FX Options Market Combined Volume Expiries. A weekly retrospective review

Hello everybody and thank you for joining us for the daily FX Options Market Combined

Volume Expiries review for the trading week ending on Friday 29th May 2020. Each week we will bring you a video taking a look back at the previous week’s FX option expiries and how they may have attributed to price action leading up to the maturities which happen at 10 a.m. Eastern Time, USA.

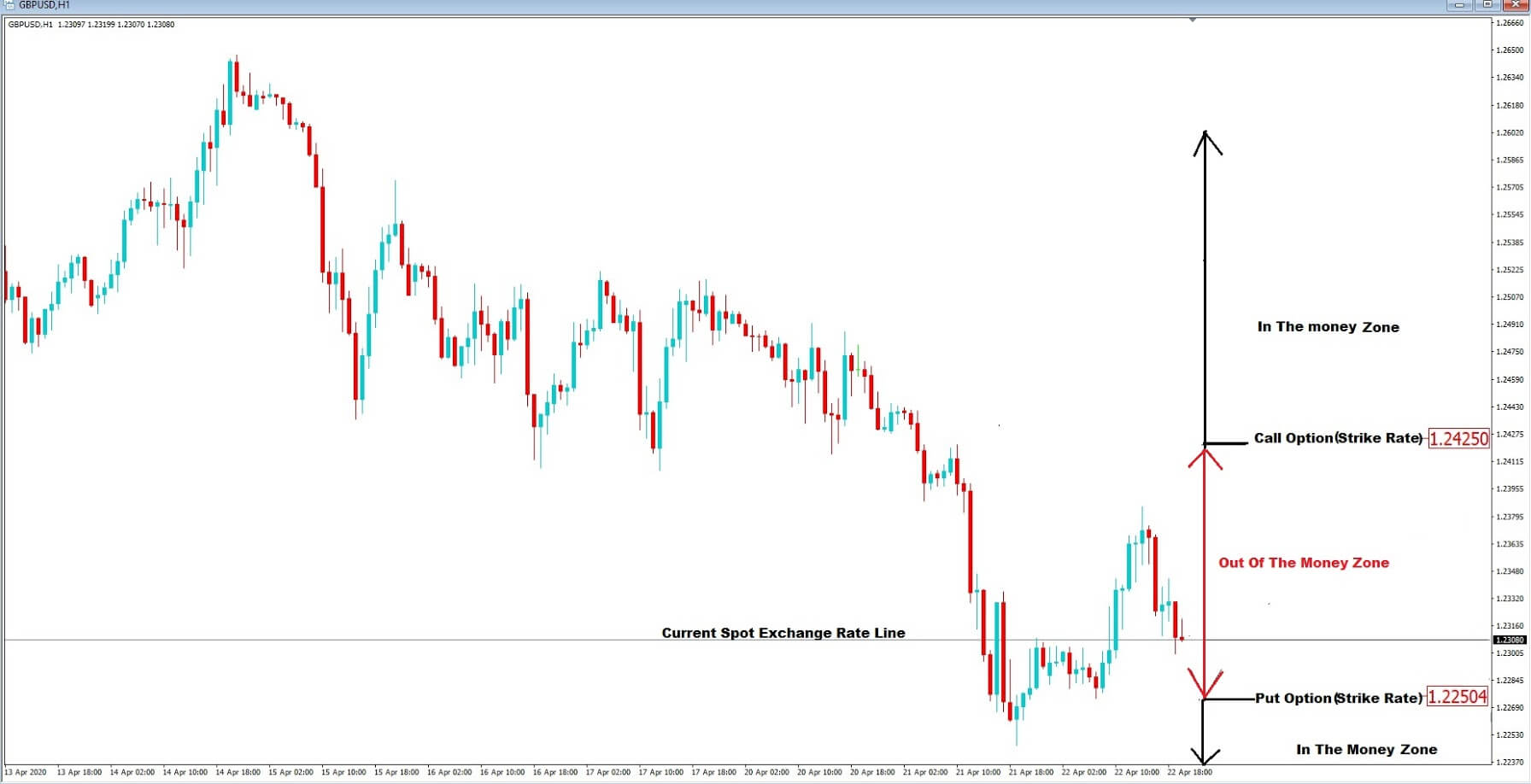

If it is your first time with us, the FX currency options market runs in tandem with the spot FX market, but where traders typically place Call and Put trades on the future value of a currency exchange rate and these futures contracts typically run from 1 day to weeks, or even months.

Each morning, from the FA website, our analyst, Kevin O’Sullivan, will bring you details of the notable FX Options Market Combined Volume Expiries, where they have an accumulative value of a minimum of $100M + and where quite often these institutional size expiries can act as a magnet for price action in the Spot FX arena leading up to the New York 10 a.m. cut, as the big institutional players hedge their positions accordingly.

