Businesses worldwide are using cloud computing to reduce costs, maximize efficiency, and increase deployment. Cloud service providers (CSPs) like Amazon’s AWS, Microsoft Azure, IBM Cloud, and others have been providing online storage services to companies worldwide for years.

But even as these big companies dominate the industry, the potential of data centers remains vastly underutilized. There remains so much idle computing power around the globe that could be harnessed to provide cheaper and more efficient cloud computing services.

What is Ankr?

Ankr is a cloud computing platform backed by the power of the blockchain. With blockchain comes increased speeds, transparency, and more inclusivity. The Ankr team believes idle computing power needn’t go to waste and that it can actually replace the need for CSP’s altogether.

In view of this, they want to create a system where people from everywhere can utilize others’ idle computing power. And it’s not just setting its sights on repurposing idle computing resources: Ankr wants to go beyond and provide an infrastructure to power the Internet of Things (IoT) and other emerging economies.

Suppliers of idle computing power will be able to make money off it, whether they’re using a mobile phone, an on-premise data center, a private cloud, etc. Ankr wants to help companies create a production environment where they can leverage people and the latest technology independent of a centralized entity and vendor contracts.

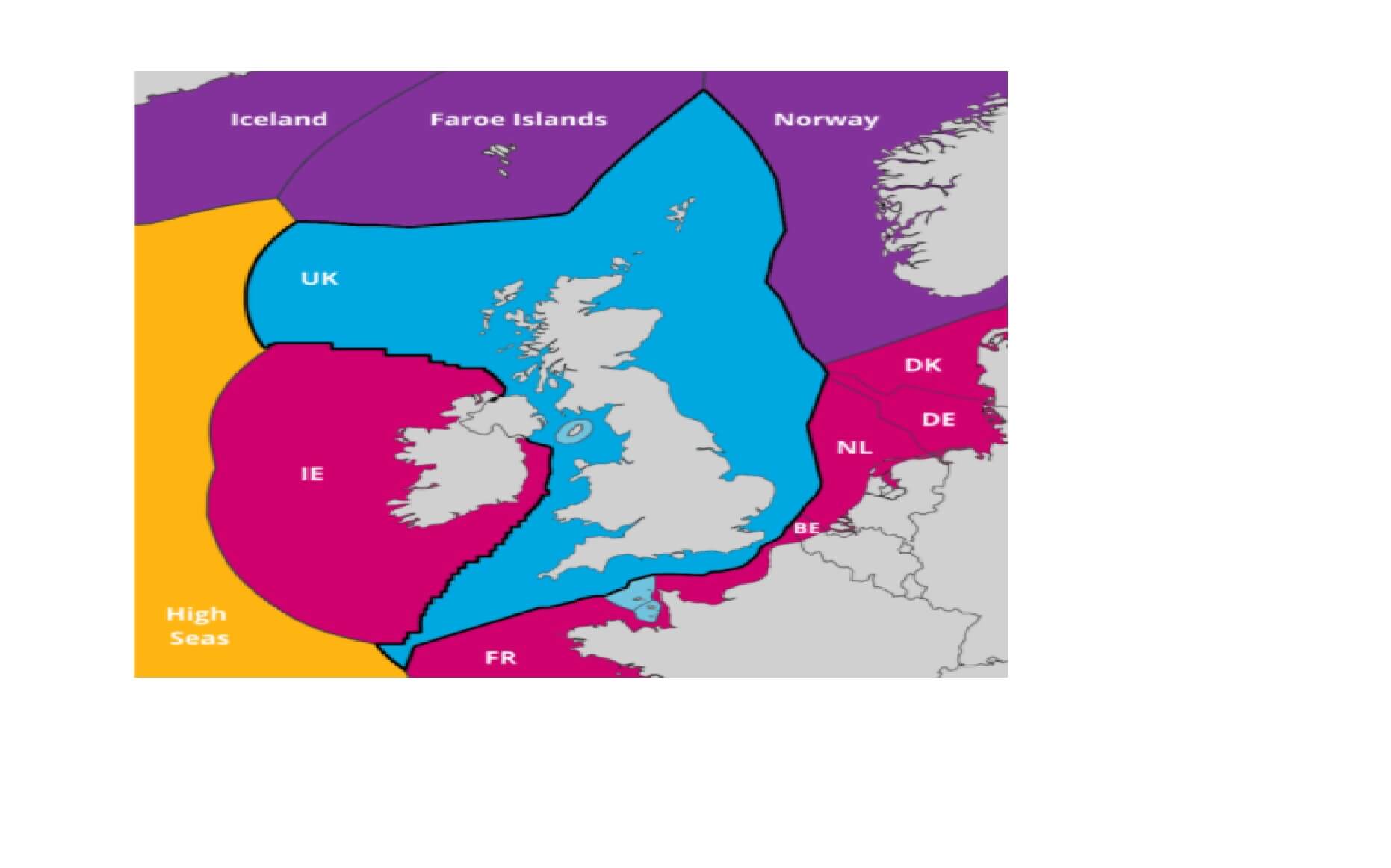

As of the time of writing, Ankr has over 8,000 nodes deployed all over the world.

Breaking Down Ankr

Ankr is a decentralized cloud computing platform supporting all manner of players in an industry that includes resource providers, end-users, app developers, and more. The Ankr team believes that cloud computing is the best way of the future, and that should be avoidable for everyone instead of being monopolized by tech giants like Google, Microsoft, Alibaba Cloud, and Amazon AWS.

Ankr will give developers the ability to deploy more than 100 types of blockchain nodes. The idea is to offer a pragmatic business model where data owners monetize their idle cloud resources, and developers can utilize them to run various services more effectively.

Some of the highlights of Ankr include:

- Single-click node deployment

- Truly decentralized infrastructure

- Automated management based on cloud-native tech and Kubernetes

Ankr: Architecture

The Ankr blockchain runs on four core layers:

#1. Core Layer

The core layer supports the network’s full nodes. It uses the Proof of Service Level and Stake Byzantine Fault Tolerance (SLSBFT) consensus mechanism. SLSBFT ensures that bandwidth, computation, and distributed storage maintains the highest quality standards.

