Introduction

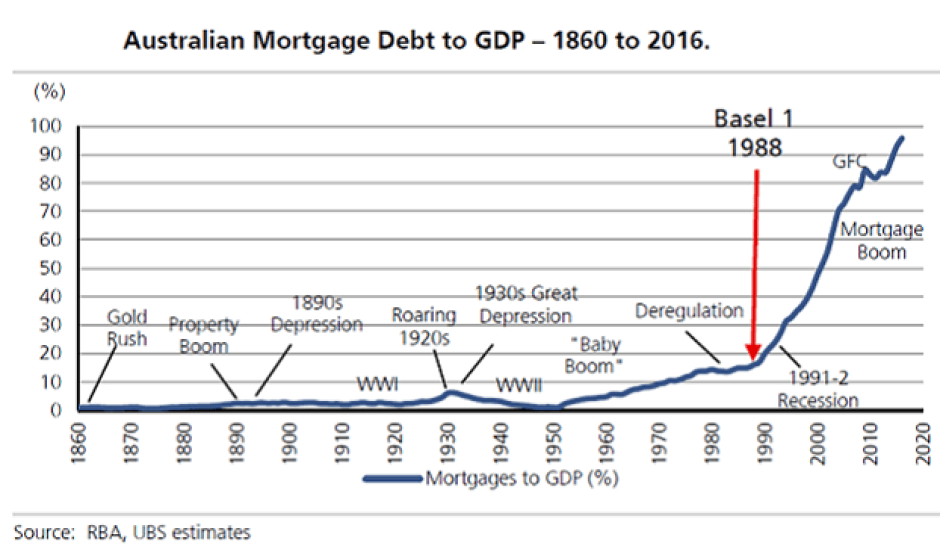

The real estate market has always been an integral part of the economy – any economy. Where the real estate sector flourishes, economic development follows. It can be argued that entire economies, from the pre-renaissance period, have been built on the back of a thriving real estate. The strategic economic importance of the real estate market is that, where houses are built, other infrastructure developments follow, social amenities, and market places. In the current age, the flourishing of the real estate sector can be taken as a leading indicator of household demand; and this is why monitoring home loans is essential.

Understanding Home Loans

A home loan is also known as an owner-occupier home loan. These loans are given to people who fully own their current home outright or have a mortgage on their existing primary residence. The home loans are usually meant to either fund the purchase of a second home or conduct renovations and improvements on the current home.

Therefore, home loans can be categorized into two; home equity loan or a mortgage.

Home mortgage: In this type of home loan, a financial institution lends money to an existing homeowner to fund the purchase of another home or to make renovations on the existing one. In this case, you transfer the deed on your current house to the banks, which is used as collateral. The financial institution can fund up to 80% of the value of your home. i.e., if your home is worth $100000, you can receive up to $80000 in the loan. Note that you will only get this type of mortgage if you outright own the home. In case you have an existing mortgage, you can opt for a home equity loan.

Home equity loan: If a mortgage funded your primary residence, you could take a second mortgage if you have enough equity on the current home. Whenever you pay down the first mortgage on your home, the value of your home equity increases. Let’s say your current home is worth $300,000, and you have an outstanding mortgage worth $100,000; this means you have equity of $200,000. Here, the equity represents the value you will remain with if you were to sell the home. Therefore, when you take a home equity loan, you will receive a lump sum amount equivalent to the equity you have on your current home.

In both types of home loans, your primary residence is the collateral. The lender is entitled to foreclose on these homes if you default on the repayment.

Using Home Loans for Analysis

As a significant indicator in the real estate market, home loans data can be used as an indicator of the overall demand in the economy. Let’s take an example of an increase in home loans.

When home loans are growing, it can be taken to mean that households have increased demand in the real estate market. Home loans are primarily used to conduct renovations on existing homes or fund the purchase of second homes. Since both these activities are not essential needs for a household, an increase in home loans can only mean that households have satisfactorily taken care of their primary and intermediate needs. Therefore, the welfare of households can be said to be improving when home loans are increasing.

Furthermore, since one is required to make a predetermined repayment on home loans or risk foreclosure, it would imply that households have a steady stream of income when they take these loans. On a macroeconomic level, an increase in the home loans would imply that unemployment levels are down or that households receive higher wages. Lower levels of unemployment and increased wages tend to increase disposable income.