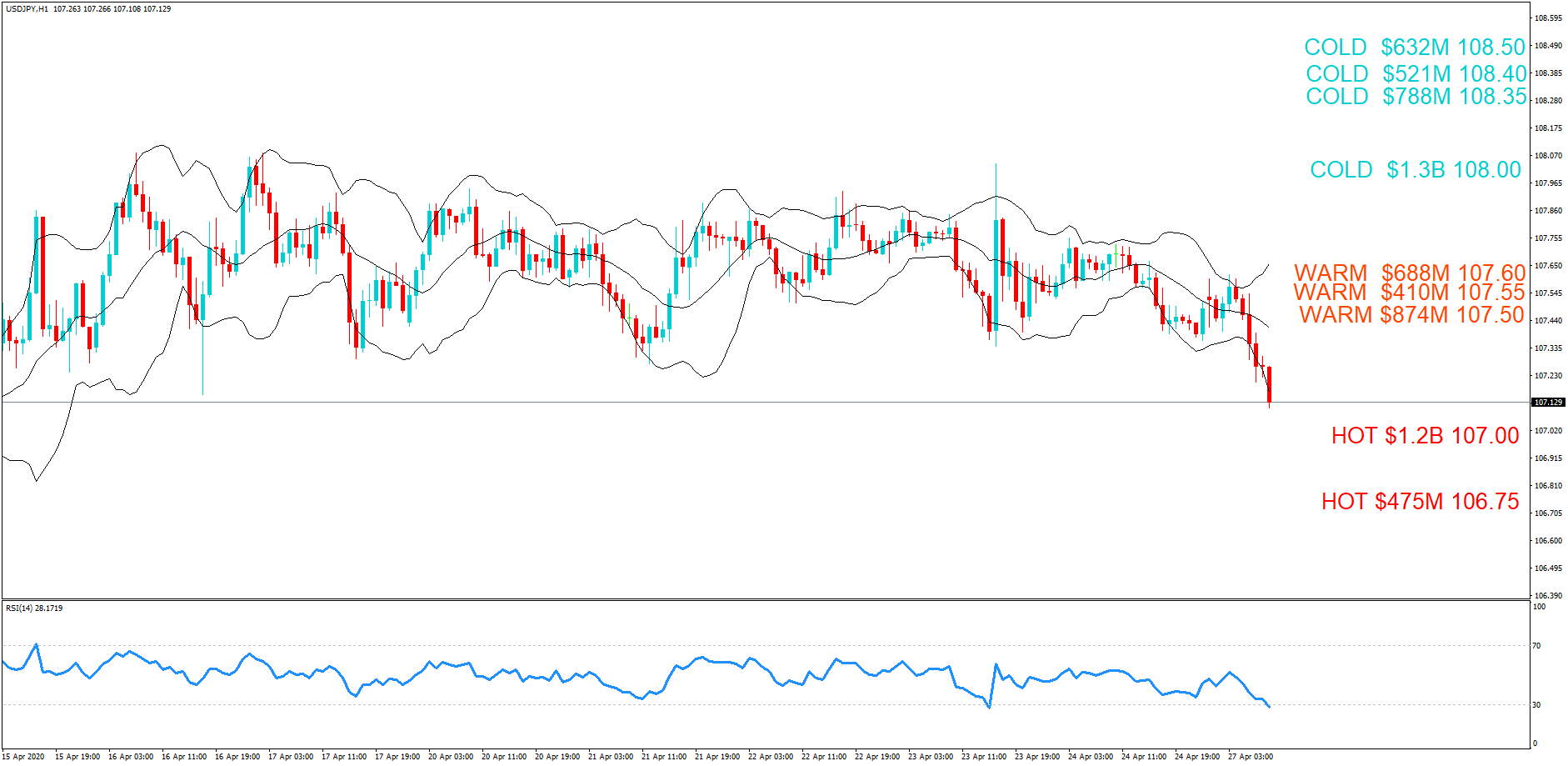

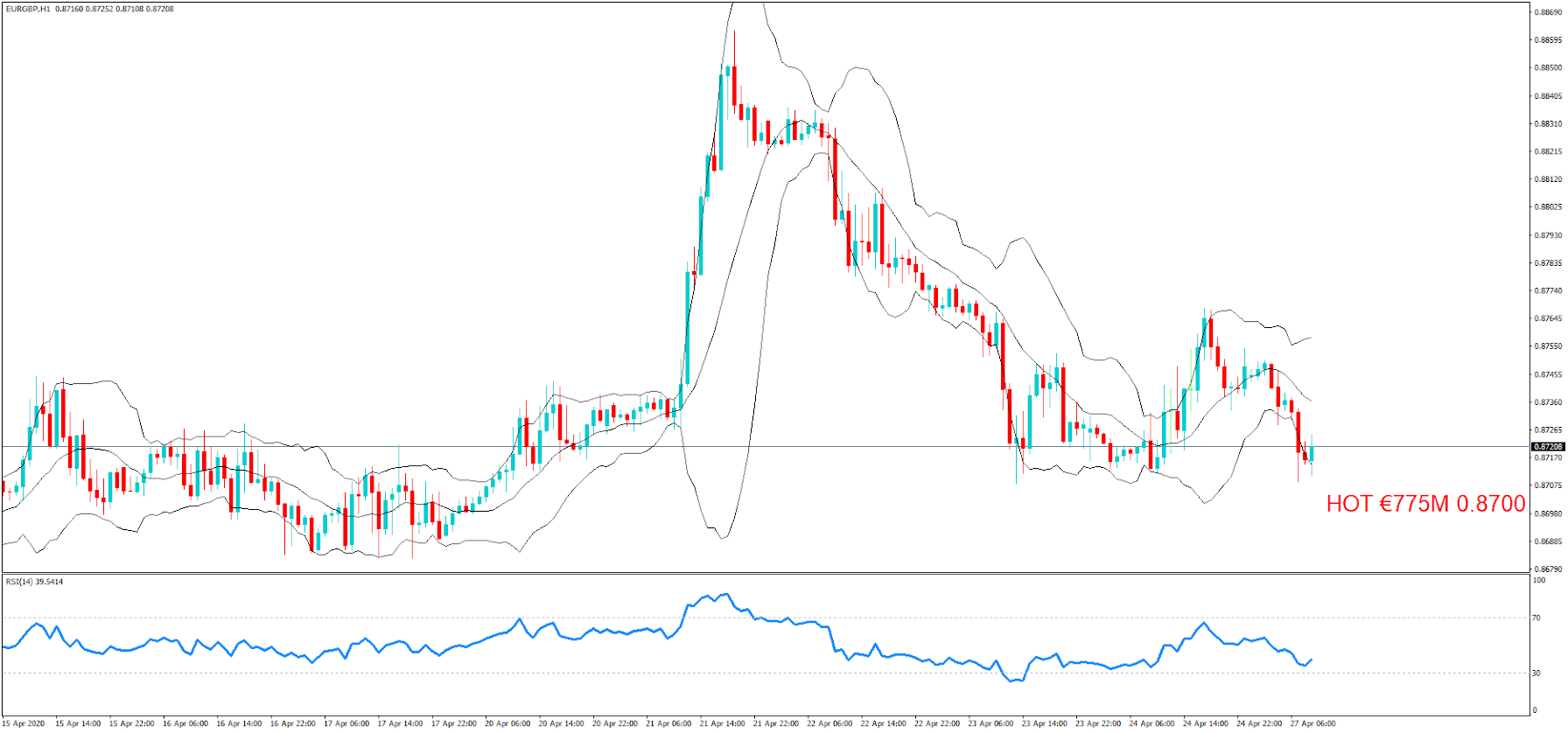

Kevin also plots the expiration levels on to the relevant charts at the various expiry exchange rates and colour codes them in red, which would have a high degree of being reached, or orange which is still possible and where these are said to be in-play. He also labels other maturities in blue and where he deems it unlikely price action will be reached by 10 a.m. New York, and thus they should be considered ‘out of play.’ Kevin also adds some technical analysis to try and establish the likelihood of the option maturities being reached that day. These are known as strikes.

Please bear in mind that Kevin will not have factored in upcoming economic data releases, or policymaker speeches and that technical analysis may change in the hours leading up to the cut.

So let’s look at a few of last week’s option maturities to see if they affected price action.

