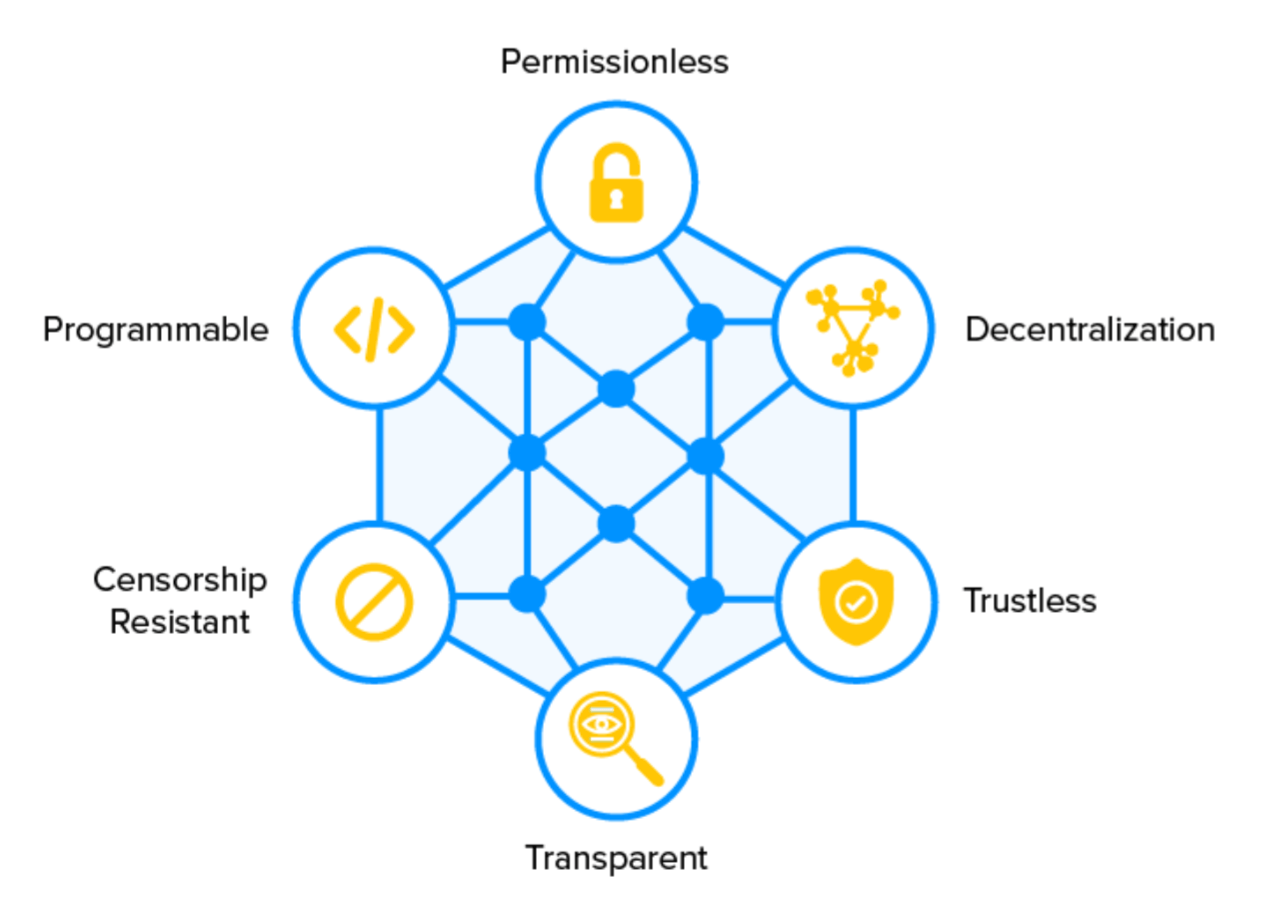

As DeFi becomes more and more of an indispensable idea, blockchain platforms are rushing to capitalize on the wave. DeFi provides endless opportunities for users: lucrative gains on staking, instant borrowing, fraud-proof transactions, and more.

