Forex Position Sizing 11 Part 2

In Part I, we have discussed how position size should depend on the trading system’s quality and how that quality can be assessed. Then, we presented a practical method to simulate nine different systems with SQN from 1 to 5, to be used in our position size simulator. In part II, we will explain how to simulate 10,000 years of trades and the maximum position size required for a desired max drawdown level.

Risk of Ruin

The term “ruin” is usually associated with the burn-out of a trading account. In this case, we will associate it with the odds of reaching a determined level of drawdown. The level at which a trader no longer would trust the system or considers himself unfit to trade.

Since this drawdown figure is particular to every trader, we will consider drawdown points starting from 5% and up to 50% in 5% steps.

The study

We have designed a computer simulation using Monte Carlo resampling of the original 10,000 trades computed for every system created. The simulation will create 10,000 resamples of 500 trades, each simulating one year of activity, thus creating 10,000 years of market activity.

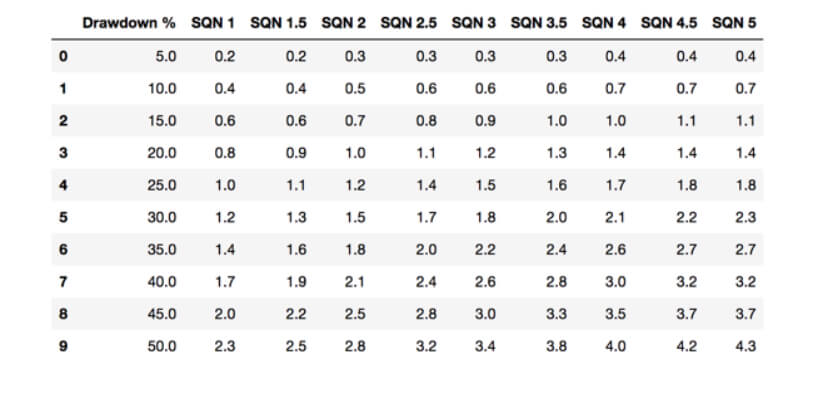

We initially created a range of position sizes, starting from 0.2% up to 10% in 0.2 steps. As we saw that the max position sizing was below 5%, we have created a second round using position sizes from 0.2% to 5% in 0.1% steps and defined as ruin if in more than 1% of the 10K simulations the max drawdown reached the predefined level (from 5% to 50%). The table shows the max position size allowed for a defined max drawdown (ruin).

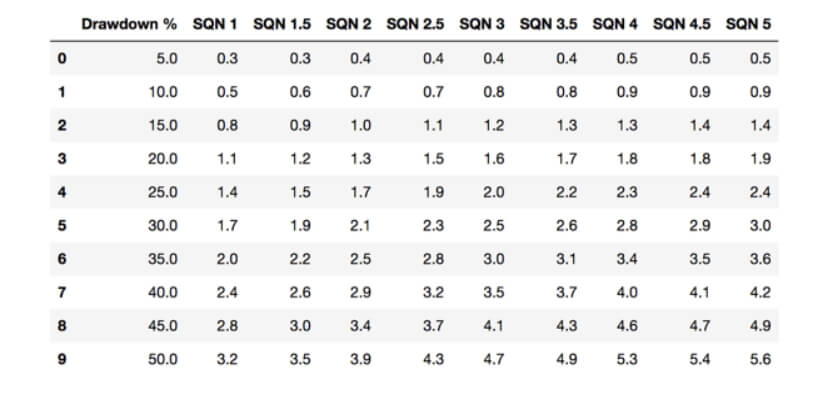

We have made a second simulation using 10% instead of 1% as the trigger level. Thus, the later table summarizes 10% odds (1 in 10 years of activity) that the max drawdown of a system touches the predefined levels.

Discussion

Considering both tables, a novice trader should be cautious and go to the safe side while learning the job. Thus, If I were new to trading, I’d assume the system’s quality to be low for two reasons. One, My system is the combination of technical signals and my interpretation of them and random factors. Also, the theoretical results of a back-tested system are always higher than the real-time results. Two, being new in this field, I still do not know my psychological reactions to losing streaks and drawdowns.

Thus, my first choice would be SQN 1 and 10% drawdown using the second table, which gives me one year in ten of 10% drawdown and one in 100 years of a 15% drawdown, but usually much less than 10%. That will mean my preferred position size will be 0.5% risk on the current account balance. After achieving 100 live trades and experience with drawdowns, we should recalculate our strategy’s parameters and consider a new position size.

A trader with 2-3 years of forex experience would prefect his strategies and reactions to the market action. Thus, an SQN 3 system is within reach. He would also accept up to 25%-30% drawdown risk. For a trader like this, a 2.5% risk would be quite reasonable.

Successful traders with over ten years of forex experience, combining fundamental and technical analysis with his trained intuition, will likely reach an SQN 4 level and taking the slight risk of 40% drawdown. To successful traders, a position size of 4-4.5% is acceptable if they feel the right pair begins moving as they planned.

As we can see, your personal experience, risk tastes, and system performance are the variables you should consider when deciding which position size best fit your needs.

Finally, this study considers that the trades are made one by one; therefore, the position size should be split into the number of open trades usually taken by the system.