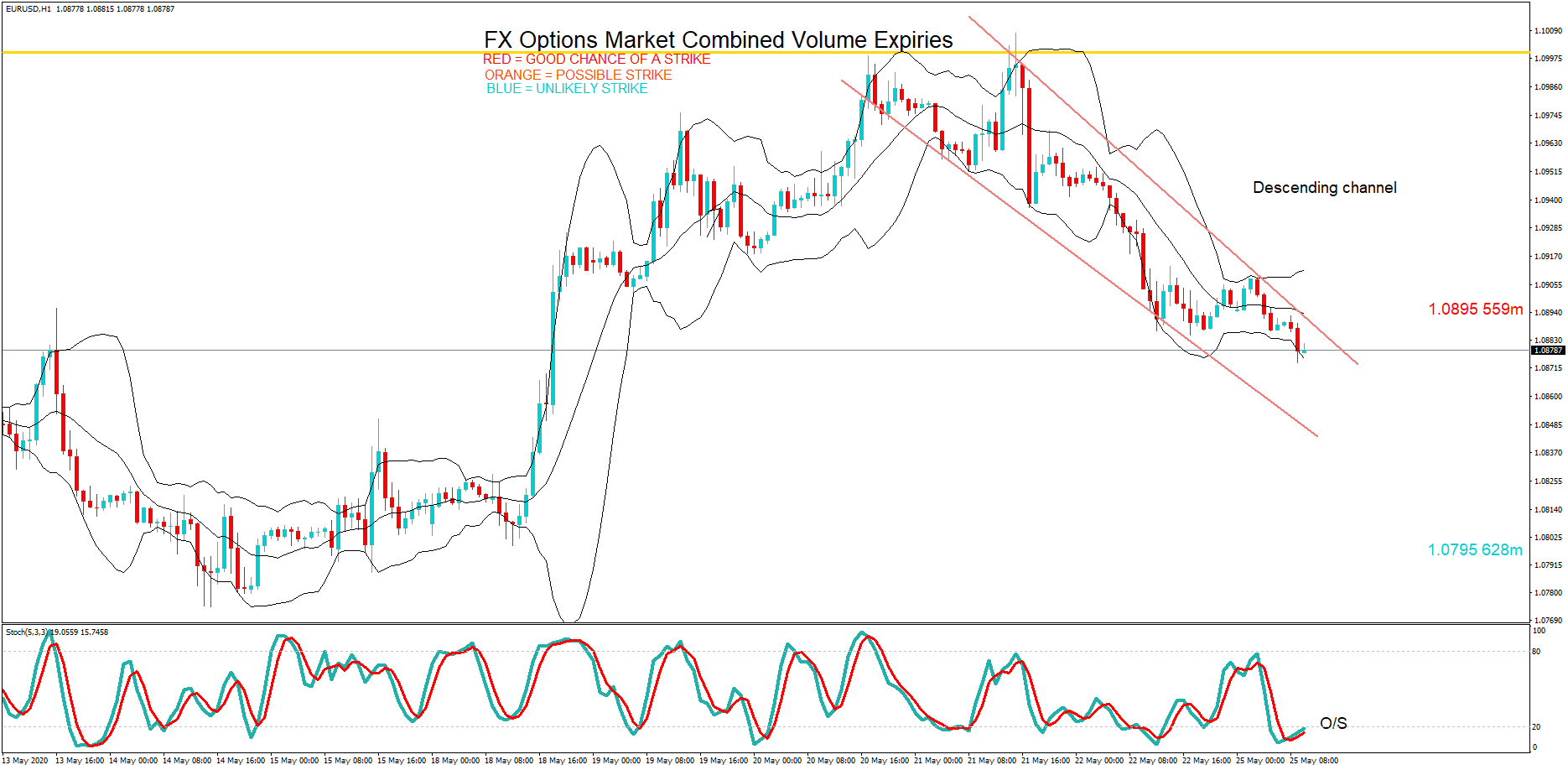

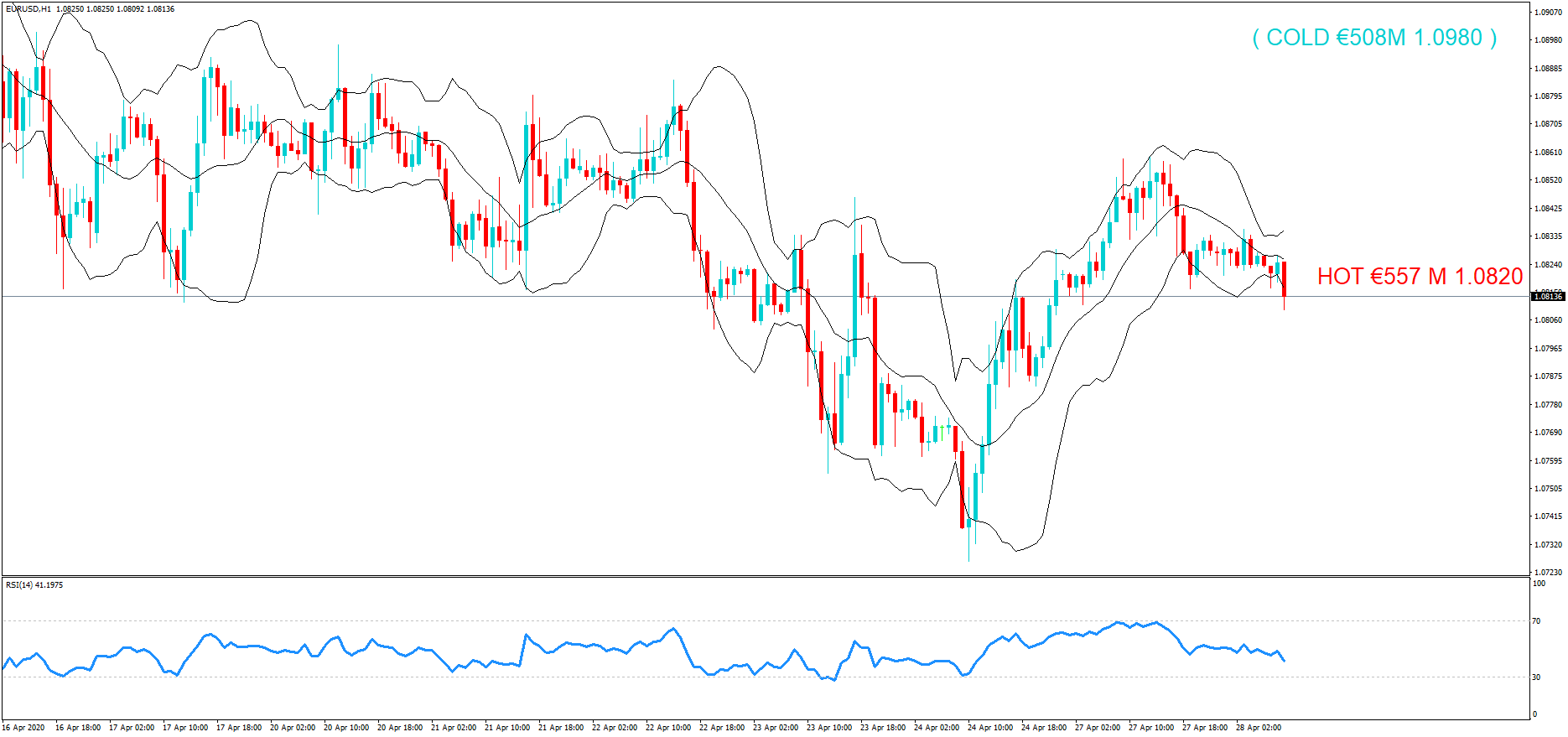

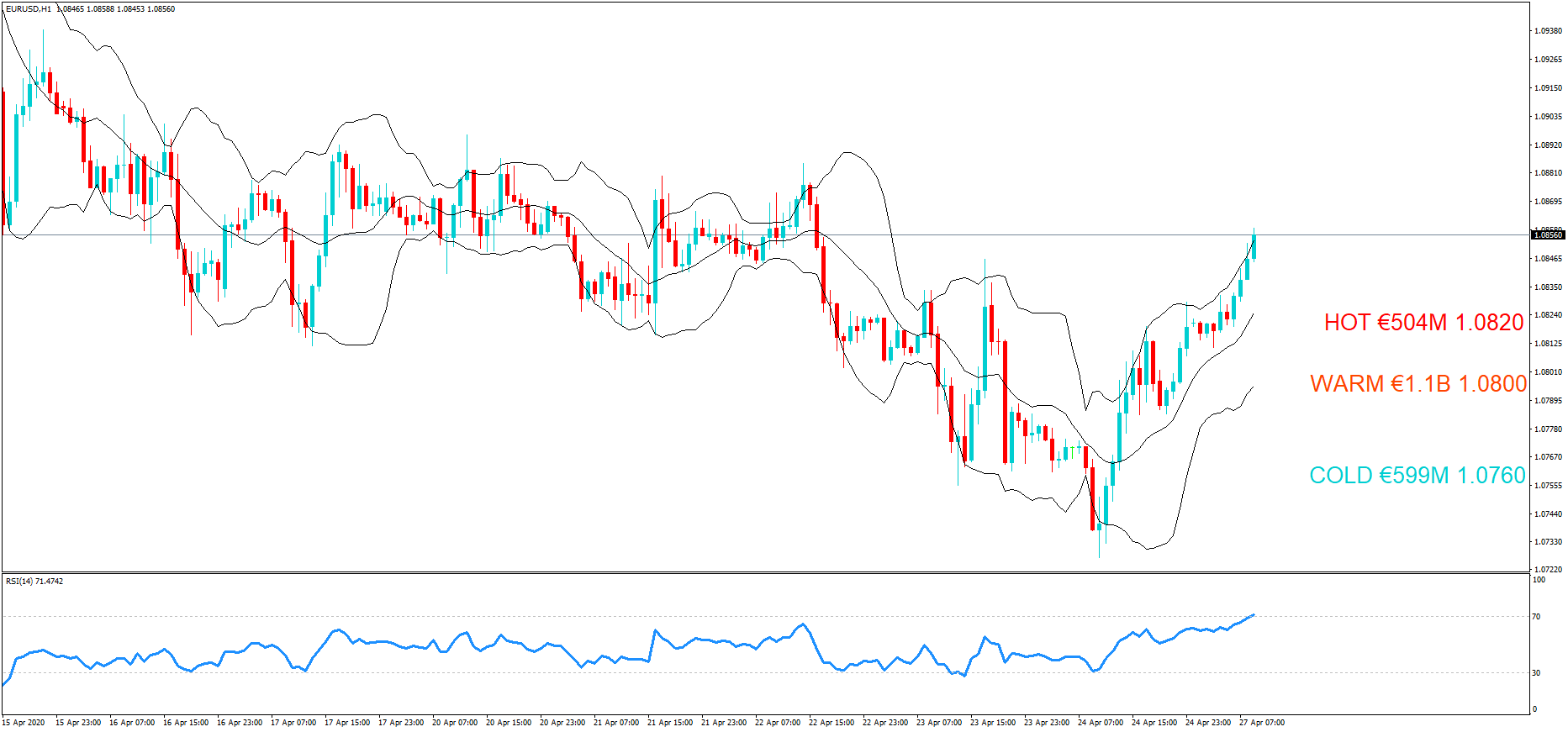

So on Monday 25th, there were two maturities for the EURUSD pair with a red one at 1.0895 for €559M. And we can see that the technical analysis as provided by Kevin was, and I quote what he put on the website at around 8 a.m.: The EURUSD pair is in a bear channel but is oversold on our one hour chart. We should expect subdued price action due to a lack of market data out today and the fact that it is a public holiday in the UK and the USA. The option maturity at 1.0895 is currently in close proximity to the exchange rate, and we may see a pull-back to the level later in the session. However, at the moment, the bears are in control.

Now let’s turn to the one hour chart at 10 a.m. New York time. The pair was an official

Strike at 1.0895.

The second maturity was labelled in blue and was considered to be out of play.