On this layer, blocks are generated until the block producers reach consensus. Users interact with this layer in either of two ways: as validator nodes or regular nodes. Validator nodes are approved by the network’s DCCN (Distributed Cloud Computing Network), while the regular nodes are open to everyone.

#2. Relay Layer

This layer supports fast network routing. All nodes on the relay layer support full nodes, except these full nodes will not produce blocks or participate in the consensus. Users have the option to add more efficient networks on top of this layer. They also stand to earn ANKR coin rewards for Proof of Network Contribution (PNC). The amount of rewards will depend on a node’s relayed packet number, network bandwidth steadiness, and service quality.

#3. Access Layer

This layer supports data center nodes, mining nodes, and edge computing nodes. All these contribute to the safety of the network by preventing illegal node access.

#4. Micro-node layer

This layer supports device nodes and transaction hashes. Smaller nodes, such as phone-based ones, are the ones referred to as micro-nodes.

Ankr’s DCCN System

Ankr’s DCCN system is deployed across various computing resources over varied geographic locations. The Kubernetes system manages these resources, arranging them in clusters through the Ankr Hub. The Hub is responsible for relaying and dispatching tasks to working clusters.

The Ankr team wants to utilize DCCN to offer an experience like that of centralized computing platforms. Through its Graphic User Interface and Command Line Interface, users can deploy apps, services, or even infrastructure for supporting such.

Resource Scheduler (and Fairness Algorithms)

A Resource Scheduler on Ankr selects and assigns tasks to nodes, who will then run them in the desired state. The scheduler will utilize the Weighted Dominant Resource Fairness Algorithm (WDRF), which evenly distributes the available resources to nodes depending on availability and the degree of urgency.

SLSBFT Consensus

Ankr utilizes the Proof of Service Level and Stake Byzantine Fault Tolerance (SLSBFT) consensus mechanism. It verifies transactions through these three phases:

- Propose

- Prevote

- Pre-commit

The SLSBFT and the standard BFT differ in that the former features Block Producer ‘BP’ nodes. BP nodes are selected based on their contribution to the network as well as their stake. This promotes decentralization and fairness in that not just large token holders can participate in the network, but any node that contributes positively. To protect the network against attacks, validator nodes are chosen in a random fashion.

