Introduction

In all the previous lessons, we understood the terminology and interpretation of the popular Elliot Wave theory. Now we are well-versed with the subject to apply it to the forex market.

The Elliot Wave Theory is a wide concept and can be traded in several different ways. In this lesson, we shall analyze the forex currency pairs using Elliot wave concepts by combining it with some price action.

The best way to trade the Elliot waves

We know that according to the Elliot wave theory, there are two types of waves. There is an impulsive wave pattern made of 5 waves, and a corrective wave made of 3 waves. The impulsive wave is towards the trend, while the corrective wave is basically a pullback for the overall trend.

As a trader, we need to look for trades that payout well along with less risk. So, it is not ideal to trade all the impulsive waves and corrective waves.

Trade setup 1

The setup is to trade the impulsive waves. In the 5-wave impulsive pattern, three waves are along with the trend and two against it. Out of those three impulse waves, the ideal wave to catch is Wave 2. This is because, the Wave 2 is usually the strongest out of the three impulse waves, which significantly reduces the risk on the trade.

Trade Example

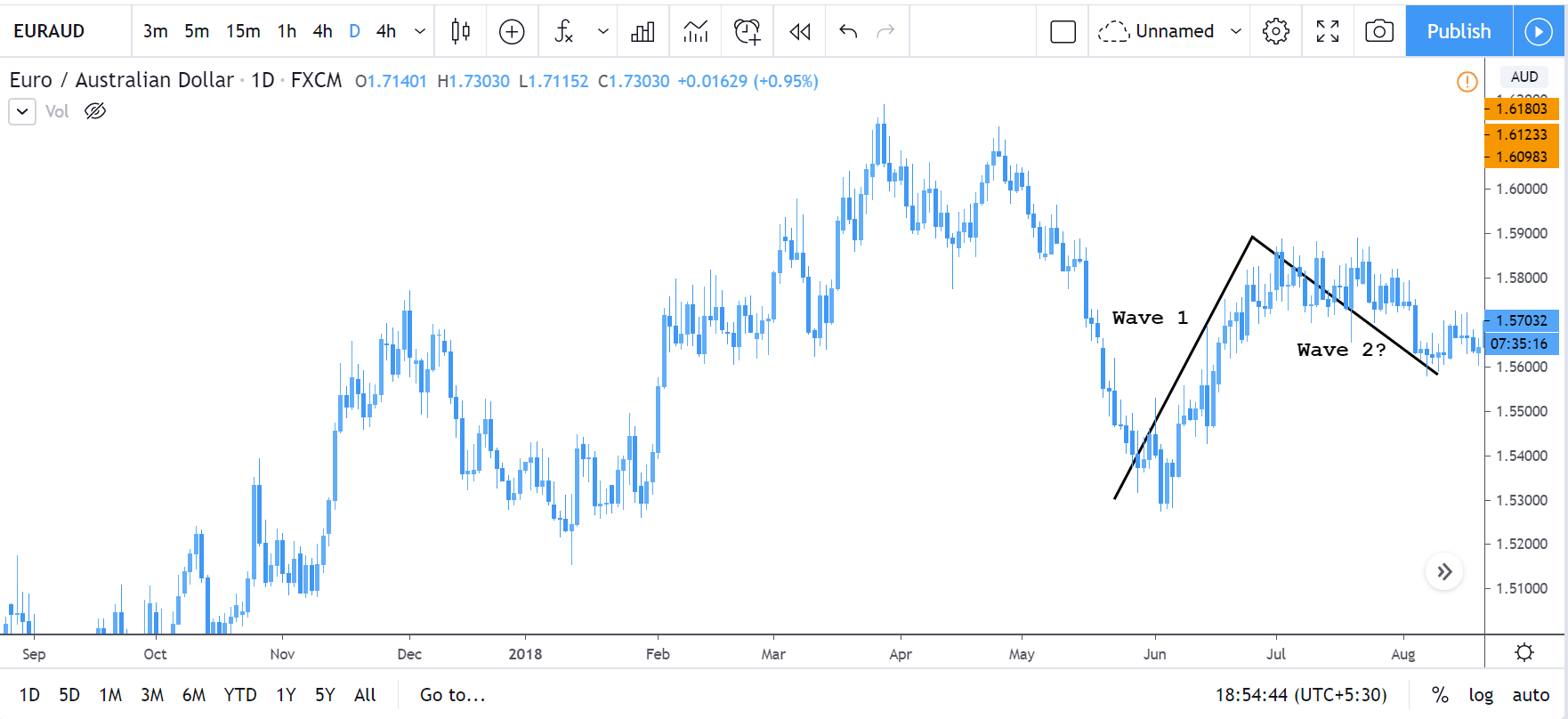

After the market makes the first wave, the price starts to pullback. But while the market is retracing, we won’t know where the market will hold and complete its second wave. So, we make use of other tools to determine where the market will resume its trend.