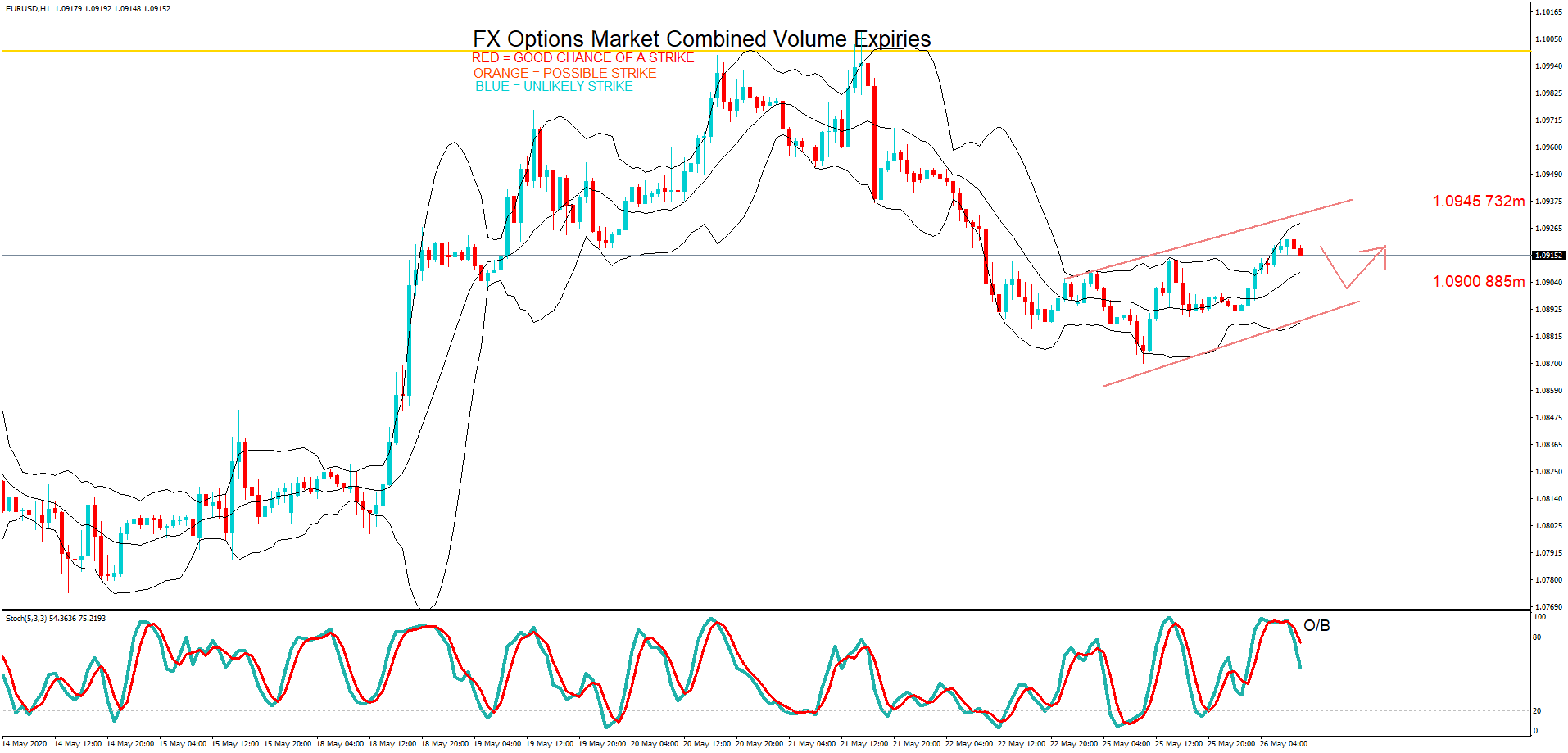

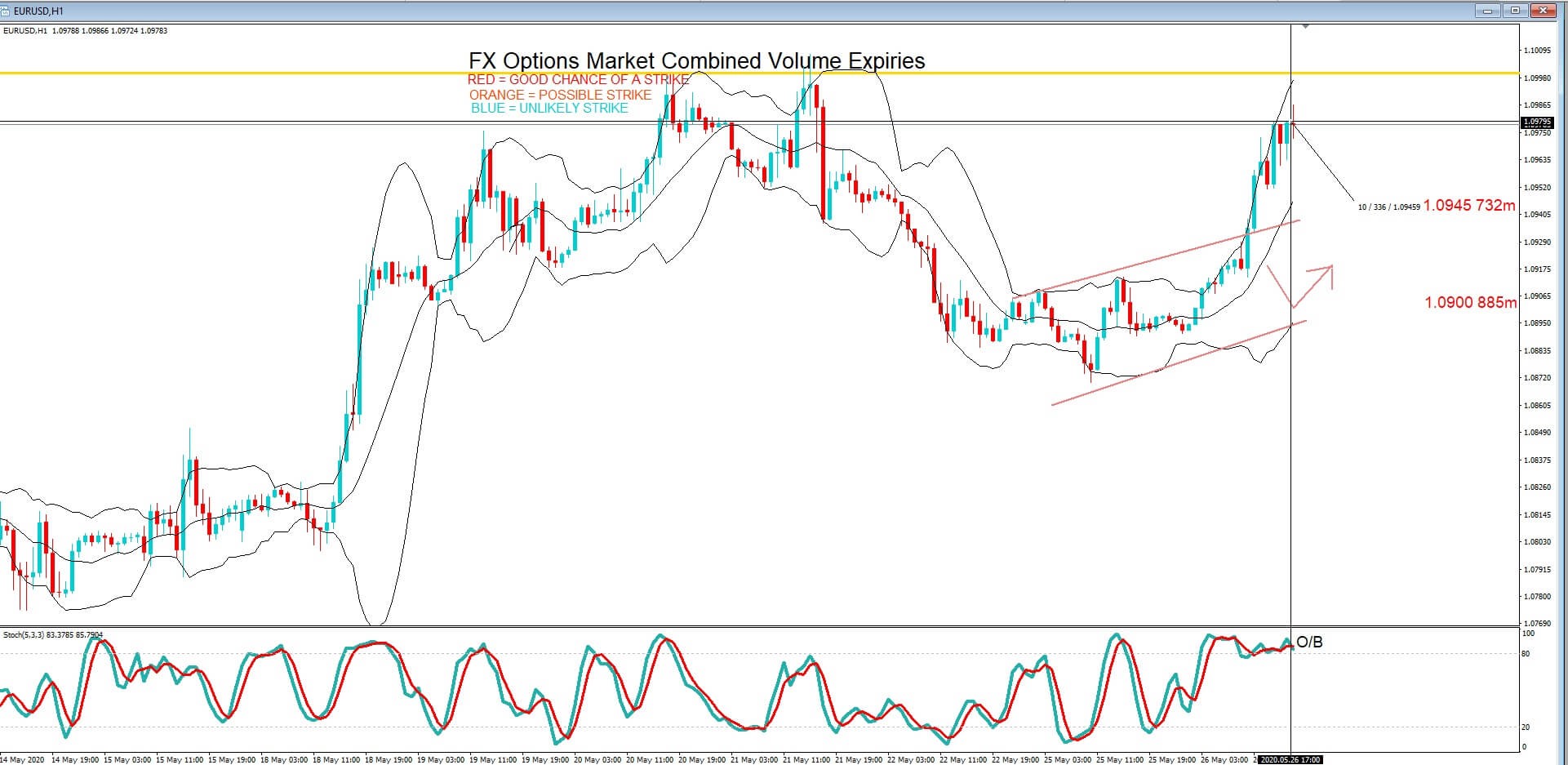

On Tuesday 26th May, we brought you a couple of options expiries for EURUSD at 1.0900 and 1.0945, and this is the original price action and technical analysis chart where the pair had been trading at 1.0915 at the time Kevin wrote the analysis.

Now let’s take a look at the price action at the time of the New York cut. Price action continued as per the technical analysis throughout the European trading session and ended up at 1.0979, which was just 33 pips above the maturity of 1.0945. Options traders who bought a premium Put option for this expiry level would have been in the money.

Retail forex traders who had bought the pair during the European sessions based on Kevin’s analysis would have been in profit by over 63 pips.