In such cases, an increase in aggregate demand is expected hence overall economic growth. Note that in most economies, households’ demand for goods and services account for almost 70% of the GDP. Therefore, an increase in the demand for houses implies that almost every other sector has also experienced increased demand. These sectors range from those providing essential to intermediate goods and services to households.

The home loans data can also be used to show the economic cycles recessions to recoveries. If the economy has gone through a period of recession, an increase in home loans can sign that money is flowing through the economy. Low economic activities characterize the economic cycles of recessions and depressions; therefore, an increase in home loans can be taken as a sign of increased economic activities. This increase can be an indicator that the economy is going through periods of recovery.

Source: ABC News Australia

Impact on currency

The forex market is forward-looking. This attribute means that for every economic indicator released, the forex market tends to anticipate how these indicators would influence the future interest rate.

When home loans are increasing, it could mean two things. Either household has access to cheaper financing, or the economic growth has increased the flow of money. In the forex market, a continuous increase in home loans can be seen as a potential trigger for contractionary monetary policies like increasing the interest rate. Such policies result in the appreciation of the currency relative to others.

Conversely, a continuous drop in the home loans leads to depreciation of the currency relative to others. In this case, governments and central banks could view the drop in home loans as a sign of the economy slowing down. Expansionary monetary and fiscal policies could be implemented to prevent the economy from going into recession.

Sources of Data

In Australia, the Australian Bureau of Statistics (ABS) is responsible for the publication of the home loans data. Trading Economics has a historical review of the Australian home loans and a global comparison with other countries.

How Home Loans Data Release Affects the Forex Price Charts

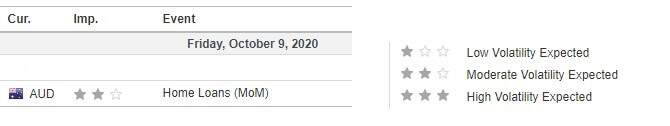

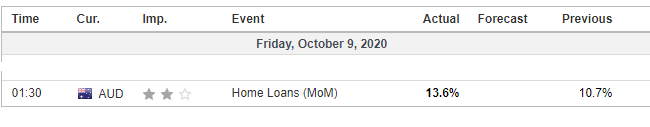

The latest publication of the home loans data by the ABS was on October 9, 2020, at 1.30 AM GMT. The release can be accessed at Investing.com. From the screengrab below, the AUD’s moderate volatility should be expected when the home loans data is released.

The home loans MoM change for August 2020 was 13.6%, an increase from 10.7% in July 2020.

Let’s see what impact this release had on the AUD.