Smart Contracts

The Ankr network supports smart contracts. The smart contract system has the following characteristics:

- Support for multiple programming languages including C/C++, JavaScript, Rust, Python, and more

- A virtual machine compatible with WebAssembly 1.0

- When smart contracts are being executed, the Ankr protocol is capable of invoking the contracts’ application programming interface tools via a service bus

- Ankr charges transaction fees according to the smart contract instructions

- Support for smart contracts’ interaction with the Ankr blockchain

- Support for smart contracts’ interactions with the off-chain system

Incorporation with DCCN

The DCCN blockchain supports the functions of Ankr’s communication in several ways, which include:

- Providing the payment interface for cloud service providers and users

- Rewarding users with returns upon their completion of computing tasks

- Rewarding validators for their formation in the maintenance of the blockchain and processing transactions

- Facilitating communication between the DCCN hub and DCCN daemon

Ankr: Incentive Mechanism

Ankr utilizes an incentive mechanism to promote healthy development of the platform and provide users with high-level services. The rewards are measured based on several yardsticks, including:

- Rewards for ANKR staking

- Rewards for utilizing the ANKR stake

- Rewards for producing and offering services

- Rewards for node reputation

The ANKR Token

ANKR is the native cryptocurrency of the Ankr platform. It’s the mechanism through which network users pay fees. Enterprise clients can pay for hosting fees via the token. Such enterprises could be crypto exchanges, staking platforms, fund management companies, etc. Individuals can also use the ANKR token to donate to non-profit Cloud computing platforms such as BOINC. And lastly, cloud service users can use ANKR to pay for the service.

Supply Distribution of ANKR

The ANKR token was distributed in the following fashion:

