Introduction

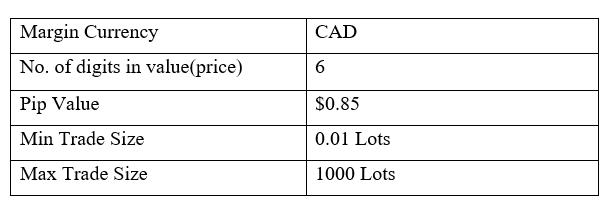

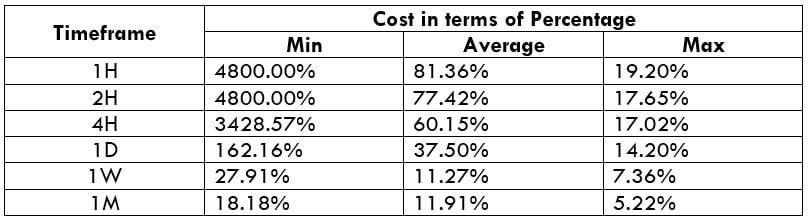

The CAD/EGP is an exotic currency pair with the CAD representing the Canadian Dollar, and EGP – the Egyptian Pound. Forex trading in such an exotic currency pair is accompanied by higher volatility. The CAD is the base currency, while the EGP is the quote currency in this pair. Therefore, the price attached to this pair shows the amount of EGP that 1 CAD can buy. Let’s say that the price of CAD/EGP is 11.7692. This price means that for every 1 CAD, you can buy 11.7692 EGP.

Spread

In the forex market, the difference between the buying and selling prices of a currency pair is called the spread. The spread for CAD/EGP is: ECN: 3.7 pips | STP: 8.7 pips

Fees

There are no broker fees associated with the STP accounts. For the ECN account, however, the trading fee is determined by your broker.

Slippage

Slippage in forex is the difference between the price that a trader requests the broker to complete a trade and the price that the broker executes the trade. This difference is determined by the brokers’ speed of execution and market volatility.

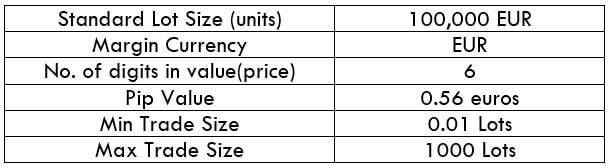

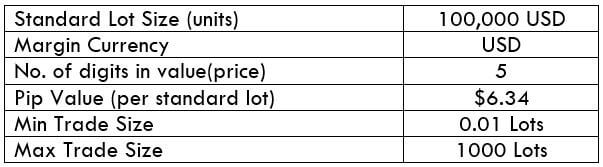

Trading Range in the CAD/EGP Pair

Forex traders endeavor to know the average number of pips that a particular currency pair moves within a given timeframe. The trading range represents the volatility of a currency pair within a particular timeframe. The knowledge of a pair’s trading range makes for a useful risk management tool.

If, for example, during the 1-hour timeframe, the CAD/EGP pair has a trading range of 10 pips, then someone trading this pair can expect to gain or lose $8.5 within this period. Below is a table showing the minimum, average, and maximum volatility of CAD/EGP across different timeframes.

The Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can determine a larger period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