Consider the below price chart. As represented, the market made its first wave. Then, wave 2 began, where the market started to retrace. But, note that, at this point in point, we cannot confirm the end of wave 2. So, to determine the completion of wave 2, we shall be applying the Fibonacci retracement.

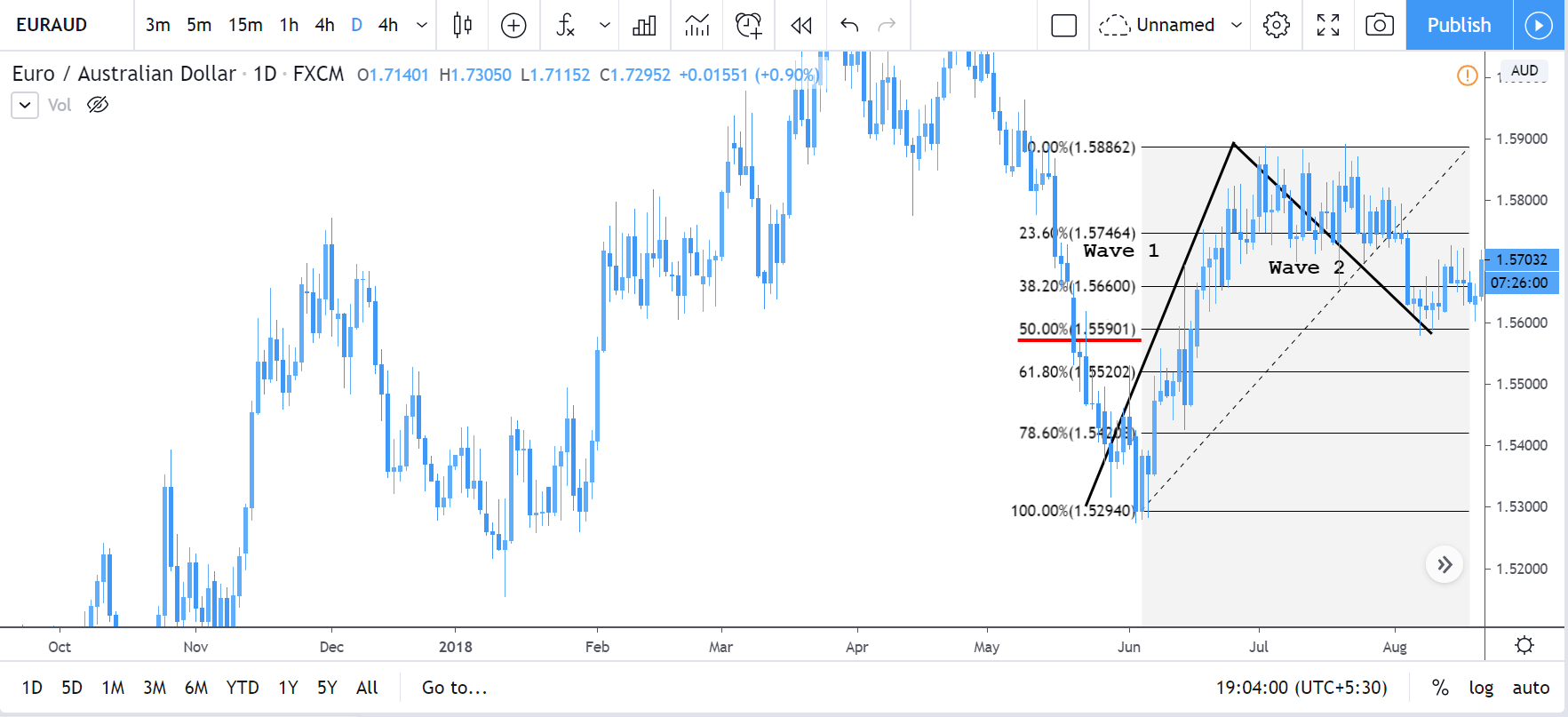

In the below chart, the fib retracement has been applied. We can see that the market began to hold at the 50% level. This hence confirms that wave-2 leg has come to an end. Thus, we can prepare to go long in anticipation of wave 3.

