Forex Option Expiries Over $100,000,000 – The 10 am New York Cut part 2

Hello everybody, and thank you for joining us for the daily FX expiries briefing video for the 10 am New York cut today.

If it is your first time with us, the FX currency options market runs in tandem with the spot FX market, but where traders typically place Call and Put trades on the future value of a currency exchange rate and these futures contracts typically run from 1 day to weeks, or months.

Each day we bring you details of the notable FX option expiries where they have an accumulative value of a minimum of $100M + and where quite often these institutional size expiries can act as a magnet for price action in the Spot FX arena leading up to the 10 am cut.

We will also plot the levels on to the relevant charts at the various exchange rates where there are due to expire, and also identify the levels which are in play, and where we believe there is a greater chance of the expiry maturing based on technical analysis at the time of writing, we will label them as hot, warm or cold.

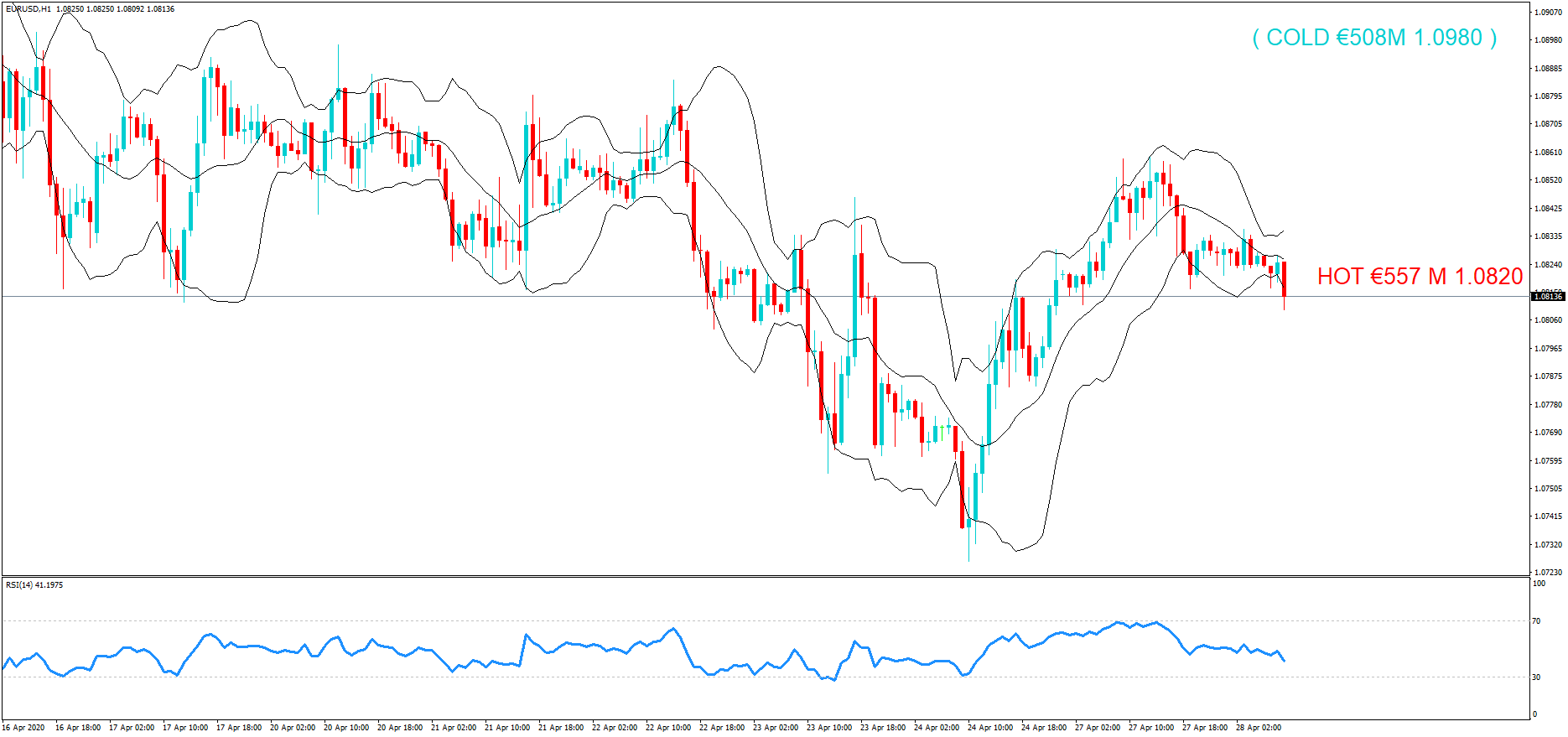

So today we have Option Expires for the EURUSD Pair We have one notable expiry which is in play at 1.0820 for €557M and a Cold expiry which is out of play for €508M at 1.0980