Blockchain platforms are now incorporating DeFi to not just accord users more value but also to remain relevant. Neo, the blockchain platform founded in China, is one of the latest to integrate DeFi in its offerings.

Neo’s DeFi platform is known as Flamingo, and it stepped into the space just September this year. This article will bring into focus everything you need to know about the platform.

Understanding Flamingo

Flamingo (flamingo.finance) is a decentralized finance protocol built atop the Neo blockchain. The platform integrates various modules to offer a comprehensive DeFi architecture, where users can take part as traders, stakers, borrowers, and liquidity providers. Flamingo is a pillar of the Neo DeFi’s ecosystem, and it comes with innovative solutions for the space such as the following:

#1. Friction and lack of cross-chain interoperability: Flamingo will be powered by the Poly Network to support cross-chain asset transfer, ensuring single market limitations are a thing of the past

#.2 Limited efficiency due to fragmented capital sources and overcollaterization: Flamingo will integrate the automated market maker (AMM) protocol and collateral asset pool, which will ensure capital is utilized to the maximum

#3. Short community participation periods: Flamingo will incentivize users with FLM tokens to reward them for their participation in the community

Project Features

The Flamingo platform will be guided by these three key elements:

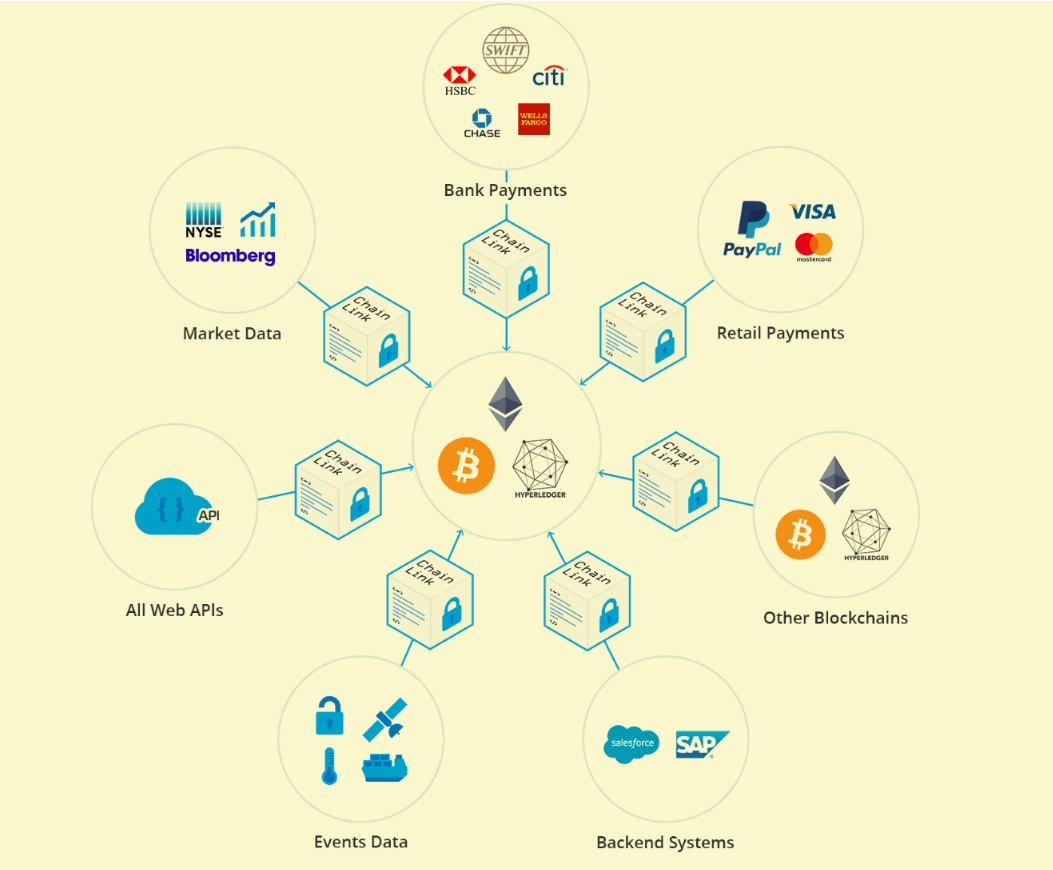

#1. Interoperability

Flamingo will heavily feature interoperability, a factor that lacks in most DeFi platforms. Through the Neo-owned interoperability protocol Poly Network, Flamingo will be collected with various blockchain networks such as Ethereum, Ontology, and Cosmos-SDK. Flamingo users can capitalize on this interoperability to access more assets within a broader DeFi ecosystem.

#2. Capital Efficiency

Flamingo is designed to integrate its Swap feature’s liquidity pool with Vault’s collateral pool. In the existing AMM decentralized exchanges, capital efficiency is usually held back by Liquidity Provider (LP) tokens, which causes some AMMs to be provisioned way below the baseline.

Flamingo will maximize capital efficiency by letting liquidity providers stake LP tokens in Vault while simultaneously minting Flamingo USD (FUSD).

#3. Fair Launch

Flamingo will distribute FLM tokens as transparently as possible, with no pre-mine launch or some reserved for the team. The community will decide the long-term distribution formula via voting.