- Public sale tokens:5%

- Private sale 1 tokens: 3%

- Private sale 2 tokens: 12%

- Private sale 3 tokens: 15%

- Team tokens: 17%

- Advisor tokens: 1.5%

- Marketing tokens: 5%

- Mining rewards: 40%

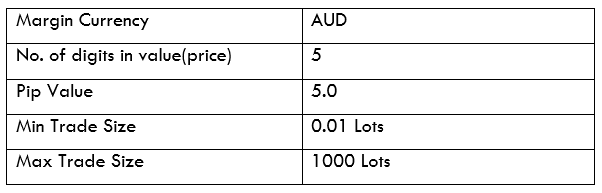

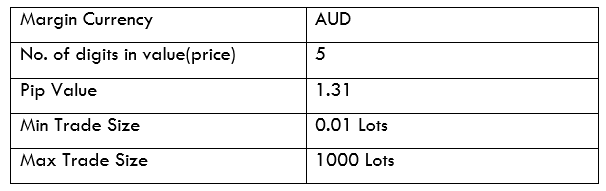

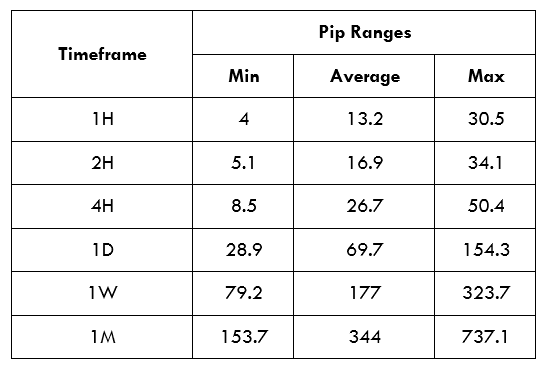

