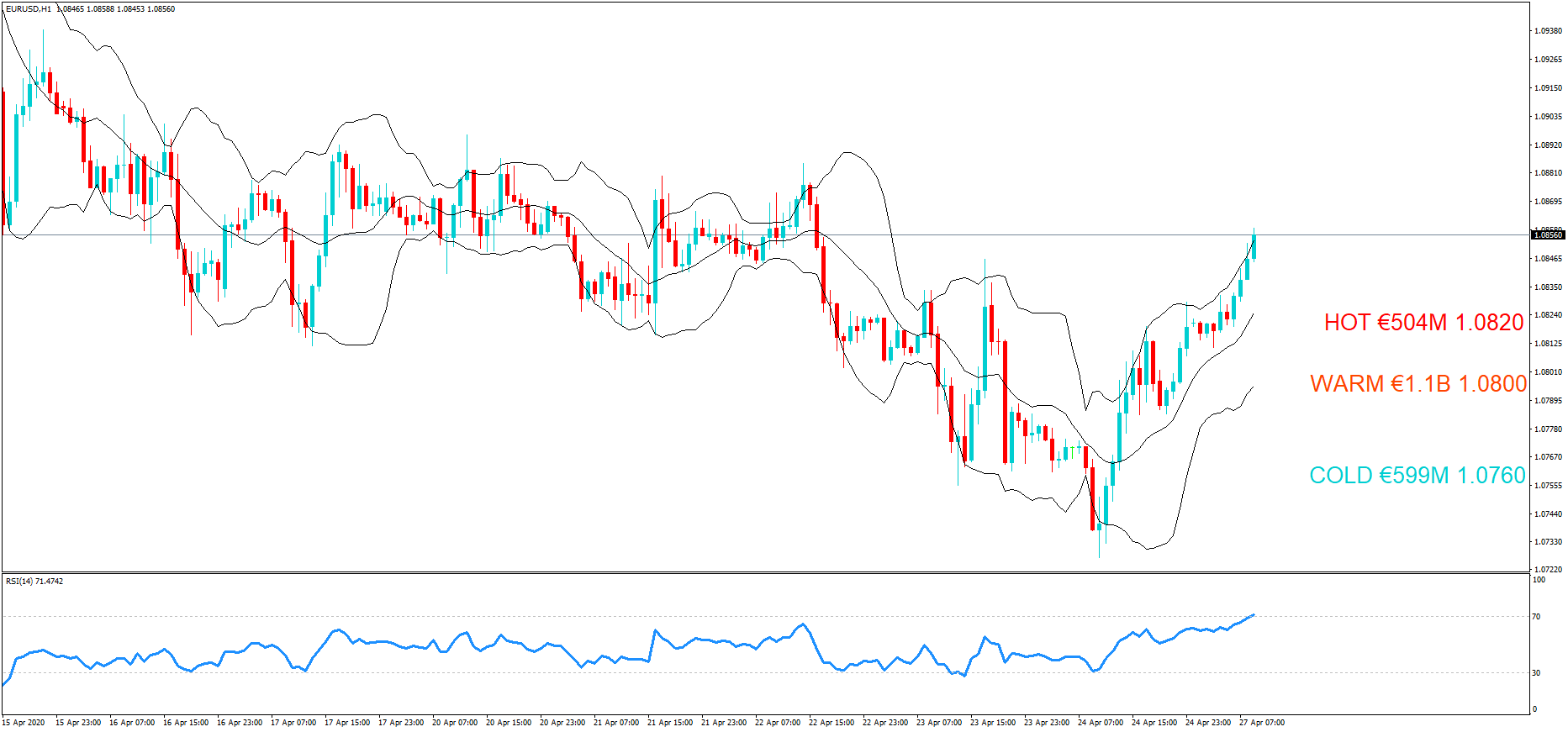

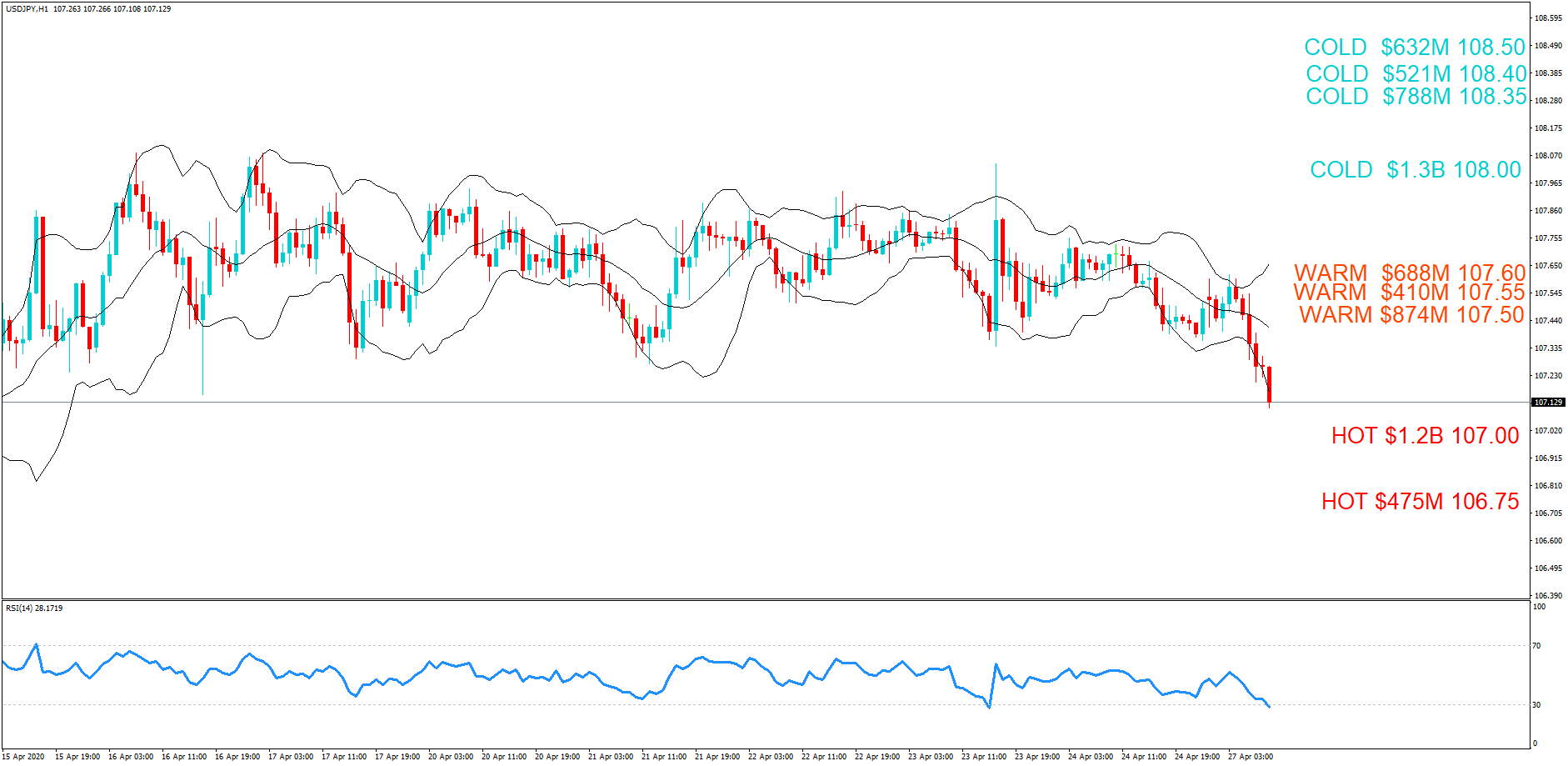

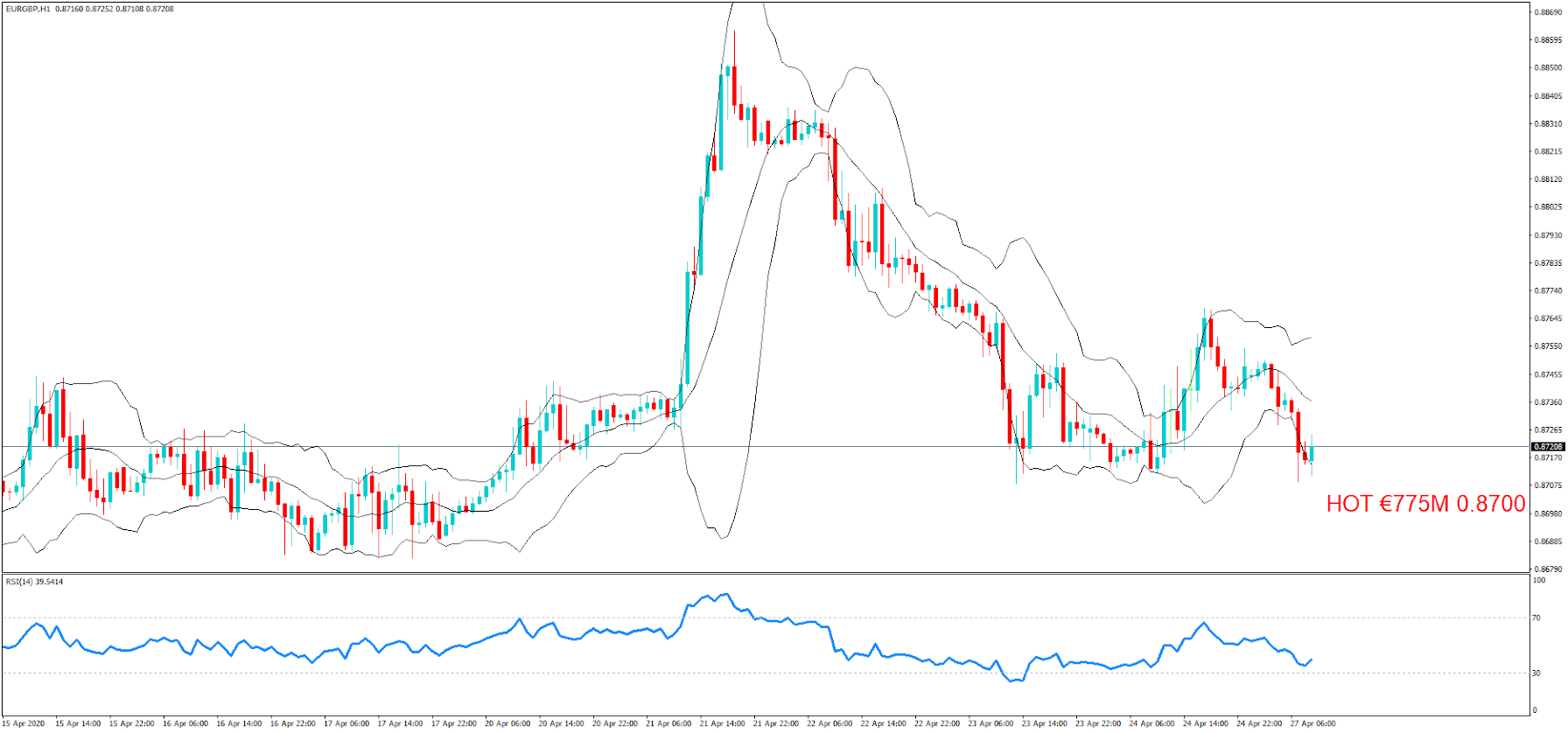