Flamingo: Components

Flamingo is defined by several core features, which are:

#1. Wrapper

This is a multi-chain asset gateway for blockchains such as Bitcoin, Ethereum, Neo, Ontology, and Cosmos-SDK. You can wrap tokens like BTC, ETH, NEO, USDT, and ONT , upon which they’ll become NEP-5 tokens (nETH, nNEO, nUSDT, nONT, and so on.) You can also unwrap tokens back to their original form.

#2. Swap

Swap is Flamingo’s automated market maker and makes wrapped assets, FLM, and NEP-5 tokens. The swap works much like Uniswap by adopting the Constant Product Market Maker (CPMM) model. On Swap, users can exchange tokens or provide liquidity to a quality pool of their choice by simply depositing tokens.

#3.Vault

This an asset manager by the Flamingo team. On Vault, users can stake in NEP-5 assets and get FLM token rewards.

#5. FUSD

This is a synthetic stablecoin mintable by users. FUSD is pegged to the price of the US dollar. Users will be offered FLM that’s in proportion to the amount of FUSD minted.

#6. Perp

This is an AMM-based contract exchange. Just like on Swap, traders can exchange perpetual contracts using the CPMM model, this time with a ten times average. Stakers need to deposit FUSD, upon which they’ll receive FLM as rewards.

#7. DAO

DAO is a protocol for governance on the Flamingo platform. The Flamingo team intends for decision-making to be taken over by the community. Cabinet members can contribute to the platform using Flamingo Improvement Proposals and Flamingo Configuration Change Proposals. On the DAO, FLM token holders can vote on critical decisions such as increasing/decreasing tokens, software upgrades, parameter configurations, etc. Voters who contribute to governance are awarded FLM tokens.

What’s Flamincome?

Flamincome is Flamingo’s dedicated platform for the new trend in DeFi, known as liquidity mining. Flamincome provides pretty much the same services as in Yearn.Finance (YFI). The tool features both an optimizer and normalizer. An optimizer increases yield by converting original assets (USD, USDC, DAI, ETH, wBTC, wETH, etc) to interest-focused assets (fUSDT, fUSDC, fDAI, fwETH, fwBTC, etc).

A normalizer changes back interest-bearing assets into original assets. Interest-bearing assets such as fUSDT, fUSDC, fDAI, fwETH, fwBTC, etc are changed into synthetic assets (nUSDT, nUSDC, nDAI, nwETH, nwBTC, etc). This conversion takes place on a 1:1 peg ratio to the underlying asset. The synthetic assets can be used in other DeFi platforms for more yield farming.