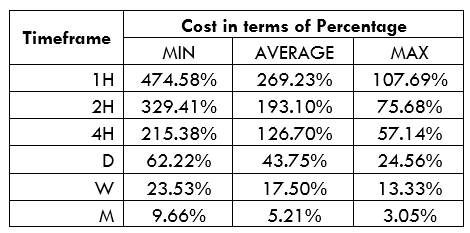

Key Metrics

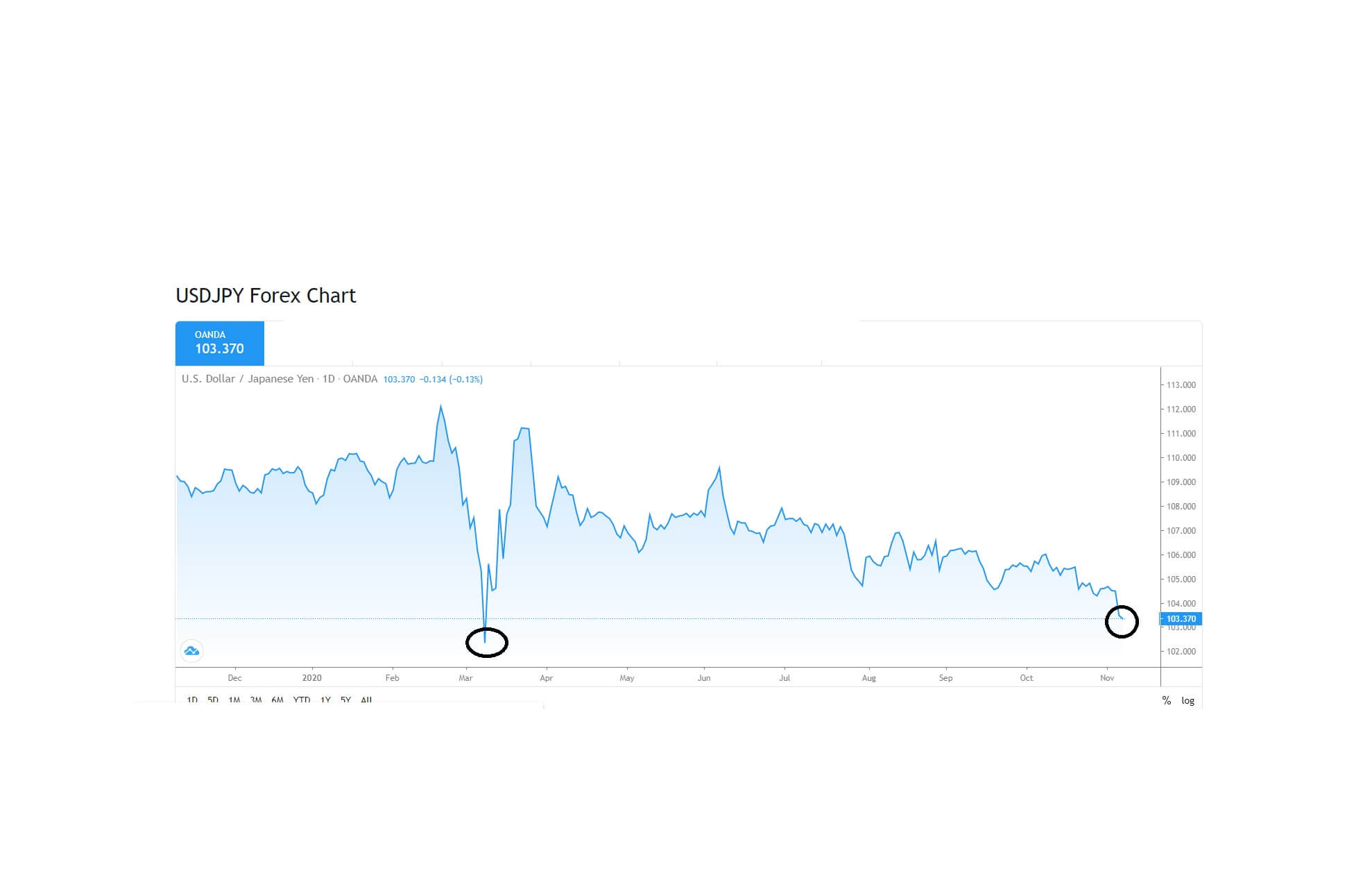

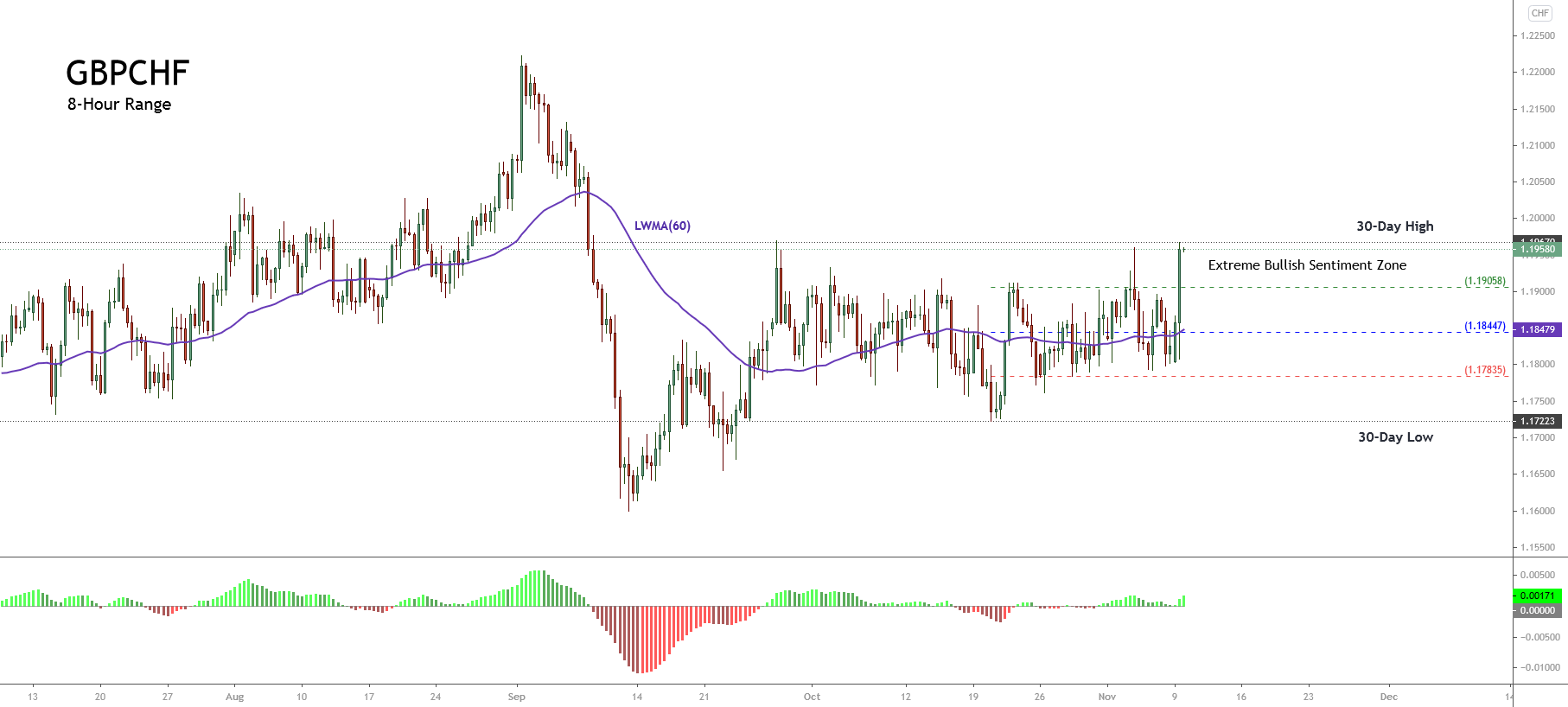

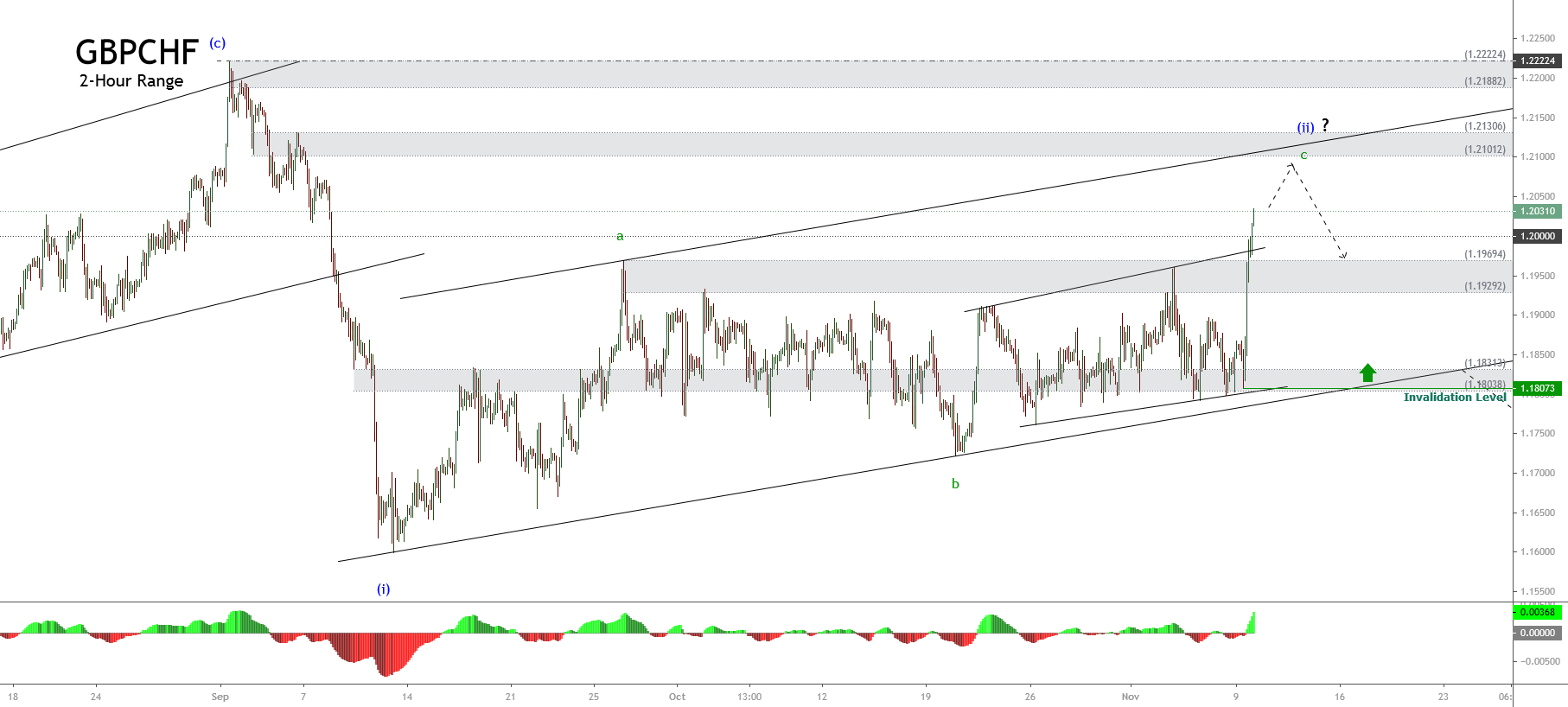

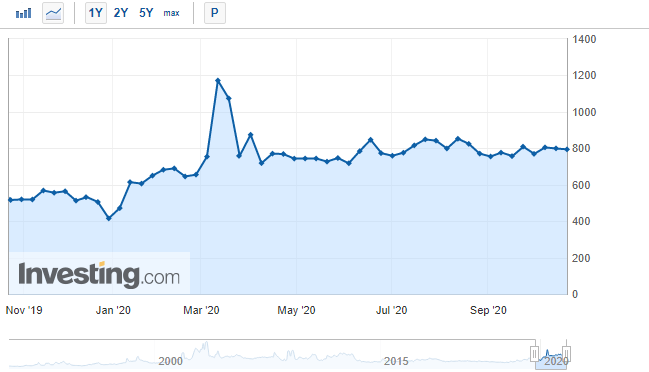

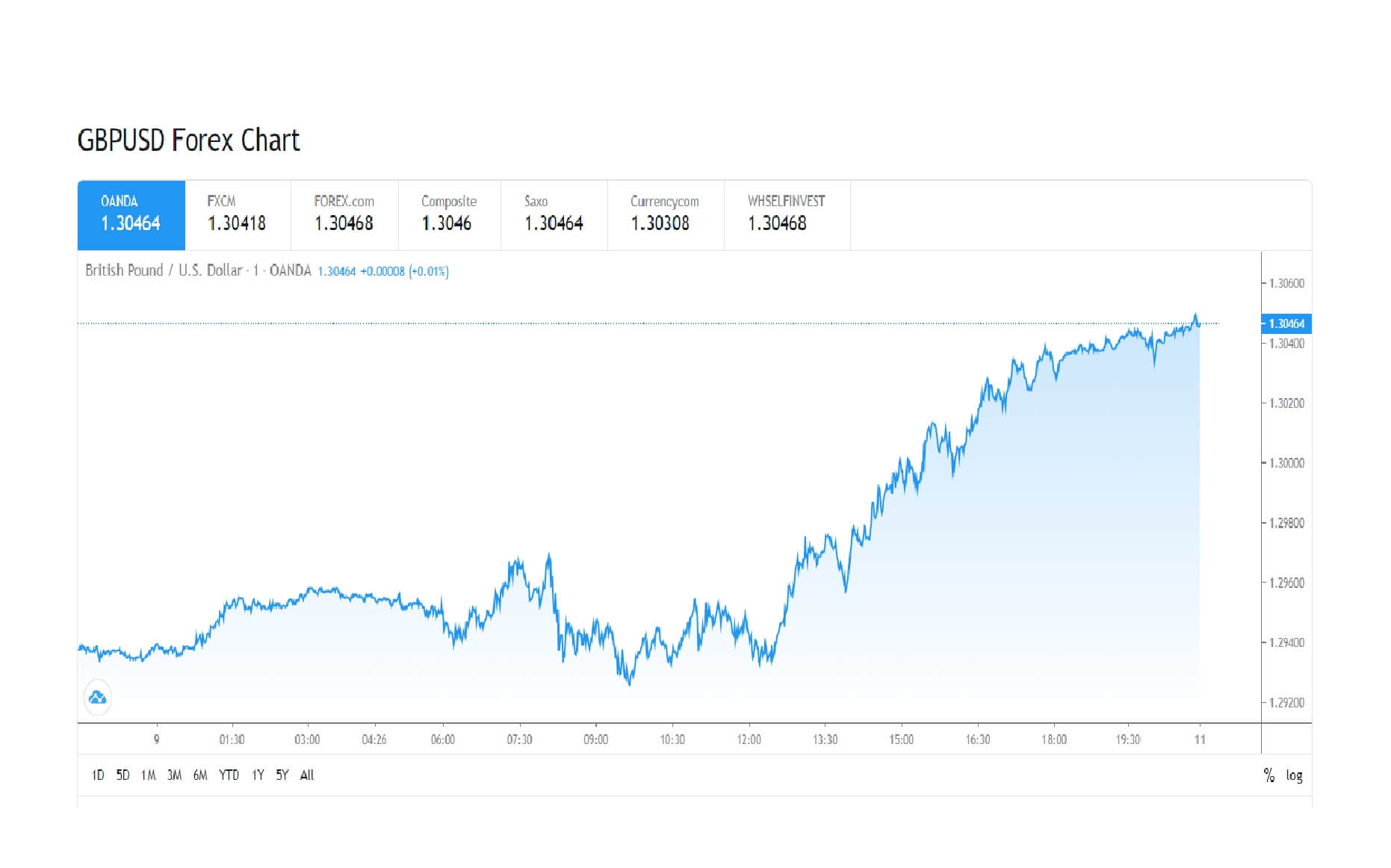

On October 20, 2020, the ANKR token traded at $0.007870, with a market cap of $45,876,543 that placed it at #156 in the market. The token has a 24-hour volume of $9,728,854, a circulating supply of 5,829,566,044, and a total supply of 10 billion. ANKR’s all-time high was $0.018332 (August 10, 2020), and its all-time low was $0.000711 (Mar 13, 2020).

Where to Buy and Store ANKR

You’ll find ANKR listed as a pair with BTC, ETH, USDT, KRW, BNB, BTC, TWD, HT, on either of these exchanges: Binance, Upbit, MXC, CoinDCX, Huobi Global, HotBit, BitMax, WazirX, CoinTiger, Gate.io, Coinone, BiKi, Sistemkoin, BitAsset, BinanceDEX, BurgerSwap, and ViteX.

Once you grab some ANKR, you can store it in any of several wallet options, including Trust Wallet, Atomic Wallet, MyEtherWallet, Trezor, and Ledger.