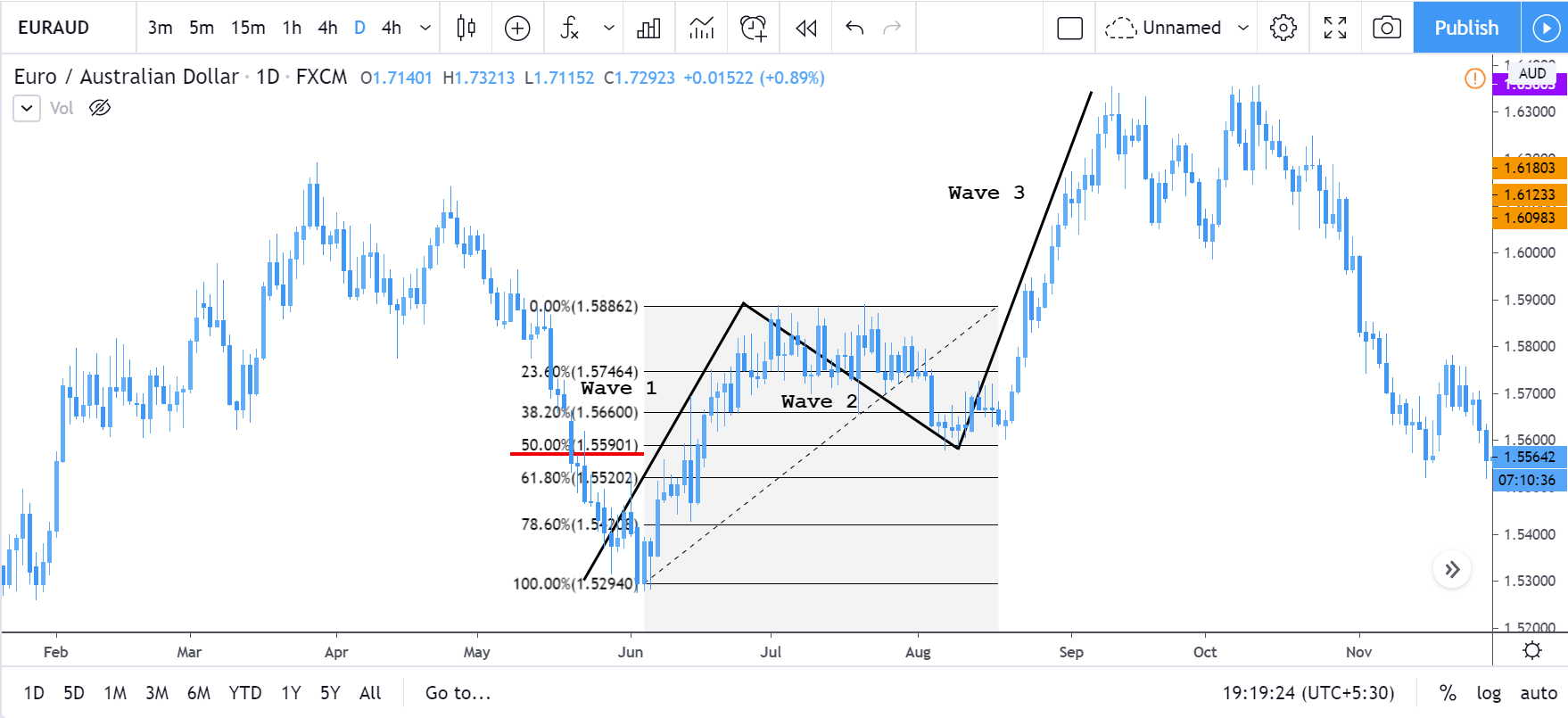

In the following chart, we can clearly see that the market held at the 50% fib level and ended up making a higher high, i.e., wave 3.