Is Flamingo Audited?

Yes, the Flamingo platform is audited. Several independent auditing outfits have audited various stacks of the platform:

- Normalizer contracts on Flamincome: PeckShield and Red4Sec

- Flamingo contracts: PeckShield

- Poly Network: Certik

- Poly Network Neo contracts: PeckShield

What are the Risks of Interacting with the Flamingo Platform?

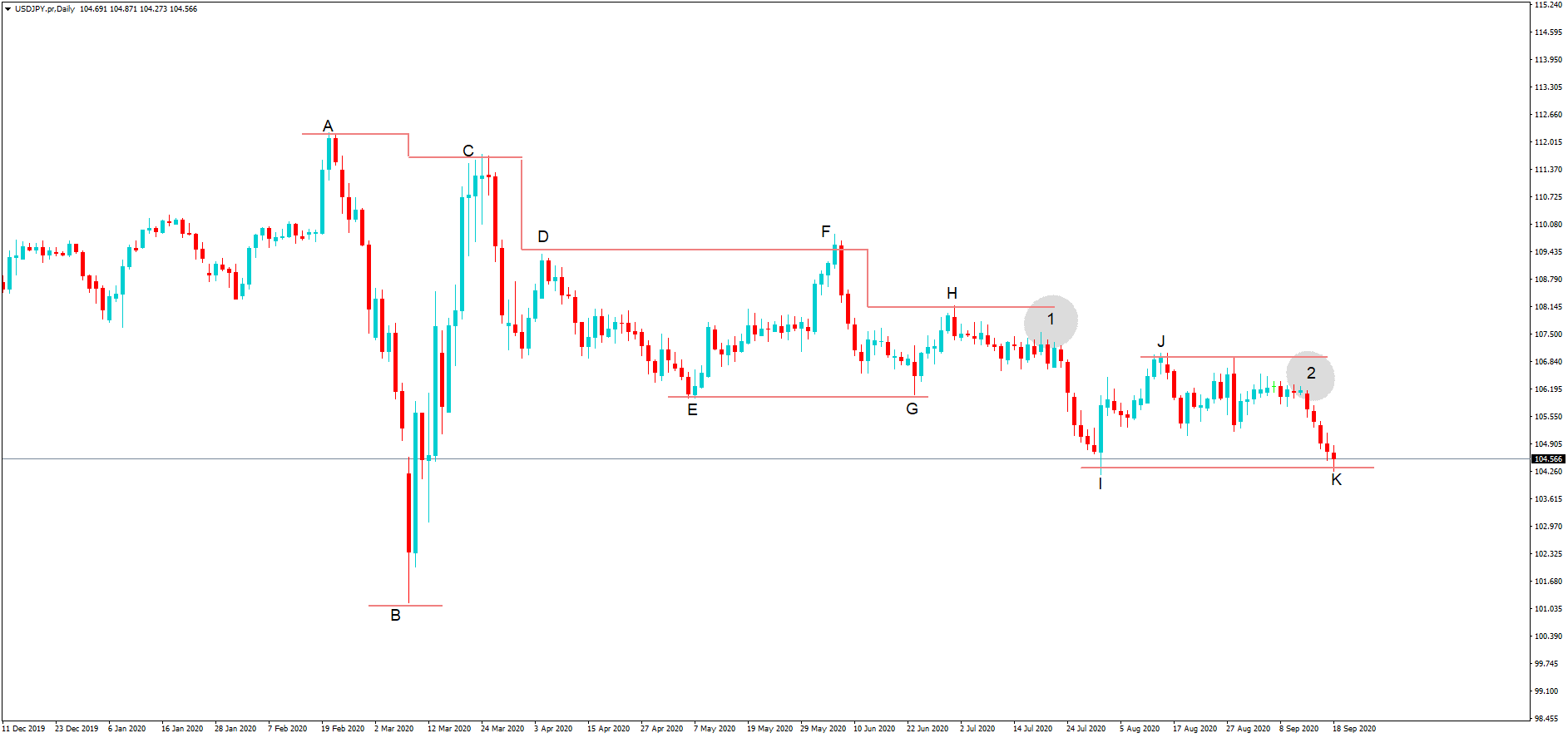

While Flamingo is thoroughly audited, mistakes/bugs are bound to occur. While there’s no inherent risk in Vault’s staking process, using the Swap module can set you up for impermanent loss (IL).