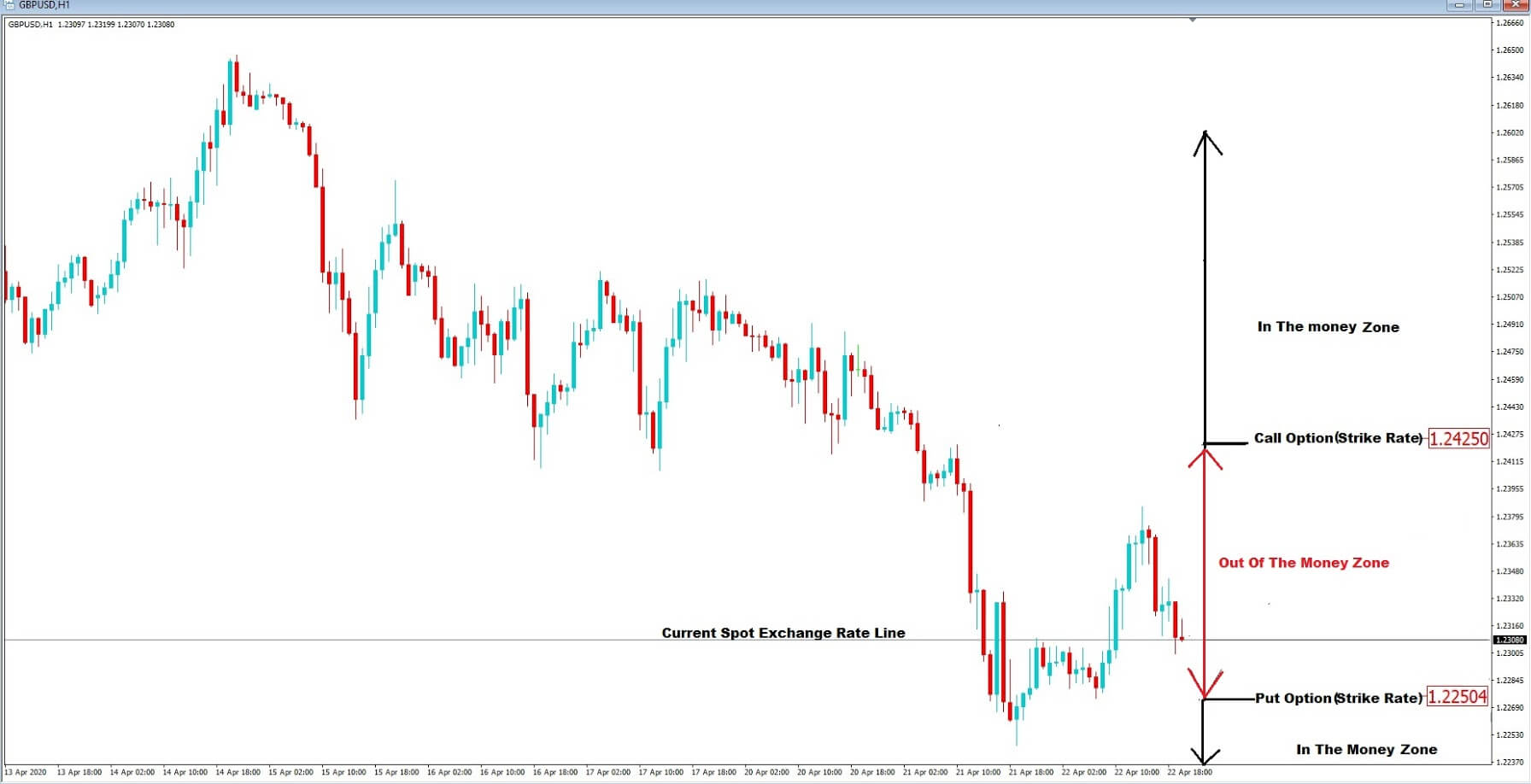

Forex.Academy will be making these levels available to you, free of charge, and they can be accessed on the options drop-down menu of our home page. For your convenience, as and when

Forex.Academy will be making these levels available to you, free of charge, and they can be accessed on the options drop-down menu of our home page. For your convenience, as and when