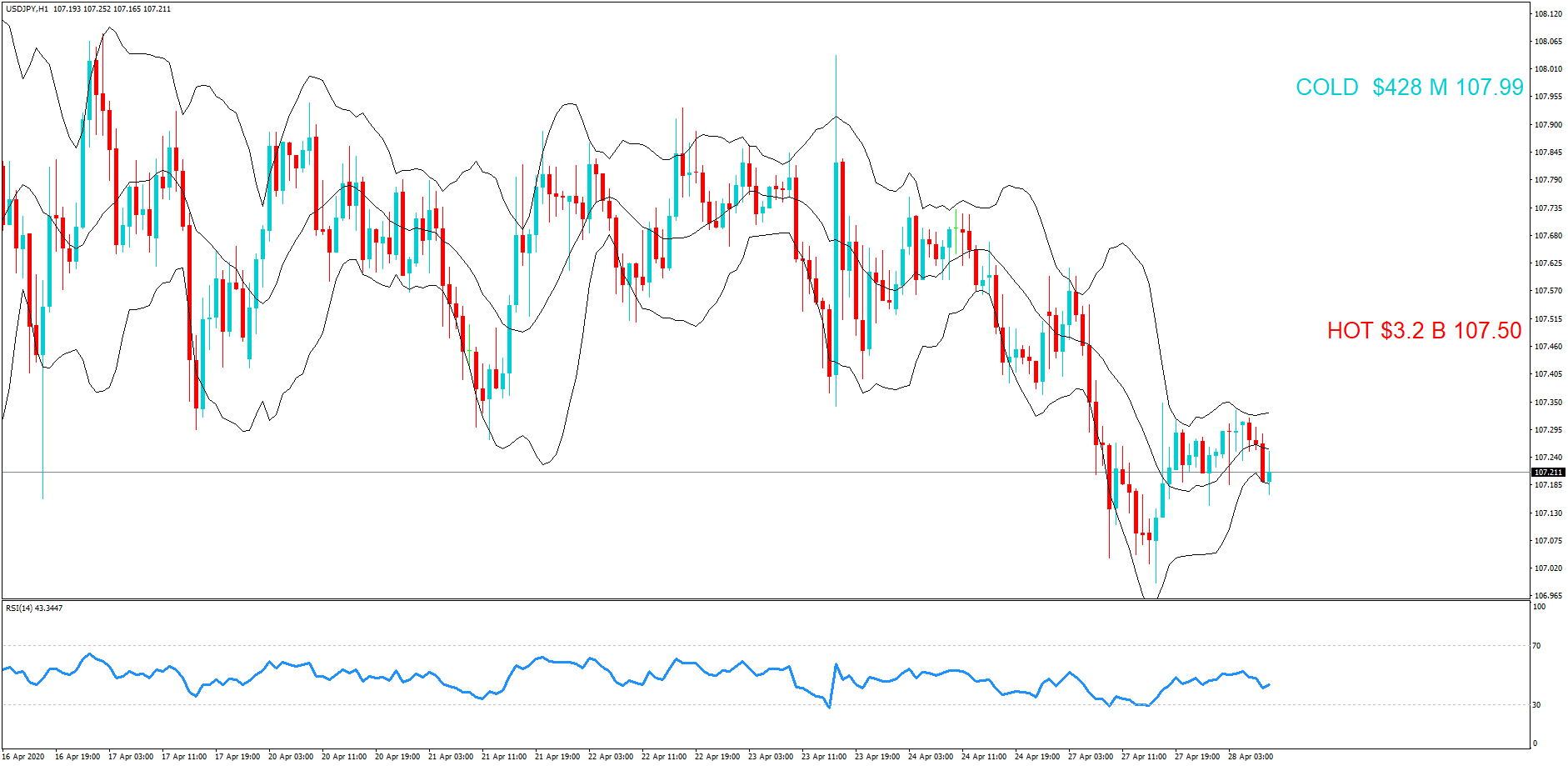

Also, there are also Options expiring for USDJPY pair with a Hot expiry at 1.0750 for $3.2 B in USD value and a cold expiry at 1.0799 for $428M