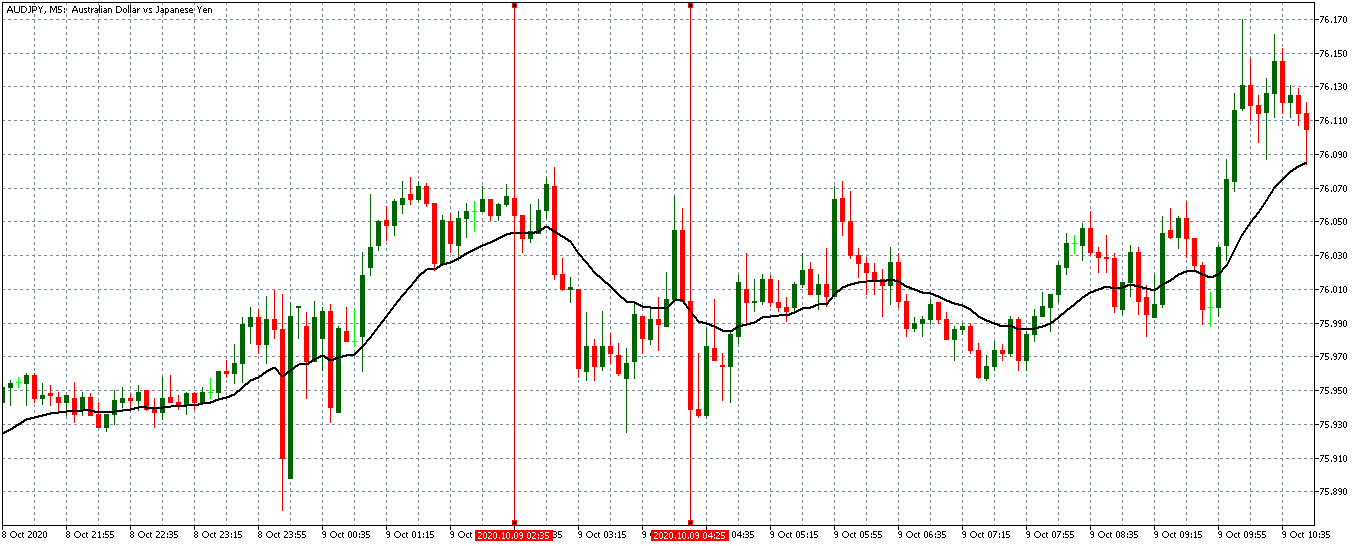

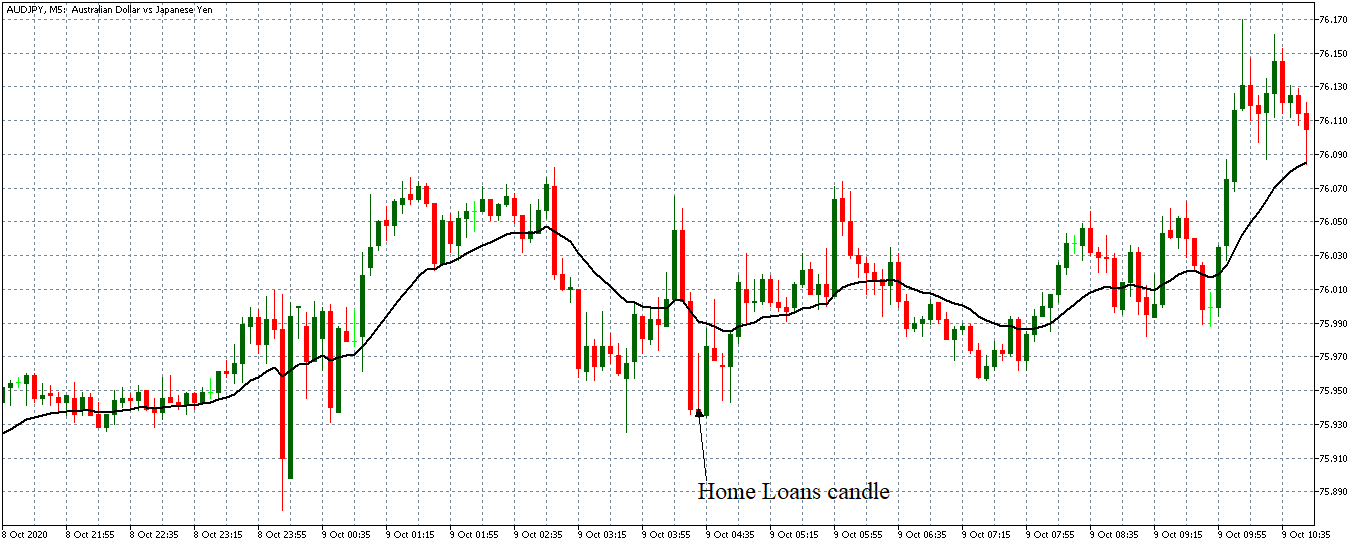

AUD/JPY: Before Home Loans Data Release on October 17, 2020, Just Before 1.30 AM GMT

The AUD/JPY pair was trading a mild downtrend before the release of the Australian home loans data. From the above 5-minute chart, the 20-period MA is slightly falling with candles forming just below it.

AUD/JPY: After Home Loans Data Release on October 17, 2020, at 1.30 AM GMT

The pair formed a 5-minute inverted bearish ‘hammer’ candles immediately after releasing the home loans data. Subsequently, the AUD/JPY adopted a subdued bullish trend as the 20-period MA began rising, and the candles crossing over it. As expected, this trend showed that the AUD became stronger after the increase in home loans.

Bottom Line

From the above analyses, we can conclude that although the home loans data is a moderate-impact economic indicator, it significantly impacts the forex price charts. This indicator’s impact can be said to have been amplified since it signals the rebounding of the real estate sector from the coronavirus-induced recessions.