Trade management is such an important factor in Forex trading. Managing trades effectively saves traders from making a loss or help them secure their profit. Sometimes traders are to close their trades earlier or lock the profit. This shall be done only when trading is done on major time frames such as the H4, the daily, or the weekly, though. In today’s lesson, we are going to demonstrate an example of an early exit in the H4 chart.

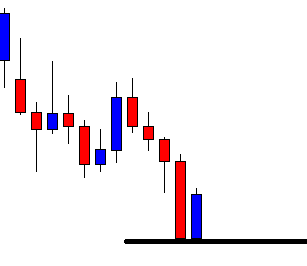

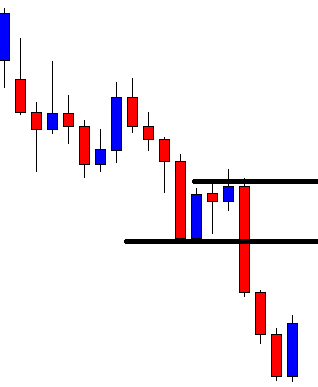

The chart shows that the price makes a strong bearish move. It makes a breakout and produces a bullish inside bar. The H4 breakout traders are to wait for the price to find its resistance and produce a bearish engulfing candle to offer them a short entry. The price is at the breakout level. It seems that the breakout level is going to play a vital role here.

The chart produces a bearish spinning top and a bullish candle. However, the breakout level works as a level of resistance and produces a bearish engulfing candle closing well below consolidation support. The sellers may trigger a short entry right after the candle closes by setting stop-loss above the breakout level and by setting take profit with 1R. The signal candle suggests that the sellers do not have to wait too long to achieve their target.

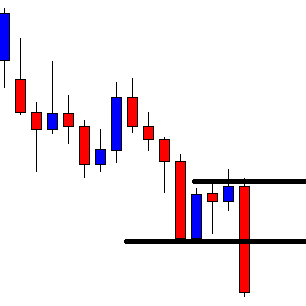

As expected, the next candle comes out as a bearish Marubozu candle as well. The sellers would love to get a bit longer bearish candle. However, as long as it comes out as a bearish candle, they should be happy with it. Remember, this is an H4 chart. Thus, a bearish Marubozu candle means a lot for the sellers. It seems the price is going to take one more candle to hit the target.

The next candle comes out as a Bearish Marubozu candle as well. However, it does not hit the target 1R. A very few pips are left to achieve the target. The sellers must wait. The last candle suggests that it is only a matter of time for the sellers to reach their destination. Let us proceed to the next chart and find out what happens next.

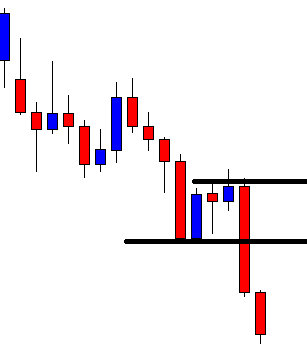

The last candle comes out as a bullish engulfing candle. This does not convey a good message for the sellers. The price is yet to hit the target. They have some profit running in the trade. What should the sellers do here?

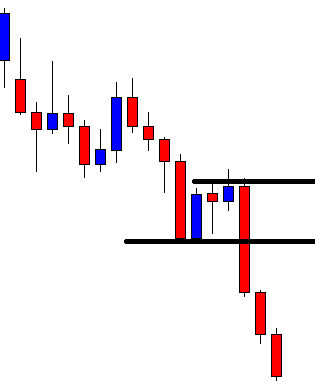

If it is an inside bar bullish candle, the sellers should keep holding the position to hit the target. However, the last candle comes out as a bullish engulfing candle (in an H4 chart). This means a lot for the minor intraday buyers. Thus, the best thing to do would be if the trade is closed manually, right after the last candle closes. It gets the sellers some profit, at least. Yes, the target is not achieved, and some profit is lost. Take it easy. Things go according to plan and sometimes don’t. This is what trading is all about.