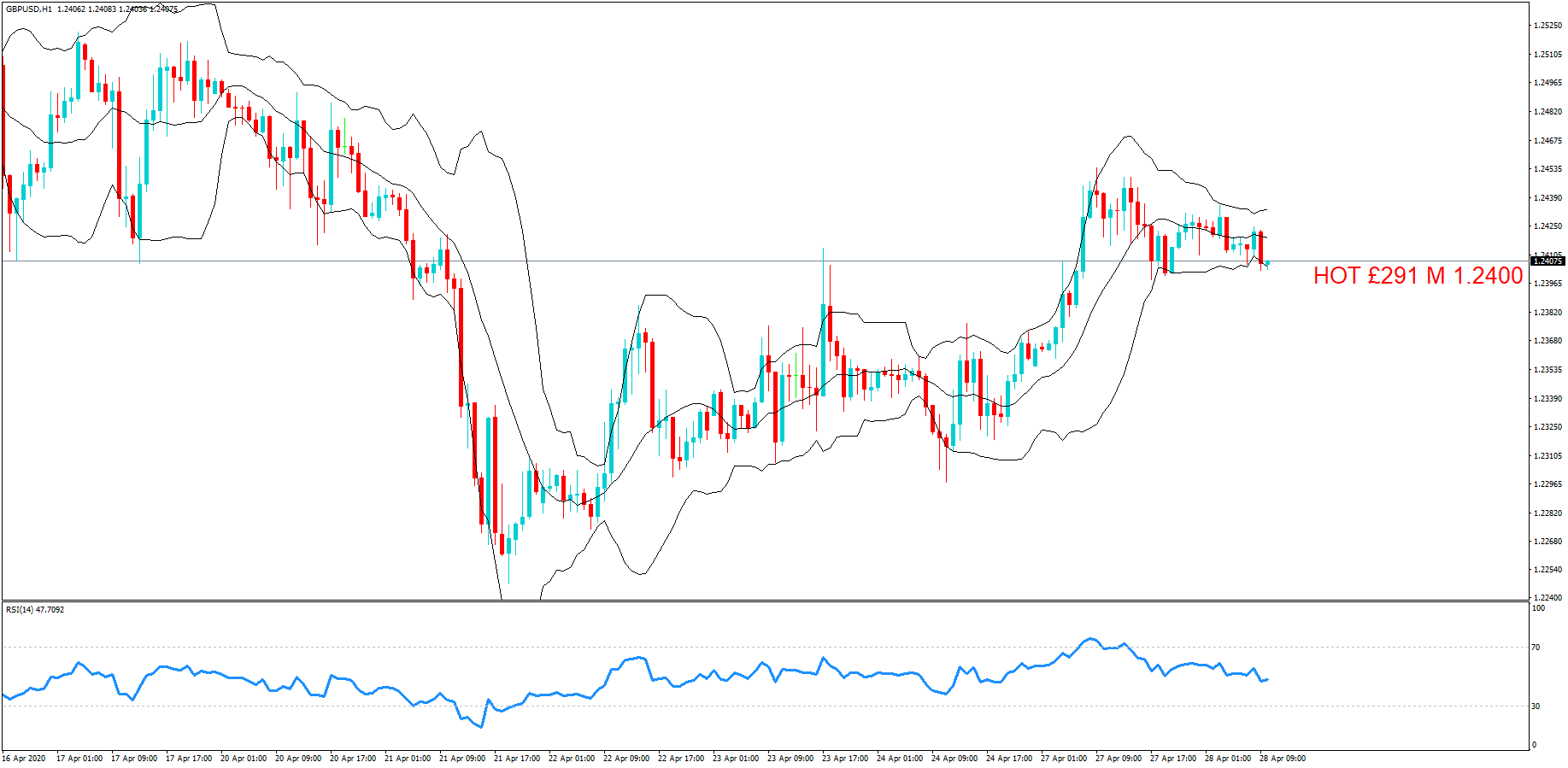

There is one expiry for the GBPUSD at 1.2400 and is Hot for £291M

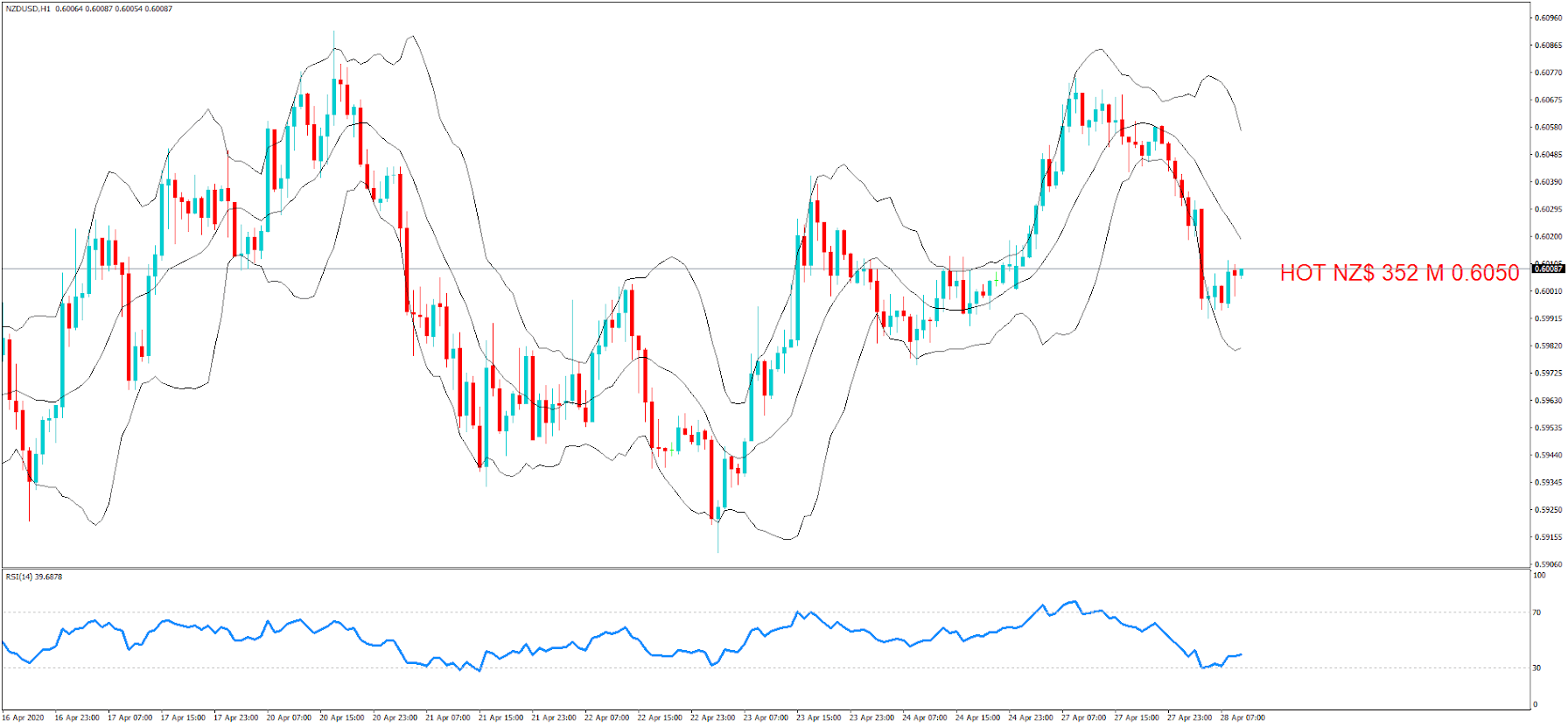

We also have a Hot expiry for the NZDUSD pair at 0.6050 for 352M In new Zealand dollar value.

Of the notable option expiries which we brought you yesterday: price action gravitated to the 107.00 level on USDJPY, just before the New York cut. We listed this as Hot

ERUGBP gravitated towards the 0.8700 level. We listed this as Hot too.

EURUSD had several options, and we listed 1.0820 as being Hot and where traders who purchased a Put, for this expiry level would have been in the money.

We suggest you take the levels and plot them onto your own trading charts and incorporate the information into your own trading methodology in order to use the information to your advantage.

Remember, the higher the amount, the larger the gravitational pull towards the exchange rate maturity at 10:00 am Eastern time.

For a detailed explanation of FX options and how they affect price action in the spot forex market, please follow the link to our educational video.