Introduction

The Euro Area’s euro against the Egyptian Pound is abbreviated as EUREGP. This is an exotic-cross currency pair in the forex market. In this pair, the EUR is the base currency, and the EGP is the quote currency.

Understanding EUR/EGP

The market price of the EUREGP depicts the value of EGP that is equivalent to one euro. It is simply quoted as 1 EUR per X EGP. So, for example, if the market price of this pair is 17.8341, then exactly 17.8341 Egyptian Pounds is required to purchase one Euro.

Spread

The difference between the bid price and the ask price is referred to as the spread. These two values are set by the brokers. Hence, it is different for different brokers. The spread also varies based on how the orders are executed.

ECN: 100 pips | STP: 111 pips

Fees

The fee is simply the commission paid on the trade. There is no fee on STP execution model but a few pips on the ECN execution model. However, the fee absence on STP accounts is usually compensated by higher spreads.

Slippage

Slippage is the difference between the price which was wanted by the trader and the price the broker actually gave the trader. It is typically not possible for brokers to give the exact price intended by the traders due to reasons:

- Broker’s trade execution speed

- Market volatility

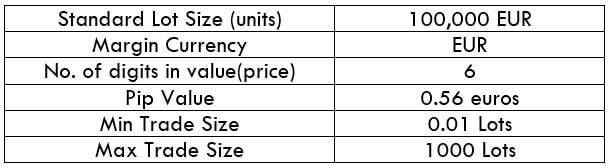

Trading Range in EUR/EGP

Trading range is an illustration of the pip movement in a currency pair for different timeframes ranging from 1H to 1M. These volatility values help in assessing the risk involved in a trade. Basically, it acts as an effective risk management tool. Another application to it is discussed in the subsequent section.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

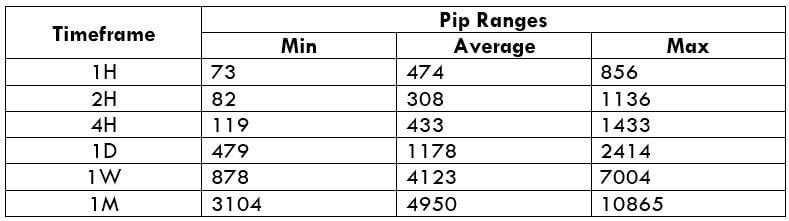

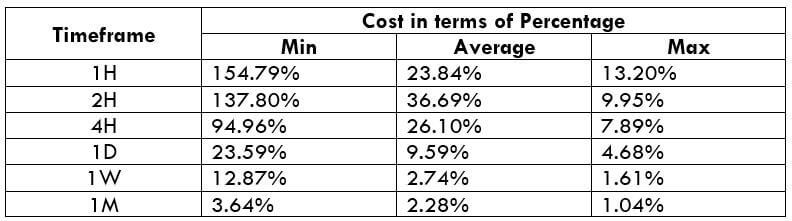

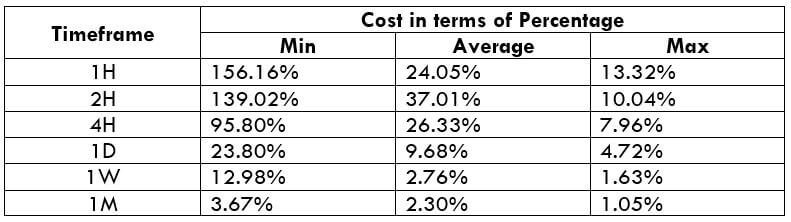

EUR/EGP Cost as a Percent of the Trading Range

This is a very helpful application of the trading range. In the cost as a percent of the trading range, we combine the volatility values with the total cost on the trade and observe how the cost varies for changing volatilities.

ECN Model Account

Spread = 100 | Slippage = 10 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 10 + 100 + 3 = 113

STP Model Account

Spread = 111 | Slippage = 10 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 111 + 0 = 114

Trading the EUR/EGP

The EUR/EGP is an exotic-cross currency pair. This pair is highly volatile, but the trading volume is pretty low. However, this pair can still be traded in certain situations.

Firstly, we can see that the spreads on this pair are high. This is because the volatility in this pair is very high. For example, the average pip movement in the 1H timeframe is over 400 pips. So, we can’t really say that the spread of this pair is high.

Consider the table representing the variation in the costs. We can see that the percentages are highest in the min column. And the values are considerably small in the average and max column. If we were to interpret this, the cost of the trade reduces as the volatility of the market increases. So, based on the type of trader you are, you can choose to enter the market. For example, if you’re concerned about the high costs, then you may trade when the volatility of the market is at its peak. If you’re a conservative trader who needs petty low volatility, then you may use it during low volatilities, but you’ll have to bear high costs for it.

Furthermore, there is a way through which you can bring down your existing cost on the trade. This is simply by executing trades using limit or stop orders instead of the market. In doing so, the slippage will be nullified. So, in our example, the total cost would reduce by ten pips.