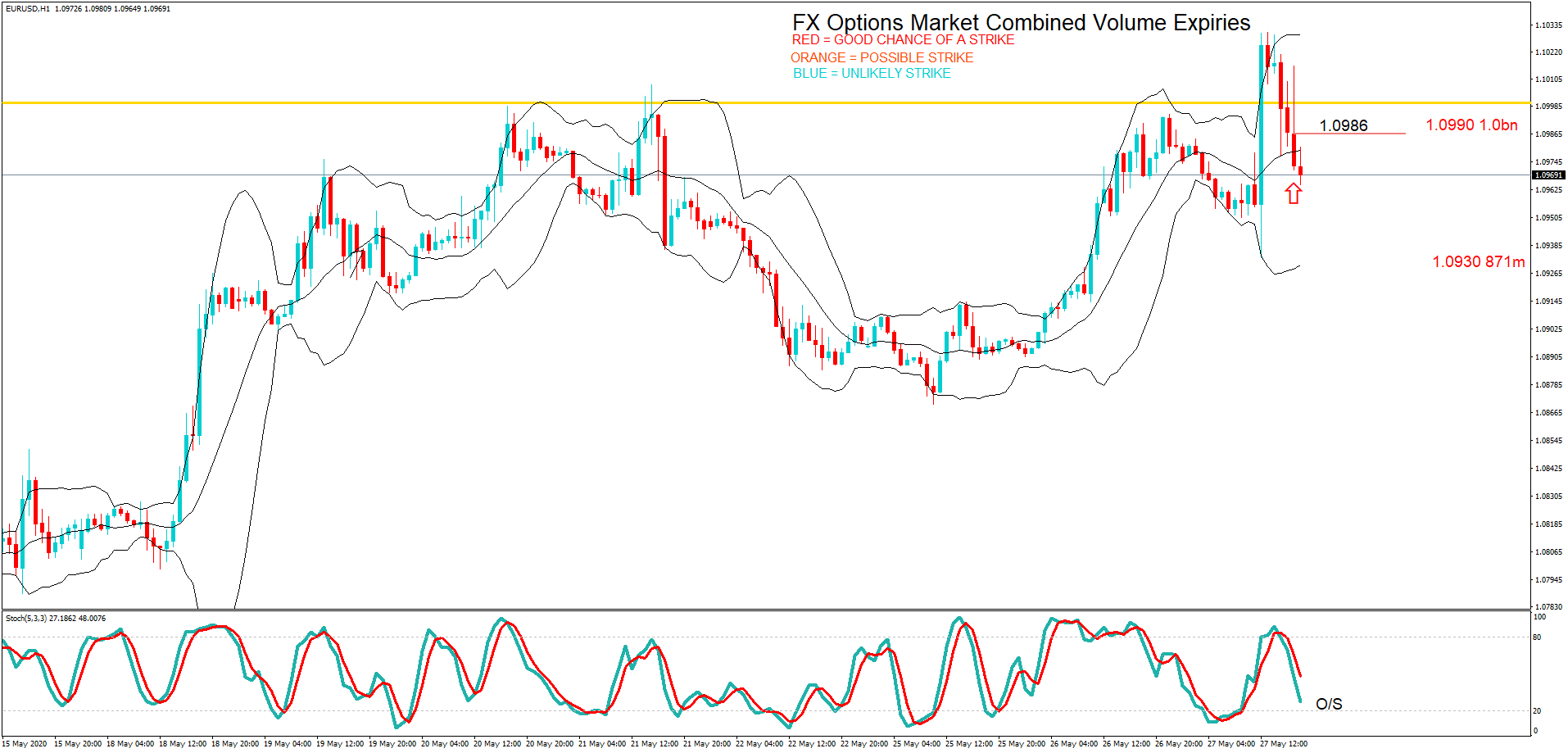

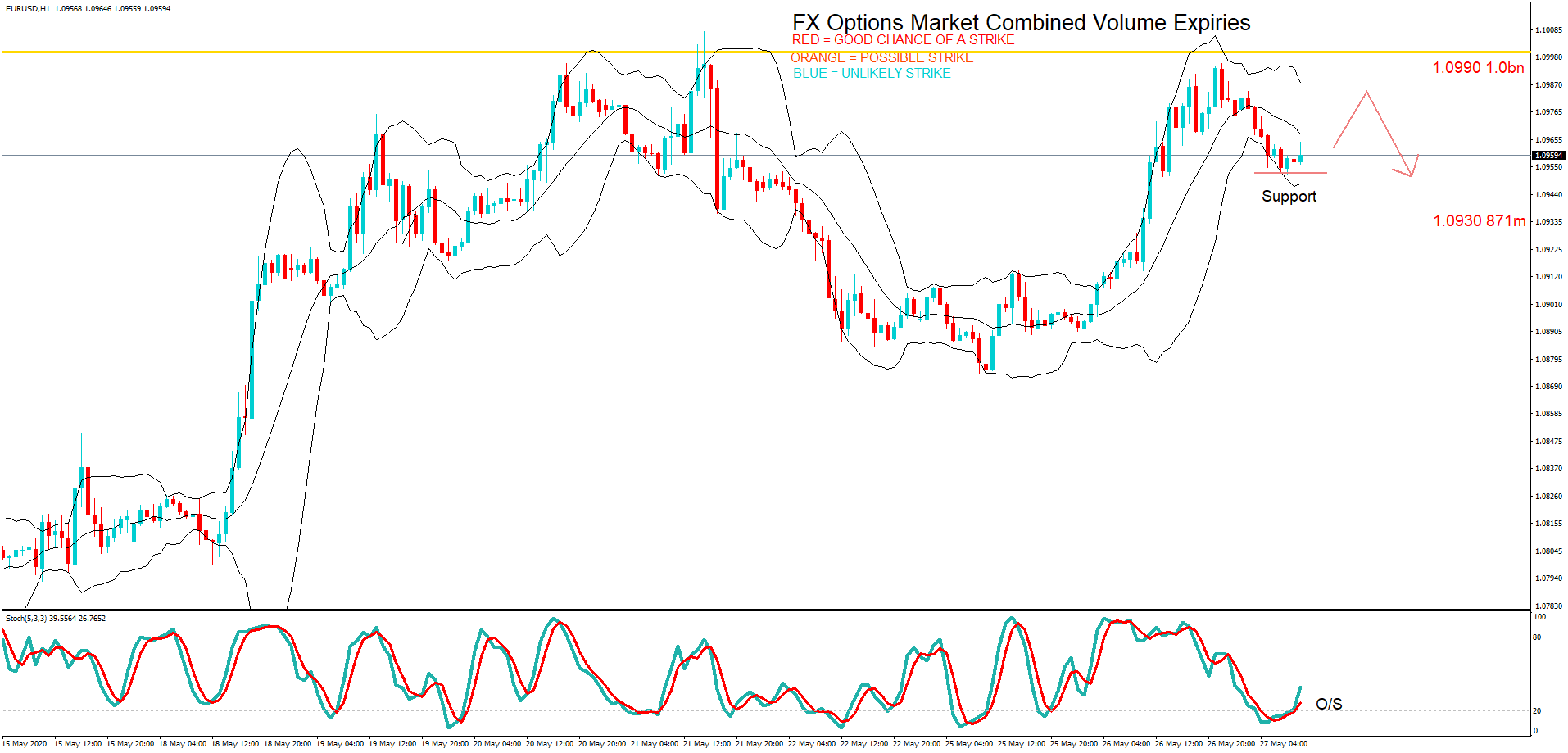

On Wednesday 27th, there were two option maturities for the EURUSD pair. At the time of the cut, the FX exchange rate was 1.0986. This was just four pips away from the huge €1 B option at 1.0990

And here is the original analysis from Kevin at just after 8 a.m. BST. Pretty much spot on to what happened at the time of the cut.