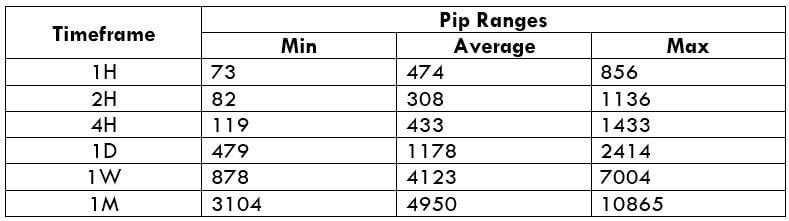

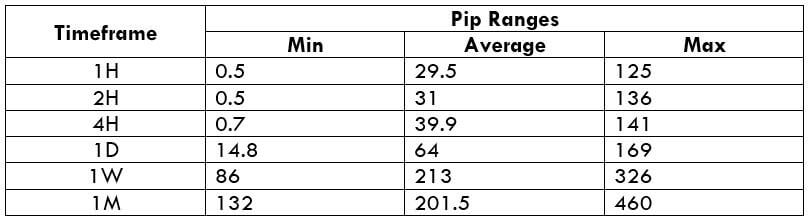

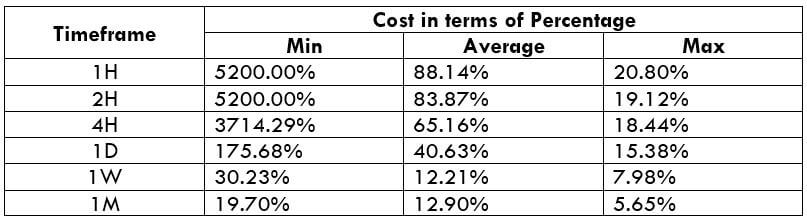

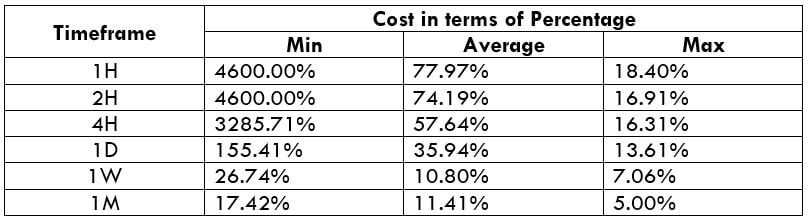

CAD/EGP Cost as a Percentage of the Trading Range

In the forex market, trading costs include brokers’ fees, slippage, and spread. i.e.

Total cost = Slippage + Spread + Trading Fee

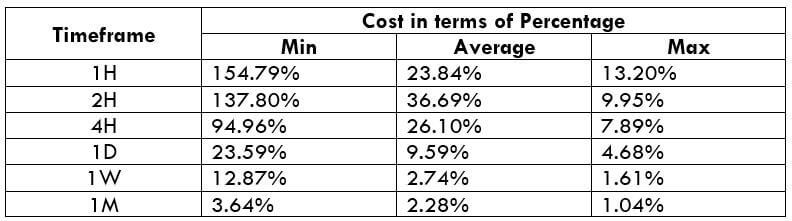

Below are analyses of percentage costs (in pips) to be expected when trading the CAD/EGP pair using either the ECN or the STP account.

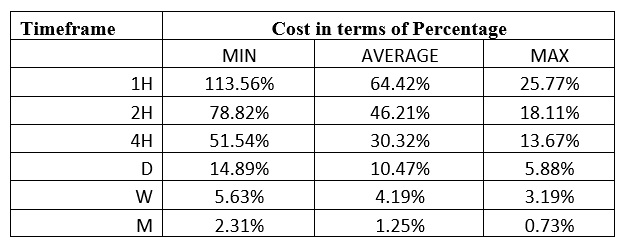

ECN Model Account

Spread = 3.7 | Slippage = 2 | Trading fee = 1

Total cost = 6.7

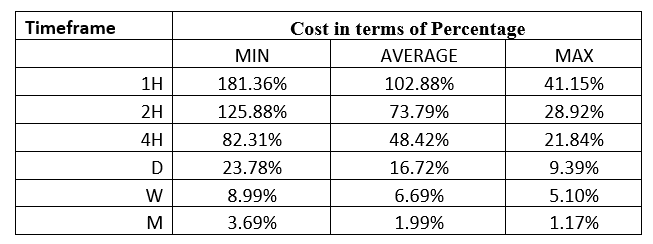

STP Model Account

Spread = 8.7 | Slippage = 2 | Trading fee = 0

Total cost = 10.7

The Ideal Timeframe to Trade CAD/EGP

As can be seen from the tables above, trading the 1-hour timeframe with either the ECN or the STP account carries the highest trading costs. We can deduce that during times of low volatility, the trading costs are higher. However, for short term traders, timing their trades when volatility is above average during the 1H, 2H, 4H, and the 1D timeframes ensure they incur lower trading costs with the CAD/EGP pair.

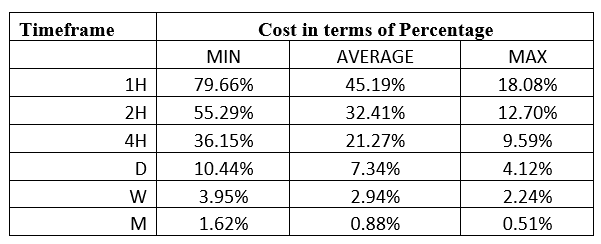

The higher timeframes provide the longer-term traders of the CAD/EGP pair lower trading costs. Forex traders can reduce the trading costs by using limit order types, which removes the risks of slippage. Here’s a demonstration of how this works in the ECN account.

Total cost = Slippage + Spread + Trading fee

= 0 + 3.7 + 1 =4.7

Notice that when the slippage cost is eliminated by using limit orders, the total costs are significantly reduced. The highest cost, for example, reduces from 113.56% to 79.66%.