Introduction

USDEGP is the abbreviation for the US Dollar against the Egyptian Pound. The USDEGP is classified under the emerging currency pairs, and the volatility in these pairs is quite high. In this pair, the US Dollar is the base currency and the EGP the quote currency.

Understanding USD/EGP

The price of USDEGP specifies the value of EGP equivalent to one USD. It is quoted as 1 USD per X EGP. So, if the market price of this pair is 15.673, then 15.673 units of EGP are required to purchase one US Dollar.

Spread

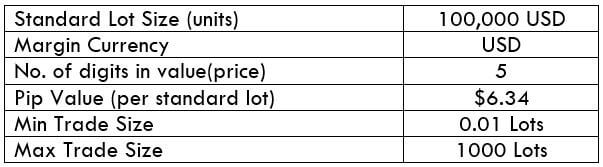

The difference between the bid and ask price is referred to as the spread. This value varies from broker to broker as well as how they execute the trade. The approximate spread on ECN and STP accounts is shown below.

ECN: 20 pips | STP: 21 pips

Fees

The fee is a commission that is to be paid to the broker for each trade you execute on an ECN account. On STP accounts, the fee is nil.

Slippage

The price you receive from the broker is usually different from the price when you executed. And the difference between these two prices is referred to as the slippage. The factors affecting slippage include,

- Market’s volatility

- Broker’s execution speed

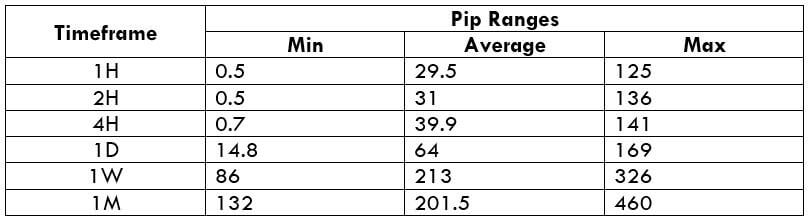

Trading Range in USD/EGP

The trading range is a tabular representation of the pip movement in a currency pair for different timeframes. With it, one can assess their risk on the trade for each given timeframe.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

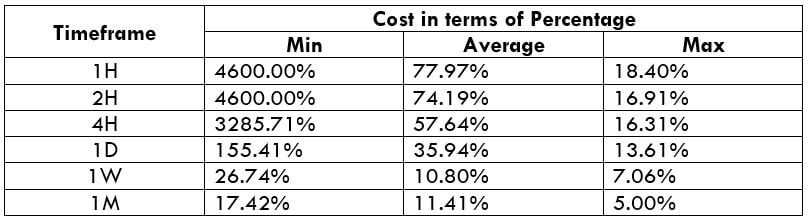

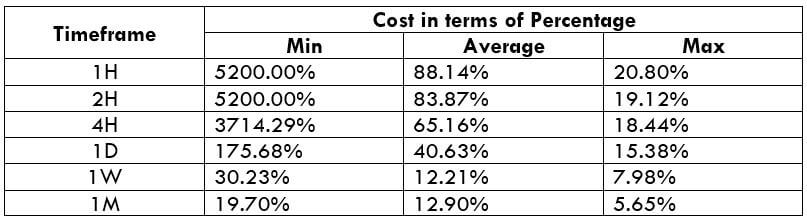

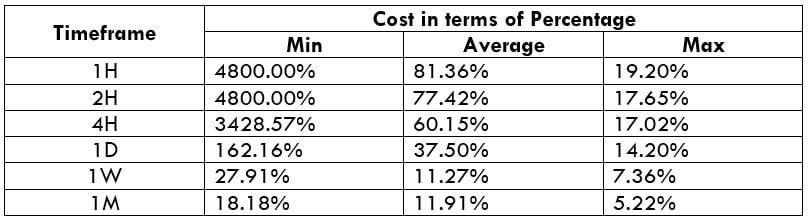

USD/EGP Cost as a Percent of the Trading Range

As the name pretty much suggests, this is a trading range table that represents cost variations (in terms of percentage) for different timeframes and volatilities. These values are useful in determining the ideal times of the day to trade this pair.

ECN Model Account

Spread = 20 | Slippage = 3 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 3 + 20 + 3 = 26

STP Model Account

Spread = 21 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 21 + 0 = 24

The Ideal way to trade the USD/EGP

In emerging currencies, the volatility is high, and the traded volume is low. So is it not ideal to enter the market any time during the day. So, let’s interpret the above tables and find the best times of the day to trade this currency pair.

The magnitude of the percentage is directly proportional to the cost of the trade. And since the percentage is higher in the min column, we can conclude that as the volatility increases, the cost reduces. However, our main aim is not only to reduce costs but to have good volatility and trading volume as well. Hence, to ensure both, it is ideal to trade when the volatility is at/above the average values in the volatility table.

Moreover, one can bring their costs slightly lower by trading using limit orders instead of market orders. This will cut off the slippage on the total cost of the trade. An example of the same is given below.