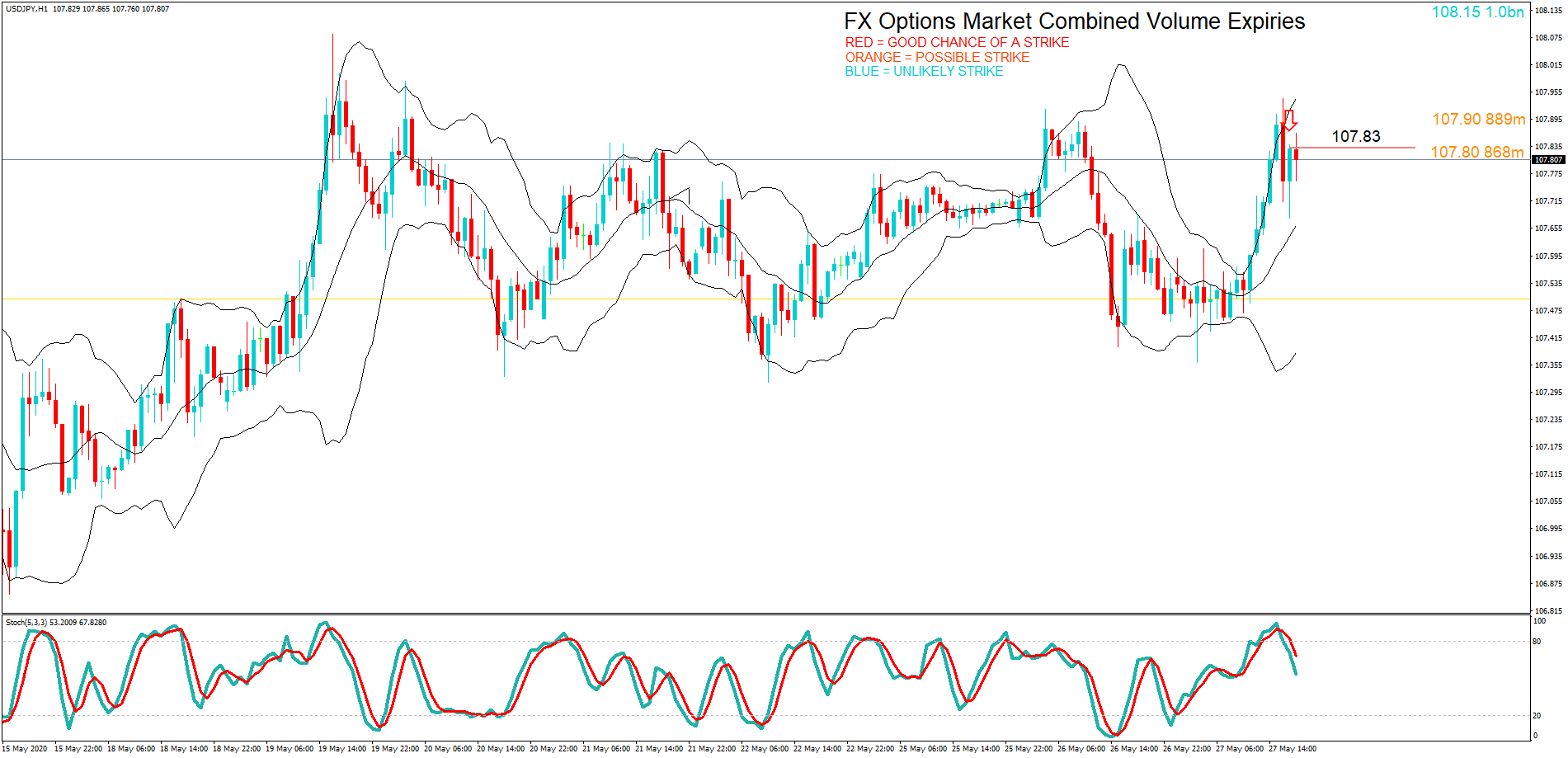

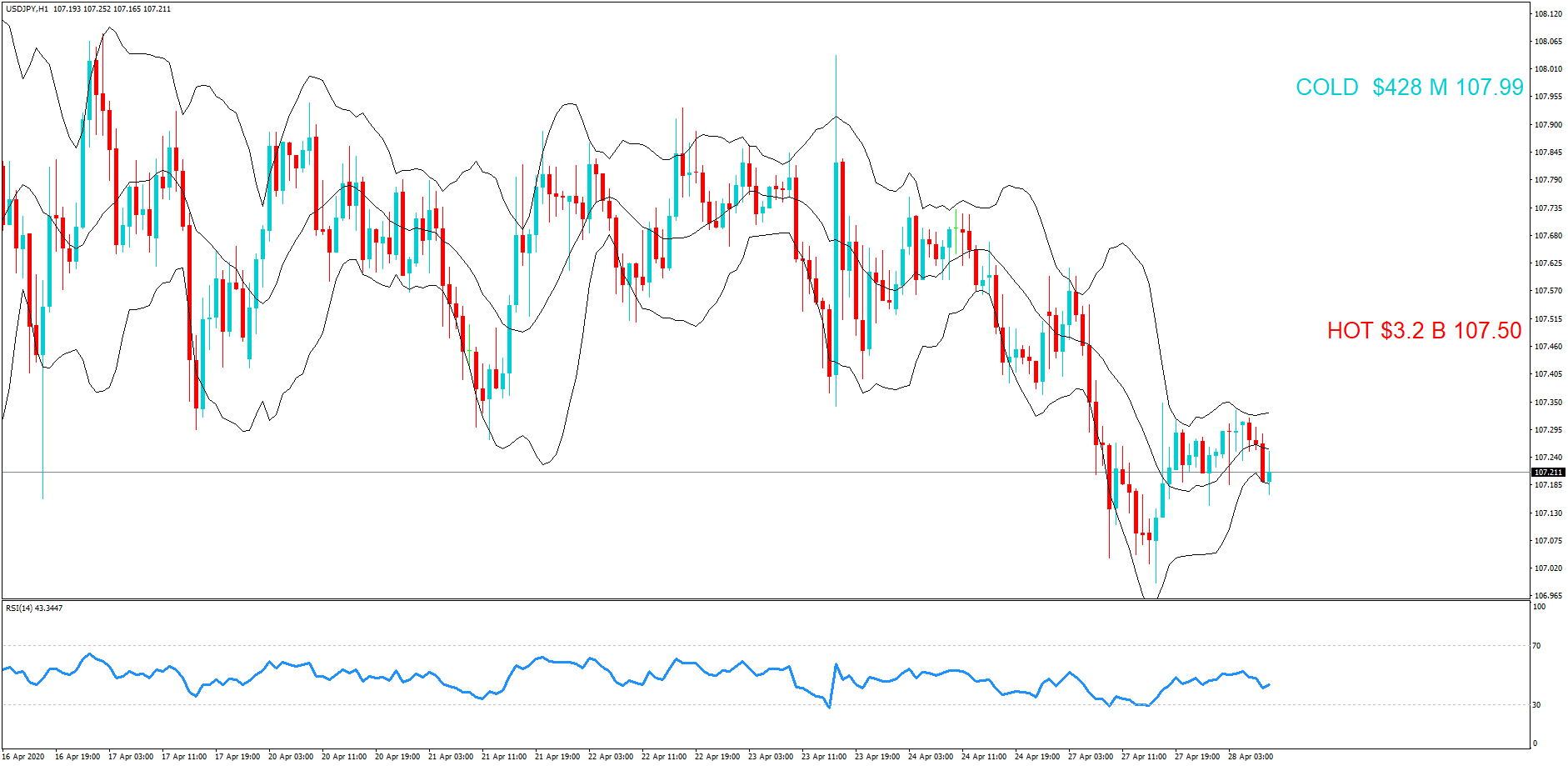

There were three option expiries for USDJPY on Wednesday, and price action at around 8 a.m. suggested consolidation with a continuation to the downside. However, the 107.86 maturity was too much of a pull. The FX pair was at 107.83 at 10 a.m. New York time. That was just a few pips either way for the two maturities Kevin marked in orange.

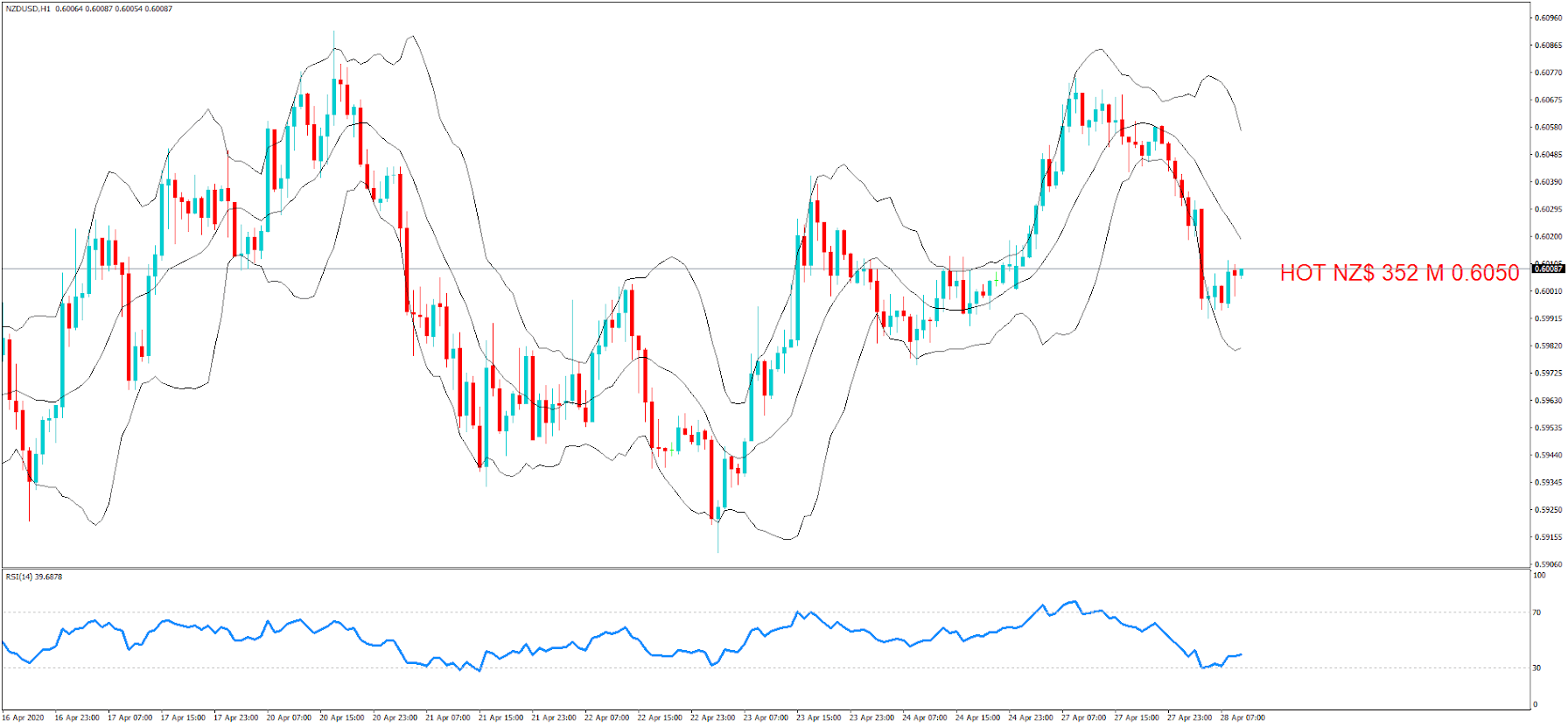

We have a similar story with the AUDUSD pair on Wednesday, which had a large maturity at 0.6600 and where the FX exchange rate hit 0.652, which was just 17 pips shy of the maturity.