Trade setup 2

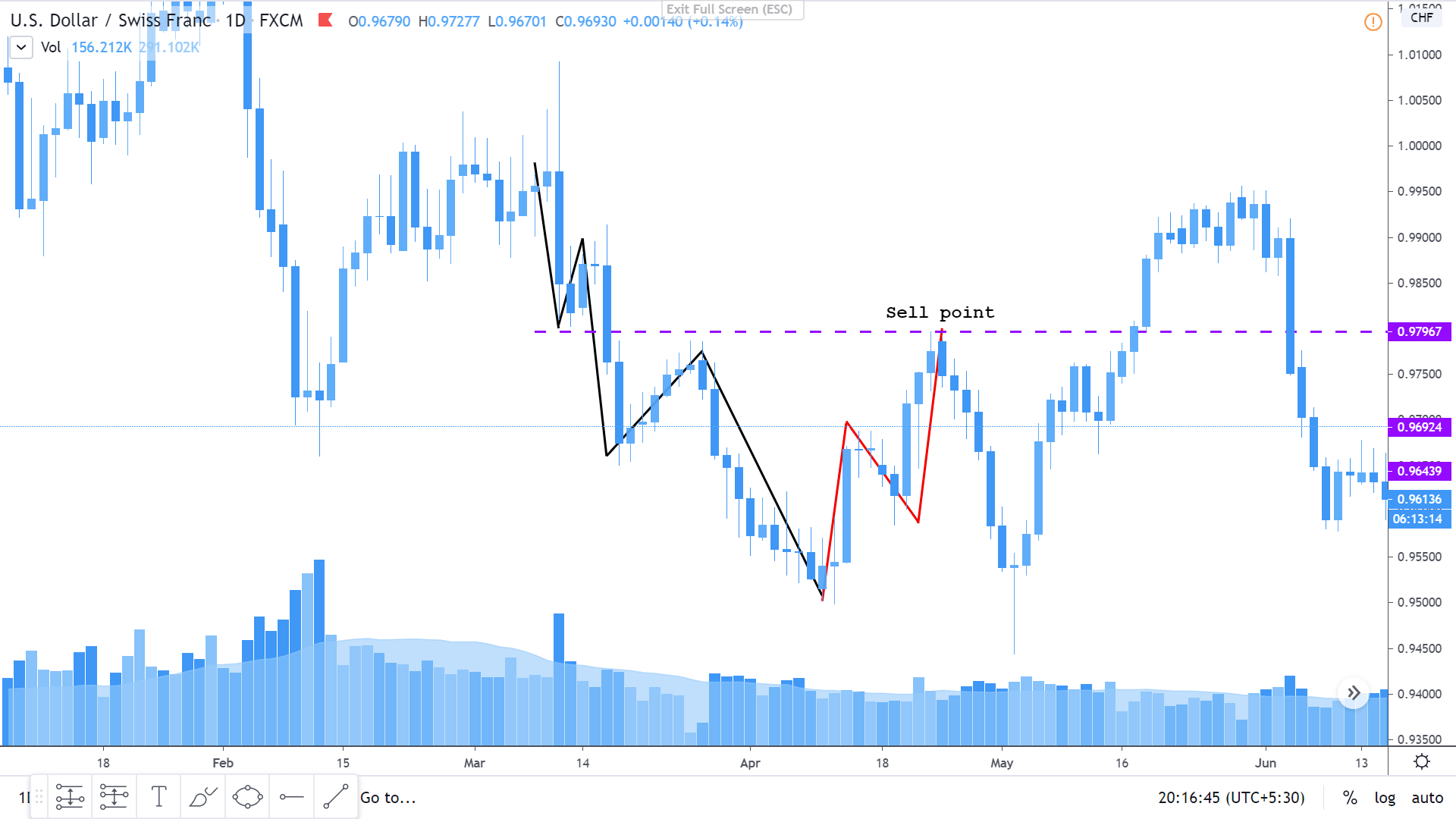

This is the type of setup where we consider the complete 5-3 wave pattern. In the below chart, the 5-wave impulsive pattern is represented with the black trend lines, while the 3-wave corrective pattern is represented by the red trend lines. Since in an Elliot wave pattern, the high of the third corrective wave must be below low of the first wave in the impulsive wave pattern, we can trigger the sell at the area shown in the chart.

This hence concludes our discussion on the Elliot Wave theory. In the next lesson, we’ll summarize this topic for your better understanding and then pick another interesting course. [wp_quiz id=”72249″]