However, as Neo founder Da Hongfei noted, this risk is often overestimated: “Only by providing liquidity to Swap may you bear IL. After all, IL is not as terrible as many people think. To provide liquidity to a trading pair A/B, after a period of time if the price of A has fallen by 50% relative to B. How much do you estimate the impermanent loss to be? The answer is 5.72%. This means you would only lose 5.72% by providing liquidity compared to holding A/B in your wallet. That’s not as bad as most people’s intuition.”

How is the Flamingo Platform Secured?

The Flamingo network is NEP-5-compliant. NEP-5 is Neo’s token compatibility standard, which means Flamingo is secured by the underlying Neo blockchain. Neo itself is secured by SHA-256 (the hash algorithm that secures Bitcoin) and RIPEMD-160 hash function.

Community Growth Strategies of Flamingo

The Flamingo team intends to implement several strategies to expand the growth of the community. These strategies include the following:

- Conducting physical marketing events and meetups

- Engaging with users via social media platforms

- Conducting online Ask Me Anything (AMA) to engage with current and potential users

Future Strategies include:

- Conducting daily weekly progress updates

- Kicking off the Developer Grant program

- Initiating voting functionalities for the Flamingo decentralized autonomous organization (DAO)

Future of Flamingo

Flamingo wants to be the stepping stone for the acceleration of DeFi in the Neo ecosystem. The Neo team doesn’t plan to stop at Flamingo but intends to launch other products like lending, insurance, and asset management products.

For now, the team is exploring ways to introduce more asset types, decide which oracle implementation to integrate, and examine how the governance mechanism will function in the future. The Flamingo team encourages input from the community. Users can submit proposals on how to optimize the platform and build a more robust protocol.

The FLM Token

The FLM token is the native token of Flamingo. Holders of the platform can participate in decision-making for things like new tokens issuance, platform parameters, etc.

Other uses include:

- Staking multi-chain assets

- Staking LP tokens, minting FUSD

- Depositing FUSD to trade in perpetual contracts

The Flamingo token was distributed in the following fashion:

- Binance Launchpool tokens: 4.17%

- Mint Rush tokens: 29.17%

- LP Token Staking: 53.33%

- FUSD Minting: 10%

- Perp Margin Rewards: 3.33%

Flamingo: Key Metrics

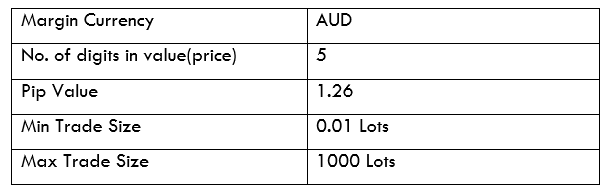

The FLM token price was $0.254369 while ranking at #3587 on October 16, 2020. The token’s 24-hour volume was $7,296,347, with a total supply of 150 million. FLM had an all-time high of $0.307385 (Oct 9, 2020) while it’s all-time low was $0.249290 (Oct 11, 2020).

Buying and Storing FLM

The FLM token is listed as a market pair of USDT, BTC, BNB, USDT, BUSD, NEO, and PERP in exchanges such as Binance, OKEx, MXC, HotBit, Binance, BitZ, LBank, Hubi, Switcheo Network, VCC Exchange, and FTX.

FLM tokens can be stored in NeoLine (Chrome Extension), O3 desktop wallet (supports Ledger), MetaMask Chrome Extension, Cyano Chrome Extension, and ONTO mobile wallet.