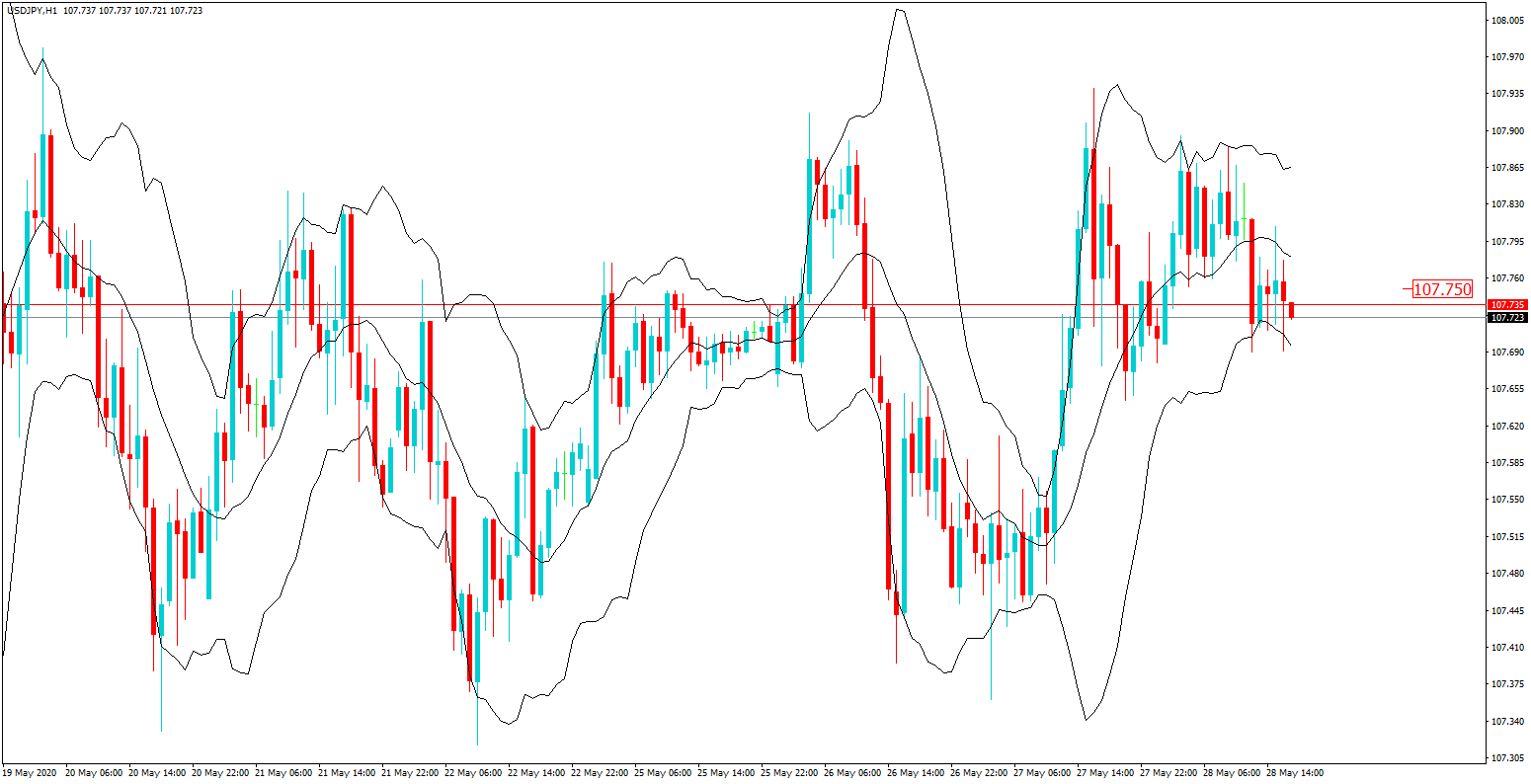

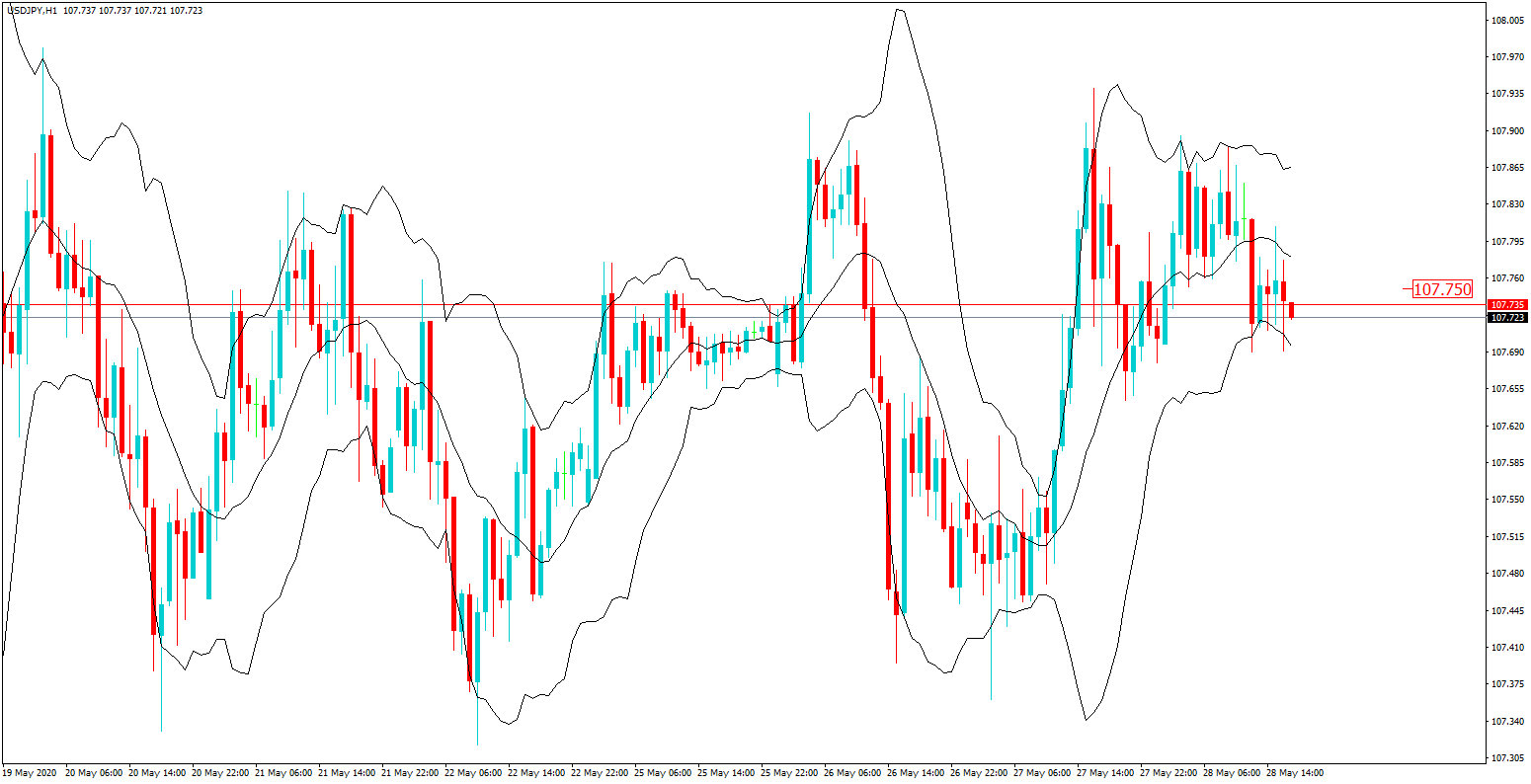

Of the notable option expiries for Thursday 28, we brought you one for USDJPY, where there was an expiry at 107.75, which was just one pip away from the exchange rate at the cut or 107.74. Remember, other brokers may be a pip out either side, in case this was as good as a strike.

We also had an expiry for the EURUSD pair at 1.0990 and 1.1020, and where the exchange rate at the cut was 1.1031. just 11 pips away from the latter.

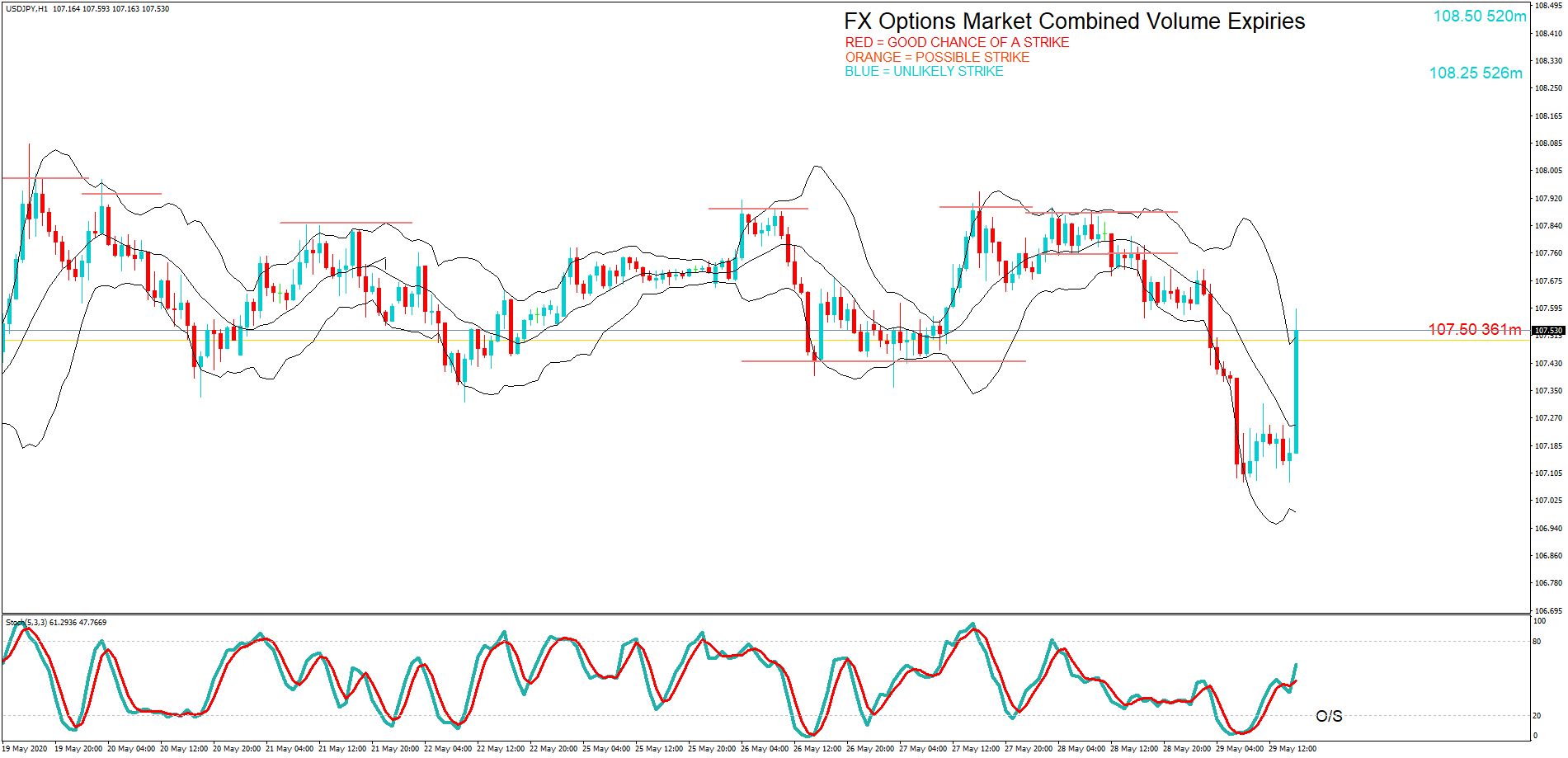

On Friday 29th, we had an option at 107.50 for the USDJPY pair, which Kevin labeled in red, the maturity was just a couple of pips higher at the cut.

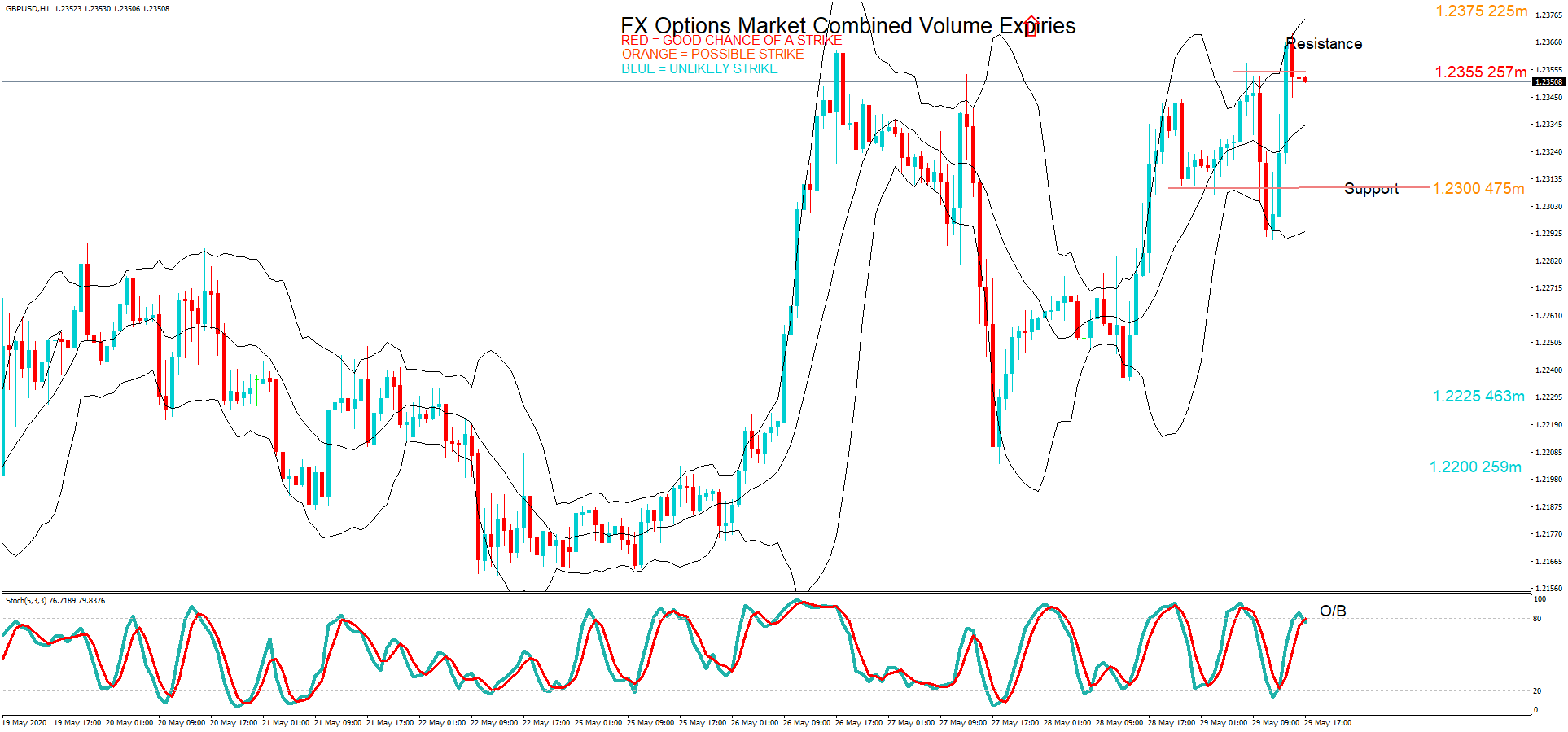

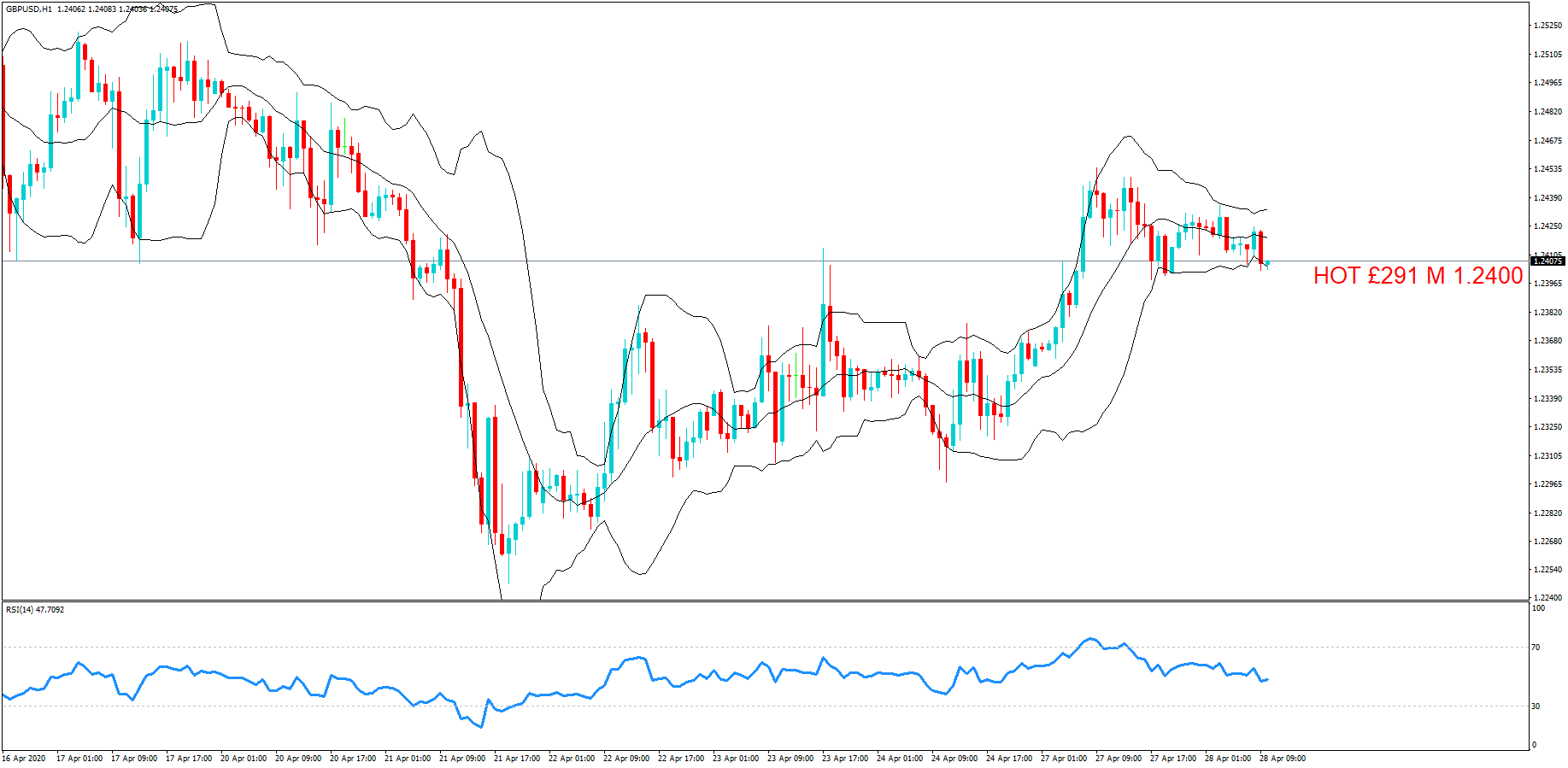

Several option expiries for the GBPUSD pair, but only one labeled in red at 1.2355 again, at the cut the exchange rate was just five pips short.

And the AUDUSD pair had a red maturity at 0.6650, and at the new york cut, the price was just 15 pips short.

Please remember, Kevin’s technical analysis is based on exchange rates, which may be several hours earlier in the day and may not reflect price action at the time of the maturities.

We suggest you get into the habit of visiting the FA website each morning just after 8 a.m. BST and take the levels and plot them onto your own trading charts and incorporate the information into your own trading methodology in order to use the information to your advantage.

Remember, the higher the amount, the larger the gravitational pull towards the exchange rate maturity at 10:00 a.m. Eastern time.

For a detailed explanation of FX options and how they affect price action in the spot forex market, please follow the link to our educational video.

Forex.Academy will be making these levels available to you, free of charge, and they can be accessed on the options drop-down menu of our home page. For your convenience, as and when

Forex.Academy will be making these levels available to you, free of charge, and they can be accessed on the options drop-down menu of our home page. For your convenience, as and when